Payment-in-kind (PIK) debt allows borrowers to pay interest with additional debt rather than cash, providing short-term liquidity relief but increasing overall debt burden. Cash-pay debt requires regular cash interest payments, offering lenders steady income and lowering the risk of escalating liabilities. Choosing between PIK and cash-pay depends on a company's cash flow stability and long-term financial strategy.

Table of Comparison

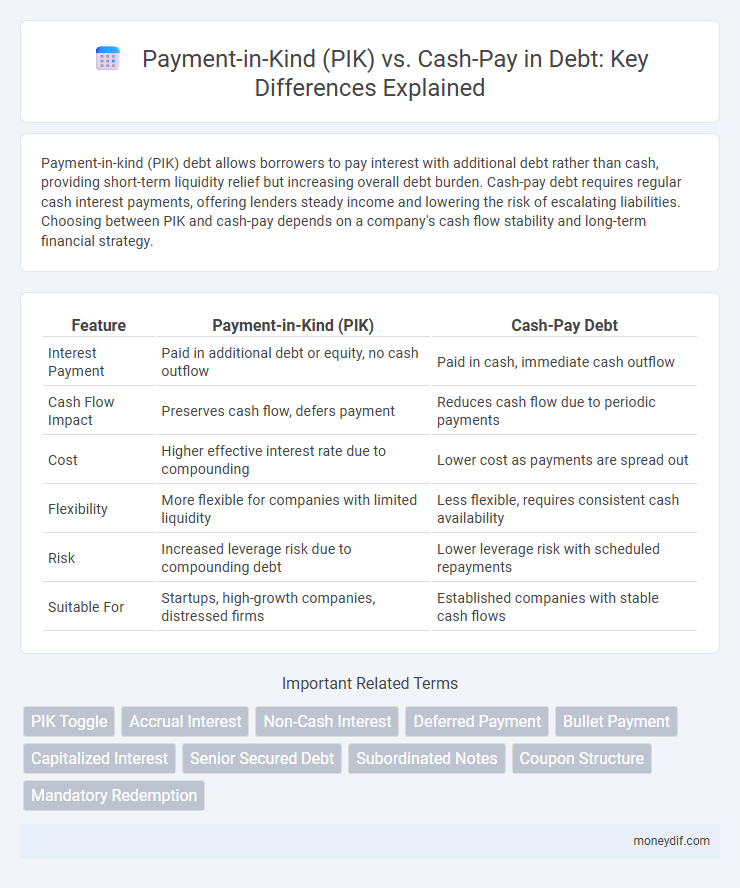

| Feature | Payment-in-Kind (PIK) | Cash-Pay Debt |

|---|---|---|

| Interest Payment | Paid in additional debt or equity, no cash outflow | Paid in cash, immediate cash outflow |

| Cash Flow Impact | Preserves cash flow, defers payment | Reduces cash flow due to periodic payments |

| Cost | Higher effective interest rate due to compounding | Lower cost as payments are spread out |

| Flexibility | More flexible for companies with limited liquidity | Less flexible, requires consistent cash availability |

| Risk | Increased leverage risk due to compounding debt | Lower leverage risk with scheduled repayments |

| Suitable For | Startups, high-growth companies, distressed firms | Established companies with stable cash flows |

Understanding Payment-in-Kind (PIK) Debt

Payment-in-Kind (PIK) debt allows borrowers to pay interest with additional debt or equity rather than cash, preserving liquidity during financial stress. This increases the principal balance over time, potentially leading to higher overall debt but defers cash outflows, making it attractive for companies with uncertain cash flow. Understanding the trade-offs between PIK and cash-pay debt is crucial for managing leverage and assessing credit risk in corporate finance.

What Is Cash-Pay Debt?

Cash-pay debt requires borrowers to make regular interest payments in cash throughout the loan term, ensuring consistent liquidity for lenders. This type of debt contrasts with payment-in-kind (PIK) debt, where interest payments are deferred and paid through additional debt rather than cash. Cash-pay debt is often preferred by conservative investors seeking steady income streams and lower risk of cash flow disruption.

Key Differences Between PIK and Cash-Pay

Payment-in-kind (PIK) debt allows borrowers to pay interest by issuing additional debt or equity instead of cash, preserving liquidity but increasing total debt burden. Cash-pay debt requires regular interest payments in cash, providing lenders with immediate returns but demanding steady cash flow from borrowers. The key differences lie in cash flow impact, risk profiles, and investor preferences, with PIK favored in high-growth or distressed situations and cash-pay preferred for stable, income-generating assets.

Advantages of Payment-in-Kind (PIK) Debt

Payment-in-Kind (PIK) debt offers issuers enhanced cash flow flexibility by allowing interest payments to be made in additional debt rather than cash, preserving liquidity during periods of financial stress. This structure reduces immediate cash outflows and helps companies manage working capital efficiently, especially in capital-intensive industries or turnaround situations. PIK debt also often carries higher yields, compensating investors for increased risk while providing issuers with less restrictive covenant packages compared to traditional cash-pay debt.

Drawbacks of Payment-in-Kind (PIK) Debt

Payment-in-Kind (PIK) debt increases the borrower's overall debt burden by adding accrued interest to the principal, which can lead to significant compounding and higher repayment amounts. This debt structure reduces cash flow flexibility since interest payments are deferred, potentially masking true financial health and increasing default risk. Lenders face increased risk due to delayed cash interest payments, making PIK debt less attractive compared to traditional cash-pay debt with regular interest disbursements.

