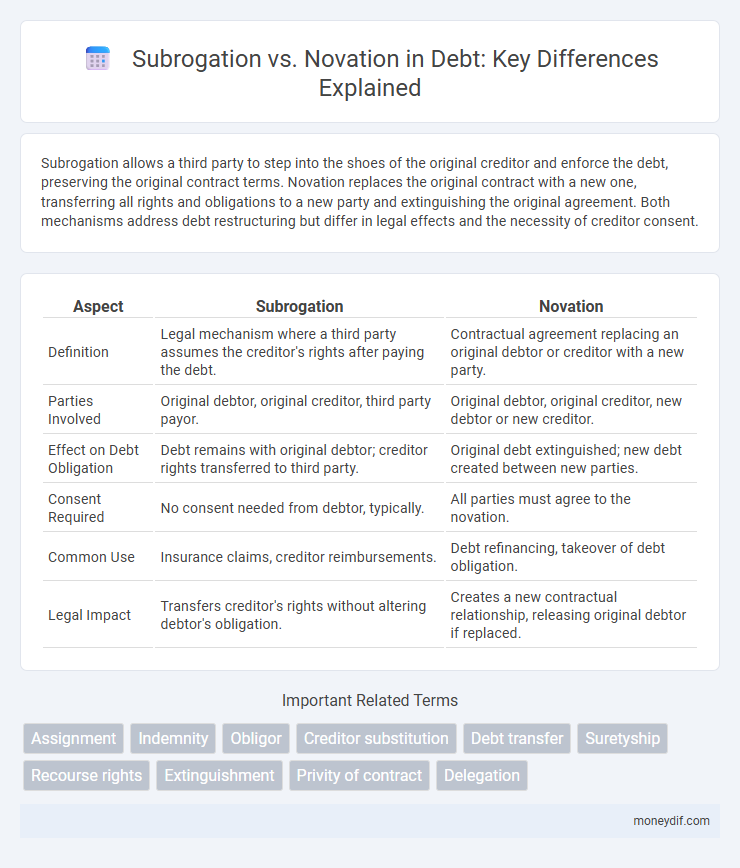

Subrogation allows a third party to step into the shoes of the original creditor and enforce the debt, preserving the original contract terms. Novation replaces the original contract with a new one, transferring all rights and obligations to a new party and extinguishing the original agreement. Both mechanisms address debt restructuring but differ in legal effects and the necessity of creditor consent.

Table of Comparison

| Aspect | Subrogation | Novation |

|---|---|---|

| Definition | Legal mechanism where a third party assumes the creditor's rights after paying the debt. | Contractual agreement replacing an original debtor or creditor with a new party. |

| Parties Involved | Original debtor, original creditor, third party payor. | Original debtor, original creditor, new debtor or new creditor. |

| Effect on Debt Obligation | Debt remains with original debtor; creditor rights transferred to third party. | Original debt extinguished; new debt created between new parties. |

| Consent Required | No consent needed from debtor, typically. | All parties must agree to the novation. |

| Common Use | Insurance claims, creditor reimbursements. | Debt refinancing, takeover of debt obligation. |

| Legal Impact | Transfers creditor's rights without altering debtor's obligation. | Creates a new contractual relationship, releasing original debtor if replaced. |

Understanding Subrogation in Debt Agreements

Subrogation in debt agreements allows a party, usually a lender or insurer, to step into the shoes of another party to enforce the original debtor's obligations after satisfying the debt. This legal mechanism ensures the subrogee acquires all rights, remedies, and securities the original creditor held, preserving priority and enforcement powers without altering the debtor-creditor relationship. Unlike novation, which replaces the original contract and parties involved, subrogation maintains the initial debt terms, enabling recovery while protecting the subrogee's legal interests.

Novation: Definition and Key Features

Novation is a contractual agreement that replaces an existing debt obligation with a new one, effectively transferring both rights and liabilities from the original party to a new party. This process requires the consent of all involved parties, including the creditor and debtor, and results in the extinguishment of the original contract as a new contract is formed. Key features of novation include the substitution of the debtor, the creation of a fresh obligation, and the discharge of the initial debt, differentiating it from subrogation, where only the creditor's rights are transferred.

Key Differences Between Subrogation and Novation

Subrogation involves one party stepping into the shoes of another to assume their rights and claims, often seen in insurance claims, whereas novation replaces an original contract with a new one, transferring all rights and obligations to a new party. Key differences include the fact that subrogation does not require the consent of the debtor, while novation requires agreement from all involved parties to release the original debtor from liabilities. Furthermore, subrogation preserves the original contract's terms, but novation creates a completely new contractual relationship, effectively extinguishing the previous agreement.

Legal Implications of Subrogation in Debt

Subrogation in debt law enables a party, often a guarantor or insurer, to assume the legal rights and remedies of the original creditor after repayment, ensuring equitable recovery without disrupting the debtor's original obligations. It preserves the creditor's priority and enforces debt collection while preventing multiple claims on the debtor for the same liability. Novation, contrastingly, replaces the original contract with a new one, discharging all prior obligations, which significantly alters legal relationships and creditor-debtor responsibilities.

