Mezzanine debt typically combines elements of equity and debt, offering lenders higher returns through interest and potential equity participation, making it attractive for companies seeking growth capital without diluting ownership significantly. Subordinated debt ranks below senior debt in the capital structure, carrying higher risk and interest rates, but it lacks the equity conversion features characteristic of mezzanine financing. Both types serve as important financing tools for companies needing capital beyond senior debt limits while balancing risk and cost.

Table of Comparison

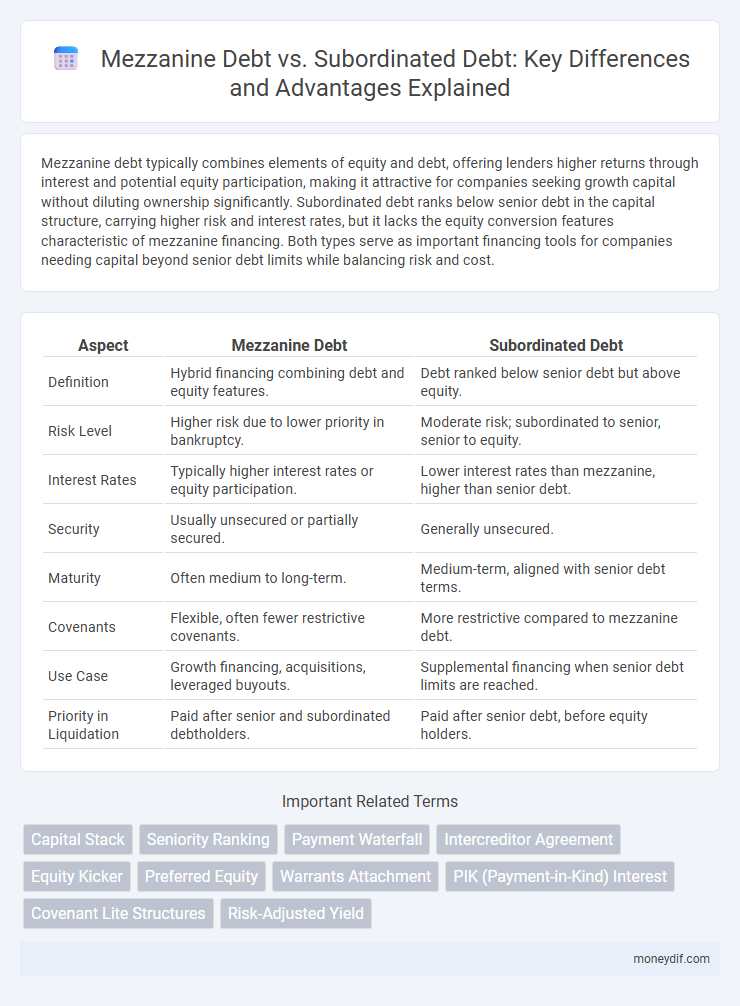

| Aspect | Mezzanine Debt | Subordinated Debt |

|---|---|---|

| Definition | Hybrid financing combining debt and equity features. | Debt ranked below senior debt but above equity. |

| Risk Level | Higher risk due to lower priority in bankruptcy. | Moderate risk; subordinated to senior, senior to equity. |

| Interest Rates | Typically higher interest rates or equity participation. | Lower interest rates than mezzanine, higher than senior debt. |

| Security | Usually unsecured or partially secured. | Generally unsecured. |

| Maturity | Often medium to long-term. | Medium-term, aligned with senior debt terms. |

| Covenants | Flexible, often fewer restrictive covenants. | More restrictive compared to mezzanine debt. |

| Use Case | Growth financing, acquisitions, leveraged buyouts. | Supplemental financing when senior debt limits are reached. |

| Priority in Liquidation | Paid after senior and subordinated debtholders. | Paid after senior debt, before equity holders. |

Understanding Mezzanine Debt: Key Features

Mezzanine debt is a hybrid form of financing that blends characteristics of debt and equity, often used by companies to fund expansion without diluting ownership. It typically carries higher interest rates than senior debt due to its subordinated position in the capital structure and often includes equity participation through warrants or convertible features. This form of debt provides lenders with upside potential while offering borrowers flexible terms and access to capital beyond traditional bank loans.

What Is Subordinated Debt? An Overview

Subordinated debt is a type of debt that ranks below senior debt in the event of a borrower's liquidation or bankruptcy, making it riskier for lenders. This debt typically carries higher interest rates to compensate for the increased risk and is often used by companies to secure additional financing without affecting senior creditors. In comparison to mezzanine debt, subordinated debt may not include equity conversion features, focusing primarily on debt financing with a lower claim priority.

Structural Differences Between Mezzanine and Subordinated Debt

Mezzanine debt typically ranks below senior and subordinated debt in the capital structure, combining debt with equity-like features such as warrants or options, while subordinated debt ranks below senior debt but above mezzanine debt without equity participation. Mezzanine debt often carries higher interest rates and may include profit-sharing mechanisms that enhance returns for lenders, contrasting with subordinated debt's fixed interest payments. Structural differences dictate risk profiles and repayment priority, with mezzanine debt positioned as a hybrid financing instrument bridging debt and equity, whereas subordinated debt remains purely debt with lower risk than mezzanine but more risk than senior debt.

Risk Profiles: Mezzanine Debt vs Subordinated Debt

Mezzanine debt carries higher risk than subordinated debt due to its position lower in the capital structure, often including equity components like warrants that increase potential returns but also volatility. Subordinated debt ranks above mezzanine debt in default hierarchy, providing lenders greater security but typically offering lower yields. Both debt types serve as hybrid financing options, with mezzanine debt appealing to investors seeking higher-risk, higher-reward profiles, while subordinated debt suits those prioritizing more stable returns amid moderate risk.

