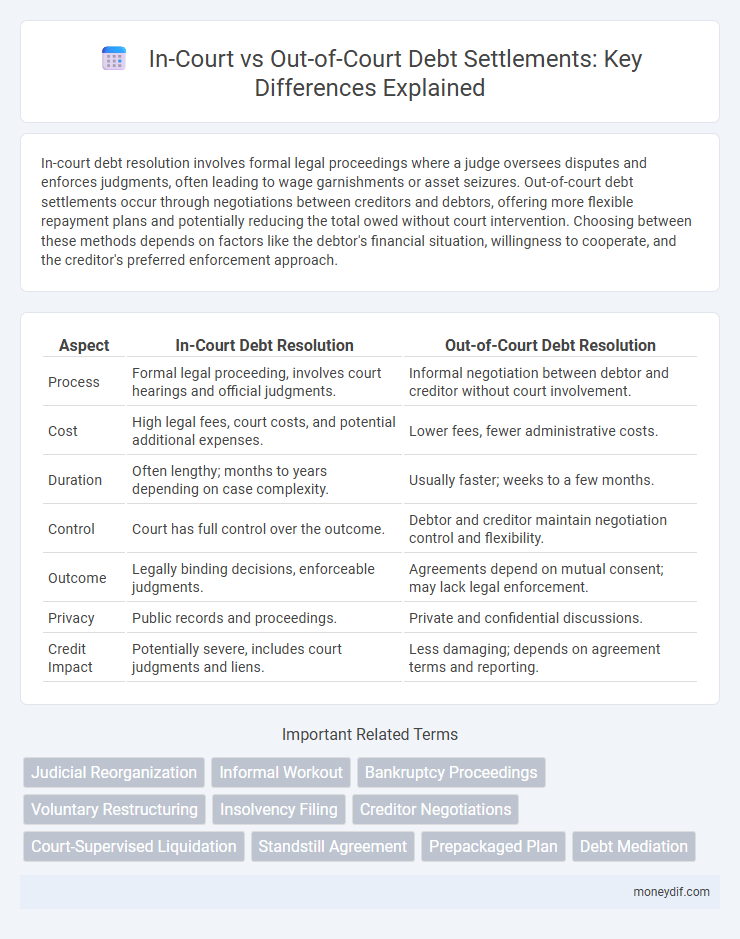

In-court debt resolution involves formal legal proceedings where a judge oversees disputes and enforces judgments, often leading to wage garnishments or asset seizures. Out-of-court debt settlements occur through negotiations between creditors and debtors, offering more flexible repayment plans and potentially reducing the total owed without court intervention. Choosing between these methods depends on factors like the debtor's financial situation, willingness to cooperate, and the creditor's preferred enforcement approach.

Table of Comparison

| Aspect | In-Court Debt Resolution | Out-of-Court Debt Resolution |

|---|---|---|

| Process | Formal legal proceeding, involves court hearings and official judgments. | Informal negotiation between debtor and creditor without court involvement. |

| Cost | High legal fees, court costs, and potential additional expenses. | Lower fees, fewer administrative costs. |

| Duration | Often lengthy; months to years depending on case complexity. | Usually faster; weeks to a few months. |

| Control | Court has full control over the outcome. | Debtor and creditor maintain negotiation control and flexibility. |

| Outcome | Legally binding decisions, enforceable judgments. | Agreements depend on mutual consent; may lack legal enforcement. |

| Privacy | Public records and proceedings. | Private and confidential discussions. |

| Credit Impact | Potentially severe, includes court judgments and liens. | Less damaging; depends on agreement terms and reporting. |

Understanding In-Court and Out-of-Court Debt Resolutions

In-court debt resolutions involve formal legal proceedings where a judge oversees the resolution process, often resulting in binding judgments such as debt restructuring or bankruptcy orders. Out-of-court debt resolutions occur through negotiated agreements between creditors and debtors without court intervention, allowing for more flexible and faster settlements. Understanding the key differences helps debtors choose strategies that minimize costs and preserve creditworthiness.

Key Differences Between In-Court and Out-of-Court Processes

In-court debt processes involve formal legal proceedings such as filing lawsuits, court hearings, and judgments, which can lead to enforceable rulings and potential liens or wage garnishments. Out-of-court debt resolutions typically include negotiations, settlements, or debt management plans initiated directly between creditors and debtors without judicial intervention. Key differences hinge on the level of formality, costs involved, timeline duration, and the enforceability of agreements reached.

Pros and Cons of In-Court Debt Settlement

In-court debt settlement offers the advantage of legally binding agreements enforced by the judiciary, ensuring creditor compliance and structured repayment plans. This method provides transparency and formal dispute resolution, beneficial for complex or contested debts. However, it involves higher costs, longer timelines, and potential credit score impact compared to out-of-court alternatives.

Advantages and Disadvantages of Out-of-Court Debt Negotiation

Out-of-court debt negotiation offers advantages such as reduced legal costs, faster resolution, and greater flexibility in payment terms, which can protect the debtor's credit rating more effectively than court proceedings. However, disadvantages include the potential for creditors to reject offers without legal obligation, the lack of formal enforcement mechanisms, and the risk of inconsistent agreements among multiple creditors. This approach requires careful negotiation to balance creditor concessions against the debtor's capacity to pay without incurring additional penalties or interest.

