Payment-in-kind (PIK) interest allows borrowers to defer cash payments by adding interest to the principal balance, increasing total debt over time. Cash interest requires regular monetary payments, impacting immediate cash flow but preventing debt accumulation. Choosing between PIK and cash interest depends on the borrower's cash flow flexibility and long-term financial strategy.

Table of Comparison

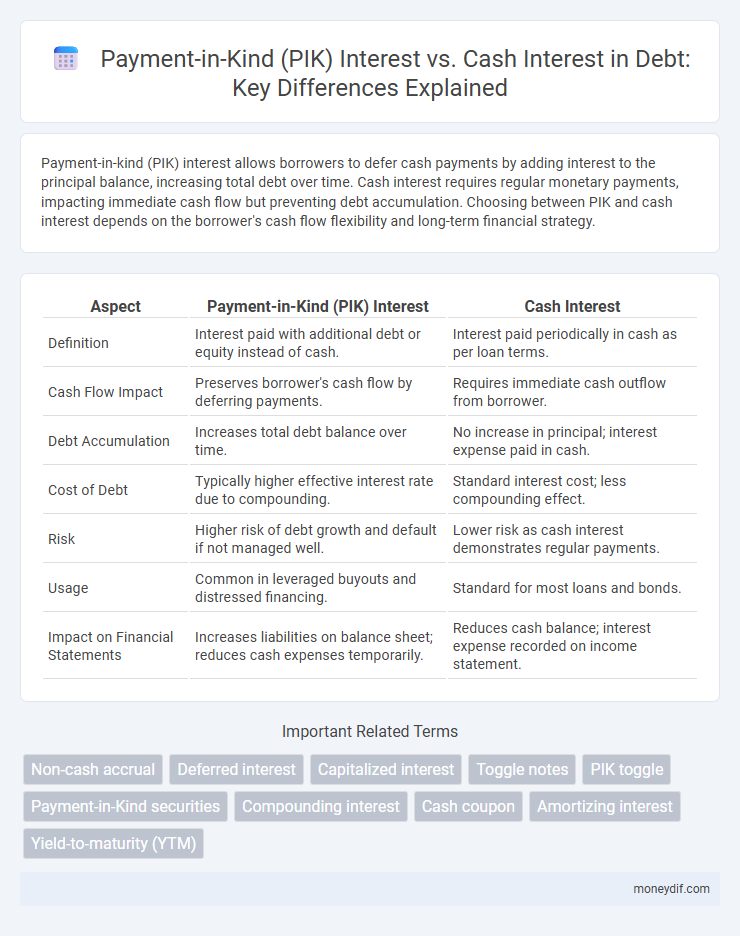

| Aspect | Payment-in-Kind (PIK) Interest | Cash Interest |

|---|---|---|

| Definition | Interest paid with additional debt or equity instead of cash. | Interest paid periodically in cash as per loan terms. |

| Cash Flow Impact | Preserves borrower's cash flow by deferring payments. | Requires immediate cash outflow from borrower. |

| Debt Accumulation | Increases total debt balance over time. | No increase in principal; interest expense paid in cash. |

| Cost of Debt | Typically higher effective interest rate due to compounding. | Standard interest cost; less compounding effect. |

| Risk | Higher risk of debt growth and default if not managed well. | Lower risk as cash interest demonstrates regular payments. |

| Usage | Common in leveraged buyouts and distressed financing. | Standard for most loans and bonds. |

| Impact on Financial Statements | Increases liabilities on balance sheet; reduces cash expenses temporarily. | Reduces cash balance; interest expense recorded on income statement. |

Understanding Payment-in-Kind (PIK) Interest

Payment-in-Kind (PIK) interest is a type of non-cash interest payment where the borrower pays interest by issuing additional debt or equity securities instead of cash. This structure allows companies with limited cash flow to defer cash payments, preserving liquidity but increasing the overall debt burden due to compounding effects. Understanding PIK interest is crucial for investors and creditors as it impacts credit risk assessment and influences the company's financial flexibility and leverage ratios.

What Is Cash Interest?

Cash interest refers to the actual cash payments made by a borrower to a lender at scheduled intervals, representing the cost of borrowing funds. Unlike payment-in-kind (PIK) interest, which is paid by issuing additional debt rather than cash, cash interest impacts a company's liquidity by reducing available cash flow. Understanding cash interest is essential for assessing a borrower's immediate financial obligations and cash management strategies.

Key Differences Between PIK and Cash Interest

Payment-in-kind (PIK) interest involves paying interest through additional debt or equity rather than cash, which preserves liquidity but increases the principal amount owed. Cash interest requires actual cash payments during the loan term, impacting the borrower's immediate cash flow but reducing the outstanding debt over time. PIK interest is common in high-yield or leveraged loans where cash flow constraints exist, whereas cash interest is typical in traditional loans prioritizing steady income for lenders.

How PIK Interest Works in Debt Financing

Payment-in-kind (PIK) interest allows borrowers to defer cash payments by capitalizing the interest into the principal balance of the loan, increasing the total debt over time. This mechanism benefits companies with limited cash flow by reducing immediate liquidity pressure while accumulating higher debt obligations. Lenders receive greater returns at maturity as the compounded interest is paid in additional debt rather than periodic cash payments.

