A negative pledge restricts a borrower from creating new liens or pledges on assets to protect existing creditors, ensuring that collateral remains unencumbered. In contrast, a positive pledge requires the borrower to actively maintain or create security interests on specified assets in favor of the lender. Understanding the distinction between negative and positive pledges is crucial for managing debt agreements and safeguarding creditor interests effectively.

Table of Comparison

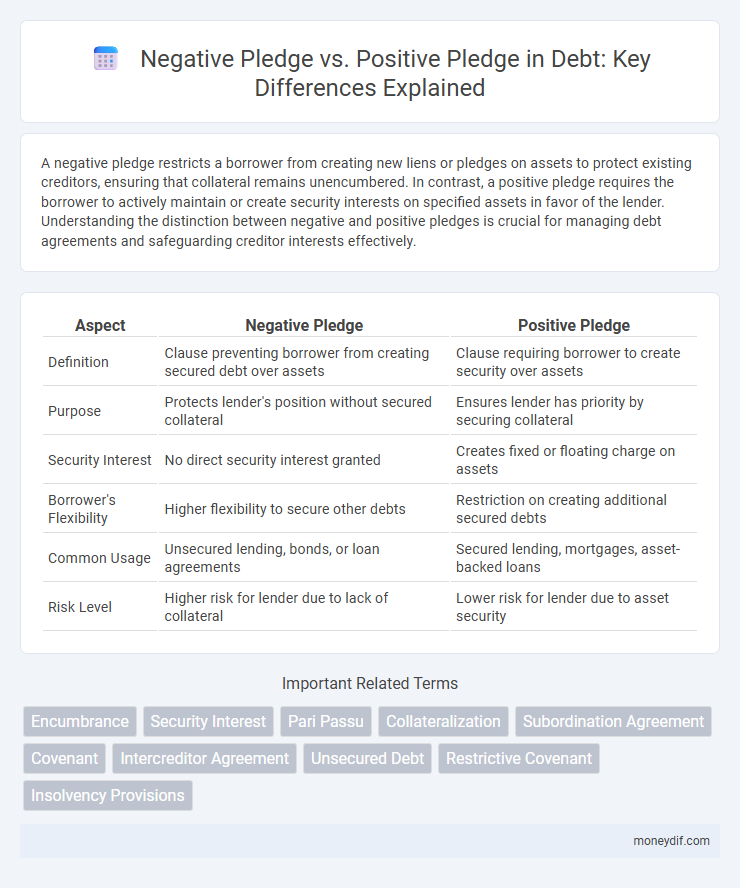

| Aspect | Negative Pledge | Positive Pledge |

|---|---|---|

| Definition | Clause preventing borrower from creating secured debt over assets | Clause requiring borrower to create security over assets |

| Purpose | Protects lender's position without secured collateral | Ensures lender has priority by securing collateral |

| Security Interest | No direct security interest granted | Creates fixed or floating charge on assets |

| Borrower's Flexibility | Higher flexibility to secure other debts | Restriction on creating additional secured debts |

| Common Usage | Unsecured lending, bonds, or loan agreements | Secured lending, mortgages, asset-backed loans |

| Risk Level | Higher risk for lender due to lack of collateral | Lower risk for lender due to asset security |

Understanding Debt Covenants: An Overview

Debt covenants include negative pledges, which restrict borrowers from pledging assets to other lenders, ensuring the primary lender's claim remains senior. Positive pledges require borrowers to maintain certain assets or financial ratios, actively safeguarding lender interests through defined performance criteria. Understanding these covenants is crucial for managing risk and maintaining lender confidence in debt agreements.

What is a Negative Pledge?

A Negative Pledge is a contractual clause in debt agreements that restricts the borrower from creating any security interests or liens on assets without the lender's consent. It protects unsecured creditors by ensuring that the borrower does not prioritize other lenders through secured debt, helping maintain equal treatment among creditors. Unlike a Positive Pledge, which requires the borrower to provide specific collateral, a Negative Pledge merely limits the borrower's ability to encumber assets.

What is a Positive Pledge?

A positive pledge is a contractual agreement in debt financing where the borrower commits to not create any secured debt without the lender's consent, thereby ensuring the lender's priority remains unaffected. Unlike a negative pledge, which restricts only the creation of secured debt, a positive pledge actively requires the borrower to maintain certain assets unencumbered or to take specific actions to protect the lender's interests. This mechanism enhances creditor protection by imposing proactive obligations on the borrower to preserve asset value and secure repayment.

Key Differences Between Negative and Positive Pledges

Negative pledges restrict borrowers from creating additional liens on their assets, protecting the lender's position without giving collateral rights, whereas positive pledges involve the borrower providing specific assets as collateral to secure the loan. Negative pledges serve as a covenanted promise limiting future secured debt, while positive pledges legally grant security interests, often requiring detailed asset valuations and enforcement terms. The key difference lies in the nature of security: negative pledges focus on maintaining a priority position without encumbering assets, whereas positive pledges provide tangible collateral rights enhancing lender protection.

Legal Implications of Pledge Types in Debt Agreements

Negative pledge clauses in debt agreements restrict borrowers from granting security interests to other creditors, preserving the lender's unsecured status and preventing priority disputes. Positive pledge clauses require borrowers to create specific security interests in assets, providing lenders with a stronger legal claim and enhanced protection in case of default. Legal implications vary significantly; negative pledges limit borrower flexibility but avoid complex enforcement issues, while positive pledges impose stricter obligations and enforceability challenges tied to asset valuation and perfection requirements.

