Bullet repayment involves paying the entire principal amount of the loan in a single lump sum at maturity, which can ease cash flow during the loan term but requires significant funds at the end. Amortizing loans distribute payments evenly across the term, combining principal and interest, resulting in gradual reduction of debt and predictable monthly expenses. Choosing between bullet and amortizing repayment structures depends on cash flow management and risk tolerance.

Table of Comparison

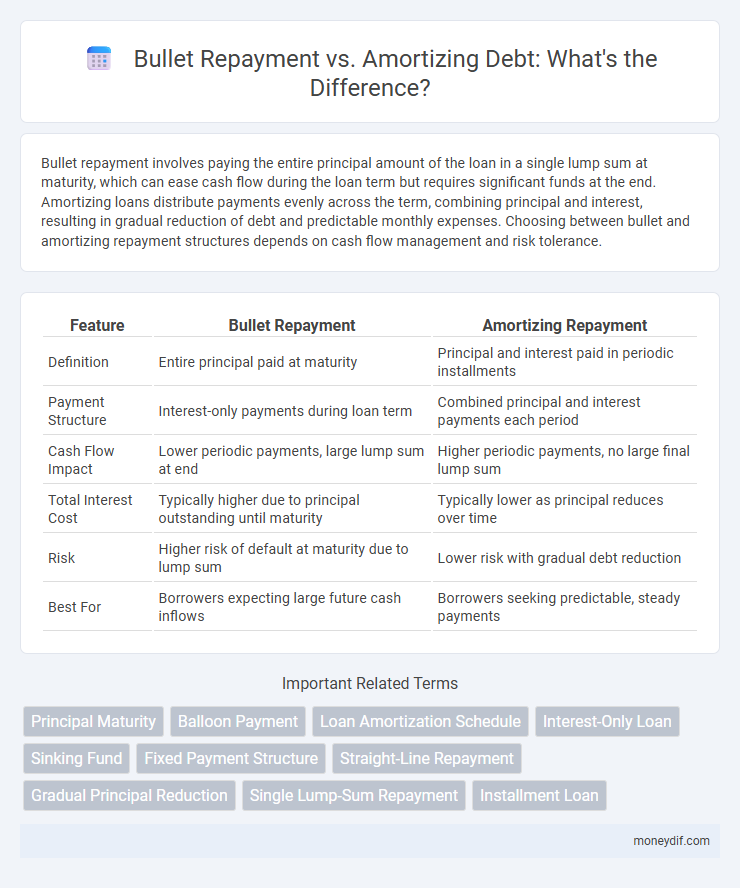

| Feature | Bullet Repayment | Amortizing Repayment |

|---|---|---|

| Definition | Entire principal paid at maturity | Principal and interest paid in periodic installments |

| Payment Structure | Interest-only payments during loan term | Combined principal and interest payments each period |

| Cash Flow Impact | Lower periodic payments, large lump sum at end | Higher periodic payments, no large final lump sum |

| Total Interest Cost | Typically higher due to principal outstanding until maturity | Typically lower as principal reduces over time |

| Risk | Higher risk of default at maturity due to lump sum | Lower risk with gradual debt reduction |

| Best For | Borrowers expecting large future cash inflows | Borrowers seeking predictable, steady payments |

Bullet Repayment vs Amortizing: Key Differences

Bullet repayment involves repaying the entire principal amount of a loan at the end of the term, resulting in lower periodic payments but a large lump sum due at maturity. Amortizing loans require equal periodic payments that cover both principal and interest, gradually reducing the loan balance over time to zero by the end of the term. The key differences lie in cash flow management, interest costs, and risk exposure, with bullet repayment offering short-term relief and amortizing loans providing steady debt reduction.

Understanding Bullet Repayment Loans

Bullet repayment loans require borrowers to pay the entire principal amount at the end of the loan term, resulting in lower periodic payments but a large lump sum due at maturity. This structure contrasts with amortizing loans, where principal and interest are paid in regular installments, gradually reducing the loan balance over time. Understanding bullet repayment loans is crucial for managing cash flow and planning for the significant lump sum payment, often used in short-term financing or bridging loans.

What Is an Amortizing Loan?

An amortizing loan requires regular payments that cover both principal and interest, gradually reducing the balance until fully paid off by the end of the term. Unlike bullet repayment loans, where the principal is paid in a lump sum at maturity, amortizing loans ensure consistent debt reduction with each installment. Common examples include mortgages and auto loans, which provide predictable payment schedules and lower default risks for lenders.

Pros and Cons of Bullet Repayment

Bullet repayment loans require the entire principal to be paid at maturity, reducing periodic payment amounts but increasing repayment risk at the end of the term. This structure improves short-term cash flow flexibility for businesses or borrowers but can lead to significant refinancing risk or default if funds are not secured by maturity. Compared to amortizing loans, bullet repayment may result in higher overall interest costs due to prolonged principal balance, making it less suitable for borrowers seeking gradual debt reduction.