When to Choose In-Court Over Out-of-Court for Debt Resolution

Choosing in-court debt resolution becomes essential when the debtor disputes the claim or when negotiations stall without a feasible repayment plan. Courts provide legally binding judgments, enforceable through liens or wage garnishments, offering stronger creditor protection compared to out-of-court settlements. Complex cases involving bankruptcy or contested debts often require judicial intervention to ensure fair asset distribution and compliance with statutory debt laws.

Legal Considerations in Debt Settlement: Court vs. Non-Court

Legal considerations in debt settlement vary significantly between in-court and out-of-court approaches. In-court settlements typically involve formal judicial procedures, providing enforceable judgments but often incurring higher costs and extended timelines. Out-of-court negotiations prioritize flexibility and confidentiality, allowing creditors and debtors to reach mutually agreeable terms without the risk of public records or a court's rigid protocols.

Costs and Timelines: In-Court Versus Out-of-Court Solutions

In-court debt resolutions generally involve higher legal costs and longer timelines due to formal procedures and court schedules. Out-of-court settlements typically reduce expenses and expedite resolution by facilitating direct negotiations between parties without judicial intervention. Choosing out-of-court solutions often leads to faster debt recovery and lower overall financial burden for both creditors and debtors.

Impact on Credit Rating: Court Proceedings vs. Private Settlements

Court proceedings often lead to public records of judgments or bankruptcies, severely damaging credit ratings by lowering credit scores and increasing interest rates. Private settlements typically avoid public records, helping preserve credit ratings by allowing negotiated repayment plans without court involvement. Choosing out-of-court resolutions reduces the risk of credit report negative entries and maintains better access to future credit.

Stakeholder Roles in In-Court and Out-of-Court Debt Processes

In in-court debt processes, stakeholders such as creditors, debtors, judges, and trustees actively participate in formal legal proceedings to resolve disputes and enforce judgments. Out-of-court procedures involve creditors, debtors, debt counselors, and mediators collaborating to negotiate repayment plans or settlements without court intervention. Each process assigns distinct roles, with courts providing legal authority in in-court cases, while negotiation and agreement facilitation define stakeholder responsibilities in out-of-court resolutions.

Real-World Case Studies: In-Court vs. Out-of-Court Debt Outcomes

Real-world case studies reveal that in-court debt resolutions often lead to legally binding payment plans with higher recovery rates but incur significant legal fees and extended timelines. Out-of-court settlements tend to provide faster resolutions and reduced costs, yet they may result in lower recovery percentages and less formal enforcement mechanisms. Analyzing specific creditor-debtor case data highlights that strategic selection between in-court and out-of-court processes depends on debt size, debtor cooperation, and asset availability.

Important Terms

Judicial Reorganization

Judicial reorganization involves court-supervised restructuring of a debtor's obligations, contrasting with out-of-court workouts that rely on voluntary agreements between creditors and debtors without formal legal intervention.

Informal Workout

Informal workouts in distressed debt negotiations occur outside formal bankruptcy proceedings, facilitating flexible in-court and out-of-court restructuring options.

Bankruptcy Proceedings

Bankruptcy proceedings involve court-supervised processes that legally restructure or liquidate debts, while out-of-court settlements allow debtors and creditors to negotiate repayment terms independently without judicial intervention.

Voluntary Restructuring

Voluntary restructuring offers businesses a flexible alternative to in-court proceedings by enabling negotiated debt adjustment with creditors outside formal bankruptcy filings, reducing costs and preserving operational control.

Insolvency Filing

Insolvency filing distinctions between in-court and out-of-court processes impact creditor negotiations, legal oversight, and asset recovery timelines.

Creditor Negotiations

Creditor negotiations in in-court settings involve formal bankruptcy proceedings supervised by the judiciary, while out-of-court negotiations rely on voluntary agreements between creditors and debtors to restructure debt without legal intervention.

Court-Supervised Liquidation

Court-supervised liquidation involves a formal judicial process where a bankruptcy court oversees the sale of assets and distribution of proceeds to creditors, ensuring compliance with legal standards and protection of debtor and creditor rights. In contrast, out-of-court liquidation is a private process negotiated directly between the debtor and creditors without court intervention, often resulting in a quicker but less structured resolution.

Standstill Agreement

A Standstill Agreement legally pauses certain actions, often used in both in-court and out-of-court scenarios to facilitate negotiations or restructuring without escalating conflicts. In-court Standstill Agreements are typically overseen by a judge, ensuring enforceability during litigation, while out-of-court versions rely on mutual consent between parties to maintain a temporary halt in disputes.

Prepackaged Plan

Prepackaged plans streamline bankruptcy by allowing debtors to negotiate restructuring agreements with creditors before filing, significantly reducing court involvement compared to traditional out-of-court workouts.

Debt Mediation

Debt mediation offers a structured process for negotiating repayment terms between debtors and creditors, with in-court mediation providing a legally supervised environment that can result in binding agreements, whereas out-of-court mediation typically allows for more flexible, informal negotiations without judicial enforcement. In-court mediation often involves a neutral judge or court-appointed mediator, while out-of-court mediation relies on professional mediators or debt counselors to facilitate communication and settlements outside the formal judicial system.

in-court vs out-of-court Infographic

moneydif.com

moneydif.com