Default interest is the higher interest rate charged on overdue debt to compensate the lender for increased risk and delayed payment, usually specified in loan agreements. Penalty interest, however, serves as a punitive charge intended to discourage late payments and is often a fixed amount or percentage separate from standard interest rates. Understanding the distinction helps borrowers manage debt obligations and avoid extra financial burdens.

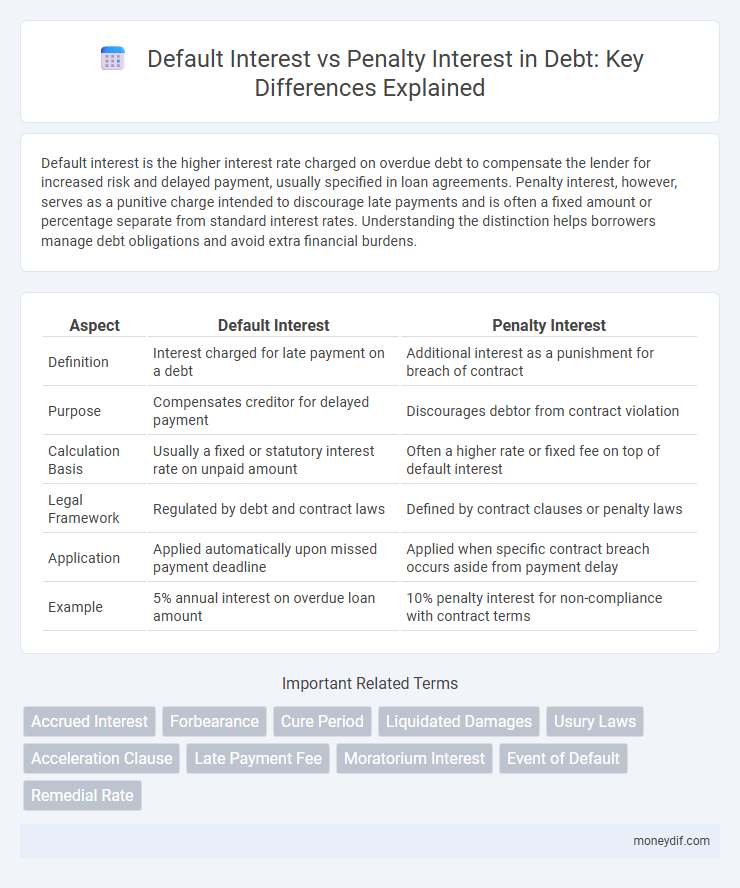

Table of Comparison

| Aspect | Default Interest | Penalty Interest |

|---|---|---|

| Definition | Interest charged for late payment on a debt | Additional interest as a punishment for breach of contract |

| Purpose | Compensates creditor for delayed payment | Discourages debtor from contract violation |

| Calculation Basis | Usually a fixed or statutory interest rate on unpaid amount | Often a higher rate or fixed fee on top of default interest |

| Legal Framework | Regulated by debt and contract laws | Defined by contract clauses or penalty laws |

| Application | Applied automatically upon missed payment deadline | Applied when specific contract breach occurs aside from payment delay |

| Example | 5% annual interest on overdue loan amount | 10% penalty interest for non-compliance with contract terms |

Understanding Default Interest in Debt Agreements

Default interest in debt agreements is a contractual rate applied when a borrower fails to meet payment obligations, typically higher than the original interest rate to compensate for increased risk. It serves as a financial deterrent against late payments but differs from penalty interest, which is often punitive and may be subject to legal restrictions. Understanding the calculation and application of default interest clauses is crucial for creditors and borrowers to manage debt compliance and avoid escalating costs.

What is Penalty Interest?

Penalty interest is an additional charge imposed on overdue debt payments, designed to incentivize timely repayment and compensate the lender for the increased risk and administrative costs associated with late payment. Unlike default interest, which typically accrues automatically after a payment default, penalty interest is often predefined in loan agreements and can be a fixed percentage or calculated on the outstanding amount. This type of interest serves as a financial deterrent against missed or late payments, impacting the total cost of borrowing.

Key Differences Between Default Interest and Penalty Interest

Default interest is charged on overdue debt to compensate the lender for the risk and loss of use of funds, typically calculated as a percentage above the original interest rate. Penalty interest is imposed as a punitive measure to discourage late payment, often higher and not directly tied to compensating for financial loss. Unlike default interest, penalty interest aims to enforce compliance rather than merely cover damages or costs incurred.

Legal Basis for Default and Penalty Interest

Default interest is grounded in contract law, typically arising when a debtor fails to fulfill payment obligations by the due date, triggering legally predefined interest rates aimed at compensating the creditor for the delay. Penalty interest, however, is often established under statutory provisions designed to punish or deter wrongful conduct beyond mere delay, reflecting a punitive rather than compensatory intent. Legal frameworks differentiate these interests by specifying distinct interest rates and conditions, with default interest linked directly to the debt's overdue status and penalty interest imposed as a sanction for breaches such as non-compliance or fraudulent behavior.

Common Scenarios Triggering Default Interest

Default interest commonly arises in loan agreements when borrowers miss scheduled payments, triggering an increased interest rate to compensate lenders for added risk. Penalty interest, in contrast, is often imposed as a punitive charge for late payments or breaches of contract terms, separate from regular interest calculations. Situations such as overdue mortgage installments, delayed credit card payments, or missed business loan repayments frequently lead to default interest charges outlined in lending agreements.

