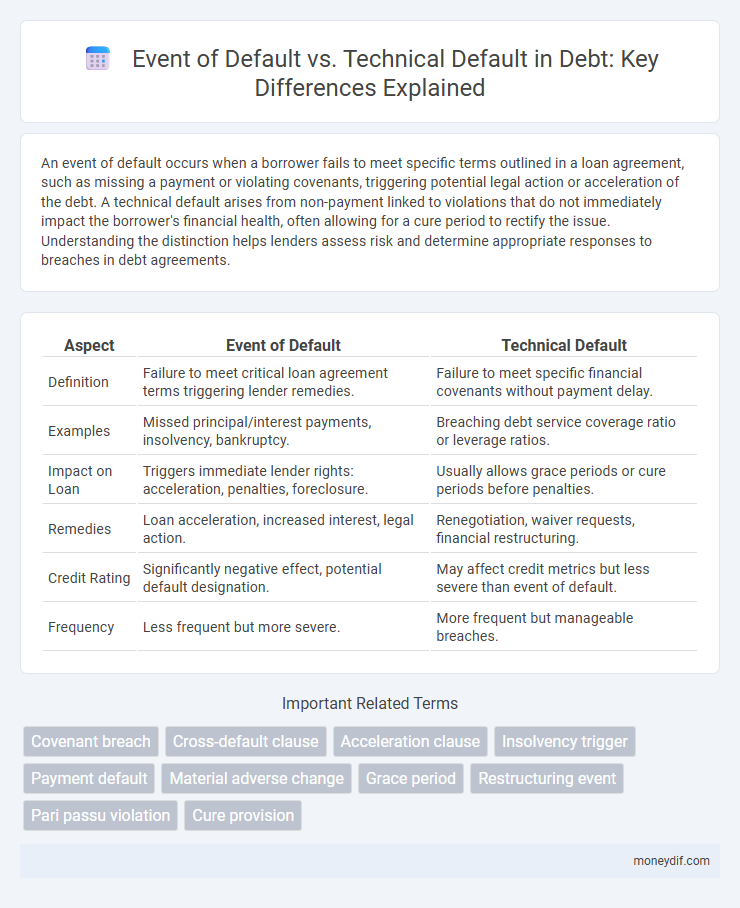

An event of default occurs when a borrower fails to meet specific terms outlined in a loan agreement, such as missing a payment or violating covenants, triggering potential legal action or acceleration of the debt. A technical default arises from non-payment linked to violations that do not immediately impact the borrower's financial health, often allowing for a cure period to rectify the issue. Understanding the distinction helps lenders assess risk and determine appropriate responses to breaches in debt agreements.

Table of Comparison

| Aspect | Event of Default | Technical Default |

|---|---|---|

| Definition | Failure to meet critical loan agreement terms triggering lender remedies. | Failure to meet specific financial covenants without payment delay. |

| Examples | Missed principal/interest payments, insolvency, bankruptcy. | Breaching debt service coverage ratio or leverage ratios. |

| Impact on Loan | Triggers immediate lender rights: acceleration, penalties, foreclosure. | Usually allows grace periods or cure periods before penalties. |

| Remedies | Loan acceleration, increased interest, legal action. | Renegotiation, waiver requests, financial restructuring. |

| Credit Rating | Significantly negative effect, potential default designation. | May affect credit metrics but less severe than event of default. |

| Frequency | Less frequent but more severe. | More frequent but manageable breaches. |

Introduction to Debt Defaults

Debt defaults occur when a borrower fails to meet the terms of a debt agreement, with event of default representing a clear breach such as missed payments or insolvency, triggering immediate lender remedies. Technical default involves violations of non-monetary covenants like failing to maintain financial ratios or reporting requirements, often allowing a grace period for correction. Understanding these distinctions is critical for investors and creditors to assess risk exposure and enforce contractual protections effectively.

Defining Event of Default

An Event of Default occurs when a borrower breaches specific terms outlined in a loan agreement, such as failure to make timely payments or insolvency declarations, triggering creditors' rights to demand immediate repayment or initiate legal action. This definition is distinct from a technical default, which often involves collateral or covenant breaches without payment delay, potentially allowing more time to remedy the issue. Clear identification of an Event of Default is crucial for lenders to enforce remedies and protect their financial interests.

Understanding Technical Default

Technical default occurs when a borrower breaches specific loan covenants without missing actual debt payments, such as violating financial ratios or reporting requirements. This type of default signals underlying financial stress and can trigger lender remedies, including accelerated repayment or increased scrutiny, even though the principal and interest remain current. Understanding technical default is crucial for investors and creditors to assess potential risks that may not be immediately apparent from payment history alone.

Key Differences Between Event of Default and Technical Default

An event of default typically involves a serious breach of debt agreement terms such as failure to make interest or principal payments, triggering lenders to demand immediate repayment or enforcement actions. Technical default refers to non-monetary violations like covenant breaches without missed payments, often allowing more time for remediation before penalties. Understanding these distinctions is crucial for managing creditor rights and debtor obligations within structured finance contracts.

