Convertible debt allows investors to convert their debt into equity, offering potential upside if the company's value increases, while non-convertible debt remains strictly as a loan with fixed repayment terms. Convertible debt often carries lower interest rates due to this conversion feature, making it attractive for startups seeking flexible financing. Non-convertible debt typically provides more predictability and control for both lenders and borrowers, as it involves a straightforward repayment schedule without equity dilution.

Table of Comparison

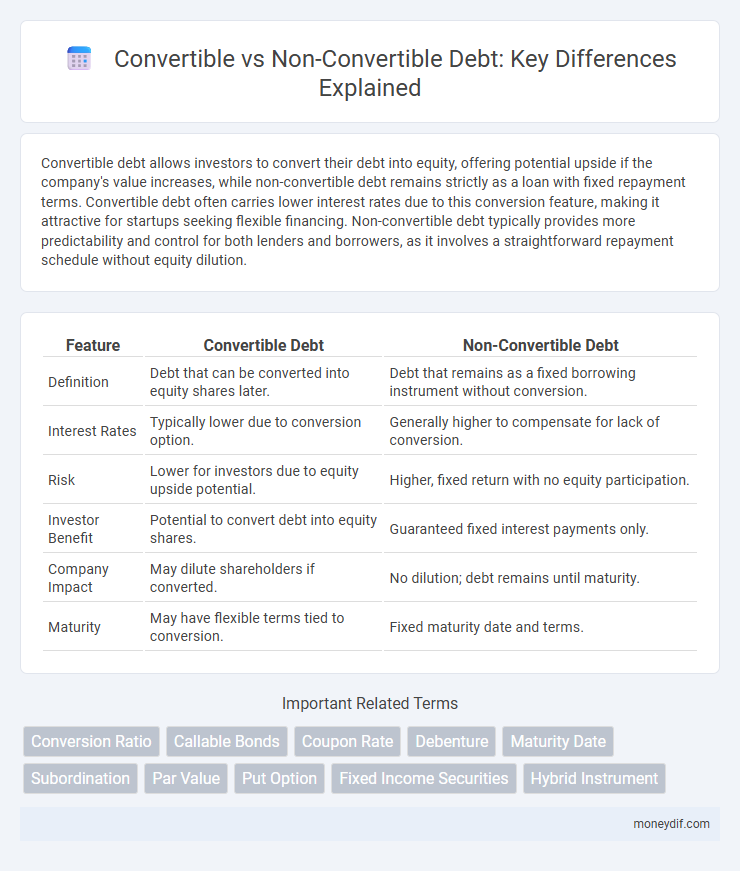

| Feature | Convertible Debt | Non-Convertible Debt |

|---|---|---|

| Definition | Debt that can be converted into equity shares later. | Debt that remains as a fixed borrowing instrument without conversion. |

| Interest Rates | Typically lower due to conversion option. | Generally higher to compensate for lack of conversion. |

| Risk | Lower for investors due to equity upside potential. | Higher, fixed return with no equity participation. |

| Investor Benefit | Potential to convert debt into equity shares. | Guaranteed fixed interest payments only. |

| Company Impact | May dilute shareholders if converted. | No dilution; debt remains until maturity. |

| Maturity | May have flexible terms tied to conversion. | Fixed maturity date and terms. |

Understanding Convertible vs Non-Convertible Debt

Convertible debt allows investors to convert their loans into equity shares of the issuing company at a predetermined conversion rate, offering potential upside if the company's stock value rises. Non-convertible debt, on the other hand, remains strictly a loan instrument with fixed interest payments and no option for conversion into equity, typically providing higher interest rates due to its lower risk profile. Understanding these differences helps in evaluating capital structure choices and investment risks in corporate finance.

Key Features of Convertible Debt

Convertible debt offers investors the option to convert their debt into equity at predetermined terms, providing potential upside if the company's value increases. This debt typically carries lower interest rates compared to non-convertible debt due to the embedded conversion feature. Conversion terms, maturity dates, and interest rates are key elements that define the flexibility and appeal of convertible debt in financing structures.

Distinct Characteristics of Non-Convertible Debt

Non-convertible debt features fixed interest payments and cannot be converted into equity, providing lenders with predictable returns and priority in claims over company assets during liquidation. It typically carries higher interest rates compared to convertible debt due to the lack of potential equity upside for investors. Non-convertible debt agreements often include stricter covenants to protect creditors and limit the issuer's financial risk-taking.

