A payment-in-kind (PIK) loan allows borrowers to defer interest payments by adding them to the principal balance, increasing overall debt but preserving cash flow during tight financial periods. In contrast, a cash-pay loan requires regular cash interest payments, maintaining a steady outflow of funds but preventing debt accumulation. Choosing between PIK and cash-pay loans depends on the borrower's immediate cash liquidity and long-term financial strategy.

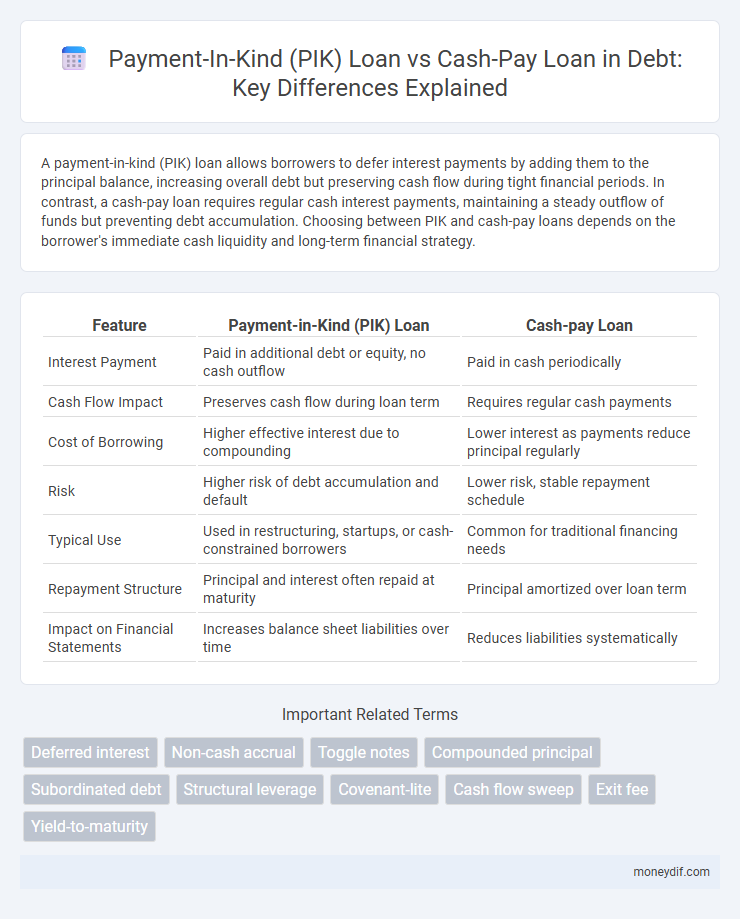

Table of Comparison

| Feature | Payment-in-Kind (PIK) Loan | Cash-pay Loan |

|---|---|---|

| Interest Payment | Paid in additional debt or equity, no cash outflow | Paid in cash periodically |

| Cash Flow Impact | Preserves cash flow during loan term | Requires regular cash payments |

| Cost of Borrowing | Higher effective interest due to compounding | Lower interest as payments reduce principal regularly |

| Risk | Higher risk of debt accumulation and default | Lower risk, stable repayment schedule |

| Typical Use | Used in restructuring, startups, or cash-constrained borrowers | Common for traditional financing needs |

| Repayment Structure | Principal and interest often repaid at maturity | Principal amortized over loan term |

| Impact on Financial Statements | Increases balance sheet liabilities over time | Reduces liabilities systematically |

Understanding Payment-in-Kind (PIK) Loans

Payment-in-Kind (PIK) loans allow borrowers to defer cash interest payments by adding interest to the principal balance, increasing the loan amount over time. Unlike cash-pay loans, which require regular cash interest payments, PIK loans provide greater liquidity flexibility but result in higher overall debt burden due to compounding interest. Understanding the trade-offs between PIK and cash-pay loans is crucial for managing cash flow and debt sustainability in leveraged financing.

What Are Cash-Pay Loans?

Cash-pay loans require borrowers to make regular interest payments in cash throughout the loan term, providing lenders with consistent income and reducing default risk. These loans typically feature fixed or variable interest rates, with scheduled payments that contribute to principal reduction or interest expense coverage. Investors often prefer cash-pay loans for their predictable cash flow and lower risk compared to payment-in-kind (PIK) loans, where interest is paid by issuing additional debt rather than cash.

Key Differences: PIK Loans vs. Cash-Pay Loans

Payment-in-kind (PIK) loans differ from cash-pay loans primarily in their interest payment method, as PIK loans allow interest to be paid with additional debt or equity rather than in cash, preserving borrower liquidity. Cash-pay loans require periodic interest payments in cash, impacting a borrower's short-term cash flow but reducing compound debt accumulation. The use of PIK loans is common in high-yield or distressed situations, while cash-pay loans are preferred for stable cash flow environments and traditional lending.

Advantages of Payment-in-Kind Loans

Payment-in-kind (PIK) loans offer the advantage of preserving a borrower's cash flow by allowing interest payments to be made in additional debt rather than cash, which is particularly beneficial during periods of limited liquidity or financial restructuring. These loans provide greater financial flexibility, enabling companies to allocate available cash towards operations or growth initiatives instead of servicing debt interest immediately. Furthermore, PIK loans often appeal to borrowers seeking to defer expenses without triggering liquidity crises, making them suitable for startups or firms undergoing turnaround efforts.

