Callable debt allows the issuer to redeem the bonds before maturity, providing flexibility to refinance at lower interest rates but increasing reinvestment risk for investors. Putable debt grants bondholders the right to sell the bonds back to the issuer at a predetermined price before maturity, offering protection against rising interest rates but potentially limiting issuer flexibility. The choice between callable and putable debt impacts the risk-return profile and is essential for aligning investment strategies with market expectations.

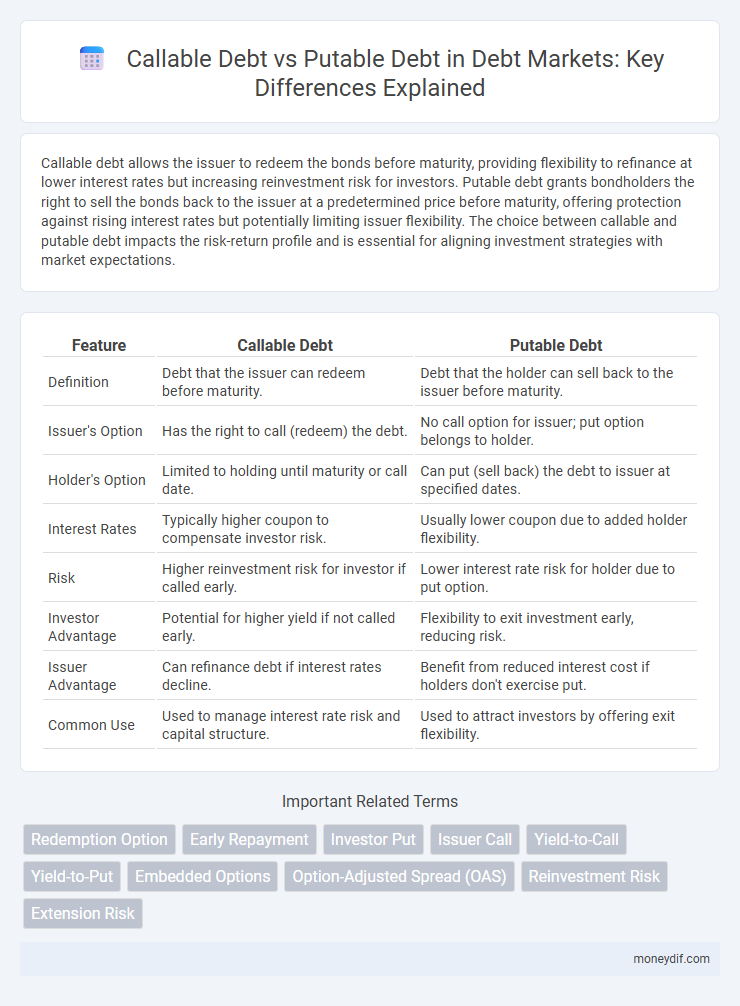

Table of Comparison

| Feature | Callable Debt | Putable Debt |

|---|---|---|

| Definition | Debt that the issuer can redeem before maturity. | Debt that the holder can sell back to the issuer before maturity. |

| Issuer's Option | Has the right to call (redeem) the debt. | No call option for issuer; put option belongs to holder. |

| Holder's Option | Limited to holding until maturity or call date. | Can put (sell back) the debt to issuer at specified dates. |

| Interest Rates | Typically higher coupon to compensate investor risk. | Usually lower coupon due to added holder flexibility. |

| Risk | Higher reinvestment risk for investor if called early. | Lower interest rate risk for holder due to put option. |

| Investor Advantage | Potential for higher yield if not called early. | Flexibility to exit investment early, reducing risk. |

| Issuer Advantage | Can refinance debt if interest rates decline. | Benefit from reduced interest cost if holders don't exercise put. |

| Common Use | Used to manage interest rate risk and capital structure. | Used to attract investors by offering exit flexibility. |

Introduction to Callable and Putable Debt

Callable debt allows the issuer to redeem the bonds before maturity, often at a premium, providing flexibility to refinance when interest rates decline. Putable debt grants the bondholder the right to sell the bond back to the issuer before maturity, offering protection against rising interest rates or credit risk. Understanding these embedded options is crucial for accurate bond valuation and risk assessment in fixed-income portfolios.

Key Features of Callable Debt

Callable debt allows the issuer to repay the principal before maturity, typically at a premium, providing flexibility to manage interest rate fluctuations. This feature benefits issuers when interest rates decline, enabling refinancing at lower costs but poses reinvestment risk to investors due to potential early redemption. Callable bonds often carry higher yields to compensate investors for the uncertainty stemming from the issuer's call option.

Key Features of Putable Debt

Putable debt grants bondholders the right to redeem the bond before maturity at predetermined dates, offering enhanced flexibility and reduced interest rate risk compared to callable debt. This feature protects investors during rising interest rate environments by allowing them to put the bond back to the issuer and reinvest at higher yields. The key characteristics include a specified put schedule, typically at par value, and the potential for increased bond pricing stability due to this embedded option.

Differences Between Callable and Putable Debt

Callable debt allows the issuer to redeem the bond before maturity, providing flexibility to refinance if interest rates decline, while putable debt grants the bondholder the right to sell the bond back to the issuer, offering protection against rising interest rates. Callable bonds typically carry higher yields due to the issuer's option to call, whereas putable bonds usually have lower yields because of the investor's option to put. The key difference lies in who holds the option: issuers benefit from callable debt, and investors gain from putable debt.

