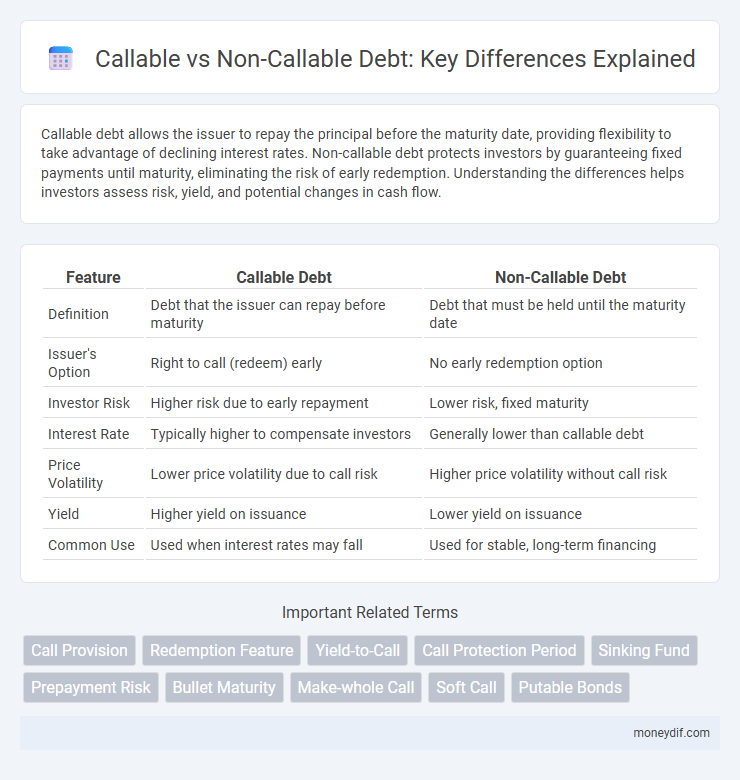

Callable debt allows the issuer to repay the principal before the maturity date, providing flexibility to take advantage of declining interest rates. Non-callable debt protects investors by guaranteeing fixed payments until maturity, eliminating the risk of early redemption. Understanding the differences helps investors assess risk, yield, and potential changes in cash flow.

Table of Comparison

| Feature | Callable Debt | Non-Callable Debt |

|---|---|---|

| Definition | Debt that the issuer can repay before maturity | Debt that must be held until the maturity date |

| Issuer's Option | Right to call (redeem) early | No early redemption option |

| Investor Risk | Higher risk due to early repayment | Lower risk, fixed maturity |

| Interest Rate | Typically higher to compensate investors | Generally lower than callable debt |

| Price Volatility | Lower price volatility due to call risk | Higher price volatility without call risk |

| Yield | Higher yield on issuance | Lower yield on issuance |

| Common Use | Used when interest rates may fall | Used for stable, long-term financing |

Introduction to Callable and Non-callable Debt

Callable debt allows the issuer to repay the loan before its maturity date, providing flexibility to refinance at lower interest rates or manage debt efficiently. Non-callable debt requires the issuer to pay interest and principal according to the original schedule, offering predictability and security to investors. Understanding the differences between callable and non-callable debt is essential for evaluating risk, yield, and investment strategy in fixed-income securities.

Defining Callable Debt Instruments

Callable debt instruments are bonds or loans that grant the issuer the right to redeem the debt before its scheduled maturity date, often at a premium or predetermined price. These instruments provide issuers with financial flexibility to refinance debt at lower interest rates when market conditions improve, but introduce reinvestment risk for investors due to the unpredictability of cash flows. Investors typically demand higher yields on callable debt compared to non-callable options to compensate for the embedded call risk.

Understanding Non-callable Debt Instruments

Non-callable debt instruments provide investors with the assurance of fixed interest payments and principal repayment at maturity without the risk of early redemption by the issuer. This stability enhances predictability in cash flow projections and reduces reinvestment risk, making non-callable bonds attractive for long-term income-focused portfolios. Such instruments typically offer slightly lower yields compared to callable bonds due to their reduced risk profile.

Key Differences Between Callable and Non-callable Debt

Callable debt allows issuers to repay the principal before maturity, offering flexibility to refinance at lower interest rates, while non-callable debt mandates repayment only at maturity, providing investors with predictable cash flows. Callable bonds typically carry higher yields due to the call risk borne by investors, whereas non-callable bonds generally have lower yields reflecting reduced issuer flexibility. The key differentiation lies in the issuer's option to redeem callable debt early, impacting risk profiles, pricing, and investment strategies.

