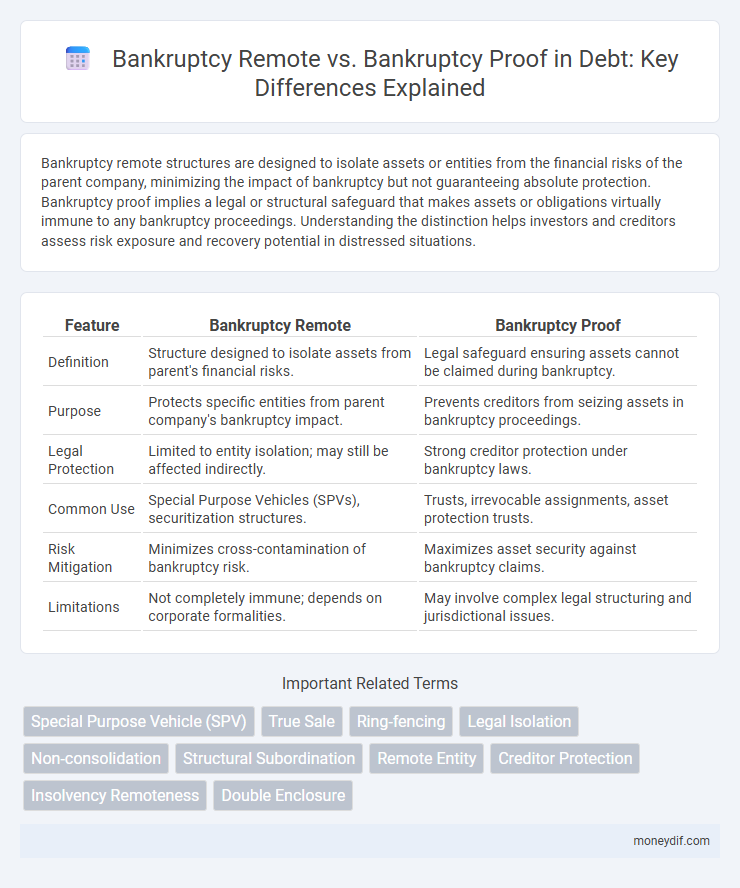

Bankruptcy remote structures are designed to isolate assets or entities from the financial risks of the parent company, minimizing the impact of bankruptcy but not guaranteeing absolute protection. Bankruptcy proof implies a legal or structural safeguard that makes assets or obligations virtually immune to any bankruptcy proceedings. Understanding the distinction helps investors and creditors assess risk exposure and recovery potential in distressed situations.

Table of Comparison

| Feature | Bankruptcy Remote | Bankruptcy Proof |

|---|---|---|

| Definition | Structure designed to isolate assets from parent's financial risks. | Legal safeguard ensuring assets cannot be claimed during bankruptcy. |

| Purpose | Protects specific entities from parent company's bankruptcy impact. | Prevents creditors from seizing assets in bankruptcy proceedings. |

| Legal Protection | Limited to entity isolation; may still be affected indirectly. | Strong creditor protection under bankruptcy laws. |

| Common Use | Special Purpose Vehicles (SPVs), securitization structures. | Trusts, irrevocable assignments, asset protection trusts. |

| Risk Mitigation | Minimizes cross-contamination of bankruptcy risk. | Maximizes asset security against bankruptcy claims. |

| Limitations | Not completely immune; depends on corporate formalities. | May involve complex legal structuring and jurisdictional issues. |

Understanding Bankruptcy Remote Structures

Bankruptcy remote structures are designed to isolate assets and liabilities, minimizing the risk that a bankruptcy filing of one entity will affect the entire group, ensuring creditor protection through legal and structural barriers. Unlike bankruptcy proof, which implies absolute immunity from bankruptcy, bankruptcy remote entities rely on contractual and organizational safeguards to reduce financial contagion risks. These structures often involve special purpose vehicles (SPVs) and limitations on control and guarantees to maintain separateness and enhance credit quality.

What Does Bankruptcy Proof Mean?

Bankruptcy proof refers to financial arrangements or structures designed to minimize the impact of one party's bankruptcy on other parties or assets. Unlike bankruptcy remote, which isolates assets to protect them legally from bankruptcy claims, bankruptcy proof emphasizes resilience against bankruptcy effects through strategic contractual and operational safeguards. This concept ensures creditors or investors maintain priority and reduce risk exposure in case of financial distress.

Key Differences Between Bankruptcy Remote and Bankruptcy Proof

Bankruptcy remote entities are structured to isolate assets and liabilities, minimizing the risk of consolidation in a parent company's bankruptcy, whereas bankruptcy proof refers to assets or arrangements legally shielded from bankruptcy claims altogether. Bankruptcy remote status often involves special purpose vehicles (SPVs) with limited recourse to protect creditors, while bankruptcy proof relies on statutory exemptions or enforceable security interests that prevent asset seizure. Understanding these distinctions is crucial for investors seeking to mitigate credit risk and ensure asset protection in financial transactions.

Legal Frameworks Governing Bankruptcy Remote Entities

Bankruptcy remote entities are structured under specific legal frameworks to isolate assets from the parent company's financial risks, primarily through non-consolidation opinions and true sale agreements that minimize creditor claims. Legal mechanisms such as Delaware's limited liability company statutes and special purpose vehicle (SPV) regulations enforce operational separateness, reducing bankruptcy risks. These frameworks aim to preserve asset integrity and investor confidence by legally segregating liabilities and preventing cross-defaults in insolvency scenarios.

