A haircut in debt restructuring refers to creditors agreeing to accept a reduction in the principal amount owed, effectively forgiving part of the debt to improve the borrower's financial stability. A cramdown, on the other hand, is a court-ordered approval of a restructuring plan that imposes new terms on dissenting creditors, forcing them to accept less favorable conditions. Both mechanisms aim to facilitate debt resolution, but haircuts rely on voluntary creditor consent, while cramdowns enforce restructuring despite objections.

Table of Comparison

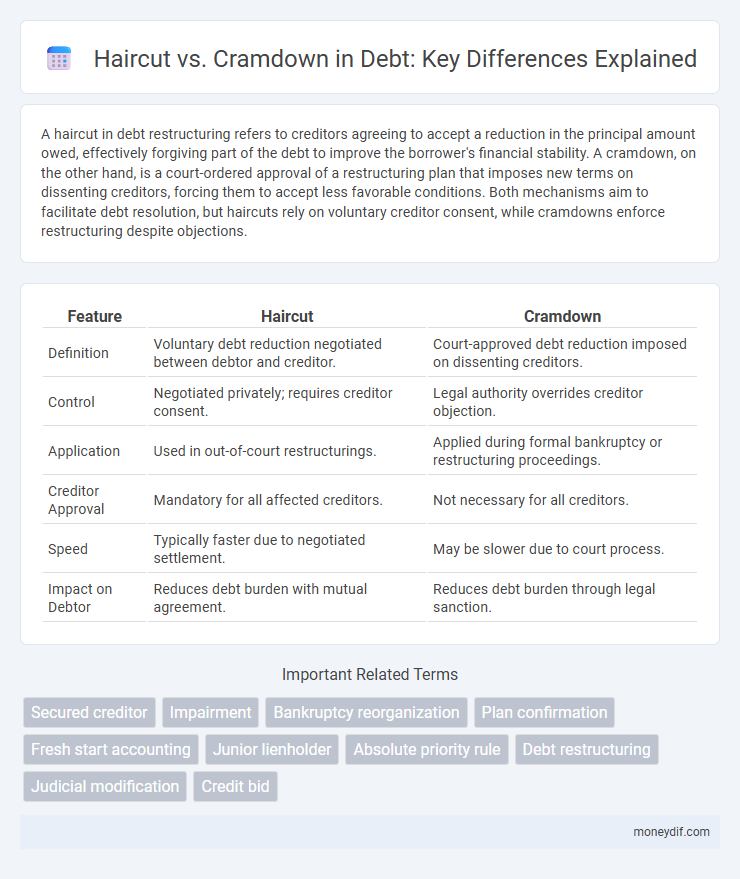

| Feature | Haircut | Cramdown |

|---|---|---|

| Definition | Voluntary debt reduction negotiated between debtor and creditor. | Court-approved debt reduction imposed on dissenting creditors. |

| Control | Negotiated privately; requires creditor consent. | Legal authority overrides creditor objection. |

| Application | Used in out-of-court restructurings. | Applied during formal bankruptcy or restructuring proceedings. |

| Creditor Approval | Mandatory for all affected creditors. | Not necessary for all creditors. |

| Speed | Typically faster due to negotiated settlement. | May be slower due to court process. |

| Impact on Debtor | Reduces debt burden with mutual agreement. | Reduces debt burden through legal sanction. |

Understanding Debt Restructuring: Haircut vs. Cramdown

Debt restructuring involves modifying the terms of a borrower's debt to improve repayment feasibility, where a haircut refers to creditors agreeing to accept less than the owed amount, reducing the principal balance. A cramdown occurs when a court enforces a restructuring plan despite creditor objections, often lowering debt claims and extending repayment terms to rehabilitate the debtor. Both strategies aim to balance creditor recovery with debtor solvency, with haircuts relying on creditor consent and cramdowns imposed through legal authority.

Defining Haircut in Debt Agreements

A haircut in debt agreements refers to the negotiated reduction in the amount a creditor agrees to accept on a debt, often expressed as a percentage of the total owed. This adjustment helps distressed borrowers manage repayment by lowering their outstanding liabilities without needing a court order. Haircuts are commonly used in restructuring to avoid bankruptcy and maintain creditor relationships, contrasting with cramdowns where courts impose debt reductions on dissenting creditors.

What is a Cramdown in Bankruptcy?

A cramdown in bankruptcy is a court-approved restructuring plan that reduces the amount a debtor owes to creditors, forcing them to accept less than the full repayment. Unlike a haircut, which is a voluntary debt reduction negotiated outside of court, a cramdown legally binds dissenting creditors to the revised terms. This mechanism ensures a fair distribution of assets and often helps debtors retain critical assets while reorganizing their financial obligations.

Key Differences Between Haircut and Cramdown

A haircut refers to the voluntary reduction in the amount of debt that creditors agree to accept from a borrower, often used in debt restructuring to avoid default. A cramdown is a judicially imposed debt restructuring where the court forces creditors to accept new terms despite objections, typically occurring during bankruptcy proceedings. Key differences include the voluntary nature of haircuts versus the mandatory enforcement in cramdowns, and the involvement of courts in cramdowns compared to negotiated agreements in haircuts.

