A debt-for-equity swap involves exchanging outstanding debt for ownership shares, reducing the borrower's liabilities while giving creditors an equity stake in the company. Debt restructuring modifies the original terms of debt agreements, such as extending repayment periods or lowering interest rates, to improve the borrower's ability to meet obligations. Both strategies aim to alleviate financial distress but differ in impact on company ownership and creditor control.

Table of Comparison

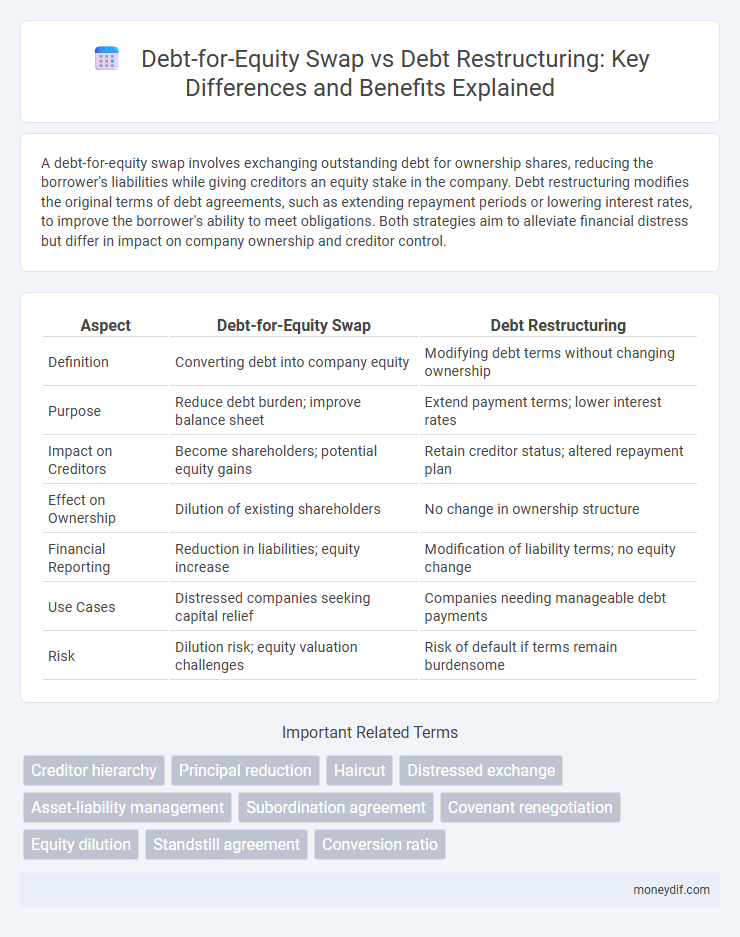

| Aspect | Debt-for-Equity Swap | Debt Restructuring |

|---|---|---|

| Definition | Converting debt into company equity | Modifying debt terms without changing ownership |

| Purpose | Reduce debt burden; improve balance sheet | Extend payment terms; lower interest rates |

| Impact on Creditors | Become shareholders; potential equity gains | Retain creditor status; altered repayment plan |

| Effect on Ownership | Dilution of existing shareholders | No change in ownership structure |

| Financial Reporting | Reduction in liabilities; equity increase | Modification of liability terms; no equity change |

| Use Cases | Distressed companies seeking capital relief | Companies needing manageable debt payments |

| Risk | Dilution risk; equity valuation challenges | Risk of default if terms remain burdensome |

Introduction to Debt-for-Equity Swap and Debt Restructuring

Debt-for-equity swap involves exchanging a company's debt for equity shares, reducing its liabilities while diluting ownership but improving financial stability. Debt restructuring modifies the terms of existing debt, such as extending maturities or lowering interest rates, to avoid default and improve cash flow. Both strategies aim to enhance solvency, but debt-for-equity swaps impact ownership structure, whereas restructuring maintains creditor relationships.

Key Differences Between Debt-for-Equity Swap and Debt Restructuring

Debt-for-equity swaps convert outstanding debt into equity shares, reducing the borrower's liabilities while giving creditors partial ownership and potential upside in the company. Debt restructuring involves altering the original loan terms, such as extending maturity, reducing interest rates, or changing payment schedules, without changing the debt into equity. Key differences lie in the impact on ownership structure--with debt-for-equity swaps diluting existing shareholders--and in the financial flexibility they provide, as restructuring maintains debt status but eases repayment burdens.

How Debt-for-Equity Swaps Work

Debt-for-equity swaps involve exchanging outstanding debt for equity stakes in the borrowing company, reducing debt burdens while aligning creditor interests with company performance. This process increases the company's equity base, improves balance sheet health, and mitigates insolvency risks without immediate cash outflows. Compared to traditional debt restructuring, debt-for-equity swaps provide creditors with potential upside through ownership, balancing debt relief and investment recovery.

The Process of Debt Restructuring

Debt restructuring involves renegotiating the terms of existing debt to improve liquidity and avoid default, typically through extending repayment schedules, lowering interest rates, or reducing the principal amount. Unlike a debt-for-equity swap, which converts debt into ownership stakes, debt restructuring retains the debt instrument but modifies its terms to better align with the debtor's current financial capacity. Key steps in the process include creditor negotiations, financial assessment, drafting a restructuring agreement, and obtaining necessary approvals to implement the revised debt terms.