Typical Use Cases for Each Debt Type

Mezzanine debt is commonly utilized for growth financing, leveraged buyouts, and recapitalizations where companies seek capital without diluting equity. Subordinated debt is typically employed in structured finance and corporate refinancing, serving as a secondary layer behind senior debt to enhance capital structure flexibility. Both debt types provide risk-adjusted returns but differ in priority claims and repayment terms in default scenarios.

Mezzanine vs Subordinated: Cost of Capital Comparison

Mezzanine debt typically carries a higher cost of capital than subordinated debt due to its hybrid nature, combining debt and equity features, which increases risk for lenders. Subordinated debt ranks lower in the capital structure than senior debt but generally has a lower yield compared to mezzanine debt because it doesn't include equity participation or warrants. Investors demand higher returns on mezzanine debt to compensate for greater risk and potential equity dilution, while subordinated debt offers a more predictable income stream with moderate risk.

Impact on Corporate Capital Structure

Mezzanine debt, positioned between senior debt and equity, typically carries higher interest rates and often includes equity warrants, impacting corporate capital structure by increasing leverage while preserving ownership dilution. Subordinated debt ranks below senior debt but above equity in claims, usually bearing lower interest rates than mezzanine debt, shaping capital structure by providing additional capital without relinquishing control. Both debt types increase financial risk and influence a company's weighted average cost of capital (WACC), but mezzanine debt's hybrid nature distinctly affects equity valuation and strategic financing flexibility.

Investor Perspectives: Returns and Security

Mezzanine debt typically offers higher returns than subordinated debt due to its hybrid nature combining debt and equity features, appealing to investors seeking enhanced yield with moderate risk. Subordinated debt ranks lower in the capital structure, providing less security but generally more predictable cash flows compared to mezzanine financing. Investors evaluate mezzanine debt for its potential equity upside, while subordinated debt is favored for its priority in repayment during insolvency events.

Documentation and Legal Considerations

Mezzanine debt typically involves more complex documentation, including detailed equity warrants and intercreditor agreements, reflecting its hybrid debt-equity nature. Subordinated debt agreements prioritize clear subordination clauses that establish repayment hierarchy but generally require less intricate documentation than mezzanine financing. Legal considerations for mezzanine debt often emphasize negotiation of control rights and exit strategies, while subordinated debt focuses on enforcement rights and creditor protections within the capital structure.

Choosing the Right Debt Instrument for Your Business

Selecting between mezzanine debt and subordinated debt hinges on your business's capital structure and risk tolerance, with mezzanine debt offering higher returns through convertible features, aligning well with growth-oriented firms. Subordinated debt provides a lower-cost financing option with fixed interest, suited for companies seeking to preserve ownership without diluting equity. Understanding the nuances of repayment priority, interest rates, and potential equity conversion ensures optimized capital infusion tailored to your business objectives.

Important Terms

Capital Stack

Mezzanine debt typically holds a position in the capital stack between senior debt and equity, offering higher yields due to its increased risk compared to senior debt but lower risk than equity. Subordinated debt ranks below mezzanine debt in the capital structure, often featuring more flexible terms but higher interest rates and lower priority in the event of liquidation.

Seniority Ranking

Seniority ranking places mezzanine debt above subordinated debt, meaning mezzanine lenders have priority claims on assets and cash flows in default or liquidation scenarios. This higher claim priority typically results in mezzanine debt carrying lower risk and potentially lower interest rates compared to the more subordinate and riskier subordinated debt.

Payment Waterfall

Payment waterfall prioritizes mezzanine debt repayments before subordinated debt, ensuring structured cash flow allocation in capital stacks.

Intercreditor Agreement

An Intercreditor Agreement defines the rights and priorities between Mezzanine Debt and Subordinated Debt holders, outlining payment order and enforcement remedies in default scenarios. This agreement ensures that Mezzanine Debt, often higher-risk but yielding higher returns, is clearly subordinated to senior lenders while establishing the ranking and control terms among subordinated creditors.

Equity Kicker

Equity kicker, often integrated with mezzanine debt, provides lenders a potential equity stake, enhancing returns beyond fixed interest by converting part of their loan into equity upon exit, differentiating it from subordinated debt that typically lacks equity participation and carries a lower risk-return profile. Mezzanine debt combines debt and equity features, leveraging equity kickers to bridge financing gaps for growth, whereas subordinated debt ranks below senior debt in repayment priority but generally excludes equity upside.

Preferred Equity

Preferred equity provides a hybrid financing option with higher priority than subordinated debt but lower than mezzanine debt in capital structure, offering investors fixed dividends and potential equity upside.

Warrants Attachment

Warrants attached to mezzanine debt provide equity upside potential, distinguishing it from subordinated debt which typically lacks such equity-linked incentives.

PIK (Payment-in-Kind) Interest

PIK interest in mezzanine debt allows deferred cash payments added to the loan principal, contrasting with subordinated debt which typically requires periodic cash interest payments and has lower risk priority.

Covenant Lite Structures

Covenant lite structures in mezzanine debt typically feature fewer financial maintenance covenants compared to subordinated debt, increasing lender risk but offering more flexibility to borrowers. Mezzanine debt under covenant lite terms often commands higher yields due to its subordinated position and reduced protective covenants relative to traditional subordinated debt.

Risk-Adjusted Yield

Risk-Adjusted Yield for mezzanine debt typically exceeds that of subordinated debt due to higher exposure to default risk and lower claim priority in capital structure. Investors demand increased compensation through elevated yields to offset the amplified risk associated with mezzanine financing compared to subordinated debt instruments.

Mezzanine Debt vs Subordinated Debt Infographic

moneydif.com

moneydif.com