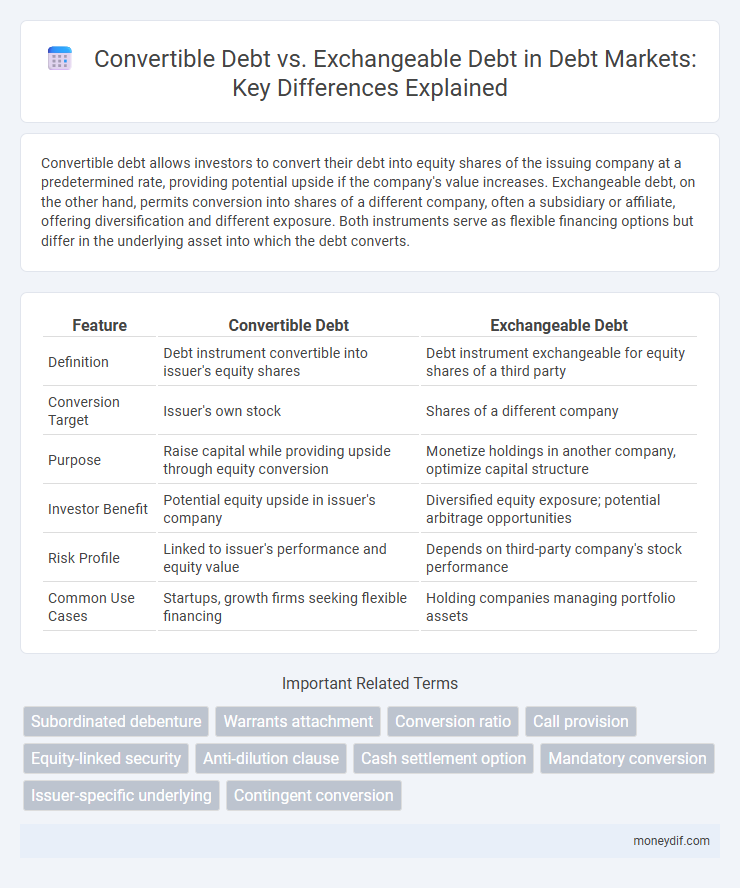

Convertible debt allows investors to convert their debt into equity shares of the issuing company at a predetermined rate, providing potential upside if the company's value increases. Exchangeable debt, on the other hand, permits conversion into shares of a different company, often a subsidiary or affiliate, offering diversification and different exposure. Both instruments serve as flexible financing options but differ in the underlying asset into which the debt converts.

Table of Comparison

| Feature | Convertible Debt | Exchangeable Debt |

|---|---|---|

| Definition | Debt instrument convertible into issuer's equity shares | Debt instrument exchangeable for equity shares of a third party |

| Conversion Target | Issuer's own stock | Shares of a different company |

| Purpose | Raise capital while providing upside through equity conversion | Monetize holdings in another company, optimize capital structure |

| Investor Benefit | Potential equity upside in issuer's company | Diversified equity exposure; potential arbitrage opportunities |

| Risk Profile | Linked to issuer's performance and equity value | Depends on third-party company's stock performance |

| Common Use Cases | Startups, growth firms seeking flexible financing | Holding companies managing portfolio assets |

Understanding Convertible Debt: Key Features

Convertible debt is a type of debt instrument that provides the holder with the option to convert the outstanding principal into a predetermined number of shares of the issuing company, typically at specific conversion rates and within set timeframes. This feature allows investors to benefit from potential equity appreciation while still receiving fixed interest payments during the debt period. Key characteristics include conversion price, conversion ratio, maturity date, interest rate, and potential dilution impact on existing shareholders.

What Is Exchangeable Debt? Core Concepts

Exchangeable debt is a financial instrument allowing the holder to exchange the debt for shares of a company other than the issuer, typically a subsidiary or affiliate, differing from convertible debt which converts into the issuer's stock. This structure provides investors with exposure to a separate equity asset while granting issuers more flexibility in capital raising and risk management. Core concepts include the defined exchange ratio, maturity date, interest payments, and the specific underlying shares eligible for exchange.

Convertible vs Exchangeable Debt: A Comparative Overview

Convertible debt allows investors to convert their debt into equity of the issuing company, typically at a predetermined conversion rate, providing potential upside through ownership participation. Exchangeable debt, in contrast, permits conversion into shares of a different company, often a subsidiary or affiliate, enabling investors to gain exposure to another entity while the original issuer maintains its equity structure. Both instruments offer unique strategic benefits for financing and portfolio diversification, with convertible debt emphasizing issuer equity alignment and exchangeable debt facilitating indirect investment opportunities.

Structural Differences Between Convertible and Exchangeable Debt

Convertible debt allows issuers to convert debt securities into shares of the issuing company, directly impacting the issuer's equity structure. Exchangeable debt enables conversion into shares of a different company, often a subsidiary or affiliate, separating the risk and control dynamics from the issuer's direct equity. The fundamental structural difference lies in the conversion target, which influences dilution potential, investor rights, and valuation methods.

Issuer and Holder Perspectives in Debt Instruments

Issuers favor convertible debt as it offers potential equity conversion, reducing cash interest payments and aligning investor interests with company growth, while holders benefit from downside protection of debt plus upside equity participation. Exchangeable debt provides issuers flexibility by allowing debt holders to convert into shares of a related or subsidiary company, preserving parent company control and simplifying capital structure. Holders of exchangeable debt gain exposure to different equity assets, often at a discount, balancing risk and return with the option to convert or redeem.

