Payment-in-kind (PIK) interest allows borrowers to pay interest by issuing additional debt rather than using cash, preserving liquidity during tight financial periods. In contrast, cash interest requires immediate cash payments, impacting short-term cash flow but reducing overall debt balance over time. Choosing between PIK and cash interest depends on a company's cash availability, growth stage, and strategic financing needs.

Table of Comparison

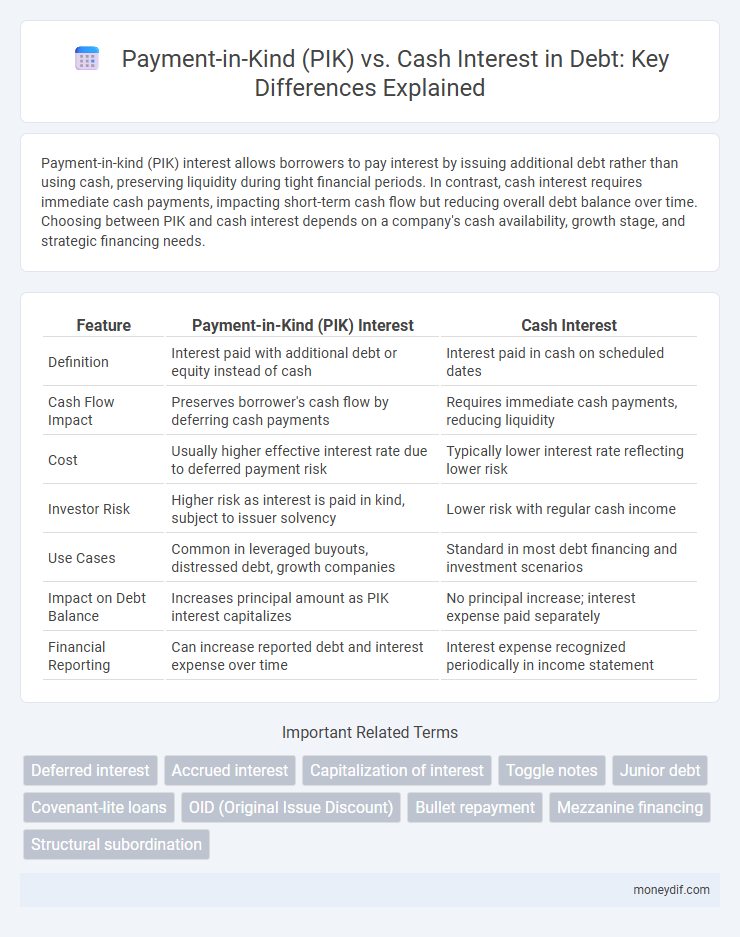

| Feature | Payment-in-Kind (PIK) Interest | Cash Interest |

|---|---|---|

| Definition | Interest paid with additional debt or equity instead of cash | Interest paid in cash on scheduled dates |

| Cash Flow Impact | Preserves borrower's cash flow by deferring cash payments | Requires immediate cash payments, reducing liquidity |

| Cost | Usually higher effective interest rate due to deferred payment risk | Typically lower interest rate reflecting lower risk |

| Investor Risk | Higher risk as interest is paid in kind, subject to issuer solvency | Lower risk with regular cash income |

| Use Cases | Common in leveraged buyouts, distressed debt, growth companies | Standard in most debt financing and investment scenarios |

| Impact on Debt Balance | Increases principal amount as PIK interest capitalizes | No principal increase; interest expense paid separately |

| Financial Reporting | Can increase reported debt and interest expense over time | Interest expense recognized periodically in income statement |

Introduction to Payment-in-Kind (PIK) and Cash Interest

Payment-in-Kind (PIK) interest allows borrowers to pay interest by issuing additional debt rather than using cash, preserving liquidity during financial constraints. Cash interest requires borrowers to make periodic cash payments based on the debt's interest rate, impacting immediate cash flow. Understanding the differences between PIK and cash interest is crucial for structuring debt that aligns with a company's financial strategy and risk tolerance.

How Payment-in-Kind (PIK) Interest Works

Payment-in-Kind (PIK) interest allows borrowers to pay interest by issuing additional debt or equity instead of cash, delaying cash outflows and preserving liquidity. This type of interest accrues and compounds over time, increasing the principal balance owed, which may lead to higher repayment obligations at maturity. PIK interest is common in high-yield bonds and leveraged loans, providing flexibility for companies with limited cash flow but raising risks for lenders due to deferred payments.

Understanding Cash Interest Payments

Cash interest payments require borrowers to pay actual cash regularly based on the loan's interest rate, impacting immediate liquidity and cash flow management. Payment-in-kind (PIK) interest allows borrowers to defer cash payments by adding accrued interest to the principal balance, which can increase overall debt but preserve short-term cash reserves. Understanding the cash interest obligations is critical for assessing a borrower's ability to meet ongoing financial commitments without risking default.

Key Differences Between PIK and Cash Interest

Payment-in-kind (PIK) interest involves paying interest through additional debt or equity rather than cash, impacting a company's cash flow differently compared to cash interest, which requires periodic cash payments. PIK interest increases the principal amount over time, often resulting in higher total debt by maturity, whereas cash interest reduces cash but keeps the principal stable. The choice between PIK and cash interest affects financial statements, liquidity management, and investor risk profiles.

