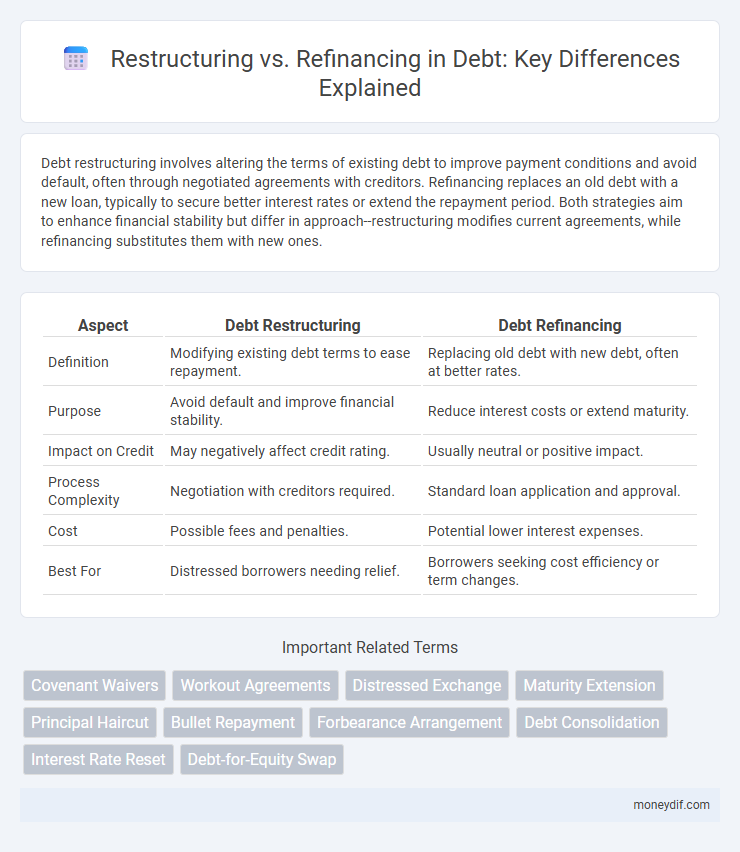

Debt restructuring involves altering the terms of existing debt to improve payment conditions and avoid default, often through negotiated agreements with creditors. Refinancing replaces an old debt with a new loan, typically to secure better interest rates or extend the repayment period. Both strategies aim to enhance financial stability but differ in approach--restructuring modifies current agreements, while refinancing substitutes them with new ones.

Table of Comparison

| Aspect | Debt Restructuring | Debt Refinancing |

|---|---|---|

| Definition | Modifying existing debt terms to ease repayment. | Replacing old debt with new debt, often at better rates. |

| Purpose | Avoid default and improve financial stability. | Reduce interest costs or extend maturity. |

| Impact on Credit | May negatively affect credit rating. | Usually neutral or positive impact. |

| Process Complexity | Negotiation with creditors required. | Standard loan application and approval. |

| Cost | Possible fees and penalties. | Potential lower interest expenses. |

| Best For | Distressed borrowers needing relief. | Borrowers seeking cost efficiency or term changes. |

Introduction to Debt Management Strategies

Debt management strategies involve restructuring and refinancing as key options to improve financial stability. Restructuring modifies existing debt terms, such as interest rates or repayment schedules, to ease borrower obligations without acquiring new funds. Refinancing replaces old debt with new loans, often at lower interest rates, to reduce overall debt costs and extend repayment periods.

Understanding Debt Restructuring

Debt restructuring involves modifying the terms of existing debt agreements to improve a borrower's financial position, often through extended payment schedules, reduced interest rates, or principal reductions. This process differs from refinancing, which replaces old debt with new debt, usually with different terms and interest rates. Understanding debt restructuring is critical for businesses seeking to avoid default and maintain cash flow without increasing overall debt levels.

Exploring Debt Refinancing

Debt refinancing involves replacing an existing loan with a new one that typically offers better interest rates, extended payment terms, or improved cash flow management. This strategy allows businesses to reduce monthly debt service burdens and optimize capital structure without altering the original loan's fundamental terms. Refinancing is distinct from debt restructuring, which often implies negotiations due to financial distress and may include changing covenants or principal reductions.

Key Differences: Restructuring vs Refinancing

Debt restructuring involves modifying the terms of existing debt agreements to improve repayment conditions, often including extended timelines or reduced interest rates. Refinancing replaces old debt with new debt, typically to secure lower interest rates or better loan terms without altering the original debt's structure. Key differences center on restructuring's focus on negotiation and modification of current debt obligations versus refinancing's goal of obtaining new financing to pay off previous debt.

