The grace period allows borrowers extra time to make a payment without penalty, preventing immediate default and maintaining a positive credit standing. In contrast, the cure period provides a designated timeframe to rectify a breach of contract, such as missed payments, before the lender can enforce legal remedies. Understanding the distinctions between these periods is crucial for effective debt management and avoiding acceleration or foreclosure.

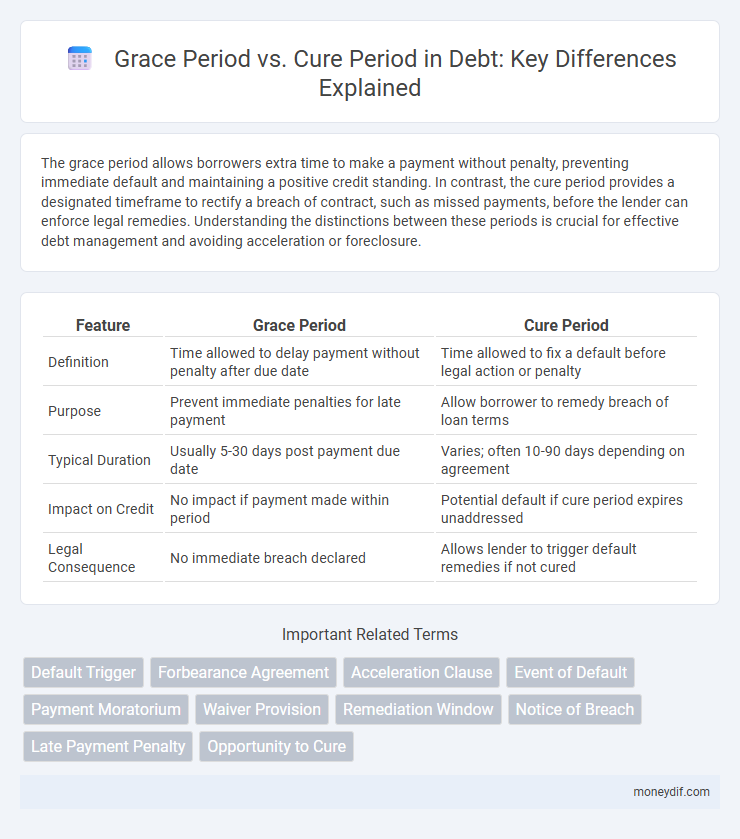

Table of Comparison

| Feature | Grace Period | Cure Period |

|---|---|---|

| Definition | Time allowed to delay payment without penalty after due date | Time allowed to fix a default before legal action or penalty |

| Purpose | Prevent immediate penalties for late payment | Allow borrower to remedy breach of loan terms |

| Typical Duration | Usually 5-30 days post payment due date | Varies; often 10-90 days depending on agreement |

| Impact on Credit | No impact if payment made within period | Potential default if cure period expires unaddressed |

| Legal Consequence | No immediate breach declared | Allows lender to trigger default remedies if not cured |

Understanding Grace Periods in Debt Agreements

Grace periods in debt agreements refer to a specific timeframe during which borrowers can delay payments without being considered in default, providing temporary financial relief. These periods are negotiated to offer flexibility and prevent immediate penalties or acceleration of the debt. Unlike cure periods, which allow borrowers to remedy a default after it occurs, grace periods proactively postpone payment obligations within the terms of the contract.

What Is a Cure Period? Key Definitions

A cure period is a designated timeframe in debt agreements during which a borrower can rectify a default or breach before the lender enforces penalties or accelerates repayment. This period allows borrowers to address missed payments, violations of covenants, or other triggers of default without immediate consequences. Grace periods often relate to short-term payment leniency, whereas cure periods specifically provide a legal opportunity to resolve defaults and maintain the loan's standing.

Grace Period vs Cure Period: Core Differences

Grace period in debt refers to a set timeframe after a missed payment during which no penalties or default consequences are applied, allowing borrowers temporary relief. Cure period, however, is the duration granted to rectify a default or breach before the lender enforces remedies like foreclosure or acceleration of debt. The core difference lies in the grace period preventing default status, whereas the cure period addresses correcting an already existing default.

Impact on Borrowers: Grace vs. Cure Period

Grace periods provide borrowers temporary relief from loan payments without penalty, allowing financial recovery without triggering default status; this reduces immediate financial stress and preserves credit standing. Cure periods offer borrowers an opportunity to rectify missed payments after default notification, helping avoid acceleration of debt or foreclosure but often requiring prompt action to prevent further legal consequences. The impact on borrowers is significant as grace periods delay payment obligations, while cure periods demand active resolution of defaults to maintain loan agreements.

Legal Significance of Grace and Cure Periods

Grace and cure periods carry distinct legal significance in debt agreements, with grace periods allowing borrowers a temporary delay to fulfill payment obligations without being considered in default. Cure periods provide a specific timeframe for borrowers to remedy defaults after a breach has occurred, preventing lenders from accelerating debt or enforcing remedies immediately. These periods safeguard borrower rights while balancing lender protections under contract law and debt enforcement regulations.

