Sovereign debt refers to the money a government borrows to finance public spending, often through issuing bonds, with repayment backed by national revenue streams. Corporate debt is issued by companies to fund business operations or expansion, typically involving higher risk and interest rates compared to sovereign debt due to the varying financial stability of corporations. Investors analyze credit ratings and economic conditions to assess default risk when choosing between sovereign and corporate debt instruments.

Table of Comparison

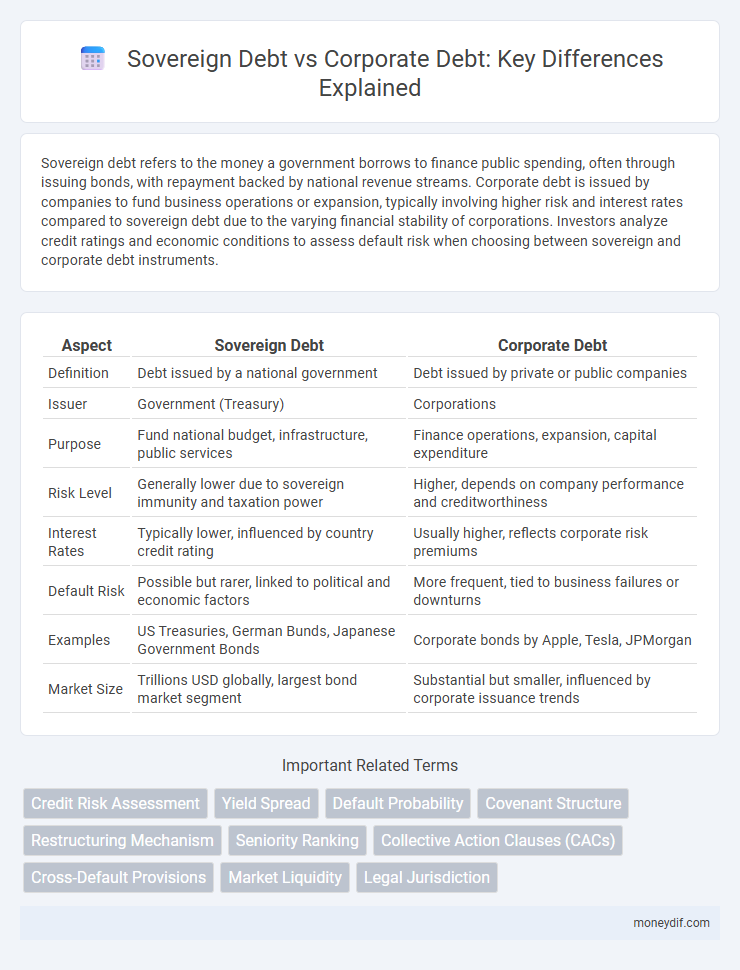

| Aspect | Sovereign Debt | Corporate Debt |

|---|---|---|

| Definition | Debt issued by a national government | Debt issued by private or public companies |

| Issuer | Government (Treasury) | Corporations |

| Purpose | Fund national budget, infrastructure, public services | Finance operations, expansion, capital expenditure |

| Risk Level | Generally lower due to sovereign immunity and taxation power | Higher, depends on company performance and creditworthiness |

| Interest Rates | Typically lower, influenced by country credit rating | Usually higher, reflects corporate risk premiums |

| Default Risk | Possible but rarer, linked to political and economic factors | More frequent, tied to business failures or downturns |

| Examples | US Treasuries, German Bunds, Japanese Government Bonds | Corporate bonds by Apple, Tesla, JPMorgan |

| Market Size | Trillions USD globally, largest bond market segment | Substantial but smaller, influenced by corporate issuance trends |

Understanding Sovereign Debt: Definition and Key Features

Sovereign debt refers to the money borrowed by a national government through issuing securities such as bonds, often denominated in the country's currency or foreign currencies like the US dollar or euro. Unlike corporate debt, sovereign debt carries unique risks related to political stability, currency fluctuations, and the government's ability to generate revenue through taxation or natural resources. Key features include varying maturities, different interest rates influenced by credit ratings assigned by agencies like Moody's, S&P, or Fitch, and the potential for restructuring during economic crises.

Exploring Corporate Debt: What Sets It Apart?

Corporate debt refers to loans and bonds issued by businesses to finance operations, expansions, or acquisitions, differing from sovereign debt which is government-issued and typically backed by tax revenues. Corporate debt often carries higher interest rates due to increased default risk and is influenced by company-specific factors such as credit ratings and cash flow stability. This type of debt can impact shareholder value and is subject to market conditions, regulatory environments, and the company's financial health.

Sovereign vs Corporate Debt: Core Differences

Sovereign debt refers to the money borrowed by national governments through instruments like government bonds, while corporate debt involves loans or bonds issued by private companies to finance operations or expansion. Sovereign debt typically carries lower interest rates due to government backing and perceived lower default risk, whereas corporate debt interest rates are higher to compensate for greater credit risk. Sovereign debt markets are influenced by fiscal policies, economic conditions, and geopolitical risks, contrasting with corporate debt, which depends heavily on company performance and industry trends.