Benefits of Cash-Pay Loans

Cash-pay loans offer clear financial planning advantages by requiring regular interest payments in cash, reducing the risk of interest compounding and balloon payments. These loans enhance creditor confidence due to consistent cash flows and lower default risk compared to Payment-in-Kind (PIK) loans, which allow interest payment through additional debt issuance. Investors often prefer cash-pay loans for their transparency and predictable returns, contributing to improved credit ratings and easier refinancing options.

Risks Associated with PIK Loans

Payment-in-kind (PIK) loans carry higher risk compared to cash-pay loans due to their accrual of interest rather than requiring immediate cash payments, leading to increased debt over time and potential liquidity issues for borrowers. The deferral of interest payments can result in ballooning outstanding balances that may be unsustainable if company cash flows do not improve. Investors face a greater possibility of default as PIK loans often have lower priority in claims during bankruptcy proceedings, increasing the risk of significant losses.

Risks of Cash-Pay Loans

Cash-pay loans require regular interest payments in cash, increasing the borrower's immediate liquidity risk and possible cash flow shortfalls. Failure to meet scheduled payments can lead to default, damaging credit ratings and triggering lender actions. These loans impose continuous financial strain, limiting flexibility in managing operations or investments during downturns.

Suitability: When to Choose PIK or Cash-Pay Loans

Payment-in-kind (PIK) loans suit companies with limited cash flow but strong asset bases, enabling interest payments through additional debt rather than cash, ideal for startups or turnaround situations. Cash-pay loans are preferable for stable firms with consistent cash earnings, ensuring regular interest payments and reducing debt accumulation. Choosing between PIK and cash-pay loans depends on cash availability, growth stage, and risk tolerance associated with deferred payments versus cash obligations.

Impact on Borrower’s Cash Flow

Payment-in-kind (PIK) loans allow borrowers to defer interest payments by adding them to the principal, reducing immediate cash flow burdens but increasing overall debt. Cash-pay loans require regular interest payments in cash, maintaining consistent cash outflows and potentially straining short-term liquidity. Borrowers with volatile cash flows often prefer PIK loans to preserve operational flexibility while managing debt service costs.

PIK vs. Cash-Pay Loans: Investor Considerations

Payment-in-kind (PIK) loans allow borrowers to pay interest with additional debt rather than cash, preserving liquidity but increasing debt load, which poses higher risk to investors due to deferred cash flows. Cash-pay loans require regular interest payments in cash, providing more predictable income streams and lower credit risk for investors, but potentially straining borrower liquidity. Investors must weigh the trade-offs between immediate cash returns in cash-pay loans and the long-term risk and yield profile associated with PIK loans.

Important Terms

Deferred interest

Deferred interest in payment-in-kind (PIK) loans accumulates and is added to the principal balance, increasing the total debt without immediate cash outflow, often resulting in higher overall repayment amounts. In contrast, cash-pay loans require regular interest payments in cash, reducing principal over time and typically limiting total interest accumulation compared to PIK loans.

Non-cash accrual

Non-cash accrual in Payment-in-Kind (PIK) loans increases the principal by capitalizing interest instead of cash-pay loans that require periodic cash interest payments.

Toggle notes

Toggle notes offer issuers flexibility by allowing interest payments to be made either in cash or through payment-in-kind (PIK), conserving cash flow compared to traditional cash-pay loans that require mandatory cash interest payments. This structure optimizes capital management for companies with variable liquidity, as PIK loans increase principal over time while cash-pay loans maintain a fixed cash outflow.

Compounded principal

Compounded principal in payment-in-kind (PIK) loans accrues interest by adding unpaid interest to the loan balance, resulting in higher total debt over time compared to cash-pay loans where interest is paid periodically in cash, preventing principal growth.

Subordinated debt

Subordinated debt with payment-in-kind (PIK) loans allows interest to be accrued and paid in additional debt rather than cash, contrasting with cash-pay loans that require periodic cash interest payments.

Structural leverage

Structural leverage in financing often involves the comparison between payment-in-kind (PIK) loans and cash-pay loans, where PIK loans allow borrowers to defer cash interest payments by adding interest to the principal balance, increasing total debt and financial leverage over time. Cash-pay loans require regular cash interest payments, maintaining steady leverage levels but limiting flexibility in cash flow management during growth or restructuring phases.

Covenant-lite

Covenant-lite loans typically feature fewer borrower restrictions and often align with payment-in-kind (PIK) loans, which allow interest payments in additional debt rather than cash-pay loans, enhancing borrower flexibility but increasing lender risk.

Cash flow sweep

A cash flow sweep accelerates principal repayment by redirecting excess cash flow, which is more impactful in cash-pay loans due to their mandatory cash interest payments, unlike payment-in-kind (PIK) loans where interest accrues and compounds without immediate cash outflow. PIK loans increase debt balance during the term, reducing cash flow sweep capacity but deferring liquidity pressure, whereas cash-pay loans require consistent cash payment, making cash flow sweep a critical mechanism for reducing overall debt faster.

Exit fee

Exit fees for payment-in-kind (PIK) loans are typically higher than those for cash-pay loans due to deferred interest capitalization increasing the loan balance at repayment.

Yield-to-maturity

Yield-to-maturity (YTM) on payment-in-kind (PIK) loans typically reflects higher yields compared to cash-pay loans due to deferred interest payments being added to the principal balance, increasing overall debt accumulation. Cash-pay loans offer lower YTM as interest is paid regularly in cash, reducing risk and cash flow uncertainty for investors.

payment-in-kind (PIK) loan vs cash-pay loan Infographic

moneydif.com

moneydif.com