Maturity extension involves lengthening the loan term to reduce periodic payments, improving short-term cash flow without altering the principal amount due. Forbearance provides temporary relief by allowing borrowers to pause or reduce payments during financial hardship, often without changing the loan's original maturity date. Both options help manage debt, but maturity extension restructures the payment schedule, while forbearance offers a short-term pause with eventual repayment obligations resuming.

Table of Comparison

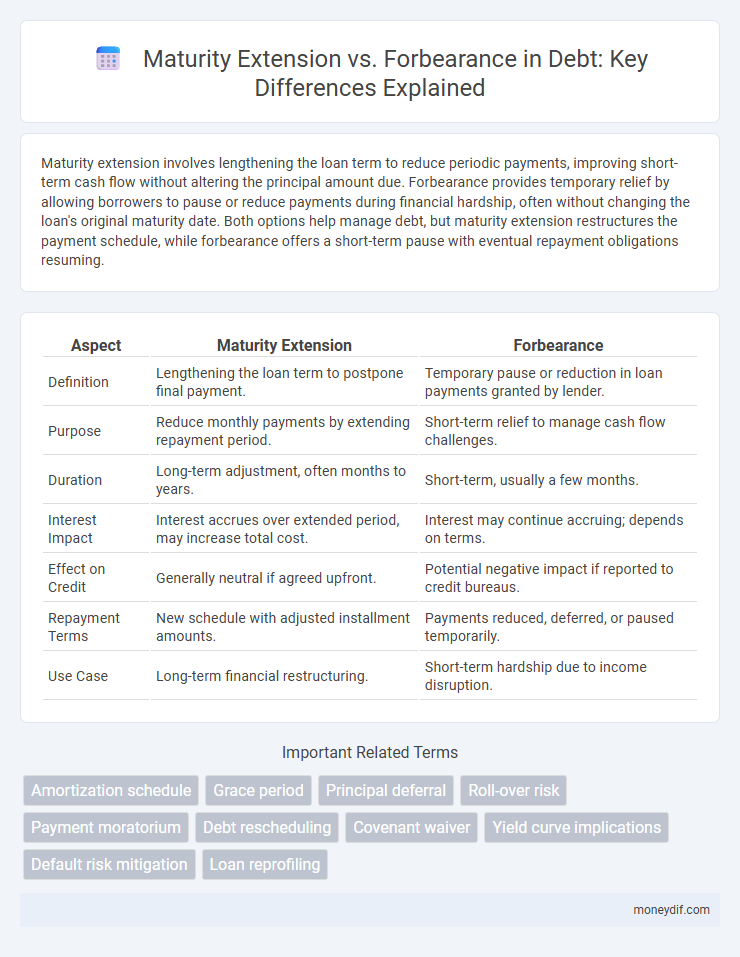

| Aspect | Maturity Extension | Forbearance |

|---|---|---|

| Definition | Lengthening the loan term to postpone final payment. | Temporary pause or reduction in loan payments granted by lender. |

| Purpose | Reduce monthly payments by extending repayment period. | Short-term relief to manage cash flow challenges. |

| Duration | Long-term adjustment, often months to years. | Short-term, usually a few months. |

| Interest Impact | Interest accrues over extended period, may increase total cost. | Interest may continue accruing; depends on terms. |

| Effect on Credit | Generally neutral if agreed upfront. | Potential negative impact if reported to credit bureaus. |

| Repayment Terms | New schedule with adjusted installment amounts. | Payments reduced, deferred, or paused temporarily. |

| Use Case | Long-term financial restructuring. | Short-term hardship due to income disruption. |

Defining Maturity Extension and Forbearance

Maturity extension refers to the agreement between a borrower and lender to lengthen the repayment period of a debt, allowing more time to fulfill financial obligations without changing the loan terms. Forbearance involves a temporary suspension or reduction of debt payments granted by the lender due to the borrower's financial hardship, often without altering the original maturity date. Both strategies provide relief during financial distress but differ in their impact on the loan's timeline and payment structure.

Key Differences Between Maturity Extension and Forbearance

Maturity extension involves lengthening the loan term to allow more time for repayment, effectively reducing each installment's amount, while forbearance temporarily suspends or reduces payments without altering the original loan maturity date. Maturity extension adjusts the loan's amortization schedule, impacting the total interest paid, whereas forbearance focuses on short-term relief without changing the principal or overall loan structure. Lenders and borrowers utilize maturity extensions as a long-term solution to financial difficulty, whereas forbearance serves as a temporary measure during short-term cash flow issues.

When to Choose Maturity Extension Over Forbearance

Maturity extension is preferable when the borrower faces temporary cash flow constraints but expects recovery within a defined period, allowing debt repayment terms to be lengthened without altering payment obligations. Forbearance suits situations with more severe financial distress requiring waived or reduced payments to avoid default, often signaling deeper or more prolonged recovery challenges. Choosing maturity extension helps maintain creditworthiness and lender relationships by demonstrating proactive debt management while avoiding the stigma and risks linked to forbearance agreements.

