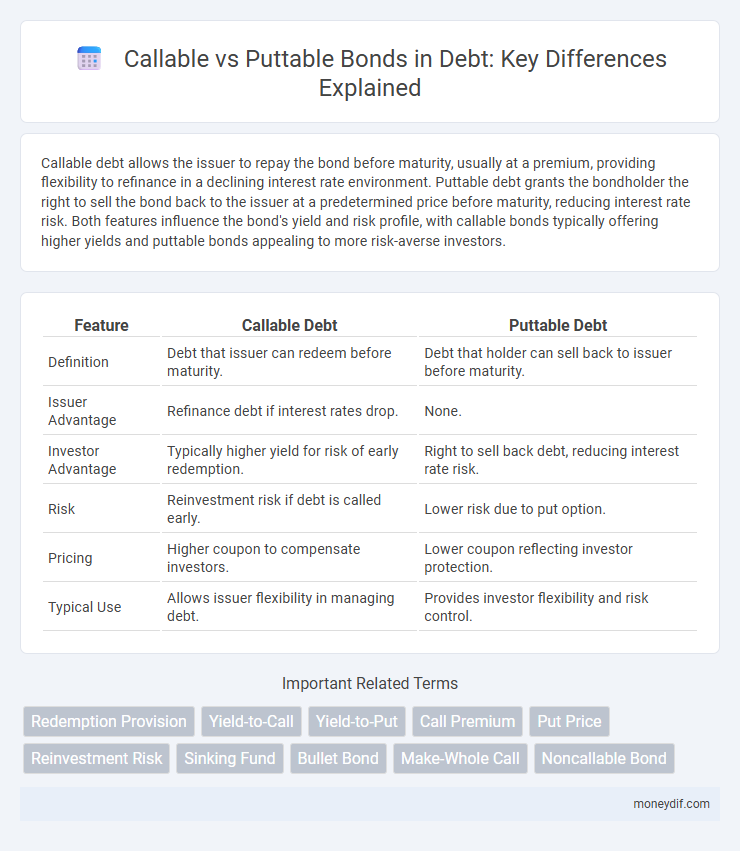

Callable debt allows the issuer to repay the bond before maturity, usually at a premium, providing flexibility to refinance in a declining interest rate environment. Puttable debt grants the bondholder the right to sell the bond back to the issuer at a predetermined price before maturity, reducing interest rate risk. Both features influence the bond's yield and risk profile, with callable bonds typically offering higher yields and puttable bonds appealing to more risk-averse investors.

Table of Comparison

| Feature | Callable Debt | Puttable Debt |

|---|---|---|

| Definition | Debt that issuer can redeem before maturity. | Debt that holder can sell back to issuer before maturity. |

| Issuer Advantage | Refinance debt if interest rates drop. | None. |

| Investor Advantage | Typically higher yield for risk of early redemption. | Right to sell back debt, reducing interest rate risk. |

| Risk | Reinvestment risk if debt is called early. | Lower risk due to put option. |

| Pricing | Higher coupon to compensate investors. | Lower coupon reflecting investor protection. |

| Typical Use | Allows issuer flexibility in managing debt. | Provides investor flexibility and risk control. |

Understanding Callable and Puttable Debt Instruments

Callable debt instruments allow issuers to redeem bonds before maturity, often to capitalize on declining interest rates and reduce overall borrowing costs. Puttable debt instruments grant investors the right to demand early repayment, providing protection against rising interest rates or issuer credit deterioration. Understanding the mechanics of callable and puttable features is crucial for assessing interest rate risk and investment flexibility in fixed-income portfolios.

Key Features of Callable Debt

Callable debt allows the issuer to redeem the bond before maturity, typically at a predetermined call price, providing flexibility to refinance if interest rates decline. This feature introduces reinvestment risk for investors, who may receive their principal back earlier than expected and face lower yields on subsequent investments. Callable bonds often offer higher coupon rates to compensate investors for this embedded call option and potential uncertainty in cash flows.

Key Features of Puttable Debt

Puttable debt provides investors the option to sell the bond back to the issuer before maturity, enhancing liquidity and reducing interest rate risk. Key features include a predetermined put date or multiple dates, allowing bondholders to exit if market conditions deteriorate or credit quality declines. This option typically results in lower yields compared to non-puttable bonds due to the added security for investors.

Major Differences Between Callable and Puttable Bonds

Callable bonds allow issuers to redeem the bond before maturity, typically when interest rates decline, benefiting the issuer by refinancing at lower costs. Puttable bonds give investors the right to sell the bond back to the issuer before maturity, offering protection against rising interest rates or credit risk. The major difference lies in who holds the option: issuers in callable bonds and investors in puttable bonds, impacting risk and return profiles.