Advantages and Disadvantages of Amortizing Loans

Amortizing loans provide structured repayment schedules where both principal and interest are paid in regular installments, facilitating predictable budgeting and gradual debt reduction. The key advantage lies in fully extinguishing the loan by maturity, avoiding large lump sum payments, which lowers refinancing risk. However, amortizing loans often result in higher total interest costs compared to bullet loans and may impose higher monthly payments, reducing short-term cash flow flexibility.

Cash Flow Implications: Bullet vs Amortizing

Bullet repayment loans require a lump-sum cash outflow at maturity, which can strain liquidity but preserve cash flow during the loan term. Amortizing loans spread principal and interest payments evenly over time, creating consistent cash outflows that facilitate budget forecasting and reduce refinancing risk. Understanding these cash flow implications is crucial for optimizing debt management and maintaining financial stability.

Risk Factors: Bullet Repayment vs Amortizing

Bullet repayment loans concentrate the entire principal repayment at maturity, increasing refinancing and default risk due to a large lump-sum payment. Amortizing loans spread principal and interest payments evenly over time, reducing default risk by lowering the principal balance gradually and improving cash flow predictability. Investors and lenders assess refinancing risk, interest rate fluctuations, and borrower cash flow stability when choosing between bullet repayment and amortizing loan structures.

Borrower Profiles Suited for Each Loan Type

Bullet repayment loans suit borrowers with irregular or large lump-sum cash flows, such as real estate investors expecting property sales or companies anticipating future capital raises. Amortizing loans benefit individuals or businesses with steady income streams, enabling consistent principal and interest payments that gradually reduce debt. Borrower profiles with stable cash flows and risk aversion typically prefer amortizing loans, while those with variable income or asset liquidation plans opt for bullet repayment structures.

Common Use Cases for Bullet Repayment and Amortizing Loans

Bullet repayment loans are commonly used for short-term financing needs such as bridge loans or real estate investments where borrowers prefer to pay interest periodically and repay the principal in a lump sum at maturity. Amortizing loans are typically favored for long-term financing like mortgages and auto loans, as they allow borrowers to gradually reduce both principal and interest through regular installments, improving cash flow predictability. Businesses often choose bullet repayment for projects with anticipated future cash inflows, while amortizing loans suit individuals seeking steady repayment schedules and interest expense management.

How to Choose: Bullet Repayment or Amortizing Loan

Choosing between bullet repayment and amortizing loans depends on cash flow stability and financial goals. Bullet loans require a large lump-sum payment at maturity, ideal for investors expecting significant future income or refinancing options. Amortizing loans spread principal and interest payments evenly over time, reducing risk and offering consistent budgeting for borrowers with steady cash flow.

Important Terms

Principal Maturity

Principal maturity refers to the date when the final loan principal payment is due, contrasting bullet repayment where the entire principal is paid at maturity versus amortizing schedules that spread principal payments over the loan term.

Balloon Payment

A balloon payment involves a large lump sum repayment at the end of a loan term, contrasting with amortizing loans where equal installments cover both principal and interest throughout the term.

Loan Amortization Schedule

A loan amortization schedule outlines periodic payments combining principal and interest, contrasting with bullet repayment loans where the principal is paid in full at maturity while only interest is paid periodically.

Interest-Only Loan

Interest-only loans require payments solely on the interest for a set period, with the principal repaid as a lump sum at maturity (bullet repayment), whereas amortizing loans combine principal and interest payments spread evenly over the loan term.

Sinking Fund

A sinking fund is a financial strategy used to set aside funds gradually to repay a bullet repayment, reducing the risk of a large lump-sum payment at maturity, while amortizing involves periodic principal repayments spread over the loan term, lowering outstanding debt progressively. Utilizing a sinking fund enhances creditworthiness by ensuring liquidity for the bullet repayment, contrasting with amortizing loans that systematically decrease principal and interest obligations over time.

Fixed Payment Structure

Fixed payment structures with bullet repayment require a lump-sum principal payment at maturity, whereas amortizing structures distribute principal and interest evenly across periodic installments.

Straight-Line Repayment

Straight-line repayment involves equal principal payments over time, contrasting bullet repayment which defers principal to maturity, while amortizing loans combine principal and interest in fixed periodic installments.

Gradual Principal Reduction

Gradual principal reduction refers to a loan repayment method where the principal balance decreases progressively through scheduled payments, contrasting with bullet repayment that requires a lump sum principal payment at maturity. Amortizing loans integrate gradual principal reduction by combining principal and interest in each installment, thereby reducing the outstanding loan amount over time.

Single Lump-Sum Repayment

Single lump-sum repayment involves paying the entire loan principal at once, unlike amortizing loans that require periodic principal and interest payments, while bullet repayment delays the principal payment until the loan term ends.

Installment Loan

Installment loans with bullet repayment require the borrower to pay interest periodically and repay the entire principal in a single lump sum at the end of the term, increasing risk but reducing monthly payments. Amortizing installment loans spread both principal and interest evenly across scheduled payments, resulting in gradual debt reduction and predictable payment amounts over the loan period.

bullet repayment vs amortizing Infographic

moneydif.com

moneydif.com