Legal Framework: Haircut vs. Cramdown

The legal framework governing haircuts and cramdowns varies significantly, with haircuts typically negotiated voluntarily between debtors and creditors, allowing for a consensual reduction in the principal owed. In contrast, cramdowns are court-imposed restructurings that override creditor objections, often used in bankruptcy proceedings under laws like the U.S. Bankruptcy Code Section 1129(b). Understanding statutory provisions and judicial precedents is crucial for determining the applicable processes and protections related to debt adjustments in different jurisdictions.

Implications for Creditors: Haircut vs. Cramdown

Haircuts reduce the principal amount owed to creditors, often achieved through negotiated agreements that preserve creditor consent and minimize litigation risks. Cramdowns impose restructured terms on dissenting creditors, allowing courts to enforce debt adjustments without unanimous approval, which can lead to longer legal battles and potential reductions in recovery rates. Creditors generally face higher uncertainty and diminished leverage under cramdowns compared to haircuts, impacting their recovery prospects and strategic decision-making.

Borrower Outcomes: Comparing Haircut and Cramdown

Haircut and cramdown are debt restructuring tools that impact borrower outcomes differently; a haircut reduces the principal amount owed by creditors voluntarily, preserving borrower creditworthiness and enabling easier future financing. Cramdown forces creditors to accept debt reduction through court approval, often leading to more significant debt relief but potential credit score damage and increased legal costs for borrowers. Borrowers typically experience less financial distress and greater control with haircuts, while cramdowns offer a binding resolution at the expense of credit and operational flexibility.

Risks and Benefits of Haircuts in Debt Deals

Haircuts in debt deals involve creditors agreeing to accept less than the full amount owed, which can reduce the borrower's debt burden and improve cash flow, enhancing the likelihood of successful restructuring. The primary risk for creditors is receiving a reduced recovery amount, which may impact their financial position and credit ratings. However, haircuts can prevent more severe losses by avoiding bankruptcy or prolonged litigation, offering a balanced approach to managing distressed debt.

Cramdown: Impact on Debt Recovery and Reorganization

Cramdown allows creditors to impose repayment terms over dissenting stakeholders, enabling the restructuring of debt without unanimous approval, which can accelerate debt recovery and improve reorganization prospects. This legal mechanism limits creditor losses by enforcing modified terms but may also affect creditor confidence and future lending conditions due to perceived increased risk. By balancing debtor rehabilitation with creditor rights, cramdowns facilitate viable restructuring plans that preserve business continuity and maximize asset value distribution.

Choosing the Right Strategy: Haircut or Cramdown?

Choosing between a haircut and cramdown hinges on the extent of debt reduction needed and creditor cooperation. A haircut involves negotiated debt forgiveness agreed upon by creditors, often preserving relationships and enabling quicker restructuring. Cramdown, enforced by the court, imposes debt terms over creditor objections, useful when consensus cannot be reached but may prolong proceedings and increase legal costs.

Important Terms

Secured creditor

A secured creditor holds a legal claim over specific collateral, which influences the impact of a haircut--a voluntary reduction of debt--on their recovery compared to unsecured creditors. In a cramdown scenario during bankruptcy, secured creditors may face a forced reduction of claim value but often retain lien priority, balancing potential losses against the debtor's reorganization plan.

Impairment

Impairment occurs when the carrying amount of a loan exceeds its recoverable amount, necessitating a haircut in restructuring or a cramdown by the court to reduce the debt principal.

Bankruptcy reorganization

Bankruptcy reorganization involves restructuring a debtor's obligations to restore financial stability, where a haircut reduces the debt owed by creditors through negotiated agreement, while a cramdown enforces court-approved debt modification despite creditor objections. Both strategies aim to balance equity for stakeholders and viability for the debtor, with cramdowns providing legal authority to impose terms unilaterally under Chapter 11 bankruptcy provisions.

Plan confirmation

Plan confirmation in bankruptcy requires meeting specific criteria under Chapter 11, where a haircut involves reducing unsecured creditors' claims while cramdown allows confirmation over dissenting classes if the plan is fair and equitable. Courts evaluate feasibility, fair treatment of creditors, and compliance with Section 1129 of the Bankruptcy Code to approve a cramdown, often used when creditors reject the plan but the debtor's reorganization is viable.

Fresh start accounting

Fresh Start Accounting requires distressed companies to revalue assets and liabilities at fair market value during a cramdown haircut to reflect the reorganized financial structure accurately.

Junior lienholder

A junior lienholder faces significant financial risk during a haircut or cramdown as their claims are either reduced in value or subordinated to senior creditors, often resulting in partial or total loss of repayment. In bankruptcy restructurings, cramdowns can override junior lienholders' interests by enforcing debt reductions or modifications, while haircuts specifically diminish the amount owed, directly impacting junior lienholder recovery rates.

Absolute priority rule

The Absolute Priority Rule mandates that in a cramdown bankruptcy, junior creditors or equity holders cannot receive compensation before senior creditors' claims are fully satisfied, whereas a haircut reduces the principal amount owed without altering creditor priority.

Debt restructuring

Debt restructuring involves negotiating a haircut, which reduces the creditor's claim, or a cramdown, where a court enforces a restructuring plan despite creditor objections.

Judicial modification

Judicial modification allows courts to alter debt terms through cramdowns by reducing principal balances (haircuts) to facilitate debtor repayment plans under bankruptcy law.

Credit bid

Credit bid allows secured creditors to bid the amount of their claim, reducing the impact of a haircut by avoiding forced asset sales under cramdown conditions in bankruptcy proceedings.

haircut vs cramdown Infographic

moneydif.com

moneydif.com