Bridge loans provide short-term financing to cover immediate cash flow needs, often used to quickly secure property or business acquisitions, while term loans offer longer repayment periods with fixed interest rates suitable for long-term investments and business expansion. Bridge loans typically carry higher interest rates and are repaid upon securing permanent financing or selling an asset. Term loans provide predictable payments and stability, making them ideal for structured financial planning.

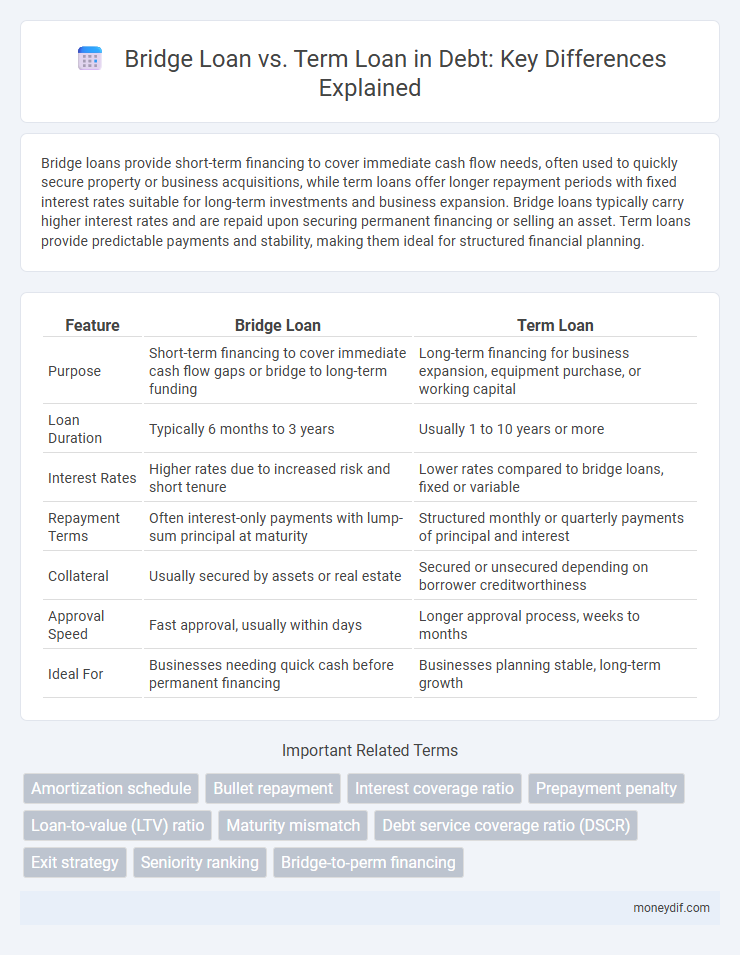

Table of Comparison

| Feature | Bridge Loan | Term Loan |

|---|---|---|

| Purpose | Short-term financing to cover immediate cash flow gaps or bridge to long-term funding | Long-term financing for business expansion, equipment purchase, or working capital |

| Loan Duration | Typically 6 months to 3 years | Usually 1 to 10 years or more |

| Interest Rates | Higher rates due to increased risk and short tenure | Lower rates compared to bridge loans, fixed or variable |

| Repayment Terms | Often interest-only payments with lump-sum principal at maturity | Structured monthly or quarterly payments of principal and interest |

| Collateral | Usually secured by assets or real estate | Secured or unsecured depending on borrower creditworthiness |

| Approval Speed | Fast approval, usually within days | Longer approval process, weeks to months |

| Ideal For | Businesses needing quick cash before permanent financing | Businesses planning stable, long-term growth |

Introduction to Bridge Loans and Term Loans

Bridge loans provide short-term financing solutions designed to cover immediate cash flow gaps or facilitate quick property acquisitions before securing long-term funding. Term loans involve borrowing a fixed amount with scheduled repayments over a specified period, ideal for long-term capital investments and business expansion. Both financial instruments serve distinct purposes in debt management, with bridge loans focusing on rapid liquidity and term loans emphasizing structured repayment plans.

Key Differences Between Bridge Loans and Term Loans

Bridge loans provide short-term financing intended to cover immediate cash flow gaps or acquire assets quickly, typically lasting six months to three years with higher interest rates. In contrast, term loans offer longer-term funding with fixed or variable interest rates, generally spanning three to ten years, designed for capital expenditures or business expansion. Key differences include loan duration, interest rates, repayment schedules, and primary purposes, with bridge loans emphasizing speed and flexibility, whereas term loans focus on stability and structured repayments.

How Bridge Loans Work

Bridge loans provide short-term financing to bridge the gap between immediate funding needs and long-term loan approval or asset sale, often secured by collateral such as real estate. These loans typically have higher interest rates and shorter terms, ranging from six months to three years, making them ideal for urgent cash flow requirements or real estate transactions. Borrowers repay bridge loans through the proceeds of a permanent loan or sale of the secured asset, allowing for seamless financial transitions without interrupting ongoing projects or investments.

