Pari passu and seniority represent two distinct approaches to debt repayment priority. Pari passu treats all creditors equally, distributing payments proportionally among them without preference. Seniority ranks creditors, ensuring senior debt holders receive full repayment before subordinate creditors are paid.

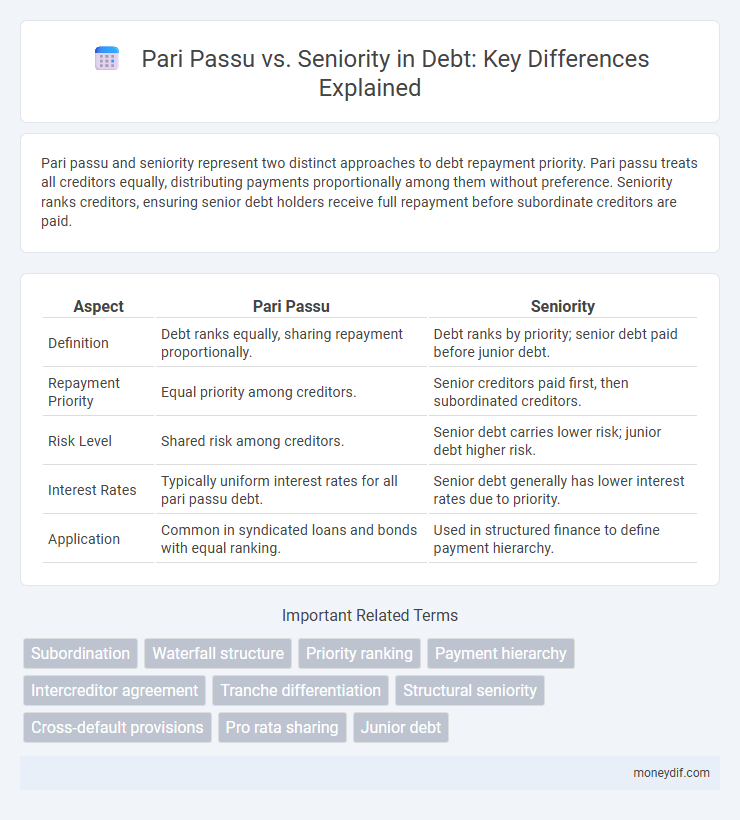

Table of Comparison

| Aspect | Pari Passu | Seniority |

|---|---|---|

| Definition | Debt ranks equally, sharing repayment proportionally. | Debt ranks by priority; senior debt paid before junior debt. |

| Repayment Priority | Equal priority among creditors. | Senior creditors paid first, then subordinated creditors. |

| Risk Level | Shared risk among creditors. | Senior debt carries lower risk; junior debt higher risk. |

| Interest Rates | Typically uniform interest rates for all pari passu debt. | Senior debt generally has lower interest rates due to priority. |

| Application | Common in syndicated loans and bonds with equal ranking. | Used in structured finance to define payment hierarchy. |

Understanding Debt Hierarchies: Pari Passu vs Seniority

Debt hierarchies determine the order in which creditors are repaid, with pari passu meaning equal ranking among lenders sharing the same claim level. Seniority, however, establishes a clear pecking order, where senior debt holders receive repayment before subordinated or junior creditors. Understanding these distinctions is critical for assessing risk and recovery rates in insolvency or restructuring scenarios.

Defining Pari Passu in Debt Agreements

Pari passu in debt agreements means that creditors share equal rank and rights to repayment without preference or subordination to one another. This principle ensures that all pari passu lenders receive proportional payments simultaneously in case of default or liquidation. It contrasts with seniority, where debt holders are prioritized based on the hierarchy of claims.

What Sets Seniority Apart in Debt Structures?

Seniority in debt structures dictates the repayment hierarchy, ensuring that senior debt holders receive priority over junior creditors during liquidation or bankruptcy events. This prioritization reduces risk for senior lenders by providing a higher probability of full repayment, often reflected in lower interest rates compared to subordinated debt. In contrast, pari passu status means equal ranking among creditors, sharing proportional payments without hierarchical preference, making seniority a key factor in risk assessment and debt pricing.

Legal Implications of Pari Passu Clauses

Pari passu clauses legally ensure equal ranking of debts, preventing creditors from being subordinated during liquidation or restructuring. These provisions mandate proportional treatment and distribution of proceeds, safeguarding creditor rights by disallowing preferential payments. Courts often enforce pari passu as a principle that upholds creditor equity and maintains market confidence in debt instruments.

Priority of Payments: Senior vs Pari Passu Creditors

Senior creditors hold a higher priority of payments compared to pari passu creditors, meaning senior debt is repaid first during insolvency or liquidation. Pari passu creditors share equal ranking and receive distributions proportionally without preference. This payment hierarchy ensures that senior debt minimizes lender risk, while pari passu debt spreads risk evenly among creditors.

