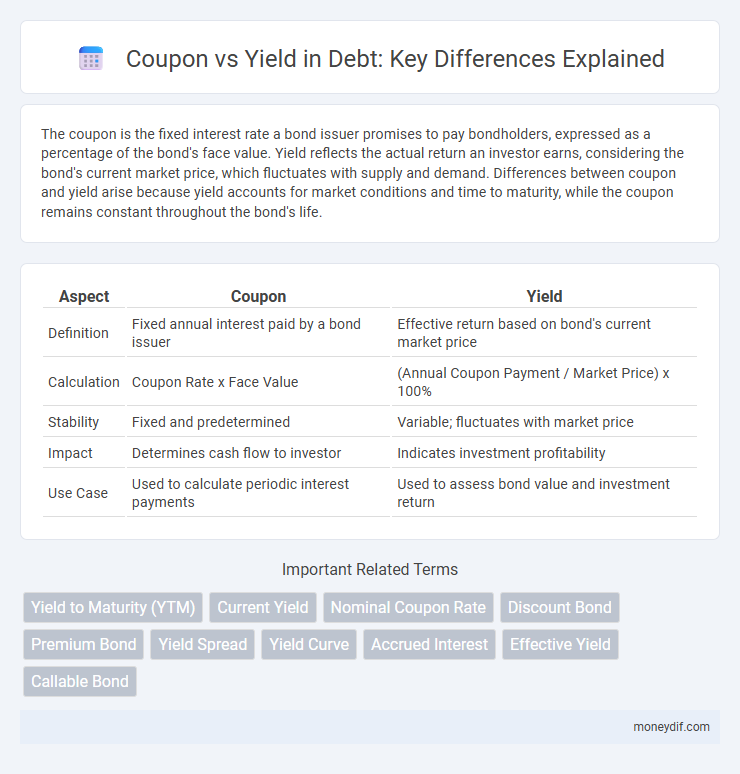

The coupon is the fixed interest rate a bond issuer promises to pay bondholders, expressed as a percentage of the bond's face value. Yield reflects the actual return an investor earns, considering the bond's current market price, which fluctuates with supply and demand. Differences between coupon and yield arise because yield accounts for market conditions and time to maturity, while the coupon remains constant throughout the bond's life.

Table of Comparison

| Aspect | Coupon | Yield |

|---|---|---|

| Definition | Fixed annual interest paid by a bond issuer | Effective return based on bond's current market price |

| Calculation | Coupon Rate x Face Value | (Annual Coupon Payment / Market Price) x 100% |

| Stability | Fixed and predetermined | Variable; fluctuates with market price |

| Impact | Determines cash flow to investor | Indicates investment profitability |

| Use Case | Used to calculate periodic interest payments | Used to assess bond value and investment return |

Introduction to Debt Securities

Coupon represents the fixed interest rate paid by a debt security issuer to bondholders, expressed as a percentage of the bond's face value. Yield reflects the actual return an investor earns, accounting for the bond's purchase price, coupon payments, and time to maturity. Understanding the distinction between coupon and yield is essential for evaluating debt securities and making informed investment decisions.

Understanding Coupons in Debt Instruments

Coupons in debt instruments represent the fixed interest payments bondholders receive periodically based on the bond's face value. Yield reflects the bond's overall return, accounting for the coupon payments, purchase price, and time to maturity, making it a dynamic measure influenced by market conditions. Understanding the distinction between coupon rate and yield is crucial for evaluating the true income and investment value of a bond.

What is Yield? Key Definitions

Yield represents the return an investor earns from a debt security, typically expressed as an annual percentage. It accounts for the bond's coupon payments relative to its current market price, reflecting the effective income generated. Yield differs from the coupon rate, which is the fixed interest rate paid on the face value of the bond.

Coupon Rate vs Yield: Core Differences

The coupon rate is the fixed annual interest percentage a bond issuer pays based on the bond's face value, while yield reflects the bond's actual return considering its current market price. Coupon rate remains constant throughout the bond's life, but yield fluctuates with market demand and price changes. Yield to maturity (YTM) is a key measure that accounts for coupon payments, price, and time to maturity, providing a comprehensive view of investment return.