Advantages of PIK Interest in Debt Financing

Payment-in-kind (PIK) interest allows borrowers to defer cash payments by issuing additional debt or equity, preserving liquidity and improving cash flow management during periods of limited cash availability. This financing structure is advantageous for companies with unpredictable revenue streams or those undergoing growth or restructuring since it reduces immediate cash burden and helps maintain operational stability. PIK interest often aligns with longer-term strategic goals by enabling flexibility in capital allocation and supporting financial resilience without triggering cash flow distress.

Drawbacks of Using PIK Interest

Payment-in-kind (PIK) interest increases the total debt burden as accrued interest compounds, leading to higher repayment obligations compared to cash interest. PIK interest can strain future cash flows since no actual payments are made during the loan term, potentially exacerbating liquidity risks for borrowers. This form of interest may also signal financial distress to investors, increasing the cost of capital and limiting refinancing options.

Cash Interest: Benefits and Limitations

Cash interest payments provide immediate liquidity to lenders, enhancing their cash flow and financial flexibility. This form of interest is straightforward to account for and often preferred by investors seeking regular income streams. However, cash interest obligations can strain borrowers' short-term finances, increasing default risk during periods of cash flow volatility.

PIK vs Cash Interest: Impact on Company Cash Flow

Payment-in-kind (PIK) interest allows companies to defer actual cash payments by increasing debt principal, preserving immediate cash flow during periods of financial stress. Cash interest requires regular cash outflows, which can strain liquidity and reduce available working capital for operations or growth initiatives. The choice between PIK and cash interest directly impacts a company's ability to maintain liquidity and manage cash flow stability over time.

Investor Considerations: PIK vs Cash Interest

Investors weigh the trade-offs between payment-in-kind (PIK) and cash interest based on liquidity and income needs, as PIK interest allows issuers to pay interest with additional debt rather than cash, preserving cash flow but increasing debt burden. Cash interest provides regular income and reduces leverage over time, appealing to investors seeking steady cash returns and lower risk. Evaluating credit risk, issuer cash flow stability, and the potential for compounding debt is critical when choosing between PIK and cash interest investments.

Choosing the Right Interest Structure for Your Debt

Selecting the appropriate interest structure for your debt involves evaluating the benefits of payment-in-kind (PIK) versus cash interest payments. PIK interest allows deferral of cash outflows by accruing interest that compounds, which can preserve liquidity during periods of limited cash flow. Cash interest requires regular cash payments, providing lenders with steady income while imposing immediate cash demands on the borrower, making it crucial to align with your financial flexibility and growth strategy.

Important Terms

Deferred interest

Deferred interest with payment-in-kind (PIK) allows borrowers to capitalize unpaid interest into the loan principal instead of making cash interest payments, increasing the loan balance, whereas cash interest requires regular cash payments reducing outstanding debt.

Accrued interest

Accrued interest for Payment-in-Kind (PIK) loans accumulates and is added to the principal balance instead of being paid in cash, increasing the total debt over time. In contrast, cash interest requires periodic cash payments, reducing accrued interest and maintaining the principal balance throughout the loan term.

Capitalization of interest

Capitalization of interest involves adding unpaid interest to the principal balance, commonly observed in payment-in-kind (PIK) interest where cash payments are deferred and interest accrues to the loan balance. Cash interest requires periodic cash payments, reducing the principal gradually, whereas PIK interest increases the overall debt obligation, impacting leverage ratios and cash flow analysis.

Toggle notes

Toggle notes allow issuers to switch between paying interest in cash or payment-in-kind (PIK), providing flexibility to manage cash flow during financial stress. The choice between PIK and cash interest impacts a company's liquidity and debt servicing, with PIK interest typically accruing to principal, increasing total debt over time.

Junior debt

Junior debt with payment-in-kind (PIK) interest defers cash payments by accruing interest to the principal, whereas junior debt with cash interest requires periodic cash payments, impacting issuer liquidity and investor yield timing.

Covenant-lite loans

Covenant-lite loans often feature payment-in-kind (PIK) interest options instead of cash interest, allowing borrowers to defer cash payments and capitalize interest, which increases loan leverage and risk for lenders.

OID (Original Issue Discount)

Original Issue Discount (OID) creates imputed interest income for tax purposes, often resulting in higher taxable income compared to payment-in-kind (PIK) interest, which accrues without current cash payments.

Bullet repayment

Bullet repayment involves settling the principal amount in a single payment at loan maturity, often paired with payment-in-kind (PIK) interest where interest is accrued and added to the principal rather than paid in cash periodically. Cash interest requires regular cash payments during the loan term, contrasting with PIK interest that increases the loan's outstanding balance until the bullet repayment date.

Mezzanine financing

Mezzanine financing often features payment-in-kind (PIK) interest to conserve cash flow by allowing interest to accrue and compound rather than requiring cash interest payments.

Structural subordination

Structural subordination occurs when payment-in-kind (PIK) interest accrues within a subsidiary, limiting cash interest payments to senior debt holders at the parent company level and impacting overall debt repayment priority.

payment-in-kind (PIK) vs cash interest Infographic

moneydif.com

moneydif.com