Advantages of Convertible Debt Instruments

Convertible debt instruments offer the advantage of lower interest rates compared to non-convertible debt due to the embedded option to convert debt into equity. This feature provides investors potential upside participation in company growth while reducing the issuer's immediate cash flow burden. Furthermore, convertible debt can enhance capital structure flexibility and attract a broader range of investors by combining features of both debt and equity financing.

Drawbacks of Convertible Debt Options

Convertible debt carries the drawback of potential equity dilution, which can reduce existing shareholders' control and earnings per share. The conversion terms often include conversion discounts or caps that may disadvantage the company during favorable market conditions. Unlike non-convertible debt, convertible instruments can introduce valuation uncertainty and complicate financial forecasting due to their hybrid debt-equity nature.

Benefits of Choosing Non-Convertible Debt

Non-convertible debt offers fixed interest rates and predictable repayment schedules, providing financial stability for both issuers and investors. It maintains the company's capital structure without diluting equity, preserving existing shareholder value. Non-convertible debt also typically involves lower administrative complexity compared to convertible options, facilitating straightforward debt management.

Risks Associated with Non-Convertible Debt

Non-convertible debt carries higher credit risk since it lacks the option to convert into equity, limiting flexibility during financial distress. Investors face increased default risk because repayment depends solely on the issuer's ability to generate cash flow without equity conversion as an alternative. Market volatility impacts non-convertible debt more severely, as its fixed-income nature restricts upside potential compared to convertible securities.

Convertible Debt vs Non-Convertible Debt: Key Differences

Convertible debt allows investors to convert their loan into equity shares, providing potential upside if the company's valuation increases, while non-convertible debt offers fixed interest payments without conversion rights. Convertible debt often features lower interest rates due to the conversion option's added value, whereas non-convertible debt typically carries higher rates to compensate for lack of equity participation. The choice between convertible and non-convertible debt impacts risk profiles, investor appeal, and company capital structure flexibility.

Ideal Scenarios for Using Convertible Debt

Convertible debt is ideal for startups seeking flexible financing without immediate equity dilution, allowing investors to convert debt into equity at a later funding round. It benefits companies anticipating growth and higher valuations, as conversion terms often include discounts or valuation caps to reward early backers. This instrument reduces initial cash outflow pressure and aligns investor incentives with the company's success.

How to Choose Between Convertible and Non-Convertible Debt

Choosing between convertible and non-convertible debt depends on a company's growth potential and investor preferences; convertible debt offers the option to convert into equity, attracting investors seeking upside in high-growth ventures. Non-convertible debt provides fixed interest and stronger creditor rights, making it suitable for companies prioritizing predictable cash flow and control retention. Evaluating factors such as interest rates, dilution risks, maturity terms, and market conditions helps determine the optimal financing structure for business objectives.

Important Terms

Conversion Ratio

The conversion ratio quantifies the number of common shares an investor receives upon converting a convertible security, distinguishing it from non-convertible securities, which do not offer such an option.

Callable Bonds

Callable bonds allow issuers to redeem debt before maturity, with convertible callable bonds offering conversion to equity whereas non-convertible callable bonds do not.

Coupon Rate

The coupon rate on convertible bonds typically offers a lower yield compared to non-convertible bonds, reflecting the added value of the conversion feature that allows bondholders to convert debt into equity shares. Non-convertible bonds usually have higher coupon rates to compensate investors for the absence of conversion options and increased fixed income security.

Debenture

Convertible debentures offer investors the option to convert debt into equity shares, while non-convertible debentures provide fixed interest returns without equity conversion rights.

Maturity Date

The maturity date for convertible bonds often aligns with the issuer's strategic timeline to allow conversion into equity, while non-convertible bonds have fixed maturity dates solely for principal repayment without equity conversion options.

Subordination

Subordination in debt financing determines the priority of repayment, where convertible bonds typically hold senior status over non-convertible bonds due to their potential equity conversion feature. Non-convertible bonds usually carry a lower claim in the capital structure, leading to higher yields as compensation for increased risk compared to the subordinated but convertible debt.

Par Value

Par value determines the fixed nominal value of convertible and non-convertible securities, influencing investor rights and conversion terms.

Put Option

A put option in convertible bonds allows investors to sell the bond back to the issuer under specific conditions, providing downside protection not typically available in non-convertible bonds.

Fixed Income Securities

Convertible fixed income securities offer investors the potential for equity upside by allowing conversion into shares, while non-convertible fixed income securities provide stable interest payments without conversion options.

Hybrid Instrument

Hybrid instruments combine features of convertible securities, which allow conversion into equity, and non-convertible securities, which remain debt-only, offering investors flexible risk and return profiles.

convertible vs non-convertible Infographic

moneydif.com

moneydif.com