Factors Affecting Yield and Coupon

Coupon rate is the fixed interest percentage paid annually by the issuer based on the bond's face value, while yield reflects the actual return an investor earns, influenced by market price fluctuations. Factors affecting yield include current market interest rates, credit risk of the issuer, and time to maturity, whereas the coupon remains constant throughout the bond's life unless it is a floating rate bond. Changes in inflation expectations, economic conditions, and monetary policies also impact bond yields more directly than coupon rates.

Relationship Between Market Prices, Coupon, and Yield

The relationship between market prices, coupon, and yield is fundamental in debt instruments. When a bond's price rises above its face value, its yield falls below the coupon rate because the fixed coupon payments represent a smaller return on the higher price paid. Conversely, if the bond's price drops below par, the yield exceeds the coupon rate, reflecting a higher effective return to compensate for the lower purchase price.

Real-World Examples: Coupon vs Yield

Corporate bonds issued by Apple Inc. often feature a fixed coupon rate, such as 2.5%, which represents the annual interest paid to investors based on the bond's face value. However, the yield to maturity fluctuates with market conditions, reflecting the bond's actual return if held until maturity; for example, if Apple's bond trades below par due to rising interest rates, the yield might increase to 3.0% despite the unchanged coupon. Real-world cases like these demonstrate that while the coupon offers fixed income payments, the yield incorporates market price changes and investor expectations, impacting the bond's attractiveness and total return.

Implications for Investors: Coupon vs Yield

Investors must understand that the coupon rate represents the fixed annual interest payment based on the bond's face value, while the yield reflects the bond's actual return considering its current market price and remaining payments. When a bond is purchased at a discount or premium, the yield provides a more accurate measure of investment performance than the coupon alone. Yield influences investment decisions by accounting for market fluctuations, reinvestment risk, and the time value of money, thus guiding investors toward bonds aligned with their return expectations and risk tolerance.

Tax Considerations for Coupons and Yields

Coupons represent the fixed interest payments on a bond and are typically taxed as ordinary income, which can result in higher tax liabilities for investors in higher tax brackets. Yield reflects the bond's overall return, including price appreciation and reinvestment income, which may be subject to capital gains tax rates that are often lower than ordinary income tax rates. Tax-exempt bonds, such as municipal bonds, provide coupons that are generally exempt from federal income tax, making yield calculations uniquely advantageous for tax-sensitive investors.

Choosing Between High Coupon and High Yield Investments

Investors deciding between high coupon and high yield bonds should consider current market interest rates and the bond's credit risk. High coupon bonds provide steady income with less price volatility, while high yield bonds typically offer greater returns due to higher credit risk. Evaluating duration, default probability, and income goals is essential for optimizing bond portfolio performance.

Important Terms

Yield to Maturity (YTM)

Yield to Maturity (YTM) represents the total return expected on a bond if held until maturity, reflecting the relationship between the bond's coupon rate and its current market yield.

Current Yield

Current yield measures the annual coupon payment divided by the bond's current market price, providing a snapshot of income relative to investment cost. Unlike yield to maturity, current yield ignores capital gains or losses, focusing solely on the bond's coupon interest in relation to its price.

Nominal Coupon Rate

The nominal coupon rate is the fixed annual interest percentage paid on a bond's face value, which differs from the bond's yield that reflects the actual return based on its current market price.

Discount Bond

A discount bond sells below its face value because its fixed coupon rate is lower than the current market yield.

Premium Bond

Premium bonds sell above face value causing their fixed coupon rate to be lower than the effective yield realized by investors.

Yield Spread

Yield spread measures the difference between the bond's coupon rate and its yield to maturity, reflecting the market's assessment of credit risk and interest rate changes.

Yield Curve

The yield curve illustrates the relationship between bond yields and maturities, reflecting how coupon rates influence the bond's yield to maturity across different time horizons.

Accrued Interest

Accrued interest represents the accumulated interest on a bond since the last coupon payment, reflecting the buyer's compensation to the seller for holding the bond between payment dates. The relationship between coupon rate and yield impacts accrued interest calculations, where a higher coupon rate generally means higher accrued interest accrual compared to the yield, which reflects the bond's overall return including price changes.

Effective Yield

Effective yield reflects the true return on a bond by accounting for its coupon payments and compounding frequency, providing a more accurate measure than the nominal coupon rate alone.

Callable Bond

A callable bond offers a higher coupon rate than its yield to compensate investors for the call risk, which allows the issuer to redeem the bond before maturity.

coupon vs yield Infographic

moneydif.com

moneydif.com