Advantages of Debt-for-Equity Swaps

Debt-for-equity swaps offer significant advantages by converting debt obligations into ownership stakes, improving a company's balance sheet and reducing leverage ratios. This process aligns creditor and company interests, fostering long-term collaboration and enhancing financial stability. Unlike traditional debt restructuring, debt-for-equity swaps can prevent bankruptcy and preserve operational continuity by eliminating debt repayment pressures.

Benefits and Drawbacks of Debt Restructuring

Debt restructuring enhances cash flow by extending payment terms or reducing interest rates, providing companies immediate financial relief without relinquishing ownership unlike debt-for-equity swaps. However, it may increase total repayment amounts and damage credit ratings, potentially limiting future borrowing capacity. While debt restructuring preserves equity control, it risks prolonged financial strain if underlying issues are not resolved effectively.

Impact on Creditors and Shareholders

Debt-for-equity swaps convert creditor claims into ownership stakes, diluting existing shareholders but providing creditors potential upside through equity participation and reducing debt burdens. Debt restructuring, often involving modified payment terms or reduced interest rates, aims to preserve creditor claims while improving the debtor's repayment capacity, causing less immediate equity dilution but potentially extending financial uncertainty. Creditors in swaps gain partial control and risk participation, whereas restructuring maintains creditor priority but may delay recoveries, balancing shareholder dilution against creditor recoverability.

Legal and Regulatory Considerations

Debt-for-equity swaps involve exchanging outstanding debt for company shares, requiring compliance with securities laws and shareholder approval, while debt restructuring typically modifies existing loan terms under applicable contract and insolvency regulations. Legal scrutiny ensures protection of creditor rights and adherence to corporate governance frameworks, with regulatory bodies monitoring market transparency and potential conflicts of interest. Jurisdiction-specific rules, such as the U.S. SEC regulations or the EU's insolvency directives, critically influence the execution and approval process of both financial mechanisms.

Real-World Examples and Case Studies

Debt-for-equity swaps have been successfully utilized in the restructuring of General Motors during the 2009 financial crisis, converting billions of dollars of debt into equity to stabilize the company and avoid bankruptcy. In contrast, Greece's sovereign debt crisis involved extensive debt restructuring agreements with creditors that extended maturities and reduced interest rates without equity conversions, allowing the country to manage its debt burden while retaining full control. These real-world case studies highlight the distinct strategic benefits of debt-for-equity swaps, which provide immediate capital infusion and ownership realignment, versus traditional debt restructuring focused on modifying repayment terms.

Choosing the Right Option: Strategic Considerations

Debt-for-equity swaps convert creditor claims into ownership stakes, aligning interests by reducing debt burdens and improving balance sheets without immediate cash outflows. Debt restructuring modifies loan terms such as interest rates, maturities, or principal amounts to enhance repayment capacity and preserve existing ownership. Strategic considerations include evaluating company valuation, stakeholder alignment, market conditions, and long-term financial flexibility when selecting between these debt relief mechanisms.

Important Terms

Creditor hierarchy

Creditor hierarchy determines the priority order in which creditors are repaid during debt restructuring, with secured creditors typically having precedence over unsecured creditors; this order significantly impacts negotiations in debt-for-equity swaps where creditors may exchange debt claims for equity stakes to reduce debt burden. Understanding the creditor hierarchy is crucial for assessing the feasibility and outcomes of debt restructuring strategies, as junior creditors may receive less favorable terms or equity positions depending on their ranking.

Principal reduction

Principal reduction in debt restructuring lowers the outstanding loan balance to improve borrower solvency, often through negotiated settlements or bankruptcy processes. Debt-for-equity swaps convert debt into ownership stakes, aligning creditor and company interests while reducing leverage without immediate cash outflows.

Haircut

A haircut in a debt-for-equity swap refers to the reduction in the debt value that creditors agree to convert into equity, often resulting in a partial loss but potential ownership upside, while debt restructuring generally involves modifying loan terms like interest rates or maturity dates without converting debt to equity. Both strategies aim to improve a company's financial stability, but haircut in debt-for-equity swaps specifically reflects the discounted debt conversion ratio impacting creditors' claims.

Distressed exchange

A distressed exchange involves swapping existing debt for equity or restructured debt terms to improve a company's financial stability and avoid default.

Asset-liability management

Asset-liability management optimizes financial stability by balancing debt-for-equity swaps that convert liabilities into equity against traditional debt restructuring methods that modify repayment terms.

Subordination agreement

A subordination agreement legally prioritizes creditor claims by ranking certain debts lower than others, often critical in debt-for-equity swaps where existing debt is converted to equity to improve balance sheets. In contrast, debt restructuring typically renegotiates terms like interest rates or repayment schedules without converting debt into equity, maintaining the original credit hierarchy unless accompanied by a subordination agreement.

Covenant renegotiation

Covenant renegotiation during debt-for-equity swaps typically involves restructuring debt terms to improve creditor returns while reducing borrower leverage, contrasting with debt restructuring that focuses on modifying repayment schedules and interest rates to enhance liquidity without altering ownership stakes.

Equity dilution

Debt-for-equity swaps cause direct equity dilution by converting debt into shares, whereas debt restructuring adjusts debt terms without immediately impacting shareholder equity.

Standstill agreement

A standstill agreement temporarily halts debt repayments, facilitating negotiations for debt restructuring or a debt-for-equity swap to improve creditor recovery and debtor liquidity.

Conversion ratio

Debt-for-equity swap typically achieves a higher conversion ratio by exchanging debt for company shares, while debt restructuring often involves negotiating new terms without altering ownership percentage.

debt-for-equity swap vs debt restructuring Infographic

moneydif.com

moneydif.com