When to Choose Debt Restructuring

Debt restructuring is ideal when a borrower faces prolonged financial distress and cannot meet existing debt obligations under current terms. It involves modifying the original loan agreement to reduce payment burdens, extend maturities, or lower interest rates, improving cash flow and avoiding default. Choosing restructuring over refinancing is beneficial when creditworthiness is impaired, making new financing unattractive or inaccessible.

When to Opt for Debt Refinancing

Opt for debt refinancing when current interest rates are significantly lower than the original loan rate, enabling cost savings through reduced monthly payments. Refinancing is ideal if the borrower's credit score has improved, allowing access to better terms and potentially extended loan maturity. It also suits situations where changing the type of debt--such as from variable to fixed rate--can mitigate financial risk in volatile markets.

Pros and Cons of Debt Restructuring

Debt restructuring offers the advantage of improved cash flow management by extending payment terms or reducing interest rates, often preventing default and preserving company stability. However, it can negatively impact credit ratings and may involve complex negotiations with creditors, potentially leading to higher long-term costs. While restructuring avoids immediate bankruptcy, it may signal financial distress to investors and creditors, affecting future borrowing capacity.

Advantages and Disadvantages of Debt Refinancing

Debt refinancing offers the advantage of securing lower interest rates, which reduces monthly payments and overall borrowing costs, improving cash flow and financial stability. However, refinancing may involve fees, extended loan terms, or stricter covenants that increase long-term obligations and constrain business flexibility. Careful evaluation of refinancing costs, potential penalties, and market conditions is essential to determine its impact on a company's debt structure and creditworthiness.

Impact on Credit Score and Financial Health

Debt restructuring can improve financial health by adjusting repayment terms to avoid default, often resulting in a temporary dip in credit score but enhancing long-term creditworthiness. Refinancing replaces existing debt with new loans, potentially lowering interest rates and monthly payments, which may positively affect credit scores if managed responsibly. Both strategies influence credit profiles differently, with restructuring emphasizing recovery from distress, while refinancing aims to optimize ongoing debt management.

Making the Right Choice for Your Debt Situation

Choosing between debt restructuring and refinancing depends on your financial goals and current obligations. Debt restructuring involves altering existing loan terms to avoid default, often suitable for those facing cash flow challenges. Refinancing replaces old debt with new loans at better rates, ideal for borrowers aiming to reduce interest costs or extend payment periods.

Important Terms

Covenant Waivers

Covenant waivers in restructuring allow temporary relief from financial ratios or performance metrics to avoid defaults while companies realign operations or debt structures. In refinancing, covenant waivers often accompany new loan agreements to adjust previously agreed covenants, providing flexibility for updated credit terms or capital structures.

Workout Agreements

Workout agreements facilitate negotiated settlements between creditors and debtors, enabling debt restructuring through modified payment terms, reduced principal amounts, or extended maturities to improve financial stability. These agreements differ from refinancing, which involves replacing existing debt with new debt, often at better rates or terms, while restructuring focuses on altering the original agreement to prevent default.

Distressed Exchange

Distressed exchange involves negotiating new debt terms to avoid bankruptcy, often replacing existing debt with equity or longer maturities, which differs from refinancing where new debt is issued to pay off old obligations without altering the original loan's fundamental terms. In restructuring, creditors accept modifications to reduce debt burden or improve cash flow, while refinancing focuses on obtaining better interest rates or extending loan durations under healthier financial conditions.

Maturity Extension

Maturity extension in financial restructuring involves lengthening loan terms to improve cash flow without altering principal, whereas refinancing replaces existing debt with new terms often involving different interest rates or lenders.

Principal Haircut

Principal Haircut refers to the percentage reduction in the outstanding loan principal during restructuring, distinguishing it from refinancing where the principal amount remains unchanged but loan terms are modified.

Bullet Repayment

Bullet repayment involves paying the entire loan principal at maturity, which can be restructured to extend payment terms or refinanced by obtaining a new loan to replace the original debt.

Forbearance Arrangement

A Forbearance Arrangement temporarily allows borrowers to delay or reduce payments during financial distress, serving as a restructuring tool that differs from refinancing, which replaces existing debt with new credit under revised terms.

Debt Consolidation

Debt consolidation involves restructuring multiple debts into a single payment plan, whereas refinancing replaces an existing loan with a new one under different terms to improve financial conditions.

Interest Rate Reset

Interest Rate Reset allows adjustment of loan rates based on market conditions, playing a crucial role in restructuring by modifying existing terms without acquiring new debt. In contrast, refinancing involves replacing old debt with new loans, often at different interest rates, to optimize cash flow or extend maturity.

Debt-for-Equity Swap

Debt-for-equity swaps facilitate corporate restructuring by converting debt into ownership stakes, reducing liabilities without incurring new debt, whereas refinancing replaces existing debt with new debt under different terms without altering equity structure.

restructuring vs refinancing Infographic

moneydif.com

moneydif.com