Risks and Benefits of Maturity Extension

Maturity extension reduces immediate repayment pressure by lengthening the loan term, which can improve cash flow and help borrowers avoid default. However, it often increases the total interest paid over time, raising the overall debt burden and potentially straining long-term financial sustainability. Unlike forbearance, maturity extension maintains regular payments but shifts risk toward higher cumulative costs and longer exposure to interest rate fluctuations.

Risks and Benefits of Forbearance

Forbearance allows borrowers to temporarily pause or reduce debt payments, providing immediate relief and helping avoid defaults or foreclosure during financial hardship. The risk includes accrued interest and potential damage to credit scores if the forbearance period ends without full repayment, which may lead to increased debt burden. Compared to maturity extension, forbearance offers quicker relief but often at the cost of higher long-term financial pressure and less structured repayment plans.

Impact on Creditworthiness and Credit Scores

Maturity extension typically improves creditworthiness by demonstrating proactive debt management and reducing the risk of default, leading to a more favorable credit score impact. Forbearance may temporarily halt payments without restructuring the loan, which can signal financial distress and result in a negative effect on credit scores. Lenders often view maturity extensions as a positive indicator, while forbearance can be considered a risk factor, influencing future borrowing ability.

Legal and Regulatory Considerations

Maturity extension involves legally amending the original loan terms to delay the repayment date, requiring creditor consent and compliance with contract law and relevant financial regulations. Forbearance agreements temporarily suspend or reduce payments without altering the maturity date but must adhere to regulatory guidelines on borrower protection and disclosure obligations. Both approaches necessitate careful documentation to ensure enforceability and alignment with jurisdiction-specific insolvency and banking laws.

Effects on Debt Servicing and Cash Flow

Maturity extension lengthens the debt repayment period, reducing periodic debt servicing obligations and improving cash flow by lowering short-term financial pressure. Forbearance temporarily suspends or reduces payments, providing immediate cash flow relief but potentially increasing total interest costs and extending the overall debt duration. Both approaches affect debt servicing schedules differently, with maturity extension offering a structured long-term benefit and forbearance delivering short-term liquidity support.

Negotiating Terms with Creditors

Negotiating terms with creditors involves extending the maturity date to delay debt repayment, providing borrowers more time to stabilize cash flows without altering original loan obligations. Forbearance agreements grant temporary relief by suspending or reducing payments, often requiring explicit creditor approval and potentially impacting credit terms. Both approaches demand clear communication and strategic planning to secure creditor consent and ensure long-term financial viability.

Case Studies: Maturity Extension vs Forbearance in Practice

Case studies in debt management reveal that maturity extension often provides borrowers with a structured timeline to repay obligations, facilitating improved cash flow without altering loan terms significantly. Forbearance agreements demonstrate flexibility by temporarily pausing or reducing payments, which can prevent defaults but may lead to accrued interest or changes in loan status. Analysis of real-world financial restructurings shows that maturity extensions suit borrowers with stable recovery prospects, while forbearance benefits those facing short-term liquidity challenges.

Important Terms

Amortization schedule

An amortization schedule adjusts payments over time reflecting maturity extension by spreading principal and interest across a longer period, whereas forbearance temporarily suspends or reduces payments without altering the original loan amortization structure.

Grace period

A grace period allows temporary relief on loan payments often linked to maturity extension, whereas forbearance involves negotiated temporary suspension or reduction of payments without necessarily extending the loan maturity.

Principal deferral

Principal deferral extends loan maturity by postponing principal payments without formal forbearance, preserving borrower credit standing while managing cash flow.

Roll-over risk

Roll-over risk increases significantly when maturity extension is used instead of forbearance because the borrower must refinance or repay debt under uncertain market conditions.

Payment moratorium

Payment moratorium extends loan maturity by postponing payments without penalty, while forbearance offers temporary relief by suspending or reducing payments but may not extend maturity.

Debt rescheduling

Debt rescheduling involves extending the loan maturity to improve cash flow without waiving any payment obligations, whereas forbearance permits temporary suspension or reduction of payments without modifying the maturity date.

Covenant waiver

A covenant waiver permits temporary relaxation of specific loan terms during maturity extension, whereas forbearance allows a borrower to delay payments without triggering default.

Yield curve implications

Yield curve implications reveal that maturity extension often flattens the curve by shifting debt obligations into longer durations, thereby reducing short-term liquidity pressures. Forbearance, by delaying payments without altering maturity, can distort credit risk assessments and potentially steepen the yield curve due to increased uncertainty in repayment timelines.

Default risk mitigation

Extending loan maturity effectively reduces default risk by allowing more time for repayment, whereas forbearance temporarily delays payments without altering the loan term, potentially increasing long-term default risk.

Loan reprofiling

Loan reprofiling through maturity extension adjusts repayment schedules to improve borrower cash flow without waiving payments, whereas forbearance temporarily pauses or reduces payments to provide immediate financial relief.

maturity extension vs forbearance Infographic

moneydif.com

moneydif.com