Intercreditor agreements regulate the relationship between multiple creditors to determine priority and rights during a borrower's default or restructuring, ensuring clear terms on repayment order. Subordination involves one creditor agreeing to rank their claim below another, which impacts recovery prospects and influences negotiation power. Understanding the distinction helps optimize debt structuring and manage risk in complex financing arrangements.

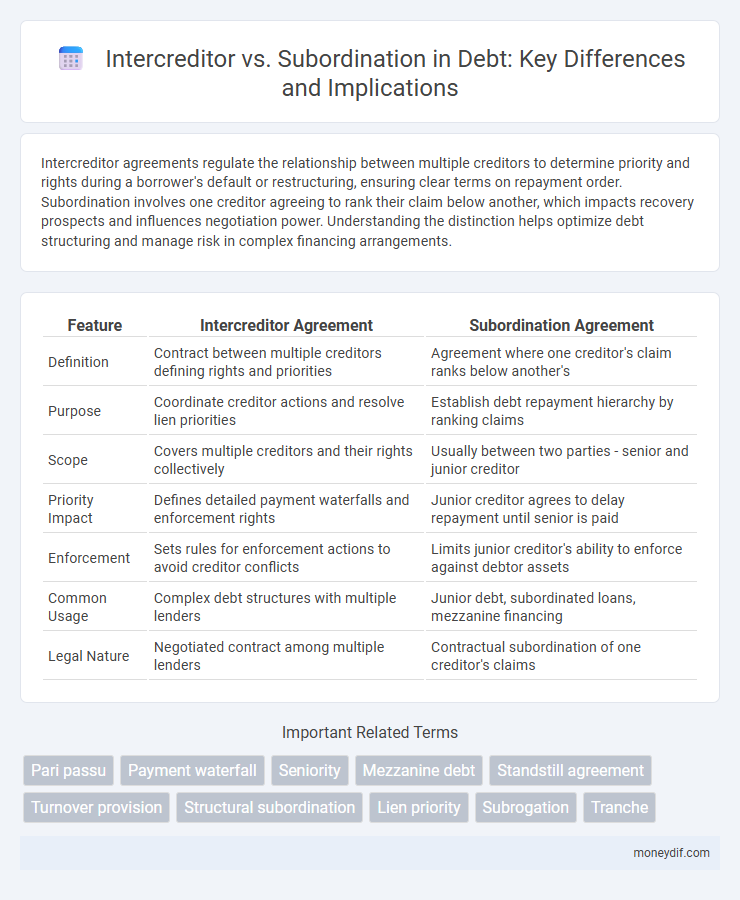

Table of Comparison

| Feature | Intercreditor Agreement | Subordination Agreement |

|---|---|---|

| Definition | Contract between multiple creditors defining rights and priorities | Agreement where one creditor's claim ranks below another's |

| Purpose | Coordinate creditor actions and resolve lien priorities | Establish debt repayment hierarchy by ranking claims |

| Scope | Covers multiple creditors and their rights collectively | Usually between two parties - senior and junior creditor |

| Priority Impact | Defines detailed payment waterfalls and enforcement rights | Junior creditor agrees to delay repayment until senior is paid |

| Enforcement | Sets rules for enforcement actions to avoid creditor conflicts | Limits junior creditor's ability to enforce against debtor assets |

| Common Usage | Complex debt structures with multiple lenders | Junior debt, subordinated loans, mezzanine financing |

| Legal Nature | Negotiated contract among multiple lenders | Contractual subordination of one creditor's claims |

Understanding Intercreditor and Subordination Agreements

Intercreditor agreements establish the rights and priorities between multiple creditors, ensuring clear terms for payment order and collateral claims in complex financing structures. Subordination agreements specifically dictate that one creditor's claim ranks below another, affecting recovery priority during default or bankruptcy. Understanding these agreements is essential for managing risks and enforcing creditors' rights in multi-lender debt arrangements.

Key Differences Between Intercreditor and Subordination Agreements

Intercreditor agreements define the rights and priorities among multiple creditors, ensuring clear governance in shared lending scenarios, while subordination agreements specifically establish the ranking of debt by subordinating one creditor's claim below another's, affecting repayment hierarchy. Intercreditor agreements often include provisions about control rights, standstill periods, and enforcement actions, whereas subordination agreements primarily focus on the priority of payment and enforcement rights. These distinctions impact creditor protections, negotiation leverage, and the structuring of complex financing arrangements.

Purpose and Importance in Debt Financing

Intercreditor agreements define the rights and priorities between multiple creditors, ensuring clarity in repayment order and minimizing conflict during debtor default, which is crucial for maintaining structured debt financing. Subordination establishes the ranking of creditor claims, with subordinated debt bearing higher risk and typically commanding higher returns to reflect its lower repayment priority. Both mechanisms are essential for optimizing capital structure, protecting lender interests, and facilitating access to diverse funding sources in complex financing arrangements.

Structure of Intercreditor Agreements

Intercreditor agreements define the rights and priorities among multiple creditors, establishing clear rules for payment waterfalls, enforcement rights, and collateral sharing to mitigate conflicts and protect senior debt interests. These agreements specify the ranking of claims, outline standstill periods preventing subordinate lenders from accelerating loans prematurely, and address control over workout decisions during borrower distress. Effective structuring of intercreditor agreements ensures orderly debt restructuring processes and balances creditor protections, contrasting with simple subordination provisions that only rank debt without detailed operational terms.

