Mezzanine debt carries higher risk than senior debt but offers greater returns through interest rates and equity participation, making it a hybrid between debt and equity financing. Senior debt holds priority claim on assets in case of default, providing lower risk and lower interest rates to lenders. Companies use mezzanine financing to bridge funding gaps when senior debt limits are reached, balancing cost and risk.

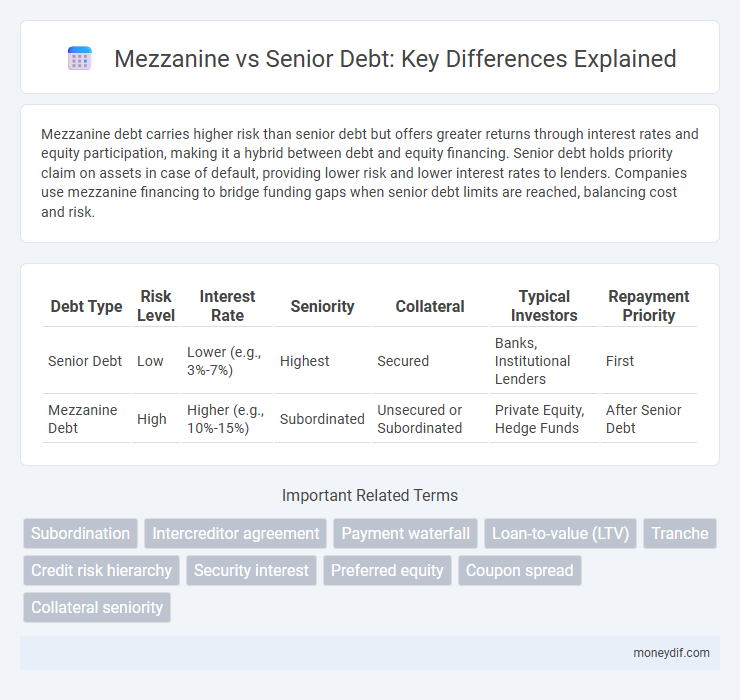

Table of Comparison

| Debt Type | Risk Level | Interest Rate | Seniority | Collateral | Typical Investors | Repayment Priority |

|---|---|---|---|---|---|---|

| Senior Debt | Low | Lower (e.g., 3%-7%) | Highest | Secured | Banks, Institutional Lenders | First |

| Mezzanine Debt | High | Higher (e.g., 10%-15%) | Subordinated | Unsecured or Subordinated | Private Equity, Hedge Funds | After Senior Debt |

Understanding Mezzanine and Senior Debt

Mezzanine debt is a hybrid form of financing that combines debt and equity features, typically ranking below senior debt in the capital structure and carrying higher interest rates to compensate for increased risk. Senior debt holds the highest priority in repayment during bankruptcy or liquidation, often secured by company assets, making it less risky and usually associated with lower interest rates. Understanding the risk, cost, and repayment hierarchy between mezzanine and senior debt is crucial for optimizing capital structure and funding strategies in corporate finance.

Key Differences Between Mezzanine and Senior Debt

Mezzanine debt typically carries higher interest rates and subordinated repayment priority compared to senior debt, which holds the highest claim on assets and lower risk. Senior debt often requires collateral, while mezzanine financing is unsecured and may include equity conversion options. The risk-return profile differs significantly, with mezzanine debt balancing higher risk and potential equity upside versus the relative safety and lower returns of senior debt.

Capital Structure: Where Mezzanine and Senior Debt Fit

In the capital structure, senior debt holds the highest priority with secured claims on assets, typically featuring lower interest rates and stricter covenants due to its reduced risk. Mezzanine debt occupies a subordinate position beneath senior debt but above equity, offering higher interest rates and allowing lenders to convert debt into equity in exchange for elevated risk exposure. This positioning impacts company leverage, cost of capital, and risk allocation among investors during financing.

Risk Profiles: Mezzanine vs Senior Debt

Senior debt carries lower risk due to its prioritization in the capital structure, providing lenders with the first claim on assets during default, and typically features lower interest rates reflecting this security. Mezzanine debt assumes higher risk by subordinating claims behind senior debt, often compensating with higher yields and potential equity participation to offset this increased exposure. The risk profiles influence borrower cost of capital and investor return expectations, with senior debt appealing to conservative investors and mezzanine debt attracting those seeking higher returns for accepting additional credit risk.