Advantages of Callable Debt for Issuers

Callable debt offers issuers the advantage of refinancing opportunities when interest rates decline, reducing overall borrowing costs. It provides financial flexibility to redeem debt before maturity, allowing issuers to manage capital structure efficiently. This option also helps in mitigating the risk of long-term debt obligations during favorable market conditions.

Benefits of Putable Debt for Investors

Putable debt provides investors with the valuable option to sell the bond back to the issuer before maturity, reducing interest rate risk and enhancing portfolio flexibility. This feature allows investors to exit unfavorable market conditions or rising interest rates, protecting the investment's value. The increased security and potential for higher returns make putable debt an attractive choice for risk-averse investors seeking stable income streams.

Risks Associated with Callable Debt

Callable debt carries higher risk for investors due to the issuer's option to redeem the bond before maturity, often when interest rates decline, which can result in reinvestment risk at lower yields. This prepayment uncertainty leads to price volatility and potential loss of expected interest income. Investors demand higher yields on callable bonds to compensate for the embedded call option risk.

Risks Associated with Putable Debt

Putable debt carries the risk of increased refinancing uncertainty, as issuers may face unpredictable cash outflows if holders exercise the put option during unfavorable market conditions. Investors might encounter reinvestment risk, receiving their principal early and being forced to reinvest at lower interest rates. This type of debt also introduces potential liquidity risk for the issuer, requiring them to maintain adequate cash reserves to honor put options when exercised.

Pricing and Valuation of Callable vs Putable Debt

Callable debt typically carries a higher yield than comparable non-callable bonds to compensate investors for the issuer's option to redeem the debt before maturity, which introduces reinvestment risk. Putable debt, in contrast, often commands a lower yield due to the bondholder's option to sell the bond back to the issuer at predetermined prices, providing downside protection and liquidity. Valuation models for callable debt factor in the issuer's calling strategy and interest rate volatility, while putable debt valuation emphasizes the bondholder's exercise strategy and credit risk dynamics.

When to Choose Callable or Putable Debt

Choose callable debt when interest rates are expected to decline, allowing issuers to refinance at lower costs and reduce debt expenses. Opt for putable debt when investors seek protection against rising interest rates or credit risk, enabling them to demand early repayment and limit potential losses. The decision hinges on interest rate forecasts, issuer financial strategy, and investor risk tolerance.

Important Terms

Redemption Option

The redemption option in callable debt allows issuers to repurchase bonds before maturity, while in putable debt, it grants investors the right to sell bonds back to the issuer at predetermined prices, impacting yield and risk profiles.

Early Repayment

Early repayment reduces interest costs by allowing borrowers to redeem callable debt before maturity while putable debt grants lenders the right to demand early repayment, shifting prepayment risk.

Investor Put

An investor put provides the bondholder the right to sell the bond back to the issuer at a predetermined price before maturity, enhancing liquidity and reducing interest rate risk in putable debt. Callable debt, in contrast, grants the issuer the option to redeem the bond early, exposing investors to reinvestment risk if the issuer calls the debt when interest rates decline.

Issuer Call

Issuer call provision allows issuers to redeem callable debt before maturity, providing flexibility to refinance at lower interest rates, unlike putable debt which grants investors the right to sell bonds back to the issuer.

Yield-to-Call

Yield-to-Call measures the return on callable debt assuming the issuer redeems the bond at the earliest call date, reflecting reinvestment risk and potential price appreciation limits. In contrast, putable debt includes an embedded put option allowing investors to sell the bond back to the issuer before maturity, affecting yield calculations with downside protection and reduced interest rate risk.

Yield-to-Put

Yield-to-Put represents the return on putable debt if the holder exercises the put option before maturity, typically lower than Yield-to-Call on callable debt due to reduced issuer risk.

Embedded Options

Embedded options in callable debt grant issuers the right to redeem bonds before maturity, typically at a predefined call price, increasing reinvestment risk for investors due to potential early redemption in falling interest rate environments. Conversely, putable debt includes embedded put options enabling bondholders to sell the bonds back to the issuer at specified times or prices, reducing risk by allowing investors to exit positions when interest rates rise or credit quality declines.

Option-Adjusted Spread (OAS)

Option-Adjusted Spread (OAS) measures the yield spread of callable debt by adjusting for the embedded call option risk, reflecting the true credit and liquidity premium investors receive beyond benchmark yields. In contrast, OAS for putable debt incorporates the value of the embedded put option, typically resulting in a narrower spread due to the issuer's reduced risk of interest rate fluctuations.

Reinvestment Risk

Reinvestment risk is higher in callable debt because issuers can redeem the bonds early when interest rates decline, forcing investors to reinvest the principal at lower rates. Putable debt reduces reinvestment risk by allowing investors to sell the bonds back to the issuer at predetermined prices, providing a safeguard against rising interest rates.

Extension Risk

Extension risk is higher in callable debt because issuers may delay refinancing during rising interest rates, whereas putable debt reduces extension risk by allowing investors to sell the bond back to the issuer before maturity.

callable debt vs putable debt Infographic

moneydif.com

moneydif.com