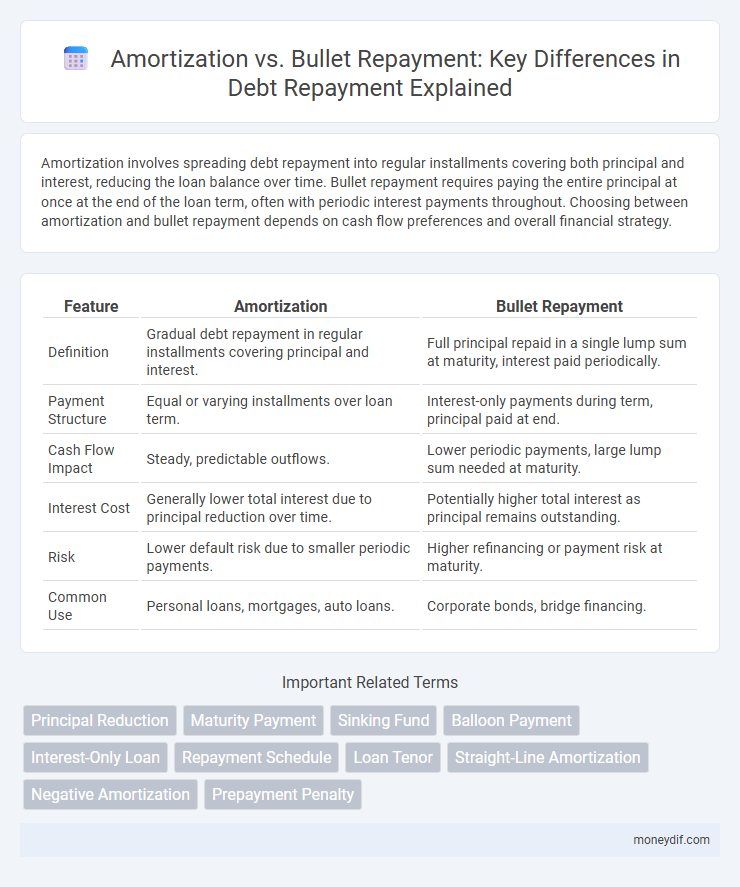

Amortization involves spreading debt repayment into regular installments covering both principal and interest, reducing the loan balance over time. Bullet repayment requires paying the entire principal at once at the end of the loan term, often with periodic interest payments throughout. Choosing between amortization and bullet repayment depends on cash flow preferences and overall financial strategy.

Table of Comparison

| Feature | Amortization | Bullet Repayment |

|---|---|---|

| Definition | Gradual debt repayment in regular installments covering principal and interest. | Full principal repaid in a single lump sum at maturity, interest paid periodically. |

| Payment Structure | Equal or varying installments over loan term. | Interest-only payments during term, principal paid at end. |

| Cash Flow Impact | Steady, predictable outflows. | Lower periodic payments, large lump sum needed at maturity. |

| Interest Cost | Generally lower total interest due to principal reduction over time. | Potentially higher total interest as principal remains outstanding. |

| Risk | Lower default risk due to smaller periodic payments. | Higher refinancing or payment risk at maturity. |

| Common Use | Personal loans, mortgages, auto loans. | Corporate bonds, bridge financing. |

Understanding Debt Repayment Structures

Amortization evenly distributes debt repayment through scheduled installments that cover both principal and interest, reducing the outstanding balance progressively over the loan term. Bullet repayment requires a single lump-sum payment for the entire principal at maturity, with periodic interest payments throughout the loan period. Selecting between amortization and bullet repayment depends on cash flow flexibility and long-term financial planning strategies.

What Is Amortization?

Amortization is the process of gradually paying off a debt over time through scheduled, fixed payments that cover both principal and interest. This method reduces the outstanding balance systematically until the loan is fully repaid by the end of the term. Unlike bullet repayment, which requires paying the entire principal in a lump sum at maturity, amortization ensures consistent cash flow management and reduced default risk.

What Is Bullet Repayment?

Bullet repayment is a debt repayment method where the entire principal is paid in one lump sum at the end of the loan term, rather than through regular installments. This approach contrasts with amortization, which involves gradual principal reduction through scheduled payments over time. Bullet repayment is commonly used for short-term loans or bonds where interest is paid periodically but the principal stays intact until maturity.

Key Differences Between Amortization and Bullet Repayment

Amortization involves periodic payments that cover both principal and interest, gradually reducing the loan balance over time, while bullet repayment requires a lump sum payment of the entire principal at maturity, with interest typically paid periodically. Amortized loans provide consistent cash flow management and lower default risk by spreading payments, whereas bullet loans offer lower periodic payments but higher refinancing or repayment risk at the end of the term. The choice between these repayment structures impacts cash flow stability, interest costs, and creditor risk profiles in debt management.

