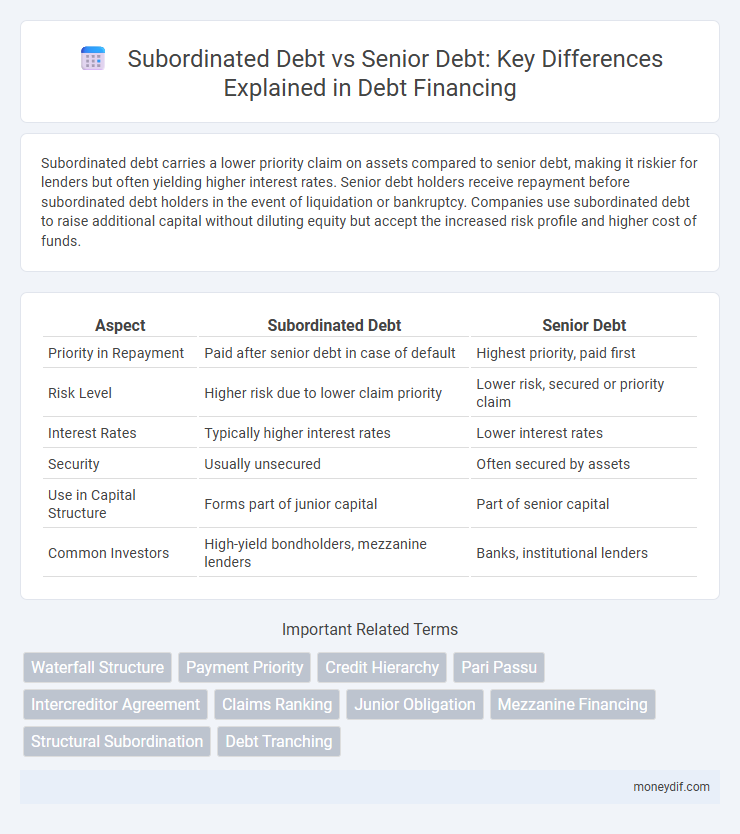

Subordinated debt carries a lower priority claim on assets compared to senior debt, making it riskier for lenders but often yielding higher interest rates. Senior debt holders receive repayment before subordinated debt holders in the event of liquidation or bankruptcy. Companies use subordinated debt to raise additional capital without diluting equity but accept the increased risk profile and higher cost of funds.

Table of Comparison

| Aspect | Subordinated Debt | Senior Debt |

|---|---|---|

| Priority in Repayment | Paid after senior debt in case of default | Highest priority, paid first |

| Risk Level | Higher risk due to lower claim priority | Lower risk, secured or priority claim |

| Interest Rates | Typically higher interest rates | Lower interest rates |

| Security | Usually unsecured | Often secured by assets |

| Use in Capital Structure | Forms part of junior capital | Part of senior capital |

| Common Investors | High-yield bondholders, mezzanine lenders | Banks, institutional lenders |

Understanding Senior Debt: Definition and Characteristics

Senior debt is a type of loan that holds priority over other debts in case of borrower default or bankruptcy, ensuring repayment before subordinated debt. It typically features lower interest rates due to its secured status and reduced risk for lenders, often backed by collateral such as property or equipment. Characteristics of senior debt include fixed repayment schedules, strict covenants, and higher creditor rights, making it a critical consideration for both borrowers and investors.

What is Subordinated Debt? Key Features Explained

Subordinated debt is a type of debt that ranks below senior debt in the priority of repayment during a borrower's liquidation or bankruptcy. It typically carries higher interest rates to compensate for increased risk and is often unsecured or less secured compared to senior debt. Key features include lower claim on assets, higher yield potential, and use primarily by companies seeking capital without diluting equity.

Priority of Claims: Senior Debt vs Subordinated Debt

Senior debt holds the highest priority in the capital structure, ensuring repayment before subordinated debt during liquidation or bankruptcy events. Subordinated debt ranks below senior debt, making it riskier with lower recovery rates if the issuer defaults. This priority of claims significantly impacts interest rates and investor risk profiles, with senior debt generally offering lower yields compared to subordinated debt.

Risk Profiles: Analyzing the Differences

Subordinated debt carries higher risk compared to senior debt because it is repaid only after senior obligations are satisfied, often resulting in lower recovery rates during default scenarios. Senior debt holders have priority claims on assets, making senior debt less risky and typically associated with lower interest rates. The differing risk profiles impact investor returns, with subordinated debt demanding higher yields to compensate for increased default risk and lower security.