Causes of Event of Default

Event of default occurs when a borrower fails to meet specific contractual obligations such as missing scheduled interest or principal payments, violating debt covenants, or insolvency events like bankruptcy. Causes of event of default also include cross-default provisions triggered by defaults on other loans, failure to maintain required financial ratios, and unauthorized asset disposals. These triggers differ from technical default, which generally relates to breaches of non-payment covenants but do not immediately result in acceleration of the debt.

Causes of Technical Default

Technical default occurs when a borrower violates specific covenants or conditions outlined in the loan agreement without missing actual payment obligations. Common causes include breaching financial ratios, such as debt-to-equity or interest coverage ratios, failing to provide required financial statements, or missing reporting deadlines. Unlike event of default, technical default may not immediately trigger acceleration of the debt but can lead to lender remedies or renegotiations.

Legal Implications of Each Default Type

Event of default triggers immediate lender remedies including acceleration of debt repayment and enforcement of security interests, often resulting in legal actions or bankruptcy proceedings. Technical default, typically associated with minor breaches of covenants or reporting failures, may allow lenders to waive the default or require corrective actions without immediate legal consequences. Courts distinguish event defaults by their material impact on creditor rights, while technical defaults often result in negotiated resolutions to avoid costly litigation.

Lender and Borrower Responses

Event of default triggers immediate lender actions such as acceleration of the loan, demands for repayment, or enforcement of collateral rights, significantly impacting borrower liquidity and operations. Technical default, often related to covenant breaches without missed payments, prompts lenders to monitor compliance closely and may lead to renegotiations or waivers to avoid triggering harsher remedies. Borrowers typically respond to event of default by seeking restructuring or cure provisions, while they address technical defaults through operational adjustments to realign with covenant terms.

Impact on Creditworthiness

An event of default directly triggers legal actions such as acceleration of debt and potential foreclosure, severely damaging a borrower's creditworthiness and access to capital markets. Technical default, often involving breaches of covenants without missed payments, may not immediately impact credit ratings but raises concerns among lenders about the borrower's financial discipline and risk profile. Persistent technical defaults can erode trust and lead to stricter lending terms or eventual event of default status, negatively affecting long-term creditworthiness.

Preventing Defaults: Best Practices

Preventing defaults requires early identification of event of default indicators such as missed payments or covenant breaches, alongside monitoring technical defaults like liquidity shortfalls or accounting errors. Implementing robust financial controls, timely communication with lenders, and maintaining covenant compliance are essential strategies to mitigate risks. Proactive risk management and regular financial audits help ensure adherence to debt agreements and avoid costly default consequences.

Important Terms

Covenant breach

A covenant breach constitutes a significant violation of loan terms triggering an event of default, whereas a technical default involves minor or procedural breaches that may not immediately lead to lender action.

Cross-default clause

A cross-default clause triggers a default if the borrower defaults on any other agreement, broadening the scope beyond a specific event of default in the primary contract, while a technical default usually involves a minor breach that does not impact overall payment obligations. This clause serves to protect lenders by linking defaults across multiple obligations, ensuring early intervention in case of financial distress.

Acceleration clause

An acceleration clause triggers the immediate repayment of the entire loan balance upon an event of default, such as missed payments or insolvency, whereas a technical default refers to breaches of loan covenants that may not involve missed payments but can still activate the clause if not remedied. Lenders use acceleration clauses to mitigate risk by demanding full repayment when either financial distress or covenant violations occur.

Insolvency trigger

An insolvency trigger occurs when events of default, such as failure to pay debts or breach of financial covenants, escalate to a situation where the company is unable to meet its obligations, leading creditors to initiate bankruptcy or restructuring proceedings. Technical default refers to non-payment or covenant breaches that do not immediately threaten solvency but may signal financial distress and increase the risk of an insolvency event if unaddressed.

Payment default

Payment default occurs when a borrower fails to meet scheduled payments, constituting an event of default if triggering legal remedies, while a technical default involves breaching non-payment contractual terms without immediate payment failure.

Material adverse change

Material adverse change (MAC) refers to a significant negative shift in a borrower's financial condition that can trigger an event of default under loan agreements. Unlike technical default, which involves a breach of specific covenants or payment terms without significant financial deterioration, a MAC focuses on substantial harm impacting the borrower's overall creditworthiness or business operations.

Grace period

A grace period allows a borrower to cure a technical default without triggering an event of default, thereby preventing immediate legal or financial penalties.

Restructuring event

A restructuring event often follows an event of default, which occurs when a borrower fails to meet contractual obligations such as missed payments, while a technical default refers to breaches of non-payment covenants like reporting requirements or financial ratios. Understanding the distinction between event of default and technical default is crucial for triggering restructuring negotiations aimed at avoiding insolvency or further credit deterioration.

Pari passu violation

A pari passu violation constitutes an event of default when a debtor fails to maintain equal ranking among creditors, whereas a technical default typically involves breaches of non-payment covenants without triggering cross-default clauses.

Cure provision

Cure provision allows a borrower to correct an event of default within a specified timeframe, preventing acceleration or enforcement of remedies under loan agreements. Technical default typically involves minor breaches like delayed reporting or covenant violations, which can be addressed through cure provisions to avoid triggering more severe legal consequences.

event of default vs technical default Infographic

moneydif.com

moneydif.com