Limitations of Bankruptcy Proof Strategies

Bankruptcy proof strategies often fail to provide absolute protection since courts can recharacterize transactions or pierce corporate veils in bankruptcy proceedings. These limitations arise from judicial authority to scrutinize the substance over form, undermining attempts to isolate assets or liabilities completely. Consequently, relying solely on bankruptcy proof structures exposes creditors and investors to residual risks despite anticipated safeguards.

Practical Applications in Corporate Finance

Bankruptcy remote structures isolate assets and cash flows to protect investors from the originator's insolvency risk, commonly used in securitization and project finance. Bankruptcy proof concepts strive to reduce debtor risk but cannot guarantee absolute immunity from bankruptcy claims. Practically, corporate finance teams employ bankruptcy remote vehicles to enhance credit ratings and lower financing costs by legally separating bankruptcy risk.

Risks Involved in Bankruptcy Remote Arrangements

Bankruptcy remote arrangements aim to isolate assets from the originating entity's financial risks but do not provide absolute protection from bankruptcy claims. Risks include potential substantive consolidation where courts may merge the entity's and special purpose vehicle's assets if fraudulent transfer or single business enterprise is proven. Creditors may challenge the arrangement's effectiveness, exposing investors to underlying entity liabilities despite bankruptcy remote structures.

How Investors Assess Bankruptcy Risks

Investors assess bankruptcy risks by analyzing the structural safeguards of bankruptcy remote entities, which isolate specific assets from parent company liabilities to minimize exposure. Bankruptcy proof mechanisms are evaluated by their ability to withstand creditor claims and maintain operational continuity during financial distress. Thorough due diligence includes reviewing contractual protections, legal separation, and asset segregation to ensure investment security against potential insolvency.

Case Studies: Bankruptcy Remote vs Bankruptcy Proof

Case studies comparing bankruptcy remote and bankruptcy proof structures reveal crucial differences in creditor protection and asset insulation. Bankruptcy remote entities often isolate specific assets to limit risk exposure, as seen in real estate investment trusts (REITs) where pre-packaged bankruptcy plans protect asset pools. Bankruptcy proof models prove more resilient in corporate debt scenarios by legally safeguarding assets from creditor claims, exemplified in structured finance deals with enhanced credit tranching and robust covenants.

Choosing the Right Approach for Risk Mitigation

Choosing the right approach for risk mitigation involves understanding the distinctions between bankruptcy remote and bankruptcy proof structures. Bankruptcy remote entities isolate assets and liabilities, minimizing exposure to creditor claims during insolvency, while bankruptcy proof strategies aim to make assets less susceptible to bankruptcy proceedings through legal protections. Evaluating the specific risk profile and legal environment helps determine the optimal method to safeguard investments effectively.

Important Terms

Special Purpose Vehicle (SPV)

A Special Purpose Vehicle (SPV) is designed as a bankruptcy-remote entity to isolate financial risk by legally separating assets and liabilities, providing enhanced protection compared to merely bankruptcy-proof structures.

True Sale

True sale transfers an asset's ownership to a bankruptcy-remote entity, ensuring the transaction is legally recognized as separate from the seller's bankruptcy estate but cannot guarantee complete bankruptcy-proof protection.

Ring-fencing

Ring-fencing isolates assets within a bankruptcy-remote entity to protect them from creditors, ensuring bankruptcy-proof status by legally separating financial risks.

Legal Isolation

Legal isolation ensures bankruptcy remote entities are structured to separate assets and liabilities, minimizing risk of creditor claims, while bankruptcy proof implies a stronger protection where the entity's assets are shielded from any bankruptcy proceedings.

Non-consolidation

Non-consolidation ensures separate legal entities maintain distinct liabilities, making bankruptcy remote structures resistant to consolidation but not entirely bankruptcy proof.

Structural Subordination

Structural subordination occurs when a parent company's creditors have a lower priority claim on the assets of a subsidiary compared to the subsidiary's own creditors, making the debt structurally subordinated in bankruptcy proceedings. In bankruptcy remote entities, structural subordination is minimized by isolating assets and liabilities to protect investors, whereas bankruptcy proof claims attempt to eliminate default risk entirely through legal and financial safeguards.

Remote Entity

A remote entity is structured to isolate liabilities from the parent company, enhancing bankruptcy remoteness by ensuring its assets remain protected even if the parent faces insolvency, but it is not entirely bankruptcy proof due to potential legal and financial risks.

Creditor Protection

Creditor protection in bankruptcy remote entities ensures separation of financial risks by isolating assets and liabilities, thereby minimizing exposure to creditors in the event of bankruptcy. Bankruptcy proof structures go further by employing legal safeguards such as non-consolidation clauses and independent management to prevent claims from creditors, enhancing asset security against bankruptcy risks.

Insolvency Remoteness

Insolvency remoteness refers to structuring an entity to isolate its financial obligations from the parent company's risks, thereby enhancing creditworthiness by limiting exposure to insolvency events. Bankruptcy remote entities are specifically designed to be bankruptcy proof by legally segregating assets and liabilities, ensuring that bankruptcy of the parent does not impact the entity's ability to meet its obligations.

Double Enclosure

Double enclosure structures enhance bankruptcy remote entities by creating multiple legal and operational barriers, ensuring creditor claims do not reach the underlying assets. This approach significantly reduces bankruptcy risk through rigorous asset segregation and independent governance, offering stronger protection compared to standard bankruptcy proof mechanisms.

bankruptcy remote vs bankruptcy proof Infographic

moneydif.com

moneydif.com