Structure of Subordination Agreements

Subordination agreements establish the priority ranking of debts by detailing which creditor's claim takes precedence in repayment scenarios, typically subordinating junior creditors to senior ones to ensure structured risk management. These agreements outline the conditions under which subordinate debt holders agree to defer their payment claims until senior obligations are fully satisfied, often including clauses related to default, bankruptcy, and enforcement rights. Clear definitions of debt classes, timing of payments, and rights to collateral are key structural components that differentiate subordination agreements from intercreditor agreements, which coordinate rights among various creditors without necessarily altering payment priority.

Rights and Priorities of Creditors

Intercreditor agreements define the rights and priorities among multiple creditors, ensuring clarity in debt repayment order during defaults or restructurings. Subordination agreements explicitly rank one creditor's claim below another's, limiting repayment rights and enforcing lower priority in asset distribution. Clear contractual terms in these agreements protect creditor interests, reduce conflicts, and facilitate structured debt recovery.

Common Clauses in Intercreditor Arrangements

Common clauses in intercreditor arrangements typically include payment restrictions, voting rights, and standstill provisions that prioritize the senior lender's interests. These agreements often set rules for enforcement actions, detailing conditions under which junior creditors can act or intervene. Subordination clauses within these contracts explicitly outline the hierarchy of claims, ensuring junior debts are subordinate to senior obligations in repayment and default scenarios.

Legal Implications of Subordination

Subordination in debt agreements legally alters the priority of creditors, placing subordinated lenders behind senior creditors in repayment hierarchy during default or bankruptcy proceedings. This arrangement affects enforcement rights, restricting subordinated creditors from initiating collection actions until senior debts are fully satisfied. Courts typically uphold subordination clauses, reinforcing the binding nature of creditor rank and influencing negotiation power among lenders.

Practical Scenarios: When to Use Each Agreement

Intercreditor agreements are essential in syndicated loans or complex financing involving multiple creditors to clearly define priority, voting rights, and enforcement procedures, preventing conflicts and ensuring orderly debt repayment. Subordination agreements are typically used in situations where a creditor agrees to lower priority behind senior debt, such as mezzanine financing or unsecured loans, to facilitate borrowing by increasing lender confidence in repayment hierarchy. Practical application depends on the capital structure complexity and creditor relationships, with intercreditor agreements used in multi-lender deals and subordination agreements in prioritizing existing debts relative to new borrowings.

Risks and Considerations for Lenders and Borrowers

Intercreditor agreements delineate priority and control rights among multiple lenders, reducing disputes but potentially limiting recovery options during default, whereas subordination clauses explicitly rank debt obligations, increasing the risk for subordinated lenders but often enabling borrowers to secure additional financing. Lenders must carefully assess the impact on their recovery prospects and control rights, while borrowers should weigh the trade-offs between attracting new capital and the complexity of negotiating terms. Clear documentation and strategic negotiation help mitigate risks, preserving flexibility and aligning interests among all parties.

Important Terms

Pari passu

Pari passu refers to equal ranking among creditors, ensuring proportional payment without preference in claims. In intercreditor agreements, pari passu clauses maintain balance by preventing subordination, while subordination contracts explicitly rank debt, subordinating junior creditors to senior ones in repayment priority.

Payment waterfall

The payment waterfall structure defines the priority of cash flow distribution among creditors, where intercreditor agreements establish the rights and hierarchy between different creditor classes while subordination clauses explicitly rank debt obligations by priority of repayment.

Seniority

Seniority in debt agreements determines the priority of payment obligations, where intercreditor agreements establish terms among creditors of similar seniority, while subordination agreements explicitly rank one creditor's claims below another's in repayment hierarchy.

Mezzanine debt

Mezzanine debt occupies a hybrid position between senior debt and equity, often subordinated to senior lenders but prioritized over common equity in the capital structure, which is clearly defined through intercreditor agreements specifying rights, payment priorities, and enforcement actions. These agreements govern the relationship between mezzanine lenders and senior creditors, ensuring structured risk allocation and protecting senior lenders' security while permitting mezzanine investors higher returns in exchange for increased risk.

Standstill agreement

A standstill agreement temporarily halts creditor actions and differs from intercreditor agreements, which establish priority and rights among multiple creditors, whereas subordination agreements specifically rank one creditor's claims below another's.

Turnover provision

Turnover provisions in intercreditor agreements ensure subordinated creditors promptly transfer recovered funds to senior lenders, prioritizing senior debt repayment and minimizing payment conflicts.

Structural subordination

Structural subordination occurs when a creditor's claim is indirectly subordinate because the debt is owed by a subsidiary rather than the parent company, distinguishing it from contractual subordination established through intercreditor agreements between lenders.

Lien priority

Lien priority is determined by the intercreditor agreement outlining the ranking of creditor claims versus subordination agreements that legally defer one lien holder's rights below another's.

Subrogation

Subrogation allows a creditor to assume another creditor's rights, impacting intercreditor agreements by potentially altering priority and conflicting with subordination clauses that rank creditor claims.

Tranche

Tranche structuring in intercreditor agreements defines priority and payment order by subordinating junior debt to senior creditors, optimizing risk allocation and creditor protection.

intercreditor vs subordination Infographic

moneydif.com

moneydif.com