Interest Rates and Returns Comparison

Mezzanine debt typically carries higher interest rates compared to senior debt due to its subordinate claim on assets and increased risk exposure, resulting in returns that are more attractive to investors seeking higher yield. Senior debt often features lower interest rates with priority repayment, making it less risky and appealing for conservative lenders. The interest rate gap between mezzanine and senior debt reflects the risk-return tradeoff crucial for capital structure decisions.

Collateral and Security: A Comparative Overview

Mezzanine debt typically ranks below senior debt in the capital structure and often lacks collateral, relying instead on the company's equity or warrants as security. Senior debt is secured by specific assets or collateral, providing lenders with a higher claim in case of default and reducing their risk exposure. This fundamental distinction in collateral and security influences the interest rates, recovery prospects, and overall risk profiles of mezzanine versus senior debt instruments.

Use Cases for Mezzanine vs Senior Debt

Mezzanine debt is typically used by companies seeking capital for growth initiatives, acquisitions, or leveraged buyouts when senior debt capacity is maxed out, offering higher risk tolerance with subordinated claims but flexible repayment options. Senior debt is preferred for more stable, lower-risk financing needs due to its priority in claims and lower interest rates, often utilized for working capital, equipment purchases, or real estate financing. Mezzanine is ideal for bridging financing gaps and enhancing equity returns, while senior debt supports foundational, asset-backed funding structures.

Pros and Cons of Mezzanine Debt

Mezzanine debt blends features of both equity and senior debt, offering higher returns than senior loans but with increased risk due to its subordinate repayment priority. It provides flexible financing options and often includes equity warrants, enhancing potential upside for lenders. The main drawbacks involve higher interest costs for borrowers and greater exposure to default risk compared to senior debt, making it suitable for firms with strong growth prospects but limited collateral.

Pros and Cons of Senior Debt

Senior debt offers lower interest rates and has priority claim over assets in case of default, making it less risky for lenders. However, it often comes with strict covenants and limited flexibility for the borrower, potentially restricting operational decisions. While senior debt reduces financing costs, it may limit the company's ability to raise additional debt or equity due to these constraints.

Choosing the Right Financing: Mezzanine or Senior Debt

Mezzanine debt offers higher returns with greater risk and typically includes equity participation, while senior debt is secured by collateral and has priority in repayment, resulting in lower risk and interest rates. Companies prioritizing capital structure stability and lower cost of capital often prefer senior debt, whereas firms seeking flexible financing with less dilution may opt for mezzanine debt. Careful evaluation of cash flow predictability, growth potential, and risk tolerance is essential in choosing between mezzanine and senior debt financing.

Important Terms

Subordination

Mezzanine debt ranks below senior debt in repayment priority, carrying higher interest rates and greater risk due to its subordinate position in the capital structure.

Intercreditor agreement

An intercreditor agreement clearly defines the rights and priorities between senior and mezzanine lenders, ensuring structured repayment and collateral enforcement hierarchy in mezzanine financing.

Payment waterfall

The payment waterfall prioritizes senior debt by allocating cash flows first to senior lenders before mezzanine investors receive payments, reflecting the hierarchical risk and return structure in capital stacks. Senior debt typically offers lower interest rates and lower risk, while mezzanine financing demands higher returns due to its subordinate position and increased credit risk.

Loan-to-value (LTV)

Loan-to-value (LTV) ratios are typically higher for mezzanine loans than senior loans because mezzanine financing assumes greater risk by subordinating to senior debt in repayment priority.

Tranche

Tranche structures in mezzanine financing involve higher-risk, higher-yield subordinate layers positioned below senior debt but above equity in the capital stack.

Credit risk hierarchy

The credit risk hierarchy prioritizes senior debt over mezzanine financing, as senior debt carries lower risk due to its higher claim on assets and repayment priority in default scenarios.

Security interest

Senior debt holds a first-priority security interest over mezzanine debt, which is subordinate and typically unsecured or secured by secondary claims.

Preferred equity

Preferred equity offers a hybrid financing option with higher risk and return than senior debt but lower priority than mezzanine debt in the capital structure.

Coupon spread

Coupon spread between mezzanine and senior debt reflects the higher risk and lower priority of mezzanine financing, typically ranging from 300 to 500 basis points above senior debt yields. This spread compensates investors for mezzanine loans' subordinated position and increased default exposure in capital structures.

Collateral seniority

Senior debt holds priority over mezzanine financing in the collateral hierarchy, ensuring senior lenders receive repayment before mezzanine investors in default scenarios.

mezzanine vs senior Infographic

moneydif.com

moneydif.com