Mezzanine debt combines elements of equity and debt, offering higher interest rates and subordinated claims, typically used for long-term growth financing or acquisitions. Bridge loans provide short-term capital to bridge gaps between transactions, often secured by collateral and repaid quickly once permanent financing is obtained. Choosing between mezzanine debt and a bridge loan depends on the borrower's timing, risk tolerance, and financial strategy.

Table of Comparison

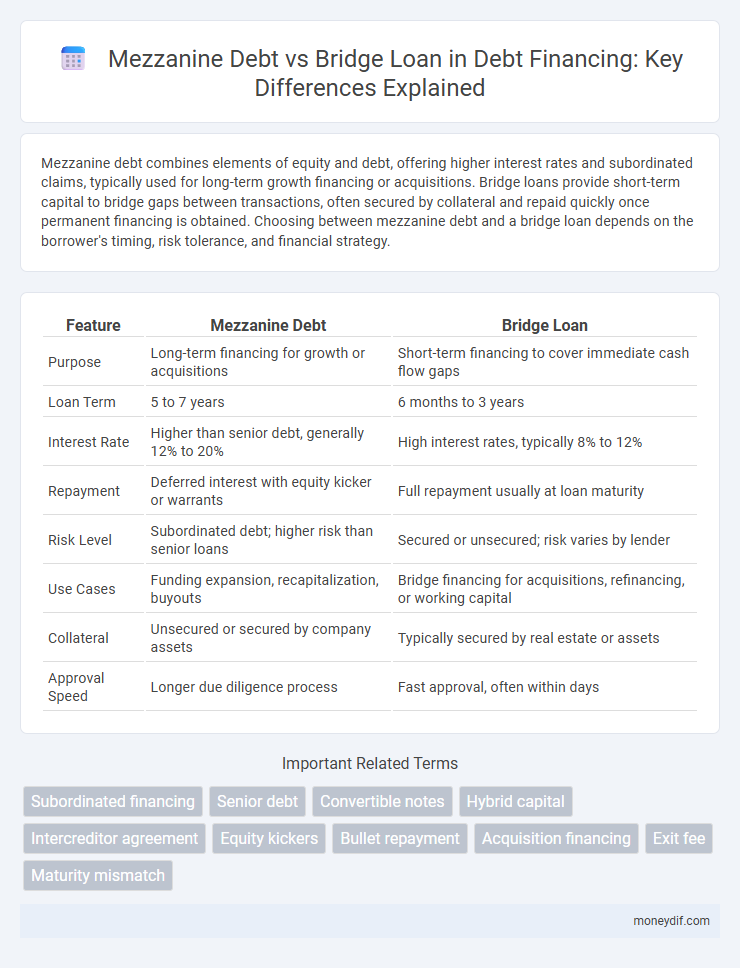

| Feature | Mezzanine Debt | Bridge Loan |

|---|---|---|

| Purpose | Long-term financing for growth or acquisitions | Short-term financing to cover immediate cash flow gaps |

| Loan Term | 5 to 7 years | 6 months to 3 years |

| Interest Rate | Higher than senior debt, generally 12% to 20% | High interest rates, typically 8% to 12% |

| Repayment | Deferred interest with equity kicker or warrants | Full repayment usually at loan maturity |

| Risk Level | Subordinated debt; higher risk than senior loans | Secured or unsecured; risk varies by lender |

| Use Cases | Funding expansion, recapitalization, buyouts | Bridge financing for acquisitions, refinancing, or working capital |

| Collateral | Unsecured or secured by company assets | Typically secured by real estate or assets |

| Approval Speed | Longer due diligence process | Fast approval, often within days |

Understanding Mezzanine Debt and Bridge Loans

Mezzanine debt is a hybrid financing option combining elements of debt and equity, typically used for growth capital or leveraged buyouts, offering higher interest rates and subordinated repayment priority compared to senior debt. Bridge loans provide short-term liquidity to cover immediate financial needs or bridge gaps between long-term financing, often secured against assets with higher interest rates due to their temporary nature. Both financing tools support different stages of capital structure needs, with mezzanine debt emphasizing flexible, long-term capital infusion and bridge loans focusing on urgent, interim funding solutions.

Key Differences Between Mezzanine Debt and Bridge Loans

Mezzanine debt typically serves as subordinated financing with higher interest rates and potential equity conversion, positioned between senior debt and equity in the capital structure. Bridge loans are short-term, high-interest loans designed to provide immediate liquidity for transactions or operational needs before securing permanent financing. Mezzanine debt often supports long-term growth and recapitalization, whereas bridge loans address transitional financing gaps with quicker repayment schedules.

Structure and Terms of Mezzanine Debt

Mezzanine debt typically features subordinated debt with equity conversion options, positioned between senior debt and equity in the capital stack, offering lenders higher returns through interest payments and potential equity upside. Its terms include longer maturities, ranging from five to seven years, and higher interest rates often accompanied by warrants or options to purchase equity shares. The structure provides flexibility in repayment schedules and may include covenants that balance lender protection with borrower operational freedom.

Structure and Terms of Bridge Loans

Bridge loans typically feature short-term structures, ranging from six months to three years, designed to provide quick liquidity during transitional phases. These loans often carry higher interest rates compared to mezzanine debt, reflecting their risk and speed of execution. Bridge loans usually require collateral and have stricter repayment schedules, emphasizing fast closure and refinancing or payoff within the loan term.