Advantages of Callable Debt for Issuers

Callable debt offers issuers the flexibility to refinance existing bonds at lower interest rates when market conditions improve, reducing overall borrowing costs. This feature allows companies to manage their capital structure dynamically by repurchasing debt before maturity, especially during periods of declining interest rates. Issuers also benefit from enhanced financial agility, enabling strategic decisions that optimize cash flow and debt servicing expenses.

Benefits of Puttable Debt for Investors

Puttable debt offers investors greater protection by allowing them to force the issuer to repurchase the bond before maturity, reducing exposure to interest rate risk and credit deterioration. This feature provides enhanced liquidity and flexibility, enabling investors to respond to market changes or issuer credit quality concerns promptly. Investors benefit from potentially higher yields compared to traditional bonds, compensating for the embedded put option's value.

Risks Associated with Callable and Puttable Debt

Callable debt carries the risk of issuer call, potentially forcing investors to reinvest at lower rates when interest rates decline, which can reduce expected returns. Puttable debt exposes issuers to early redemption risk, increasing refinancing uncertainty and potentially higher interest costs during unfavorable market conditions. Both types introduce liquidity and interest rate risks, making careful evaluation essential for investors and issuers.

Impact on Yield and Pricing

Callable bonds typically offer higher yields to compensate investors for the issuer's option to redeem the bond before maturity, introducing reinvestment risk and potentially lowering the bond's price. Puttable bonds generally have lower yields since they provide investors with the right to sell the bond back to the issuer at a predetermined price, reducing downside risk and increasing bond value. The embedded options in callable and puttable bonds create distinct pricing adjustments reflecting the cost or benefit of the associated exercise rights.

Real-World Examples of Callable and Puttable Debt

Callable debt, such as corporate bonds issued by large companies like Apple or AT&T, allows issuers to redeem bonds before maturity, often used when interest rates decline to refinance at lower costs. Puttable debt, commonly seen in municipal bonds or preferred stocks issued by utilities like Duke Energy, grants investors the right to sell bonds back to the issuer, providing downside protection in volatile markets. Real-world application of callable and puttable features demonstrates strategic flexibility in managing interest rate risk and investor confidence.

Choosing the Right Debt Instrument: Factors to Consider

When choosing between callable and puttable debt instruments, factors such as interest rate expectations, issuer flexibility, and investor protection are critical. Callable bonds offer issuers the option to redeem debt early, potentially benefiting from declining rates, while puttable bonds provide investors the right to sell back the bond, reducing downside risk. Evaluating market volatility, credit risk, and cash flow needs helps determine the optimal instrument for both issuers and investors.

Important Terms

Redemption Provision

Redemption provisions determine whether a security is callable by the issuer or puttable by the investor, affecting the timing and conditions under which the security can be redeemed before maturity.

Yield-to-Call

Yield-to-Call measures the return on a callable bond if redeemed by the issuer before maturity, typically at a premium price, reflecting the bondholder's potential lost interest due to early call. In contrast, Yield-to-Put applies to puttable bonds, indicating the yield if the holder exercises the option to sell the bond back to the issuer prior to maturity, often providing a floor against interest rate declines.

Yield-to-Put

Yield-to-Put (YTP) measures the annualized return an investor receives if a puttable bond is sold back to the issuer at the put date, providing downside protection against interest rate rises. In contrast, callable bonds expose investors to reinvestment risk as issuers can redeem the bond early at a call date, potentially limiting yield to call rather than yield to maturity.

Call Premium

Call premiums typically reflect the extra cost paid by issuers for callable bonds, compensating investors for the risk of early redemption, whereas puttable bonds often trade with lower premiums due to the investor's right to sell back the bond before maturity.

Put Price

Put price reflects the value of the option to sell a security before maturity, typically higher in puttable bonds compared to callable bonds due to the investor's added downside protection.

Reinvestment Risk

Callable bonds expose investors to higher reinvestment risk as issuers can redeem them early when interest rates decline, whereas puttable bonds reduce reinvestment risk by allowing investors to sell back the bond at a predetermined price if rates rise.

Sinking Fund

A sinking fund reduces issuer risk in callable bonds by ensuring periodic repayments, whereas puttable bonds provide investors protection by allowing early redemption, impacting the fund's management strategy.

Bullet Bond

A callable Bullet Bond allows the issuer to redeem the bond before maturity, while a puttable Bullet Bond grants the investor the right to sell the bond back to the issuer, enhancing flexibility and risk management.

Make-Whole Call

A Make-Whole Call allows issuers to redeem callable bonds before maturity by paying bondholders a lump sum equal to the present value of remaining payments, contrasting with puttable bonds that grant holders the right to sell the bond back to the issuer at a predetermined price.

Noncallable Bond

A noncallable bond prevents the issuer from redeeming it before maturity, unlike callable bonds which allow early redemption, while puttable bonds grant the investor the right to sell the bond back to the issuer before maturity.

callable vs puttable Infographic

moneydif.com

moneydif.com