Cross-default clauses trigger a default if a borrower fails to meet payment obligations on any other debt agreements, ensuring lenders can act before a small default escalates. Cross-acceleration provisions, on the other hand, accelerate the repayment schedule of all debts upon a default in any related financial obligation, tightening the lender's control. Understanding these mechanisms is crucial for managing credit risk and negotiating loan terms effectively.

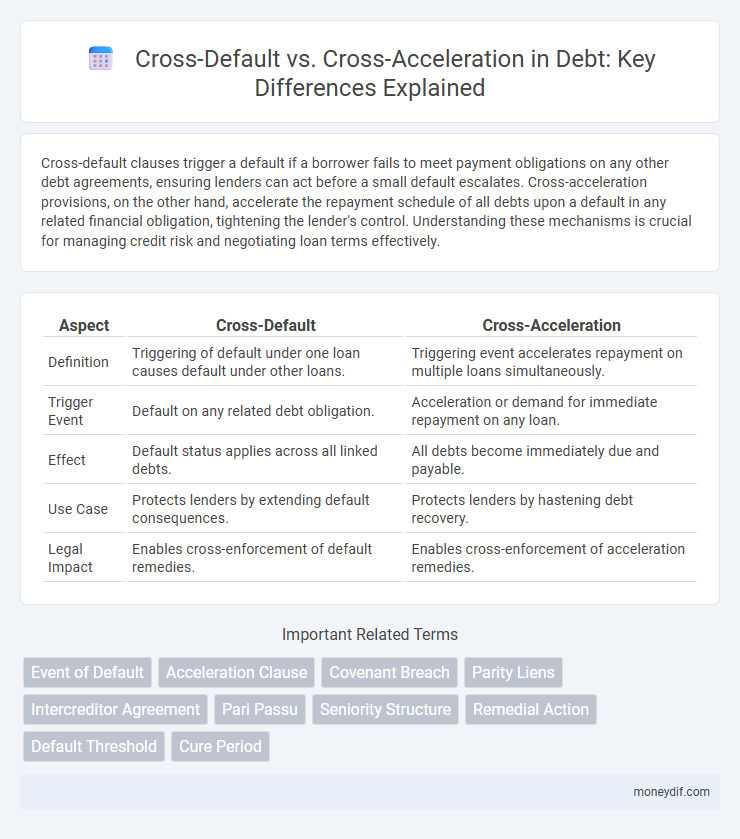

Table of Comparison

| Aspect | Cross-Default | Cross-Acceleration |

|---|---|---|

| Definition | Triggering of default under one loan causes default under other loans. | Triggering event accelerates repayment on multiple loans simultaneously. |

| Trigger Event | Default on any related debt obligation. | Acceleration or demand for immediate repayment on any loan. |

| Effect | Default status applies across all linked debts. | All debts become immediately due and payable. |

| Use Case | Protects lenders by extending default consequences. | Protects lenders by hastening debt recovery. |

| Legal Impact | Enables cross-enforcement of default remedies. | Enables cross-enforcement of acceleration remedies. |

Introduction to Cross-Default and Cross-Acceleration

Cross-default clauses trigger a default if a borrower defaults on any other debt, ensuring lenders are protected across multiple obligations. Cross-acceleration provisions enable lenders to demand immediate repayment of the principal if a default occurs on another loan. Both mechanisms serve to safeguard creditors but differ in timing and scope of enforcing rights upon defaults.

Defining Cross-Default Clauses

Cross-default clauses trigger a default if a borrower defaults on one debt obligation, causing other linked debts to become immediately due, enhancing creditor protection by preventing selective defaults. These clauses are common in loan agreements and bonds, effectively ensuring that a default under any related debt agreement results in cross-triggered defaults. The precise definition and scope of cross-default provisions vary, but they primarily serve to safeguard lenders by treating a default in one contract as a default in all interconnected contracts.

Understanding Cross-Acceleration Provisions

Cross-acceleration provisions trigger a lender's right to demand immediate repayment of a loan when a borrower defaults on another debt, accelerating the debt repayment schedule. Unlike cross-default clauses, which activate upon any default across multiple debt agreements, cross-acceleration specifically speeds up the repayment timeline, increasing financial pressure on the borrower. Understanding these provisions is crucial for managing loan risks and negotiating debt terms in complex financing structures.

Key Differences: Cross-Default vs Cross-Acceleration

Cross-default clauses trigger a default if a borrower defaults on any other loan, broadening lender protections by linking multiple debt agreements. Cross-acceleration provisions allow lenders to demand immediate repayment of a loan upon default on related debt, accelerating the entire debt's maturity. The key difference lies in cross-default identifying the event of default, while cross-acceleration enforces accelerated repayment following that event.

Common Use Cases in Loan Agreements

Cross-default clauses are commonly used in syndicated loan agreements to protect lenders by triggering a default if the borrower defaults on any other debt, ensuring early intervention across related obligations. Cross-acceleration provisions typically appear in complex financing structures, enabling lenders to accelerate repayment deadlines when a default occurs on another loan, improving debt recovery timing. Both clauses help maintain lender control and mitigate risk but are tailored to different credit events and enforcement strategies within loan covenants.