Interest Rates: Senior vs Subordinated Debt Comparison

Subordinated debt typically carries higher interest rates compared to senior debt due to its lower repayment priority and increased risk for lenders. Senior debt is secured by collateral and has priority claims during bankruptcy, resulting in lower interest costs. The interest rate spread between subordinated and senior debt reflects the risk premium investors demand for the subordinated position.

Repayment Structure and Maturity

Subordinated debt carries a lower priority in repayment structure compared to senior debt, meaning it is repaid only after all senior obligations have been fulfilled, increasing its risk profile. Senior debt typically has a fixed maturity date with structured repayment schedules, often including periodic principal and interest payments. Subordinated debt usually features longer maturity terms and may include deferred interest options, reflecting its subordinate status in the capital structure.

Impact on Credit Ratings and Borrowing Capacity

Subordinated debt carries higher risk compared to senior debt, leading credit rating agencies to assign lower credit ratings to issuers with substantial subordinated debt on their balance sheets. This increased risk perception can reduce a company's overall borrowing capacity by limiting access to lower-cost senior debt markets. Conversely, maintaining a higher proportion of senior debt supports stronger credit ratings and enhances borrowing capacity due to its priority claim in the event of default.

Legal and Bankruptcy Implications

Subordinated debt holders have lower priority claims compared to senior debt holders during bankruptcy, often resulting in reduced recovery rates. Senior debt is secured by company assets, giving these lenders first rights to repayment before subordinated creditors in legal proceedings. The legal framework enforces this hierarchy, impacting restructuring negotiations and creditor protections.

Real-World Examples: Senior and Subordinated Debt in Practice

Senior debt holds priority in repayment during bankruptcy, exemplified by large corporations like General Electric, where senior bondholders are paid before subordinated creditors. Subordinated debt, used by companies such as Tesla in its convertible notes, carries higher risk and interest rates due to its lower claim on assets. In practice, banks often structure loans with senior debt secured by tangible assets, while subordinated debt serves as mezzanine financing to bridge funding gaps.

Which is Right for You? Factors to Consider

Choosing between subordinated debt and senior debt depends on factors like risk tolerance, cost, and repayment priority. Senior debt offers lower risk with higher repayment priority but typically carries lower interest rates, while subordinated debt involves higher risk and higher returns due to its lower claim in case of default. Evaluate your company's cash flow stability, capital structure needs, and market conditions to determine which debt type aligns with your financial strategy.

Important Terms

Waterfall Structure

Waterfall structure prioritizes repayment by allocating cash flows first to senior debt holders before subordinated debt holders receive payment, reflecting their relative risk and claim hierarchy.

Payment Priority

Payment priority dictates that senior debt holders receive full repayment before any funds are distributed to subordinated debt holders, reflecting the higher risk and lower claim priority associated with subordinated debt. This hierarchy ensures that in case of liquidation or bankruptcy, senior debt is prioritized, protecting lenders with stronger collateral and reducing their default risk.

Credit Hierarchy

In credit hierarchy, senior debt holds priority repayment rights over subordinated debt, which carries higher risk and interest rates due to its lower claim in bankruptcy.

Pari Passu

Pari Passu ensures that subordinated debt ranks below senior debt in repayment priority during insolvency proceedings.

Intercreditor Agreement

An Intercreditor Agreement defines the priority and rights between subordinated debt holders and senior debt holders, ensuring senior debt has precedence in repayment and enforcement actions.

Claims Ranking

Claims ranking prioritizes senior debt over subordinated debt, ensuring senior creditors receive repayment before subordinated lenders in insolvency proceedings.

Junior Obligation

Junior obligation refers to subordinated debt that ranks below senior debt in priority for repayment during issuer liquidation, resulting in higher risk and typically higher interest rates.

Mezzanine Financing

Mezzanine financing occupies a hybrid capital position, ranking below senior debt but above equity in the capital structure, often taking the form of subordinated debt with warrants or conversion features. Its higher risk compared to senior debt demands elevated interest rates, reflecting its secondary claim on assets and cash flow during liquidation or bankruptcy.

Structural Subordination

Structural subordination occurs when a parent company's creditors have senior debt claims on consolidated assets, while creditors of its subsidiary hold subordinated debt that is only backed by the subsidiary's assets, creating a hierarchy in creditor repayment priority that impacts recovery rates in insolvency scenarios. Senior debt benefits from higher priority claims and typically lower risk profiles, whereas subordinated debt carries greater risk and higher interest rates due to its position behind senior obligations within the corporate structure.

Debt Tranching

Debt tranching structures funding by prioritizing senior debt with higher repayment priority and lower risk, while subordinated debt carries lower priority, higher risk, and typically offers higher returns.

subordinated debt vs senior debt Infographic

moneydif.com

moneydif.com