In rem actions target the property itself, allowing creditors to claim or seize specific assets to satisfy a debt, regardless of the owner's identity. In personam actions focus on the debtor as an individual, seeking a personal judgment that requires the debtor to pay or perform obligations. Understanding the distinction between in rem and in personam is essential for effective debt collection strategies and legal enforcement.

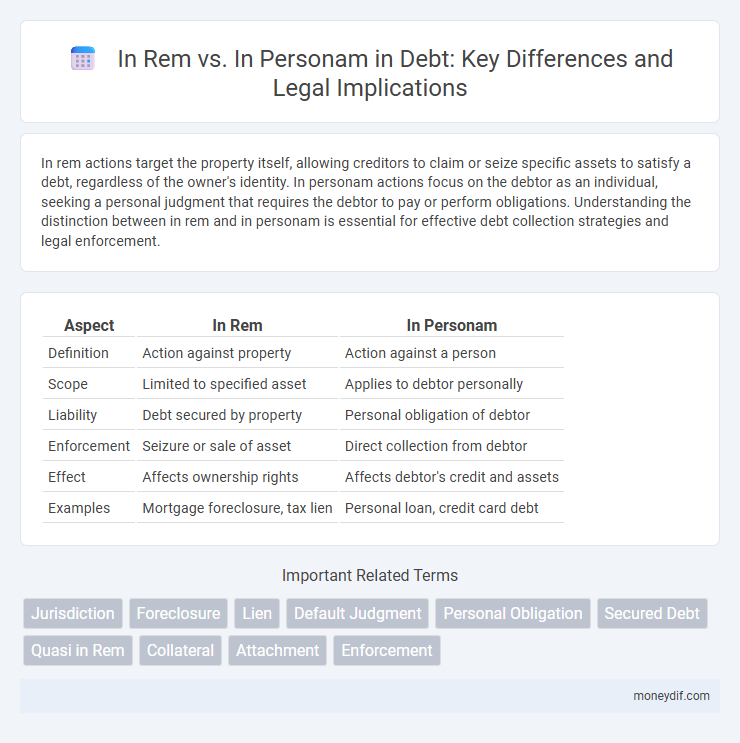

Table of Comparison

| Aspect | In Rem | In Personam |

|---|---|---|

| Definition | Action against property | Action against a person |

| Scope | Limited to specified asset | Applies to debtor personally |

| Liability | Debt secured by property | Personal obligation of debtor |

| Enforcement | Seizure or sale of asset | Direct collection from debtor |

| Effect | Affects ownership rights | Affects debtor's credit and assets |

| Examples | Mortgage foreclosure, tax lien | Personal loan, credit card debt |

Understanding In Rem and In Personam Debt Actions

In rem debt actions target a specific property to satisfy a creditor's claim, allowing creditors to recover debt by seizing or selling the asset without holding the debtor personally liable. In personam debt actions pursue the debtor personally, enabling creditors to pursue wages, bank accounts, or other personal assets to fulfill the debt obligation. Understanding the distinction between in rem and in personam actions is critical for determining the scope of creditor rights and debtor liabilities in debt recovery processes.

Key Differences Between In Rem and In Personam

In rem jurisdiction targets property itself, allowing creditors to claim against assets regardless of the owner's identity, while in personam jurisdiction involves claims directly against an individual debtor. In rem actions typically resolve disputes over property rights, often used in foreclosure or tax cases, whereas in personam actions address personal liabilities such as contract debts. These distinctions impact enforcement methods, with in rem judgments binding upon the property and in personam judgments enforceable against the person's overall assets.

Legal Basis for In Rem Debt Proceedings

In rem debt proceedings are grounded in the legal principle that the court's jurisdiction extends over the property itself rather than the individual debtor, allowing creditors to enforce claims directly against specific assets. This legal basis enables the attachment, seizure, or sale of the property to satisfy debts, irrespective of the debtor's personal liability or presence. Such proceedings ensure creditor rights are protected through property-focused remedies under laws governing secured transactions and foreclosure actions.

Legal Basis for In Personam Debt Proceedings

In personam debt proceedings are grounded in the debtor's personal obligation to repay a debt, allowing creditors to pursue claims against the individual's assets regardless of specific property involved. The legal basis rests on contractual agreements or statutory provisions that create personal liability, enabling courts to issue judgments compelling payment or garnishment of wages. This contrasts with in rem actions, which target particular properties rather than the debtor's broader personal liability.

