A haircut in debt management refers to a partial reduction in the amount owed by a borrower, often negotiated to avoid default and maintain some repayment. A write-off occurs when a creditor removes the debt from their accounts, typically because it is deemed uncollectible, impacting the borrower's credit but freeing the lender from pursuing repayment. Understanding the distinctions between a haircut and a write-off is crucial for assessing financial recovery options and credit implications.

Table of Comparison

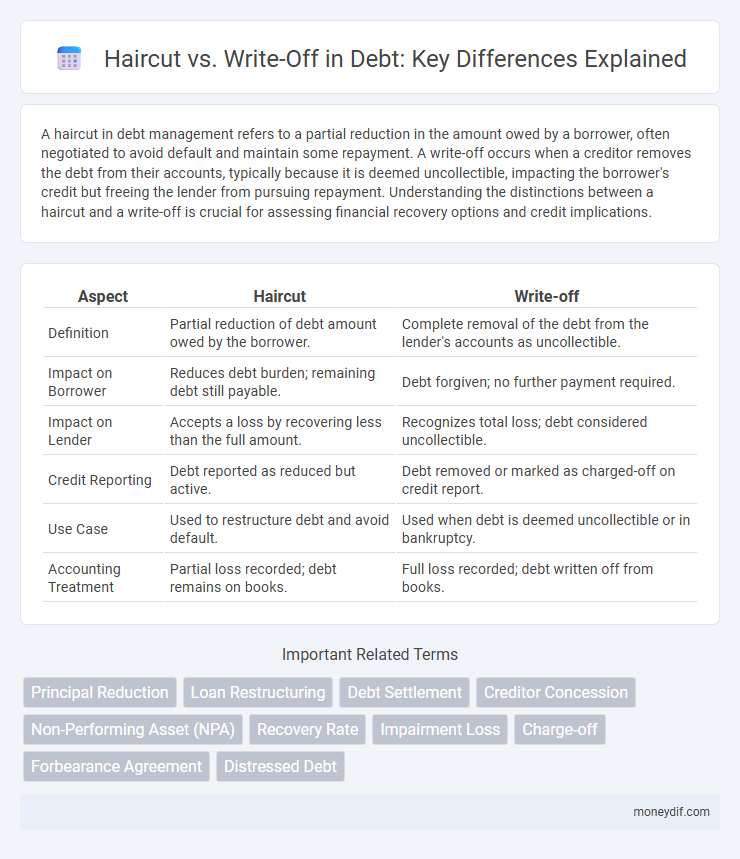

| Aspect | Haircut | Write-off |

|---|---|---|

| Definition | Partial reduction of debt amount owed by the borrower. | Complete removal of the debt from the lender's accounts as uncollectible. |

| Impact on Borrower | Reduces debt burden; remaining debt still payable. | Debt forgiven; no further payment required. |

| Impact on Lender | Accepts a loss by recovering less than the full amount. | Recognizes total loss; debt considered uncollectible. |

| Credit Reporting | Debt reported as reduced but active. | Debt removed or marked as charged-off on credit report. |

| Use Case | Used to restructure debt and avoid default. | Used when debt is deemed uncollectible or in bankruptcy. |

| Accounting Treatment | Partial loss recorded; debt remains on books. | Full loss recorded; debt written off from books. |

Understanding Debt Haircut and Write-off

A debt haircut involves a reduction in the amount owed by the debtor, negotiated to avoid default and facilitate partial repayment, often seen in sovereign debt restructuring. A write-off occurs when the creditor removes the uncollectible debt from their financial statements, acknowledging it as a loss, without necessarily impacting the debtor's obligations. Understanding the distinction is crucial for investors and creditors managing distressed assets and evaluating credit risk adjustments.

Key Differences Between Haircut and Write-off

A haircut in debt restructuring refers to a negotiated reduction in the amount a creditor will receive, often expressed as a percentage of the original debt, allowing partial recovery while avoiding default. A write-off occurs when a creditor fully recognizes a debt as uncollectible and removes it from the balance sheet, impacting financial statements and credit ratings. The key difference lies in haircuts preserving some value and credit exposure, whereas write-offs signify total loss and formal acknowledgment of debt irrecoverability.

How Debt Haircuts Work

Debt haircuts reduce the nominal value of outstanding debt through negotiated agreements between creditors and debtors, often during financial restructuring or sovereign debt crises. This process lowers the principal amount owed, improving the debtor's ability to repay while allowing creditors to recover a portion of the loan rather than risking default. Haircuts differ from write-offs as the latter completely removes the debt from the balance sheet, while haircuts adjust the debt's value to reflect partial forgiveness.

The Process of Debt Write-off

Debt write-off involves removing uncollectible debt from a company's accounting records after exhaustive collection efforts fail, effectively recognizing it as a loss. The process includes identifying delinquent accounts, evaluating the likelihood of recovery, and obtaining internal approvals before officially writing off the debt. This ensures accurate financial reporting and compliance with accounting standards while impacting a company's profitability and credit management.