How Term Loans Work

Term loans provide businesses with a fixed amount of capital that is repaid over a predetermined schedule, typically with regular interest payments. These loans often have longer durations ranging from one to ten years, offering stability and predictability in cash flow management. Unlike bridge loans, term loans are structured for long-term financing needs, supporting investments in equipment, expansion, or other substantial business expenses.

Pros and Cons of Bridge Loans

Bridge loans offer rapid access to funds, making them ideal for short-term financing needs such as property purchases before securing permanent financing. Their high-interest rates and shorter repayment periods can pose risks if the borrower fails to refinance promptly. Unlike term loans, bridge loans may provide more flexibility but often come with stricter qualification criteria and higher costs.

Pros and Cons of Term Loans

Term loans offer fixed interest rates and structured repayment schedules, providing predictable monthly payments that help with budgeting and financial planning. They typically have lower interest rates than bridge loans, making them cost-effective for long-term financing needs; however, the longer approval process and stricter qualification criteria can delay access to capital. Limited flexibility in repayment terms and potential prepayment penalties may pose challenges for borrowers seeking to adjust loan conditions.

When to Choose a Bridge Loan

Bridge loans are ideal for short-term financing needs when immediate capital is required to secure a property or asset before securing long-term funding. These loans typically have higher interest rates and shorter durations, usually ranging from six months to three years, making them suitable for quick transactions or temporary cash flow gaps. Choosing a bridge loan is advantageous when timing is critical and traditional term loans are not yet accessible due to underwriting delays or ongoing refinancing processes.

When to Choose a Term Loan

Term loans are ideal for financing long-term investments such as purchasing equipment or real estate, where fixed interest rates and predictable monthly payments offer financial stability. Businesses seek term loans when they require substantial capital amounts with structured repayment schedules spanning several years. Choosing a term loan supports sustainable growth and capital expenditure without the short-term pressure of rapid repayment typical of bridge loans.

Interest Rates and Repayment Terms Compared

Bridge loans typically carry higher interest rates compared to term loans due to their short-term, high-risk nature, often ranging from 8% to 12%. Term loans feature lower, fixed or variable rates usually between 4% and 9%, designed for longer repayment periods spanning several years. Bridge loans require quick repayment within months, while term loans offer structured repayment schedules over multiple years, providing more predictable cash flow management.

Which Loan Option is Best for Your Needs?

Bridge loans offer short-term financing solutions ideal for urgent cash flow needs or transitional periods, typically featuring higher interest rates and quicker approval times. Term loans provide longer repayment periods with fixed or variable interest rates, suitable for stable, planned investments requiring substantial capital. Selecting the best option depends on your specific financial timeline, interest rate tolerance, and purpose of funding.

Important Terms

Amortization schedule

A detailed amortization schedule reveals that bridge loans typically have shorter terms with interest-only payments, while term loans feature longer durations with principal and interest repayments evenly distributed.

Bullet repayment

Bullet repayment in bridge loans involves paying the entire principal amount at the end of the loan term, typically used for short-term financing with quick turnaround, whereas term loans usually feature amortized repayments made periodically over the loan duration, providing structured cash flow management. Bridge loans with bullet repayments are favored for bridging financing gaps before long-term funding, while term loans offer predictable repayment schedules suited for long-term capital needs.

Interest coverage ratio

The interest coverage ratio for bridge loans is typically lower than for term loans due to higher interest expenses and shorter repayment terms associated with bridge financing.

Prepayment penalty

Prepayment penalties on bridge loans are often higher or more rigid compared to term loans, reflecting the short-term, high-risk nature and upfront costs associated with bridge financing. Term loans generally feature lower or no prepayment penalties, encouraging borrowers to pay down debt early over longer repayment periods with more predictable cash flow.

Loan-to-value (LTV) ratio

The Loan-to-Value (LTV) ratio for bridge loans typically ranges from 65% to 80%, higher than term loans which usually have LTV ratios between 50% and 70%, reflecting increased risk and shorter repayment terms.

Maturity mismatch

Bridge loans typically exhibit higher maturity mismatch due to their short-term nature compared to term loans, which have longer, fixed maturities aligning better with asset durations.

Debt service coverage ratio (DSCR)

Debt service coverage ratio (DSCR) typically is higher for term loans than bridge loans due to term loans' structured repayment schedules and longer terms reducing short-term cash flow pressure.

Exit strategy

Exit strategy for a bridge loan typically focuses on short-term refinancing or sale of assets within 6 to 12 months, leveraging its higher interest rates and flexible terms. In contrast, a term loan exit strategy involves long-term repayment plans spanning several years, prioritizing structured cash flow and stable financial projections.

Seniority ranking

Seniority ranking in debt financing determines the repayment priority between bridge loans and term loans, with senior debt such as term loans typically having priority over junior bridge loans in case of default. Bridge loans are often subordinate to term loans, carrying higher interest rates to compensate for increased risk due to their lower position in the capital structure.

Bridge-to-perm financing

Bridge-to-perm financing combines a short-term bridge loan providing immediate funding with a long-term term loan that replaces it, optimizing cash flow and securing permanent financing for real estate projects.

bridge loan vs term loan Infographic

moneydif.com

moneydif.com