Penalty Interest: When and Why Is It Applied?

Penalty interest is applied when a borrower fails to meet repayment deadlines, serving as a financial consequence for late payments. It is typically set at a higher rate than default interest to incentivize timely debt settlement and compensate the lender for increased risk. Legal contracts and loan agreements specify conditions triggering penalty interest, ensuring clear terms for debt enforcement.

Impact of Default and Penalty Interest on Borrowers

Default interest increases the cost of borrowing significantly by accruing on overdue payments, exacerbating the borrower's financial burden and potentially leading to further defaults. Penalty interest, often higher than regular interest rates, serves as a punitive measure that can strain cash flow and reduce the borrower's ability to meet other obligations. Both types of interest amplify debt obligations, making loan recovery more difficult and compromising long-term creditworthiness.

Regulatory Guidelines: Default vs Penalty Interest

Regulatory guidelines distinguish default interest as the rate applied when a borrower fails to meet payment obligations on time, typically reflecting the lender's cost of risk and prescribed maximum limits under financial regulations. Penalty interest, conversely, is often a punitive rate exceeding default interest, designed to deter late payments and may be restricted or prohibited in some jurisdictions to protect consumer rights. Compliance with these regulatory frameworks ensures transparency and fairness in debt recovery practices, preventing excessive financial burdens on borrowers.

How to Avoid Default and Penalty Interest Charges

Default interest typically accrues when a borrower misses a payment deadline, while penalty interest is a more severe charge imposed as a punishment for breach of contract terms. To avoid default and penalty interest charges, it is crucial to maintain timely payments by setting up automatic transfers or reminders and communicating proactively with lenders about any financial difficulties. Monitoring loan agreements closely for specific interest rates and payment due dates helps prevent unexpected charges and preserve credit standing.

Default Interest vs Penalty Interest: Which is More Detrimental?

Default interest accrues automatically on overdue debt at a prescribed rate, increasing the debtor's financial burden steadily, while penalty interest is imposed as an additional punitive charge meant to discourage late payments. Default interest often compounds, leading to significantly higher total debt over time, whereas penalty interest is typically a fixed amount or a higher rate applied once, creating immediate but potentially less ongoing cost. In terms of long-term detriment, default interest usually causes greater financial strain due to its compounding nature, making it more impactful on debt recovery and debtor creditworthiness.

Important Terms

Accrued Interest

Accrued interest represents the accumulated interest on a loan or bond, distinguishing default interest as additional interest charged for late payments compared to penalty interest, which is a fixed charge imposed for breach of contract terms.

Forbearance

Forbearance agreements allow temporary relief from loan payments without triggering default interest, which accrues as a higher interest rate penalty once payments are missed. Penalty interest typically applies immediately upon default, whereas forbearance suspends both principal and default interest accrual, providing borrowers a structured path to avoid foreclosure or further credit damage.

Cure Period

The cure period allows borrowers to remedy a default before default interest accrues instead of immediately triggering harsher penalty interest charges.

Liquidated Damages

Liquidated damages represent a pre-agreed sum stipulated in a contract as compensation for breach, differing from default interest which accrues periodically on overdue amounts based on a fixed rate, and penalty interest designed primarily to deter non-performance rather than to compensate for actual losses. Courts often distinguish liquidated damages as enforceable estimations of loss, whereas penalty interest may be unenforceable if deemed punitive rather than a genuine pre-estimate of damage.

Usury Laws

Usury laws regulate the maximum interest rates lenders can charge to prevent excessively high repayments, distinguishing default interest as a legally permissible higher rate applied during payment delays from penalty interest, which often exceeds statutory limits and may be considered unlawful. Courts typically enforce default interest rates within usury thresholds, while penalty interest rates surpassing these limits risk invalidation under applicable state or federal usury statutes.

Acceleration Clause

An acceleration clause triggers default interest rates upon borrower default, which are typically higher than standard rates but differ from penalty interest designed solely to punish late payments.

Late Payment Fee

Late payment fees often involve default interest, which accrues based on the outstanding amount and statutory rate, reflecting the lender's cost of delayed payment, whereas penalty interest is a fixed or elevated rate imposed as a punitive measure beyond compensatory compensation. Default interest aims to compensate for loss from delayed payments, while penalty interest serves as a deterrent to prevent future defaults and enforce timely obligations.

Moratorium Interest

Moratorium interest applies to overdue payments calculated at a higher rate than default interest but differs from penalty interest, which is imposed as a punitive charge rather than compensation for delayed payment.

Event of Default

Event of Default triggers Default Interest, which accrues at a higher rate than the contractual ordinary interest but remains distinct from Penalty Interest designed to punish non-compliance. Default Interest compensates the lender for increased risk and delayed payment, while Penalty Interest serves as a deterrent against breaches without necessarily reflecting actual losses.

Remedial Rate

Remedial Rate typically refers to the higher Default Interest charged on overdue payments to incentivize timely repayment, differing from Penalty Interest which is a fixed fee imposed as punishment for contractual breaches.

Default Interest vs Penalty Interest Infographic

moneydif.com

moneydif.com