Typical Use Cases for Mezzanine Debt

Mezzanine debt is typically used to finance the expansion of established companies that require growth capital without diluting equity ownership significantly. It is often employed in leveraged buyouts, recapitalizations, and acquisitions where long-term financing bridges the gap between senior debt and equity. This form of debt provides borrowers with more flexible terms compared to bridge loans, which are usually short-term solutions meant to cover immediate cash flow needs.

Typical Use Cases for Bridge Loans

Bridge loans are commonly used to provide short-term financing during transitional periods such as property acquisitions before securing long-term financing or refinancing. Real estate developers often rely on bridge loans to quickly close deals while awaiting permanent mortgage approval or before the sale of an existing asset. These loans are ideal for addressing immediate liquidity needs, covering gap financing, or facilitating project kick-starts when time-sensitive capital inflows are crucial.

Risk and Return Comparison

Mezzanine debt typically carries higher risk than bridge loans due to its subordinate position in the capital stack but offers greater returns through higher interest rates and equity participation. Bridge loans present lower risk with shorter terms and secured collateral, providing more predictable but modest returns focused on interest income. The risk-return profile of mezzanine debt suits investors seeking enhanced yields with exposure to credit and equity risk, while bridge loans appeal to those prioritizing capital preservation and liquidity.

Security and Collateral: Mezzanine vs Bridge Financing

Mezzanine debt typically ranks subordinate to senior debt but is secured through equity warrants or subordinated liens, offering lenders potential upside while absorbing higher risk. Bridge loans are secured by the borrower's primary assets or property, providing superior collateral protection and priority in repayment compared to mezzanine financing. The distinct security structures influence lender risk profiles, with bridge loans favored for their asset-backed collateral and mezzanine debt often utilized to fill financing gaps with equity-linked incentives.

Pros and Cons of Mezzanine Debt

Mezzanine debt offers flexible financing with higher loan amounts and is subordinate to senior debt but ranks above equity, making it attractive for companies seeking growth capital without immediate equity dilution. It typically carries higher interest rates and may include equity warrants, increasing the overall cost of capital compared to senior or bridge loans. While mezzanine debt provides longer-term funding than bridge loans, it can impose substantial financial strain due to its repayment obligations and potential impact on control through equity participation.

Pros and Cons of Bridge Loans

Bridge loans offer rapid financing solutions with flexible approval criteria, making them ideal for businesses needing quick capital to seize time-sensitive opportunities or cover cash flow gaps. However, their short-term nature often comes with higher interest rates and fees compared to traditional loans, increasing the overall borrowing cost. Limited funding amounts and potential refinancing risks further complicate reliance on bridge loans for long-term financial planning.

Important Terms

Subordinated financing

Subordinated financing typically refers to mezzanine debt, which ranks below senior debt but above equity in the capital structure, often carrying higher interest rates and equity participation rights to compensate for increased risk. Bridge loans, by contrast, are short-term, senior secured loans designed to provide immediate liquidity until longer-term financing is secured, lacking the subordinated status and associated risk-return profile of mezzanine debt.

Senior debt

Senior debt holds priority over mezzanine debt and bridge loans in repayment hierarchy, typically offering lower interest rates and secured collateral compared to the higher-risk, subordinated mezzanine debt and short-term bridge loans.

Convertible notes

Convertible notes are a form of mezzanine debt that blend elements of debt and equity, offering investors the option to convert the loan into equity at a later stage, often used to bridge financing gaps during startup fundraising rounds. Unlike traditional bridge loans that provide short-term liquidity without equity conversion features, convertible notes typically include interest rates, maturity dates, and conversion terms that align investor incentives with company growth.

Hybrid capital

Hybrid capital combines features of both debt and equity, commonly used to balance risk and return in mezzanine debt and bridge loans. Mezzanine debt acts as subordinated financing with equity-like warrants enhancing yield, while bridge loans provide short-term liquidity secured by assets or anticipated cash flows, optimizing capital structure flexibility.

Intercreditor agreement

An intercreditor agreement establishes the priority and rights between mezzanine debt and bridge loan lenders to manage repayment hierarchy and collateral claims during financing events.

Equity kickers

Equity kickers in mezzanine debt provide lenders partial ownership upside as compensation for higher risk, unlike bridge loans which typically do not include equity participation and focus on short-term financing.

Bullet repayment

Bullet repayment in mezzanine debt typically involves a single lump-sum payment at maturity, contrasting with bridge loans that often require shorter-term repayment or refinancing before the bullet payment.

Acquisition financing

Acquisition financing often involves mezzanine debt, which provides subordinated capital with equity kickers typically used for leveraged buyouts requiring flexible repayment terms and higher risk tolerance, whereas bridge loans offer short-term, senior-secured funding designed to quickly bridge gaps before permanent financing is secured, usually at lower interest rates but stricter covenants. Mezzanine debt suits companies seeking growth capital without immediate dilution, while bridge loans facilitate seamless deal closures with rapid access to liquidity.

Exit fee

Exit fees for mezzanine debt typically range from 1% to 3% of the loan amount, whereas bridge loans often have lower or no exit fees but higher interest rates to compensate for short-term risk.

Maturity mismatch

Mezzanine debt typically involves longer-term maturity compared to shorter-term bridge loans, creating a maturity mismatch risk that can impact refinancing strategies and cash flow management.

mezzanine debt vs bridge loan Infographic

moneydif.com

moneydif.com