Typical Duration: Grace Periods Compared to Cure Periods

Grace periods typically range from 15 to 30 days, providing borrowers temporary relief before default is recorded, while cure periods usually extend from 30 to 90 days, allowing more time to rectify payment delinquencies. Lenders often set grace periods shorter to avoid early penalties, whereas cure periods offer a formal window to negotiate remedies or restructure debt. Understanding these durations helps creditors balance risk management with borrower flexibility in debt agreements.

Contractual Scenarios: When Each Period Applies

In contractual scenarios, a grace period applies immediately after a payment due date, allowing borrowers extra time to make payments without penalties or default status, commonly seen in loan agreements and credit cards. Cure periods are usually invoked after a default has occurred, providing a structured timeframe for the borrower to remedy the breach and avoid contract termination or acceleration of debt. Grace periods prioritize payment leniency, while cure periods focus on contractual remediation after a missed obligation.

Lender Perspectives on Grace and Cure Periods

Lenders view grace periods as borrower-friendly intervals allowing temporary relief without penalty, reducing default risk while maintaining loan compliance. Cure periods are critical for lenders, providing a structured timeframe to rectify default events and protect collateral interests before initiating enforcement actions. Effective management of these periods enhances loan performance monitoring and mitigates potential losses in credit portfolios.

Penalties and Consequences: Missing Grace or Cure Periods

Missing a grace period in debt agreements often triggers immediate penalties such as increased interest rates or late fees, escalating the borrower's financial burden. Failure to meet the cure period deadline usually results in default status, accelerating debt recovery actions like foreclosure or legal proceedings. Lenders enforce these timelines strictly, as breaches amplify risk exposure and undermine credit terms.

Best Practices for Managing Grace and Cure Periods

Best practices for managing grace and cure periods include clearly defining the duration and conditions of each period in loan agreements to prevent ambiguity and disputes. Maintaining proactive communication with borrowers during these timelines helps address repayment issues early, reducing the risk of default. Utilizing automated monitoring systems ensures timely notifications and enforcement, supporting smoother debt management and compliance.

Important Terms

Default Trigger

The Default Trigger defines the conditions under which a party is considered in breach, often activating a grace period that allows for temporary non-compliance without penalty, whereas the cure period is the specific timeframe given to remedy the default after the grace period ends. Understanding the distinctions between grace periods, which provide leniency for minor or temporary breaches, and cure periods, which mandate corrective action to avoid further consequences, is crucial for effective risk management in contractual agreements.

Forbearance Agreement

A Forbearance Agreement temporarily pauses or reduces loan payments by providing a grace period during which the borrower is not required to pay, while the cure period allows the borrower additional time after a default to remedy the breach and avoid foreclosure or penalty.

Acceleration Clause

Acceleration Clause typically mandates immediate repayment of the full loan balance if a default occurs, often following the expiration of the grace period during which missed payments can be forgiven. The cure period allows borrowers additional time beyond the grace period to rectify defaults and avoid triggering the acceleration clause, balancing lender protection with borrower flexibility.

Event of Default

An Event of Default triggers after the expiration of the grace period, whereas the cure period allows the borrower to remedy the default before it formally occurs.

Payment Moratorium

A payment moratorium temporarily suspends debt repayments by allowing a grace period for missed payments without penalties, whereas a cure period provides additional time to rectify defaults before contractual consequences are enforced.

Waiver Provision

A waiver provision in contracts allows one party to voluntarily relinquish a right, often related to deadlines, distinguishing between a grace period--an additional time allowance to fulfill an obligation without penalty--and a cure period, which specifically permits correcting a breach before further legal actions occur. Understanding the precise definitions and applications of grace periods versus cure periods within waiver provisions is crucial for effective risk management and contract enforcement.

Remediation Window

The remediation window defines the timeframe within which a party must address a contractual breach to avoid penalties, encompassing both the grace period and the cure period. The grace period typically allows a brief delay without consequences, while the cure period provides a specific duration to rectify the violation before enforcement actions are triggered.

Notice of Breach

A Notice of Breach initiates the grace period, allowing the breaching party a defined timeframe to remedy the violation during the cure period before further contractual actions ensue.

Late Payment Penalty

Late payment penalties are enforced after the grace period, which allows a borrower extra time to make a payment without penalty, while the cure period provides an opportunity to correct the default and avoid further consequences. Understanding the distinction between these periods is crucial for managing loan repayments and minimizing financial charges.

Opportunity to Cure

The Opportunity to Cure defines the grace period as the time allowed to remedy a breach before the cure period begins, which is the timeframe to fully resolve the underlying issue and avoid contract termination.

grace period vs cure period Infographic

moneydif.com

moneydif.com