Advantages of Amortized Loans

Amortized loans offer the advantage of predictable monthly payments that combine both principal and interest, reducing the risk of a large balloon payment at the end of the term. This structure improves cash flow management for borrowers and lowers credit risk by steadily decreasing the outstanding loan balance throughout the repayment period. Lenders benefit from consistent income streams and reduced default likelihood compared to bullet repayment loans where principal is due in full at maturity.

Pros and Cons of Bullet Repayment

Bullet repayment offers the advantage of lower periodic payments as the entire principal is paid at maturity, enhancing short-term cash flow management for borrowers. However, this repayment method carries the risk of a large lump-sum payment at the end, which may create refinancing challenges or liquidity issues. Investors often view bullet loans as higher risk due to the absence of incremental principal reduction, potentially leading to higher interest rates or stricter lending terms.

Impact on Interest Costs

Amortization gradually reduces principal and interest costs over the loan term, resulting in lower total interest expenses compared to bullet repayment, where interest accrues on the entire principal until maturity. Bullet repayment typically leads to higher interest costs because the principal remains outstanding and interest compounds until a lump sum payment is made. Lenders often price bullet loans with higher interest rates to compensate for the increased risk and delayed principal repayment.

Suitability for Borrowers: Who Should Choose Which?

Borrowers seeking predictable monthly payments and gradual principal reduction should opt for amortization loans, which suit individuals with stable cash flow and long-term financial planning needs. Bullet repayment loans benefit those expecting a large lump sum inflow at maturity, such as investors or businesses with fluctuating revenues requiring minimal interim payments. Choosing between amortization and bullet repayment depends on the borrower's income stability, repayment capacity, and financial strategy to manage debt efficiently.

Risk Factors and Considerations

Amortization reduces credit risk by spreading principal and interest payments over the loan term, enhancing cash flow predictability and lowering default probability. Bullet repayment concentrates risk at maturity, requiring a large lump-sum payment that can strain borrower liquidity and increase refinancing risk. Lenders and borrowers must evaluate cash flow stability, interest rate fluctuations, and market conditions when choosing between amortization and bullet repayment structures.

Choosing the Right Repayment Method for Your Debt

Choosing the right repayment method for your debt depends on cash flow stability and long-term financial goals. Amortization spreads payments evenly over time, reducing principal and interest gradually, ideal for consistent budgets and lowering total interest costs. Bullet repayment requires a large lump sum payment at the end, suitable for borrowers expecting significant future income or financing through refinancing options.

Important Terms

Principal Reduction

Principal reduction through amortization spreads payments over time, lowering interest costs and principal balance gradually, whereas bullet repayment requires full principal payment at maturity, impacting cash flow and financing strategy.

Maturity Payment

Maturity payment refers to the lump sum amount due at the end of a loan term, often employed in bullet repayment structures where the principal is repaid in full at maturity rather than through periodic amortization. In contrast, amortization spreads principal and interest payments evenly over the loan period, minimizing the maturity payment but increasing total periodic obligations.

Sinking Fund

A sinking fund systematically accumulates funds to amortize debt over time, reducing principal gradually through periodic payments, contrasting with bullet repayment which involves settling the entire principal in a single lump sum at maturity. This structured approach minimizes refinancing risk and interest burden compared to the lump-sum payment obligation characteristic of bullet repayment.

Balloon Payment

A balloon payment is a large, final loan payment that contrasts with full amortization schedules where principal is paid down gradually, and differs from bullet repayment which involves paying the entire principal amount at maturity without interim installments.

Interest-Only Loan

Interest-only loans require payments solely on the interest during the loan term, postponing the principal repayment until maturity, which contrasts with amortization loans that systematically reduce both principal and interest over time. Bullet repayment involves a lump-sum payment of the entire principal at the end of the loan period, differing from amortization's gradual principal reduction through scheduled payments.

Repayment Schedule

A repayment schedule outlines the timeline and structure for loan repayment, distinguishing between amortization and bullet repayment methods. Amortization involves periodic, incremental payments covering both principal and interest, while bullet repayment requires a lump sum principal payment at the end of the term, often leading to lower interim payments but higher final outflows.

Loan Tenor

Loan tenor influences repayment structure by determining whether amortization schedules spread principal and interest payments over time or a bullet repayment consolidates the principal into a single lump sum at maturity.

Straight-Line Amortization

Straight-line amortization evenly spreads principal payments over the loan term, contrasting with bullet repayment where the entire principal is paid in a single lump sum at maturity.

Negative Amortization

Negative amortization occurs when loan payments are insufficient to cover interest, causing the principal to increase, unlike standard amortization which gradually reduces the loan balance or bullet repayment where the entire principal is paid at maturity.

Prepayment Penalty

Prepayment penalties often apply to amortization loans to deter early full repayment, whereas bullet repayment loans typically avoid such penalties due to their lump-sum maturity structure.

Amortization vs Bullet Repayment Infographic

moneydif.com

moneydif.com