Advantages of Choosing PIK Interest

Payment-in-kind (PIK) interest offers the advantage of conserving a borrower's cash flow by allowing interest to be paid in additional debt rather than immediate cash, which is especially beneficial during periods of tight liquidity. This flexibility helps companies maintain operational stability without jeopardizing liquidity, making PIK interest attractive for startups or firms with unpredictable cash flows. Moreover, deferring cash payments can align financial obligations with future revenue growth, reducing short-term financial strain and enabling strategic reinvestment.

Risks and Drawbacks of PIK Interest

Payment-in-kind (PIK) interest increases debt burden by adding unpaid interest to the principal, leading to compound growth and escalating repayment amounts. Unlike cash interest, PIK interest can obscure true debt levels, reducing transparency and complicating credit risk assessment for investors and lenders. The deferral of cash payments may strain future cash flows, heightening default risk and potentially undermining the borrower's financial stability.

Cash Flow Implications: PIK vs. Cash Interest

Payment-in-kind (PIK) interest increases debt principal by adding unpaid interest to the loan balance, resulting in no immediate cash outflow but higher future repayment obligations. Cash interest requires regular cash payments, impacting the borrower's current cash flow and liquidity but keeping debt levels stable. Companies with tight cash flow often prefer PIK interest to preserve cash, while cash interest helps maintain a clearer debt profile and avoids compounding liabilities.

Tax Treatment: PIK Interest vs. Cash Interest

Payment-in-kind (PIK) interest is generally not deductible for tax purposes until it is actually paid in cash, whereas cash interest is typically deductible in the year it accrues. This deferral of the tax deduction for PIK interest can result in higher taxable income and increased tax liability in the short term. Corporations issuing PIK debt must carefully consider the timing differences in interest expense recognition to optimize tax benefits and manage cash flow effectively.

Use Cases: When to Use PIK vs. Cash Interest

Payment-in-kind (PIK) interest is often used in leveraged buyouts, distressed debt, or startup financing where cash flow is limited, allowing borrowers to conserve cash by paying interest in additional debt rather than cash. Cash interest is preferred in stable, cash-generative companies where regular cash flows support ongoing interest payments, providing certainty and cash yield to investors. Employing PIK interest enhances flexibility during periods of financial constraint, while cash interest secures steady income streams for lenders in low-risk, mature business environments.

Impact of PIK and Cash Interest on Investors and Borrowers

Payment-in-kind (PIK) interest allows borrowers to pay interest with additional debt rather than cash, preserving liquidity but increasing overall debt burden, which can raise risk for investors due to deferred payments. Cash interest requires actual cash outflows during the loan term, providing steady income to investors but potentially straining borrower cash flow and limiting operational flexibility. The choice between PIK and cash interest affects investor yield profiles, borrower balance sheet health, and the timing of cash flows, influencing credit risk and recovery prospects in default scenarios.

Important Terms

Non-cash accrual

Non-cash accrual refers to the accounting process where interest expense is recognized without an actual cash outflow, common in Payment-in-Kind (PIK) interest structures that allow borrowers to pay interest by increasing the principal balance rather than making immediate cash payments. Unlike cash interest, which requires periodic cash disbursements, PIK interest accrues and compounds over time, impacting debt levels and financial statements by increasing liabilities without affecting current cash flow.

Deferred interest

Deferred interest allows borrowers to postpone cash payments, accruing interest that is often added to the principal balance, as seen in Payment-In-Kind (PIK) interest structures where interest is paid by issuing additional debt rather than cash. Cash interest requires regular monetary payments, providing lenders immediate income, while PIK interest increases the loan's outstanding amount, impacting the borrower's future cash flows and leverage ratios.

Capitalized interest

Capitalized interest increases the loan principal by adding unpaid payment-in-kind (PIK) interest, unlike cash interest which requires immediate cash payment.

Toggle notes

Toggle notes allow issuers to switch between paying interest in cash or payment-in-kind (PIK), enabling flexible cash flow management while balancing debt servicing costs.

PIK toggle

PIK toggle bonds allow issuers to switch between payment-in-kind interest, which accrues as additional debt, and cash interest, providing flexibility in managing cash flow and debt servicing.

Payment-in-Kind securities

Payment-in-Kind (PIK) securities pay interest by issuing additional securities instead of cash, contrasting with cash interest payments that provide immediate cash income to investors.

Compounding interest

Payment-in-kind (PIK) interest compounds by adding accrued interest to the principal balance, increasing future interest calculations, whereas cash interest requires periodic cash payments without affecting the principal.

Cash coupon

Cash coupons represent periodic interest payments made in cash, contrasting with payment-in-kind (PIK) interest where interest is paid by issuing additional securities instead of cash.

Amortizing interest

Amortizing interest reduces the principal over time through scheduled payments, while payment-in-kind (PIK) interest compounds by adding accrued interest to the principal, differing from cash interest which requires periodic actual cash payments.

Yield-to-maturity (YTM)

Yield-to-maturity (YTM) on bonds with payment-in-kind (PIK) interest typically reflects higher yields than cash interest bonds due to deferred interest payments increasing overall risk and compounding effects.

payment-in-kind (PIK) interest vs cash interest Infographic

moneydif.com

moneydif.com