Benefits of Cash-Pay Debt Structures

Cash-pay debt structures provide consistent cash flow, allowing companies to manage interest payments without increasing debt burden. These structures enhance creditor confidence by reducing payment risk, which can result in lower interest rates and improved borrowing terms. Cash payments also support clearer financial planning and transparency for investors.

Risks Associated With Cash-Pay Debt

Cash-pay debt requires regular interest payments in cash, which can strain a borrower's liquidity during economic downturns or cash flow disruptions. The risk of default increases if the borrower cannot generate sufficient operational cash flow to meet scheduled payments, potentially leading to insolvency or restructuring. Unlike payment-in-kind (PIK) debt, cash-pay debt does not offer flexibility in deferring interest payments, making it less suitable for companies with volatile or unpredictable revenues.

When to Choose PIK Over Cash-Pay

Payment-in-kind (PIK) debt is often preferred over cash-pay in scenarios where preserving liquidity is critical, such as during early-stage investments or companies with irregular cash flows. PIK interest allows issuers to defer cash interest payments by issuing additional debt or equity, which minimizes immediate cash outflows and supports operational flexibility. This choice suits businesses anticipating future cash generation or undergoing restructuring where conserving cash strengthens financial stability.

Impact of PIK and Cash-Pay on Financial Statements

Payment-in-kind (PIK) debt increases liabilities without immediate cash outflows, causing interest expenses to accumulate and compound on the balance sheet, which can inflate total debt over time. Cash-pay debt requires actual interest payments, reducing cash reserves and affecting the cash flow statement while decreasing liabilities more predictably. The choice between PIK and cash-pay impacts profitability ratios, liquidity metrics, and leverage by altering interest expense recognition and cash availability on financial statements.

PIK vs Cash-Pay: Which Is Right for Your Business?

Payment-in-kind (PIK) debt allows businesses to defer cash interest payments by paying interest with additional debt or equity, preserving liquidity compared to cash-pay loans that require regular cash interest payments. PIK financing suits companies with volatile cash flows or early-stage businesses prioritizing growth, while cash-pay debt is preferable for stable firms with predictable earnings and steady cash flow. Evaluating your business's cash flow stability, growth stage, and financing needs is crucial when deciding between PIK and cash-pay debt options.

Important Terms

PIK Toggle

PIK Toggle notes give issuers the option to pay interest either in cash or additional debt securities, allowing flexibility compared to strict cash-pay loans that require regular cash interest payments. This hybrid structure helps companies manage cash flow variability by toggling between cash payment and payment-in-kind, often resulting in higher overall borrowing costs due to increased credit risk.

Accrual Interest

Accrual interest on Payment-in-Kind (PIK) loans accumulates and increases the principal balance, whereas cash-pay loans require periodic interest payments in cash, reducing immediate debt burden.

Non-Cash Interest

Non-cash interest, frequently associated with payment-in-kind (PIK) loans, allows borrowers to defer cash payments by accruing interest that is paid in additional securities or principal, enhancing liquidity management while increasing overall debt obligations. Cash-pay interest, contrastingly, requires periodic cash payments from borrowers, ensuring immediate expense recognition and reducing long-term debt accumulation risks.

Deferred Payment

Deferred Payment allows companies to manage cash flow by substituting immediate cash-pay interest with Payment-in-Kind (PIK) interest, which accrues as additional debt or equity instead of cash outflows.

Bullet Payment

Bullet payments involve a lump-sum principal repayment at maturity and can be structured as payment-in-kind (PIK), where interest is accrued and added to the principal, or as cash-pay, where interest is paid periodically in cash.

Capitalized Interest

Capitalized interest increases the loan balance by adding unpaid interest to the principal, commonly seen in payment-in-kind (PIK) loans where interest is paid by issuing additional debt rather than cash. Cash-pay loans require regular interest payments in cash, preventing capitalization and avoiding growth of the principal amount over time.

Senior Secured Debt

Senior Secured Debt with payment-in-kind (PIK) features allows issuers to defer cash interest payments by increasing the principal, unlike cash-pay debt which requires regular cash interest payments, impacting cash flow and leverage ratios.

Subordinated Notes

Subordinated Notes with payment-in-kind (PIK) feature allow issuers to defer interest payments by issuing additional debt instead of cash, enhancing liquidity flexibility but increasing overall debt burden. In contrast, cash-pay subordinated notes require regular interest payments in cash, providing investors with steady income but imposing immediate cash flow demands on the issuer.

Coupon Structure

Coupon structure in bonds significantly impacts cash flow management, with Payment-in-Kind (PIK) bonds allowing issuers to pay interest by increasing the principal balance instead of cash, deferring cash outflows and enhancing short-term liquidity. Cash-pay bonds require periodic cash interest payments, providing predictable income to investors but imposing immediate cash obligations on the issuer.

Mandatory Redemption

Mandatory redemption requires issuers to repurchase securities either through cash payments or payment-in-kind (PIK), where PIK allows interest to be paid with additional securities instead of cash, impacting liquidity and financial flexibility.

payment-in-kind (PIK) vs cash-pay Infographic

moneydif.com

moneydif.com