Impact on Borrowers: Haircut vs Write-off

A haircut reduces the outstanding debt by a negotiated percentage, allowing borrowers to retain some loan principal and improve their cash flow without complete debt elimination. Write-offs remove the debt entirely from the borrower's balance sheet, often signaling severe financial distress or insolvency, but may damage creditworthiness more significantly. Haircuts can provide a manageable restructuring pathway, whereas write-offs may lead to bankruptcy and loss of future borrowing capacity.

Implications for Lenders and Creditors

A haircut reduces the principal amount lenders expect to recover, allowing debtors to restructure while still preserving some lender value, thereby minimizing immediate losses and enabling potential future gains. Write-offs remove the debt from the creditor's books as an uncollectible asset, leading to immediate financial loss and impacting the lender's balance sheet and capital reserves. Creditors must balance the trade-off between accepting partial repayment through haircuts and recognizing definitive losses through write-offs, influencing lending strategies and risk management.

Legal Aspects of Debt Haircuts and Write-offs

In debt restructuring, a haircut legally reduces the principal or interest owed without extinguishing the debt, allowing creditors to retain some claim, while a write-off legally removes the debt from the debtor's books, often implying uncollectibility but not necessarily erasing the creditor's right to pursue repayment. Jurisdictions vary in defining the enforceability and implications of haircuts and write-offs, influenced by insolvency laws, creditor agreements, and regulatory requirements. Legal frameworks typically require transparent documentation and creditor consent for haircuts, whereas write-offs often involve accounting standards and tax regulations governing recognition of losses.

Financial Reporting: Haircuts vs Write-offs

In financial reporting, a haircut represents a partial reduction in the carrying value of a debt instrument, reflecting a negotiated discount that creditors agree upon without completely removing the asset from the balance sheet. A write-off, by contrast, fully removes the debt asset when it is deemed uncollectible or worthless, directly impacting profit and loss statements by recognizing a loss. Companies apply haircuts to manage credit risk and preserve asset value, while write-offs signal definitive impairment and affect solvency ratios and shareholder equity.

Global Examples of Debt Haircuts and Write-offs

Debt haircuts represent negotiated reductions in the principal amount creditors agree to accept, as seen in Greece's 2012 sovereign debt restructuring where private bondholders faced a 53.5% nominal haircut. Write-offs occur when lenders classify debts as uncollectible losses, exemplified by Japan's extensive bank write-offs following the 1990s asset price bubble collapse. Both mechanisms are crucial in managing sovereign and corporate debt crises, impacting global financial stability and creditor recoveries.

Choosing the Right Option: Haircut or Write-off

Choosing between a haircut and a write-off depends on the debtor's financial condition and the creditor's recovery goals. A haircut involves reducing the debt amount to facilitate partial repayment while preserving the debtor's creditworthiness, whereas a write-off completely eliminates the debt from the creditor's books, often following prolonged default or insolvency. Evaluating the debtor's cash flow, asset value, and potential for future payments is crucial to determine the most effective strategy for minimizing losses and maximizing recovery in debt restructuring.

Important Terms

Principal Reduction

Principal reduction involves lowering the outstanding loan balance to help borrowers avoid default, differing from a write-off which removes the debt entirely from the lender's books, while a haircut refers to the percentage reduction in the loan's value during restructuring.

Loan Restructuring

Loan restructuring involves modifying debt terms to improve repayment prospects, where a haircut reduces the principal owed by a negotiated percentage, while a write-off completely removes the debt from the lender's balance sheet as a loss.

Debt Settlement

Debt settlement involves negotiating a haircut, a partial debt reduction, versus a write-off, which is a complete cancellation of the debt by the creditor.

Creditor Concession

A creditor concession involves renegotiating debt terms to avoid default, often by applying a haircut--a partial reduction in the debt's principal or interest--while a write-off completely removes the debt from the creditor's books, reflecting a total loss. Haircuts preserve some value for creditors by reducing the owed amount, whereas write-offs signify uncollectible debts impacting creditworthiness and financial statements.

Non-Performing Asset (NPA)

Non-Performing Assets (NPAs) involve a haircut as a partial reduction in the asset's value reflecting potential loss, whereas a write-off represents the complete removal of the asset from the financial statements due to irrecoverability.

Recovery Rate

Recovery rate measures the percentage of assets recovered after a haircut, directly impacting the extent of write-offs in financial asset management.

Impairment Loss

Impairment loss occurs when the asset's recoverable amount falls below its carrying value, with a haircut representing a partial reduction in value while a write-off signifies the complete removal of the asset from the books.

Charge-off

Charge-offs occur when a debt is declared uncollectible and removed from accounts, often following a significant haircut, which is the reduction in the debt's value before the final write-off.

Forbearance Agreement

A forbearance agreement temporarily delays debt obligations, often involving a negotiated haircut where creditors accept reduced repayment rather than a complete write-off of the outstanding balance.

Distressed Debt

Distressed debt investors face a crucial decision between a haircut, which reduces the debt's face value but allows partial recovery, and a write-off, which fully eliminates the asset due to insolvency or default.

Haircut vs Write-off Infographic

moneydif.com

moneydif.com