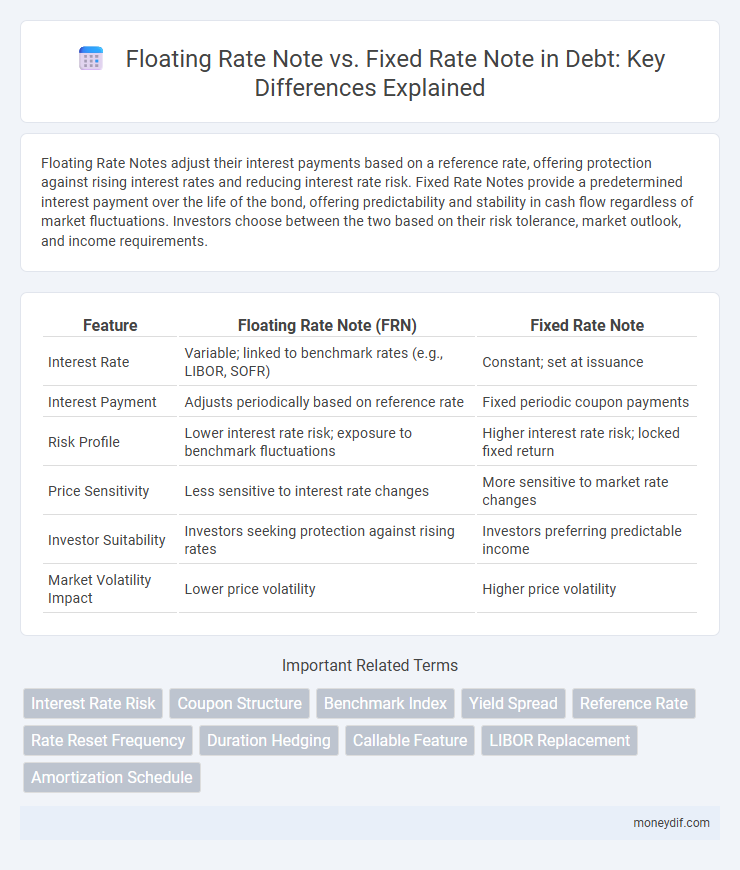

Floating Rate Notes adjust their interest payments based on a reference rate, offering protection against rising interest rates and reducing interest rate risk. Fixed Rate Notes provide a predetermined interest payment over the life of the bond, offering predictability and stability in cash flow regardless of market fluctuations. Investors choose between the two based on their risk tolerance, market outlook, and income requirements.

Table of Comparison

| Feature | Floating Rate Note (FRN) | Fixed Rate Note |

|---|---|---|

| Interest Rate | Variable; linked to benchmark rates (e.g., LIBOR, SOFR) | Constant; set at issuance |

| Interest Payment | Adjusts periodically based on reference rate | Fixed periodic coupon payments |

| Risk Profile | Lower interest rate risk; exposure to benchmark fluctuations | Higher interest rate risk; locked fixed return |

| Price Sensitivity | Less sensitive to interest rate changes | More sensitive to market rate changes |

| Investor Suitability | Investors seeking protection against rising rates | Investors preferring predictable income |

| Market Volatility Impact | Lower price volatility | Higher price volatility |

Overview of Floating Rate Notes (FRNs) and Fixed Rate Notes

Floating Rate Notes (FRNs) feature variable interest rates tied to benchmark indexes such as LIBOR or SOFR, providing protection against rising interest rates and reducing interest rate risk for investors. Fixed Rate Notes, in contrast, offer predetermined, stable coupon payments over the life of the bond, delivering predictable income but exposing holders to greater interest rate risk if market rates increase. The choice between FRNs and fixed rate notes depends on investors' risk tolerance, market outlook, and desire for income stability versus flexibility.

Key Differences Between FRNs and Fixed Rate Notes

Floating Rate Notes (FRNs) have variable interest rates linked to benchmark rates such as LIBOR or SOFR, causing coupon payments to fluctuate with market conditions, while Fixed Rate Notes offer predetermined, stable interest payments throughout the bond's life. FRNs typically reduce interest rate risk and provide protection against rising rates, whereas Fixed Rate Notes carry more interest rate risk but offer predictable income for investors. Liquidity and pricing behavior also differ; FRNs often have narrower spreads during rising rate environments compared to Fixed Rate Notes, which may trade at a premium or discount relative to interest rate changes.

How Floating Rate Notes Work

Floating Rate Notes (FRNs) have variable interest rates tied to benchmark indices like LIBOR or SOFR, adjusting periodically based on market conditions. These instruments reduce interest rate risk by realigning coupon payments with current rates, making them attractive during rising interest rate environments. Investors in FRNs benefit from regular coupon resets, which provide a hedge against inflation and changing economic conditions.

How Fixed Rate Notes Operate

Fixed Rate Notes operate by issuing debt securities with a predetermined interest rate that remains constant throughout the life of the bond, providing predictable interest payments to investors. The fixed coupon payments are typically made semi-annually or annually, ensuring consistent cash flows regardless of market interest rate fluctuations. These notes offer stability for both issuers and investors, as the fixed interest expense for issuers and fixed income for holders reduce exposure to interest rate volatility.