Advantages of Callable Debt for Issuers

Callable debt offers issuers the strategic advantage of refinancing at lower interest rates when market conditions improve, reducing overall borrowing costs. It provides flexibility to manage debt maturity and cash flow by repurchasing bonds before maturity, optimizing capital structure. This feature can enhance financial agility during fluctuating interest rate environments, allowing issuers to leverage favorable economic shifts.

Investor Perspectives: Callable vs Non-callable Debt

Callable debt offers investors higher yields to compensate for the risk of early redemption by the issuer, which can limit upside potential if interest rates decline. Non-callable debt provides investors with predictable cash flows and protection from reinvestment risk, enhancing income stability over the bond's term. Choosing between callable and non-callable debt involves balancing yield opportunities against interest rate risk and cash flow certainty.

Risks Associated with Callable Debt

Callable debt carries higher risks for investors due to the issuer's option to redeem the bonds before maturity, leading to reinvestment risk when interest rates decline. The unpredictability of call dates complicates cash flow forecasting and may result in the bondholder receiving less than the anticipated yield. This embedded call option typically causes callable bonds to offer higher interest rates to compensate for the increased uncertainty and potential loss of future income.

Pricing and Yield Implications

Callable bonds typically offer higher yields compared to non-callable bonds to compensate investors for the issuer's right to redeem the bond before maturity, which introduces reinvestment risk. Non-callable bonds generally have lower yields but provide price stability and predictable cash flows since the issuer cannot call the bond early. Pricing callable bonds involves modeling interest rate volatility and call risk, resulting in more complex valuation compared to non-callable bonds with more straightforward discounting of fixed cash flows.

Market Trends for Callable and Non-callable Debt

Callable debt has gained traction in volatile interest rate environments, allowing issuers to refinance at lower rates when market conditions improve, driving increased demand among corporate borrowers seeking flexibility. Non-callable debt remains favored by conservative investors prioritizing predictable income streams and reduced reinvestment risk, maintaining stable demand particularly in low-rate or stable-rate markets. Recent trends show a growing issuance of callable bonds in sectors experiencing rapid growth, while government and municipal bonds predominantly continue as non-callable to reassure risk-averse investors.

How to Choose Between Callable and Non-callable Debt

Selecting between callable and non-callable debt depends on the issuer's risk tolerance and interest rate expectations. Callable debt provides issuers the flexibility to refinance if interest rates decline, but often comes with higher initial costs and investor yield demands. Non-callable debt offers certainty of payment and fixed costs, making it ideal for stable, long-term financing needs with predictable cash flows.

Important Terms

Call Provision

Call provision allows issuers to redeem callable bonds before maturity, offering flexibility unlike non-callable bonds which must be held until the maturity date.

Redemption Feature

The redemption feature allows issuers to repay callable bonds before maturity, providing flexibility absent in non-callable bonds which must be held until their fixed maturity date.

Yield-to-Call

Yield-to-Call measures the return on callable bonds if redeemed before maturity, contrasting with non-callable bonds that lack early redemption risk and yield variability.

Call Protection Period

The Call Protection Period refers to the timeframe during which a callable bond cannot be redeemed by the issuer, offering investors a guaranteed interest income without early repayment risk. Non-callable bonds lack this feature, ensuring fixed interest payments until maturity but often present lower yields compared to callable bonds with limited call protection.

Sinking Fund

A sinking fund requires the issuer to regularly set aside funds to repay callable bonds before maturity, reducing credit risk and limiting the issuer's ability to call the bonds prematurely. Non-callable bonds lack this provision, creating higher risk for investors as the issuer cannot retire debt ahead of schedule through a sinking fund.

Prepayment Risk

Prepayment risk is higher in callable bonds than non-callable bonds because issuers can redeem callable bonds early when interest rates decline, affecting investors' expected returns.

Bullet Maturity

Bullet maturity refers to a loan or bond structure where no principal repayments are made until the final maturity date, contrasting callable securities that allow issuers to repay early, often benefiting from falling interest rates. Non-callable bullet maturities offer investors predictable cash flows and reduced reinvestment risk due to the absence of call features.

Make-whole Call

A make-whole call provision allows issuers of callable bonds to redeem the bonds early by paying a lump sum that compensates investors for lost interest, whereas non-callable bonds do not offer early redemption options, ensuring fixed interest payments until maturity.

Soft Call

Soft calls allow issuers to redeem callable bonds under specific conditions, offering more flexibility than non-callable bonds that cannot be redeemed before maturity.

Putable Bonds

Putable bonds allow investors to sell the bond back to the issuer before maturity, providing protection against interest rate rises, unlike callable bonds where the issuer can redeem early, potentially limiting gains.

Callable vs Non-callable Infographic

moneydif.com

moneydif.com