Legal Implications and Risks

Cross-default clauses trigger a default if a borrower defaults on any other obligation, potentially causing widespread legal exposure across multiple contracts. Cross-acceleration provisions allow creditors to demand immediate repayment of the entire debt upon detecting a default, increasing the risk of accelerated legal enforcement actions. Both mechanisms intensify lenders' control but also raise complex litigation risks and negotiation challenges in restructuring scenarios.

Impact on Borrowers and Lenders

Cross-default clauses trigger a default if a borrower misses payments on related loans, increasing risk exposure for lenders by potentially accelerating all debts, while borrowers face heightened financial strain and loss of negotiating leverage. Cross-acceleration provisions allow lenders to demand immediate repayment of all outstanding obligations upon default on any loan, intensifying pressure on borrowers to maintain strict compliance across multiple credit agreements. Both clauses elevate the risk of rapid debt repayment but differ in enforcement mechanisms and implications for cash flow management.

Real-World Examples and Case Studies

Cross-default clauses triggered Apple Inc.'s $1 billion bond issue when its revolving credit default occurred in 2020, illustrating the ripple effect of linked debt agreements. In contrast, the cross-acceleration provision accelerated payments for Tesla during its 2019 debt restructuring after missing a loan milestone, showcasing immediate consequences on repayment schedules. These examples reveal how cross-default amplifies default recognition across debts, while cross-acceleration enforces swift repayment, affecting corporate liquidity management differently.

Negotiation Strategies for Debt Covenants

Cross-default clauses trigger a default if a borrower misses payments on any other debt, while cross-acceleration clauses allow lenders to demand immediate repayment of the entire loan upon any default. Effective negotiation strategies for debt covenants involve clearly defining scope, thresholds, and cure periods for these clauses to prevent unintended triggers. Borrowers should seek to limit cross-default exposure to specific key debts and negotiate grace periods to maintain operational flexibility during financial distress.

Best Practices for Managing Cross-Clauses

Effective management of cross-default and cross-acceleration clauses involves clear identification of triggering events in debt agreements to prevent unintended acceleration of obligations. Regular monitoring of all related debt covenants and maintaining open communication with creditors reduce the risk of cross-triggered defaults. Implementing robust compliance protocols and conducting periodic legal reviews ensure alignment with best practices in mitigating cross-clause risks.

Important Terms

Event of Default

A cross-default triggers a default if any related debt defaults, while cross-acceleration allows lenders to demand immediate repayment of their loans if any related debt is accelerated due to default.

Acceleration Clause

An acceleration clause triggers full debt repayment upon default, whereas cross-default provisions activate default consequences across multiple loans, and cross-acceleration clauses speed up repayment obligations on linked debts simultaneously.

Covenant Breach

Covenant breach triggers cross-default provisions allowing acceleration of all related debts, while cross-acceleration provisions enable immediate repayment acceleration solely upon a default event.

Parity Liens

Parity liens ensure equal priority among secured creditors, whereas cross-default clauses trigger default across agreements upon one default, and cross-acceleration provisions accelerate debt repayment across loans when a default occurs.

Intercreditor Agreement

An Intercreditor Agreement typically defines how cross-default triggers multiple creditors' claims when a borrower defaults on one loan, while cross-acceleration allows creditors to demand immediate repayment upon a default under another agreement.

Pari Passu

Pari passu clauses ensure equal ranking among creditors, preventing preferential treatment in debt repayments, which is crucial when comparing cross-default and cross-acceleration provisions in loan agreements. Cross-default triggers a default if a borrower defaults elsewhere, whereas cross-acceleration accelerates repayment obligations upon default in another agreement, both impacting pari passu treatment in creditor hierarchies.

Seniority Structure

Seniority structure in debt agreements dictates the priority of claims, influencing cross-default and cross-acceleration clauses that protect creditors by triggering defaults or accelerating debt repayment upon a borrower's failure to meet obligations in related agreements. Cross-default provisions activate if a borrower defaults on any specified indebtedness, while cross-acceleration clauses accelerate debt repayment when specific defaults occur, both of which interact with seniority to determine claim priority during restructuring or bankruptcy.

Remedial Action

Remedial action in cross-default clauses activates when a default under one agreement triggers defaults under others, whereas cross-acceleration triggers immediate repayment obligations across multiple agreements upon a single default.

Default Threshold

The default threshold in cross-default clauses defines the minimum payment failure amount that triggers cross-default, while cross-acceleration clauses promptly accelerate debt repayment upon any default without a monetary threshold.

Cure Period

The cure period in cross-default clauses allows a borrower time, typically 30 to 90 days, to remedy a default before it triggers acceleration of debt obligations under other agreements. Cross-acceleration provisions differ by enabling lenders to demand immediate repayment if a default on one loan accelerates repayment obligations on another, often without a cure period.

Cross-default vs Cross-acceleration Infographic

moneydif.com

moneydif.com