Interest Rate Risk Comparison

Floating Rate Notes (FRNs) adjust interest payments based on prevailing benchmark rates like LIBOR or SOFR, reducing exposure to interest rate risk by aligning coupon payments with market fluctuations. Fixed Rate Notes maintain a consistent interest rate throughout their maturity, exposing investors to higher interest rate risk as market rates rise, potentially decreasing bond value. Investors prioritize FRNs in rising rate environments to mitigate duration risk, whereas Fixed Rate Notes may be preferred for stable or declining rate conditions due to predictable income streams.

Suitability for Different Market Environments

Floating Rate Notes (FRNs) are highly suitable for volatile or rising interest rate environments due to their periodic interest rate adjustments, which protect investors from inflation risk. Fixed Rate Notes provide stability and predictable income, making them ideal for investors seeking fixed returns in stable or declining interest rate markets. Investors should align their choice between FRNs and Fixed Rate Notes with their risk tolerance and interest rate outlook to optimize portfolio performance.

Investor Risk and Return Profiles

Floating Rate Notes offer investors protection against rising interest rates by adjusting coupon payments periodically, reducing interest rate risk but introducing variability in income. Fixed Rate Notes provide predictable, stable returns with fixed coupon payments, appealing to risk-averse investors but exposing them to potential losses if market rates increase. The choice between these instruments hinges on an investor's risk tolerance and expectations of future interest rate movements.

Advantages and Disadvantages of FRNs

Floating Rate Notes (FRNs) offer the advantage of interest payments that adjust with benchmark rates like LIBOR or SOFR, reducing interest rate risk and providing protection against inflation. However, FRNs typically have lower initial coupon rates compared to Fixed Rate Notes and may result in unpredictable cash flows, complicating financial planning for investors. The variable interest component can lead to increased volatility in returns during fluctuating interest rate environments, which might not suit risk-averse investors.

Advantages and Disadvantages of Fixed Rate Notes

Fixed Rate Notes provide investors with predictable interest payments and protection against rising interest rates, making them suitable for risk-averse individuals seeking stable income. However, their main disadvantage is interest rate risk when market rates increase, causing fixed payments to lose relative value and potentially leading to capital losses if sold before maturity. Fixed Rate Notes often have lower yields compared to Floating Rate Notes, limiting potential gains in a rising interest rate environment.

Choosing Between Floating and Fixed Rate Notes

Choosing between floating rate notes (FRNs) and fixed rate notes depends primarily on interest rate forecasts and risk tolerance. FRNs offer protection against rising rates through variable coupons linked to benchmarks like LIBOR or SOFR, making them suitable for investors anticipating inflation or rate hikes. Fixed rate notes provide predictable income with stable coupons, ideal for conservative investors seeking certainty in long-term cash flows despite interest rate fluctuations.

Important Terms

Interest Rate Risk

Floating Rate Notes mitigate interest rate risk by adjusting coupon payments based on benchmark rates, whereas Fixed Rate Notes expose investors to greater risk due to stable, unchanging interest payments despite market fluctuations.

Coupon Structure

Floating Rate Notes (FRNs) feature coupon payments that adjust periodically based on a reference interest rate, such as LIBOR or SOFR, plus a fixed spread, providing protection against interest rate fluctuations. In contrast, Fixed Rate Notes maintain a constant coupon rate throughout the life of the bond, offering predictable income but exposing investors to interest rate risk in rising rate environments.

Benchmark Index

Benchmark indices for Floating Rate Notes typically reflect short-term interest rate trends, whereas Fixed Rate Notes are benchmarked against long-term government bond yields to determine coupon payments.

Yield Spread

Yield spread between Floating Rate Notes (FRNs) and Fixed Rate Notes (FRNs) reflects the difference in interest rates, capturing the risk premium investors demand for interest rate fluctuations; typically, FRNs yield lower spreads due to their variable coupons adjusting with benchmark rates, while Fixed Rate Notes often provide higher yields to compensate for fixed interest risk. Monitoring this spread helps investors assess market expectations for interest rate volatility and credit risk differentials.

Reference Rate

Reference Rate, such as LIBOR, SOFR, or EURIBOR, serves as the benchmark interest rate for Floating Rate Notes, causing their coupon payments to fluctuate based on market conditions. Fixed Rate Notes, in contrast, offer predetermined, stable coupon payments unaffected by changes in the Reference Rate, providing predictability for investors seeking consistent income.

Rate Reset Frequency

Rate reset frequency in Floating Rate Notes determines interest payment adjustments based on benchmark rates, contrasting with Fixed Rate Notes that maintain constant interest rates throughout the bond's term.

Duration Hedging

Duration hedging mitigates interest rate risk by pairing Floating Rate Notes, which have shorter durations due to periodic rate resets, with Fixed Rate Notes, which exhibit longer durations sensitive to interest rate changes.

Callable Feature

The callable feature in floating rate notes allows issuers to redeem the bond before maturity, offering flexibility against interest rate fluctuations unlike fixed rate notes that provide stable, predictable coupon payments without early redemption options.

LIBOR Replacement

The LIBOR replacement drives shifting investor preference towards Floating Rate Notes due to their variable interest rates adjusting with benchmark changes, contrasting with Fixed Rate Notes' stable but inflexible coupon payments.

Amortization Schedule

An amortization schedule for a floating rate note adjusts periodic payments based on interest rate fluctuations, whereas a fixed rate note maintains consistent payments throughout the loan term.

Floating Rate Note vs Fixed Rate Note Infographic

moneydif.com

moneydif.com