Impact on Borrowers: Negative vs Positive Pledge

A negative pledge restricts borrowers from creating certain liens or pledges on their assets, preserving unencumbered collateral for existing creditors and limiting the borrower's ability to secure additional debt. In contrast, a positive pledge requires borrowers to actively pledge specific assets as collateral, which can enhance creditor protection but may reduce the borrower's flexibility in managing asset-backed financing. The impact on borrowers varies as negative pledges offer more operational freedom but might limit future borrowing options, whereas positive pledges improve creditor confidence but impose stricter asset commitments.

Lender Protections: Which Pledge Offers More Security?

Negative pledges restrict borrowers from creating new liens on assets, ensuring existing lenders maintain priority claims, while positive pledges grant specific collateral rights to lenders, enhancing direct security. Lenders benefit from positive pledges through tangible asset control, reducing risk in default scenarios, whereas negative pledges rely on borrower compliance and legal enforcement. Consequently, positive pledges generally offer stronger lender protections and greater security in debt agreements.

Examples of Negative and Positive Pledge Clauses

Negative pledge clauses restrict a borrower from creating any liens on specified assets, ensuring creditors maintain priority, such as a corporation agreeing not to secure additional debt against its property without lender consent. Positive pledge clauses require the borrower to actively maintain certain assets free from liens or to provide specific collateral if additional debt is incurred, like a company pledging machinery as security for future loans. These clauses are critical in debt agreements to manage risk and protect creditor interests.

When to Use Negative or Positive Pledge in Debt Structuring

Negative pledges are typically used when lenders want to restrict a borrower from granting future security interests to other creditors, preserving the lender's position without requiring immediate collateral. Positive pledges are employed when lenders require the borrower to maintain or create specific security on assets, often in more structured or higher-risk debt arrangements. Choosing between negative and positive pledges depends on the lender's need for control, risk mitigation, and the borrower's asset management strategy.

Best Practices for Negotiating Pledge Covenants

Best practices for negotiating pledge covenants emphasize clear definitions of asset scope to avoid ambiguity between negative pledge and positive pledge clauses. Parties should prioritize specifying permitted encumbrances and exception baskets, ensuring transparency and flexibility while protecting creditors' interests. Regular review and alignment with evolving financial conditions enhance enforceability and mitigate risks associated with collateral claims.

Important Terms

Encumbrance

A negative pledge restricts future encumbrances on assets without creating immediate liens, while a positive pledge actively grants security interests, directly encumbering the borrower's property.

Security Interest

Security interest involves a legal claim on collateral to secure the repayment of a debt, distinguishing negative pledge and positive pledge agreements. A negative pledge prohibits the borrower from creating any security interests over specified assets, preserving lender priority, while a positive pledge grants lenders a direct security interest in pledged assets, enhancing their claim in case of default.

Pari Passu

Pari passu ensures equal ranking of obligations, preventing creditors from gaining priority over others, which aligns with the principles of a Negative Pledge by restricting borrowers from creating secured debts that would subordinate existing unsecured creditors. In contrast, a Positive Pledge actively requires the borrower to grant specific security interests or collateral to certain creditors, thus creating a ranking hierarchy that deviates from the pari passu principle.

Collateralization

Collateralization involves securing a loan by pledging assets, with a Negative Pledge clause restricting the borrower from creating additional encumbrances on assets, while a Positive Pledge requires the borrower to provide specific collateral to secure the loan. Negative Pledge protects lenders by limiting future secured debt, whereas Positive Pledge assures lenders by identifying and prioritizing collateral.

Subordination Agreement

A Subordination Agreement legally establishes the priority of one debt over another, often differentiating between Negative Pledge clauses, which prevent a borrower from granting security interests to new creditors, and Positive Pledge clauses, which allow the borrower to offer specific collateral while maintaining certain debt restrictions. Understanding the implications of Negative Pledge versus Positive Pledge within a Subordination Agreement is essential for creditors to protect their interests and for borrowers to manage secured and unsecured financing effectively.

Covenant

A covenant with a negative pledge restricts a borrower from pledging assets to other creditors, whereas a positive pledge requires the borrower to actively pledge specific assets as collateral.

Intercreditor Agreement

An Intercreditor Agreement defines the rights and priorities between creditors, where a Negative Pledge restricts a borrower from creating new liens on assets, while a Positive Pledge mandates the borrower to provide collateral to secure the loan.

Unsecured Debt

Unsecured debt is often governed by negative pledge clauses restricting borrowers from granting future liens, while positive pledge clauses require the borrower to secure the debt with specific assets.

Restrictive Covenant

A restrictive covenant in finance limits actions by a borrower, with negative pledges preventing asset collateralization for other debts and positive pledges requiring specific assets to secure certain obligations.

Insolvency Provisions

Insolvency provisions often distinguish between negative pledge clauses, which prevent borrowers from granting security interests to other creditors, and positive pledge clauses, which require borrowers to provide specific assets as collateral. Negative pledges protect existing lenders by maintaining asset availability during insolvency, while positive pledges strengthen creditor claims by prioritizing secured debt repayment in bankruptcy proceedings.

Negative Pledge vs Positive Pledge Infographic

moneydif.com

moneydif.com