Benefits and Risks of Convertible Debt

Convertible debt offers investors the dual benefit of fixed-income returns with the potential upside of equity conversion, enhancing portfolio diversification and capital appreciation opportunities. The primary risks include dilution of existing shareholders' equity upon conversion and the issuer's obligation to repay principal if conversion does not occur, which can strain cash flow. This instrument's hybrid nature provides flexibility but demands careful assessment of market conditions, issuer creditworthiness, and conversion terms.

Advantages and Pitfalls of Exchangeable Debt

Exchangeable debt offers investors the advantage of converting debt into shares of a different company, providing diversified exposure and potential upside from the underlying equity's performance. This instrument can enhance liquidity and may carry lower interest rates relative to traditional debt due to its conversion feature. However, exchangeable debt carries dilution risk for the issuer's shareholders and complexity in valuation, as market fluctuations of the underlying shares affect the debt's attractiveness and pricing.

Strategic Use Cases for Each Debt Type

Convertible debt allows companies to raise capital while offering investors the option to convert debt into equity, making it ideal for startups seeking growth funding without immediate dilution. Exchangeable debt provides flexibility by enabling debt holders to swap debt securities for shares of a related but different company, often used in complex corporate structures to optimize tax benefits or facilitate strategic partnerships. Strategic use of convertible debt focuses on encouraging investor commitment through potential equity upside, whereas exchangeable debt targets portfolio diversification and risk management among affiliated entities.

Tax and Regulatory Implications

Convertible debt allows the issuer to convert debt into equity, triggering potential tax events such as capital gains or income recognition, and often requires regulatory disclosure under securities laws. Exchangeable debt, which enables swapping debt for equity of a different entity, may result in distinct tax consequences influenced by cross-border tax treaties and differing regulatory frameworks. Both instruments demand careful analysis of jurisdiction-specific tax treatments and compliance with applicable financial regulations to optimize structuring and minimize liabilities.

Choosing the Right Debt Instrument for Your Needs

Convertible debt allows investors to convert their debt into a predetermined number of shares of the issuing company, providing potential equity upside and aligning interests with company growth. Exchangeable debt permits conversion into shares of a different company, offering diversification benefits without direct equity exposure to the issuer. Selecting the appropriate instrument depends on factors like desired exposure, risk tolerance, and strategic investment goals.

Important Terms

Subordinated debenture

Subordinated debentures rank below senior debt in claims on assets, often paired with convertible debt that allows holders to convert bonds into equity, enhancing potential upside. Exchangeable debt offers the option to swap bonds for shares of a different company, typically providing strategic flexibility but maintaining similar subordinated status in the capital structure.

Warrants attachment

Warrants attached to convertible debt efficiently enhance investor returns by allowing equity conversion at favorable terms, whereas warrants in exchangeable debt provide the option to swap underlying securities, optimizing portfolio flexibility and value.

Conversion ratio

Conversion ratio measures the number of shares received per unit of convertible debt upon conversion, directly affecting equity dilution and investor return. Exchangeable debt, typically convertible into shares of a third-party subsidiary, uses a similar ratio but factors in the value and volatility of the underlying exchangeable shares, influencing conversion incentives and valuation differences.

Call provision

Call provisions in convertible debt grant the issuer the right to redeem the debt before maturity, allowing them to limit dilution by forcing conversion at a predetermined price, whereas exchangeable debt typically features call provisions that focus on repurchasing the debt linked to underlying shares held in a separate entity. These call options impact investor risk and issuer flexibility by defining the timing and conditions under which the debt can be redeemed or converted into equity.

Equity-linked security

Equity-linked securities include convertible debt, which can be converted into the issuer's shares, and exchangeable debt, which allows conversion into shares of a different company, offering distinct risk and control profiles for investors.

Anti-dilution clause

An anti-dilution clause in convertible debt protects investors from ownership dilution during subsequent equity financings, while exchangeable debt typically lacks such provisions due to its linkage to existing shares rather than new issuance.

Cash settlement option

Cash settlement options in convertible debt allow investors to receive the monetary value of converted shares, whereas exchangeable debt permits conversion into shares of a different company's stock, impacting liquidity and tax treatment.

Mandatory conversion

Mandatory conversion requires convertible debt holders to convert their bonds into equity shares by a specified date, ensuring the issuer reduces debt and increases shareholder equity. Unlike exchangeable debt, which allows bondholders to exchange debt for shares of a third-party company, mandatory conversion involves automatic transformation into the issuer's own stock, impacting capital structure and leverage ratios.

Issuer-specific underlying

Issuer-specific underlying assets in convertible debt are typically the issuer's own shares, whereas exchangeable debt is backed by shares of a third-party company, reflecting distinct ownership and risk profiles.

Contingent conversion

Contingent conversion refers to the conversion of convertible debt into equity based on specific predefined conditions or events, whereas exchangeable debt allows holders to exchange the debt for shares of a third party company rather than the issuer. Convertible debt typically involves automatic or optional conversion into the issuer's stock, while exchangeable debt links conversion rights to external equity, providing distinct risk and return profiles.

convertible debt vs exchangeable debt Infographic

moneydif.com

moneydif.com