Practical Implications: In Rem vs In Personam

In rem actions target specific property to satisfy a debt, allowing creditors to recover assets regardless of the owner's identity, which is crucial in secured debt cases like mortgages. In personam actions, however, seek to hold a debtor personally liable, enabling creditors to pursue the debtor's entire asset pool, including wages and accounts, beyond specific property. Understanding these distinctions helps creditors strategize enforcement, with in rem providing limited recourse tied to the property and in personam offering broader recovery possibilities.

Examples of In Rem Debt Claims

In rem debt claims involve pursuing repayment through specific property rather than targeting the debtor personally, commonly seen in mortgage foreclosures where the lender seeks repayment by claiming the property itself. Tax liens represent another example, allowing governments to place claims on real estate due to unpaid property taxes that must be resolved before the property can be sold or transferred. Ship mortgages also illustrate in rem claims, enabling creditors to enforce debt repayment directly against the vessel as collateral.

Examples of In Personam Debt Claims

In personam debt claims arise when a creditor sues an individual personally for repayment, such as credit card debt, personal loans, and unpaid medical bills. These claims target the debtor's assets and income, allowing judgments that may include wage garnishment or bank account levies. Unlike in rem claims, in personam actions hold the debtor personally liable regardless of specific property.

Jurisdictional Considerations: In Rem and In Personam

In rem jurisdiction involves the court's authority over property within its territory, making it critical in cases where the debt is secured by specific assets, such as real estate or personal property. In personam jurisdiction, on the other hand, targets an individual's obligation to pay, allowing courts to issue judgments enforceable against the debtor's personal assets regardless of location. Understanding these jurisdictional distinctions ensures proper legal strategy in debt recovery, especially when dealing with cross-border or multi-jurisdictional claims.

Impact on Creditors and Debtors

In rem actions target specific property to satisfy a debt, limiting creditors to recovering only the value of that property, which restricts debtor liability to the asset involved. In contrast, in personam actions hold the debtor personally liable, allowing creditors to pursue all available assets beyond a single property, increasing the likelihood of full debt recovery. This distinction critically impacts creditor strategies and debtor risk, influencing credit terms and enforcement approaches.

Choosing the Right Legal Approach: In Rem or In Personam

Choosing the right legal approach between in rem and in personam is essential for effective debt recovery. In rem actions target specific property to satisfy a debt, making them ideal when the debtor's location is unknown or assets are limited to a particular item. In personam suits focus on the debtor personally, allowing for broader judgments including wage garnishment and bank account levies, which are preferable when the debtor's identity and whereabouts are known.

Important Terms

Jurisdiction

Jurisdiction over In Rem cases focuses on the property location, while In Personam jurisdiction targets the parties involved in the legal dispute.

Foreclosure

Foreclosure actions in rem target the property itself to satisfy a creditor's claim, allowing the sale of the secured asset regardless of the owner's presence or liability. In contrast, in personam foreclosure involves a judgment against the property owner personally, enabling creditors to pursue their other assets beyond the foreclosure property.

Lien

A lien is a legal claim against property (in rem) providing creditors the right to satisfy debts from that specific asset, contrasting with in personam claims that target the debtor personally.

Default Judgment

Default judgment in in rem cases specifically affects property rights within the jurisdiction, whereas in personam default judgment targets the personal obligations of the defendant regardless of property location.

Personal Obligation

Personal obligation arises from In Personam jurisdiction, creating a duty enforceable against a specific individual, unlike In Rem jurisdiction which involves rights or obligations related to property.

Secured Debt

Secured debt involves a creditor's claim on specific collateral through an in rem action, allowing recovery from the asset itself, whereas in personam actions pursue the debtor personally for repayment regardless of collateral.

Quasi in Rem

Quasi in rem jurisdiction permits courts to adjudicate claims against a defendant's property within the forum state to satisfy a personal obligation, differing from in rem jurisdiction that directly adjudicates rights in the property itself and from in personam jurisdiction that concerns personal claims against the defendant regardless of property location.

Collateral

Collateral secures an obligation and can be enforced in rem against property, while in personam claims target a specific individual's personal liability.

Attachment

Attachment is a legal remedy used to secure a debtor's property before a judgment, often applied in in rem actions where the court asserts control over specific property rather than personal liability. In contrast, in personam jurisdiction focuses on the defendant's personal liability, allowing courts to enforce judgments against individuals rather than against property itself.

Enforcement

Enforcement in legal contexts distinguishes between In Rem, which targets property rights to satisfy judgments, and In Personam, which focuses on compelling the behavior or obligations of a specific individual. In Rem enforcement typically involves jurisdiction over tangible or intangible assets, while In Personam enforcement entails court orders binding a defendant directly.

In Rem vs In Personam Infographic

moneydif.com

moneydif.com