Risk Assessment: Sovereign Debt vs Corporate Debt

Sovereign debt risk assessment centers on a country's economic stability, political environment, and ability to generate revenue through taxation, with key indicators including GDP growth, fiscal deficit, and foreign exchange reserves. Corporate debt risk evaluation emphasizes a company's cash flow, creditworthiness, industry position, and balance sheet strength, relying on metrics like EBITDA, debt-to-equity ratio, and interest coverage ratio. Sovereign debt often carries lower default risk but higher exposure to geopolitical events, while corporate debt risk fluctuates with market conditions and company-specific operational performance.

Factors Influencing Sovereign and Corporate Borrowing

Sovereign debt is influenced by factors such as a nation's fiscal policy, political stability, economic growth, and credit ratings, which affect its borrowing capacity and interest rates. Corporate debt depends on company-specific elements like cash flow, profitability, market conditions, and creditworthiness, determining access to capital and debt cost. Both sovereign and corporate entities face macroeconomic factors like interest rate fluctuations and global financial markets when managing borrowing strategies.

Debt Instruments: Sovereign Bonds vs Corporate Bonds

Sovereign bonds are debt securities issued by national governments to finance public spending and are often considered low-risk due to government backing and the ability to raise taxes for repayment. Corporate bonds are issued by companies to raise capital for expansion or operations and typically offer higher yields to compensate for greater credit risk compared to sovereign bonds. The liquidity, maturity, and credit ratings of these debt instruments vary significantly, influencing investor decisions in fixed-income portfolios.

Default and Restructuring: Sovereign vs Corporate Scenarios

Sovereign debt defaults often involve complex negotiations with multiple creditors including international institutions, leading to extended restructuring processes that may impact national credit ratings and economic stability. Corporate debt defaults typically result in bankruptcy proceedings or out-of-court settlements aimed at protecting shareholder value while restructuring debt obligations. Unlike corporate debt, sovereign restructuring lacks a formal bankruptcy framework, relying more on diplomacy and political considerations to reach agreements.

Impact on Investors: Sovereign vs Corporate Debt Exposures

Sovereign debt typically offers investors lower yields but higher credit stability due to government backing and monetary policy support, making it attractive for risk-averse portfolios. Corporate debt, while generally providing higher yields, carries increased default risk tied to company performance and market conditions, requiring thorough credit analysis by investors. Diversifying between sovereign and corporate debt exposures helps balance risk and return, influencing portfolio resilience amid economic fluctuations.

Case Studies: Notable Sovereign and Corporate Debt Crises

The 1997 Asian Financial Crisis exemplifies a sovereign debt crisis where countries like Thailand and Indonesia faced overwhelming external debt burdens leading to severe economic contraction and IMF intervention. In contrast, the 2008 collapse of Lehman Brothers highlights a corporate debt crisis triggered by excessive leverage and poor risk management, which significantly contributed to the global financial meltdown. These cases illustrate how sovereign debt crises often involve government borrowing mismatches, while corporate debt crises stem from private sector insolvencies impacting broader financial stability.

Future Outlook: Trends in Sovereign and Corporate Debt Markets

Sovereign debt markets are expected to face increasing pressure from rising interest rates and geopolitical uncertainties, leading to higher borrowing costs for governments. Corporate debt continues to grow, driven by low-interest rates and strong investor demand, but risks of defaults may rise amid tightening monetary policies. Advances in credit risk assessment and sustainable finance are shaping future trends, promoting more resilient and transparent debt markets globally.

Important Terms

Credit Risk Assessment

Credit risk assessment evaluates the likelihood of default by sovereign entities versus corporate borrowers by analyzing fiscal health, economic stability, and repayment capacity.

Yield Spread

Yield spread between sovereign debt and corporate debt reflects the risk premium investors demand for bearing higher credit and default risks associated with corporate bonds compared to government securities.

Default Probability

Default probability on sovereign debt is generally lower than corporate debt due to government tax powers and monetary policy control impacting credit risk assessment.

Covenant Structure

Covenant structures in sovereign debt typically feature fewer and less restrictive covenants compared to corporate debt, reflecting sovereign immunity and the unique risk profiles of governments.

Restructuring Mechanism

Sovereign debt restructuring mechanisms prioritize negotiated debt relief and IMF guidelines, while corporate debt restructuring often involves bankruptcy proceedings and creditor consensus frameworks tailored to private sector solvency challenges.

Seniority Ranking

Seniority ranking determines the priority of claims in debt repayment, with sovereign debt often holding higher seniority compared to corporate debt due to government backing and legal frameworks.

Collective Action Clauses (CACs)

Collective Action Clauses (CACs) are contractual provisions predominantly used in sovereign debt contracts to facilitate bondholder coordination during debt restructurings, whereas their application in corporate debt is less common and often governed by different legal frameworks.

Cross-Default Provisions

Cross-default provisions trigger immediate default on sovereign or corporate debt if a default occurs on other related obligations, protecting creditors by linking multiple debts under unified default conditions.

Market Liquidity

Market liquidity in sovereign debt typically surpasses that of corporate debt due to higher trading volumes, greater transparency, and stronger credit backing from governments. Sovereign bonds benefit from deep, liquid markets and lower bid-ask spreads, while corporate debt often faces liquidity constraints driven by issuer credit risk and market segmentation.

Legal Jurisdiction

Legal jurisdiction determines the applicable laws and courts governing disputes in sovereign debt, which involves national governments, versus corporate debt, which pertains to private or public companies.

sovereign debt vs corporate debt Infographic

moneydif.com

moneydif.com