Real-World Examples: Pari Passu and Senior Debt in Action

Pari passu and senior debt distinctions critically impact recovery outcomes in corporate bankruptcies, as seen in the 2009 General Motors restructuring, where senior secured lenders were prioritized over pari passu unsecured creditors, resulting in varied repayment rates. The Lehman Brothers collapse also highlights pari passu treatment among unsecured creditors who shared losses equally, contrasting sharply with the preferential treatment senior creditors received. These examples demonstrate how creditor hierarchy influences debt restructuring strategies and financial distress resolutions in global markets.

Impact on Recovery Rates in Default Scenarios

Pari passu debt ranks equally in claims on assets, resulting in similar recovery rates for bondholders during default scenarios, whereas senior debt holders receive payment priority and thus higher recovery rates. The presence of senior debt reduces the residual value available to pari passu and subordinated creditors, often lowering their recovery percentages significantly. Recovery rates are critical for investors evaluating risk, making the debt ranking structure a key factor in credit analysis and loss given default models.

Investor Perspectives: Risk and Return Considerations

Investors analyzing debt instruments weigh pari passu and seniority structures to assess risk exposure and potential returns, with pari passu offering equal ranking that dilutes recovery in default scenarios. Seniority provides a hierarchy in claims, granting senior debt holders priority in repayments and typically lower yields due to reduced risk. Understanding these distinctions enables investors to balance portfolio risk and optimize expected return profiles effectively.

How Pari Passu and Seniority Affect Debt Covenants

Pari passu and seniority directly influence the structure and priority of debt covenants, determining the order in which creditors are repaid during default or restructuring. Pari passu clauses ensure equal ranking and equal treatment among creditors, limiting preferential rights and impacting covenant flexibility by preventing discriminatory actions. Seniority establishes a hierarchy of claims, with senior debt holders having precedence over junior creditors, shaping covenant terms to protect senior lenders' interests by enforcing stricter financial ratios and restrictions.

Best Practices for Assessing Debt Structure Risks

Analyzing debt structure risks requires prioritizing the seniority of claims to understand repayment order during default scenarios, with senior debt holders typically having priority over pari passu creditors. Best practices involve detailed review of debt covenants, documentation, and intercreditor agreements to identify subordination provisions and equal ranking clauses. Incorporating stress testing and scenario analysis on cash flows ensures comprehensive evaluation of liquidity risks associated with both pari passu and senior debt tranches.

Important Terms

Subordination

Subordination in debt agreements determines the priority of claims, where pari passu clauses ensure equal seniority among creditors, while seniority establishes a strict ranking of repayment priority.

Waterfall structure

Waterfall structure allocates payments in a priority sequence, where senior tranches receive funds before pari passu tranches, which share payments equally without priority. This hierarchy ensures senior creditors have first claim on cash flows, while pari passu creditors hold equal ranking within their layer.

Priority ranking

Priority ranking determines the order in which creditors are paid, with senior debt holding a higher claim over assets compared to pari passu obligations that share equal ranking without preference. Seniority ensures that senior creditors receive full repayment before pari passu creditors, impacting recovery rates during insolvency or liquidation.

Payment hierarchy

Payment hierarchy defines the order in which creditors are repaid during liquidation, prioritizing senior debt holders over subordinate creditors, while pari passu denotes equal ranking where multiple creditors share repayment simultaneously without preference. In structured finance, senior debt typically has priority claim on assets, whereas pari passu arrangements ensure pro-rata distribution among equal-ranking debt holders, impacting recovery rates and risk allocation.

Intercreditor agreement

An intercreditor agreement establishes the priority of claims among creditors by defining pari passu status or seniority to determine the order of repayment and enforcement rights.

Tranche differentiation

Tranche differentiation in structured finance defines payment priority, where senior tranches have higher repayment precedence over junior tranches despite pari passu status within each class.

Structural seniority

Structural seniority defines the repayment hierarchy among debt instruments, where senior debt holds priority over junior or subordinated debt in claims on assets and cash flows. Pari passu indicates equal ranking and simultaneous payment rights among creditors within the same class, ensuring no creditor is favored over another.

Cross-default provisions

Cross-default provisions trigger immediate debt repayment upon default on any related obligation, potentially overriding pari passu clauses and impacting debt seniority rankings.

Pro rata sharing

Pro rata sharing allocates losses or recoveries proportionally among creditors based on their claim size, ensuring fairness under pari passu arrangements where all creditors rank equally. In contrast, seniority dictates a hierarchical payment order, with senior creditors paid in full before junior creditors receive any distribution, overriding pro rata principles among different tiers.

Junior debt

Junior debt ranks below senior debt in the capital structure, meaning it is repaid after senior creditors in case of liquidation or default, leading to higher risk and typically higher interest rates. Pari passu clauses ensure that multiple creditors of the same seniority level have equal rights to repayment, preventing any one creditor from being prioritized over others within that class.

pari passu vs seniority Infographic

moneydif.com

moneydif.com