How Novation Impacts Debt Obligations

Novation replaces the original debt obligation with a new contract, effectively extinguishing the initial debt and transferring all rights and liabilities to a new party. This process alters the debtor's responsibilities by creating a fresh agreement that requires consent from all involved parties, ensuring clear and enforceable debt obligations. Unlike subrogation, novation impacts the debtor's legal position by discharging previous commitments and establishing a new debt relationship.

Advantages and Disadvantages of Subrogation

Subrogation allows a third party, often an insurer, to step into the shoes of the original creditor to recover debts, providing a cost-effective means to enforce payment without initiating a new contract. This mechanism avoids disrupting the original debt terms and maintains creditor's rights continuity, which reduces litigation complexity and preserves the debtor's obligations. However, subrogation limits the new party to the rights and defenses available to the original creditor, potentially restricting recovery options compared to novation, which creates a new contractual agreement between debtor and creditor.

When to Use Novation in Debt Restructuring

Novation is used in debt restructuring when the original debtor seeks to transfer the entire debt obligation to a new party, fully replacing the initial contract with a new one involving the creditor and the new debtor. This approach is preferable when both parties want to discharge the original debtor's liability completely, ensuring legal clarity and minimizing future disputes. Unlike subrogation, which involves stepping into the original debtor's shoes, novation creates a new contractual relationship, making it essential in cases where the old debt agreement needs to be extinguished and replaced.

Practical Examples: Subrogation vs Novation

In practical scenarios, subrogation occurs when an insurer pays the insured's debt and steps into their shoes to recover the amount from the original debtor, exemplified by a health insurer reimbursing medical bills and pursuing the negligent party. Novation involves replacing the original debtor with a new one, often seen in business contracts where a new party assumes existing debts and obligations, such as when a company sale transfers liabilities to the buyer. Understanding these distinctions is essential for debt recovery strategies, ensuring proper legal rights and obligations are maintained.

Subrogation and Novation in Loan Agreements

Subrogation in loan agreements allows a lender or third party to step into the shoes of the original creditor to recover debts, preserving the original contract's terms and creditor rights. Novation replaces the original loan agreement with a new contract, transferring obligations and rights entirely to a new party and extinguishing the initial debt relationship. Understanding these distinctions is crucial for managing liability, risk allocation, and enforcement strategies in debt financing.

Choosing the Right Option: Factors to Consider

Choosing between subrogation and novation hinges on factors such as the legal transfer of debt obligations, the extent of creditor rights, and the impact on debtor liabilities. Subrogation allows a party to step into another's shoes, maintaining original contractual terms, while novation replaces the original contract, creating new obligations and often requiring consent from all parties involved. Evaluating the nature of the debt, consent requirements, and the desired legal outcome ensures the most effective debt assignment strategy.

Important Terms

Assignment

Subrogation transfers legal rights from one party to another to recover debts, while novation replaces an original contract with a new one, discharging the former obligations.

Indemnity

Indemnity involves compensating for loss, while subrogation transfers the indemnity holder's rights to recover from a third party, and novation replaces one contract party with another, extinguishing the original contract.

Obligor

An obligor's liability can shift through subrogation, which transfers the creditor's rights to a new party without altering the original obligation, or through novation, which replaces the original contract with a new one, extinguishing prior obligations.

Creditor substitution

Creditor substitution involves transferring the creditor's rights to a new party, commonly achieved through subrogation, where the new creditor steps into the position of the original creditor without altering the debtor's obligations. Novation, by contrast, replaces both the creditor and the debtor or modifies the original contract, requiring the debtor's consent and extinguishing the prior agreement to create a new contractual obligation.

Debt transfer

Debt transfer involves subrogation, where a third party assumes the debtor's rights without altering the original contract, unlike novation, which replaces the original contract with a new agreement substituting the debtor.

Suretyship

Suretyship involves a guarantor's promise to fulfill the debtor's obligation, where subrogation allows the surety to step into the creditor's rights after payment, while novation replaces the original contract with a new one, releasing the surety from liability.

Recourse rights

Recourse rights allow a party to seek reimbursement after subrogation transfers the claim to a new party, whereas novation replaces the original contract and extinguishes the original party's obligations.

Extinguishment

Extinguishment occurs when an original debt is discharged, which can happen through novation by substituting a new obligation that replaces the old one, effectively terminating the prior contract. In subrogation, extinguishment results from a third party stepping into the creditor's shoes to satisfy the debtor's obligation without creating a new contractual relationship.

Privity of contract

Privity of contract restricts subrogation by preventing third-party claims without original consent, whereas novation creates a new contract replacing the original parties and obligations.

Delegation

Delegation involves transferring contractual duties to a third party, whereas subrogation transfers legal rights to recover debts, and novation replaces an original contract with a new one, extinguishing prior obligations.

subrogation vs novation Infographic

moneydif.com

moneydif.com