An indenture is a formal legal agreement outlining the terms and conditions between a bond issuer and bondholders, specifying obligations and rights in debt issuance. Surety involves a third party that guarantees the repayment of a debt if the primary borrower defaults, providing additional security to lenders. While indenture sets the contractual framework, surety serves as a protective guarantee to reduce lender risk.

Table of Comparison

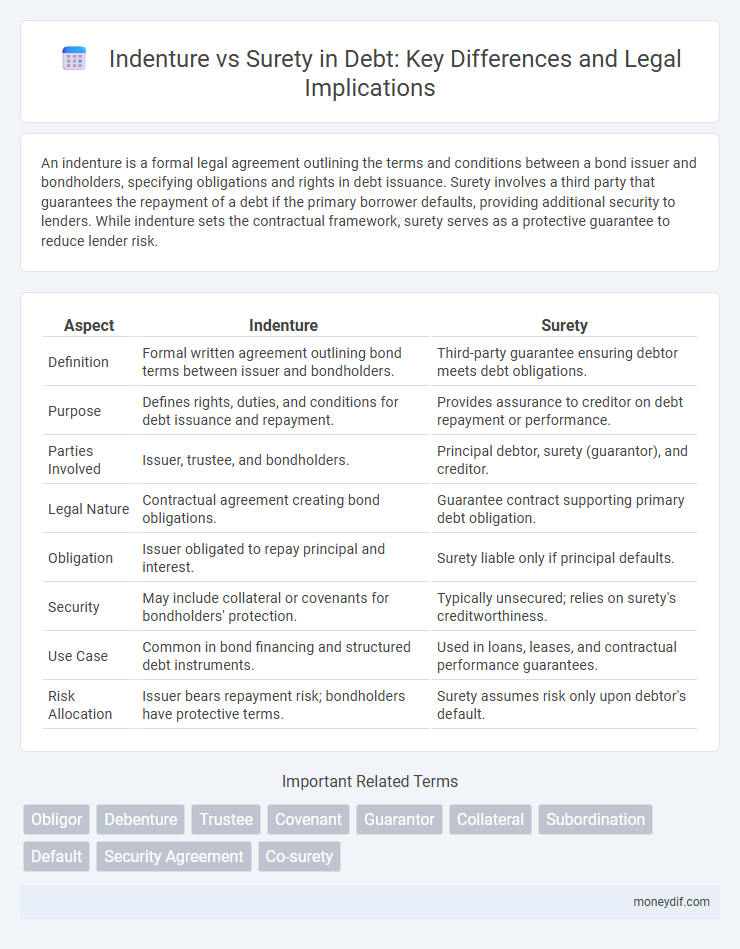

| Aspect | Indenture | Surety |

|---|---|---|

| Definition | Formal written agreement outlining bond terms between issuer and bondholders. | Third-party guarantee ensuring debtor meets debt obligations. |

| Purpose | Defines rights, duties, and conditions for debt issuance and repayment. | Provides assurance to creditor on debt repayment or performance. |

| Parties Involved | Issuer, trustee, and bondholders. | Principal debtor, surety (guarantor), and creditor. |

| Legal Nature | Contractual agreement creating bond obligations. | Guarantee contract supporting primary debt obligation. |

| Obligation | Issuer obligated to repay principal and interest. | Surety liable only if principal defaults. |

| Security | May include collateral or covenants for bondholders' protection. | Typically unsecured; relies on surety's creditworthiness. |

| Use Case | Common in bond financing and structured debt instruments. | Used in loans, leases, and contractual performance guarantees. |

| Risk Allocation | Issuer bears repayment risk; bondholders have protective terms. | Surety assumes risk only upon debtor's default. |

Understanding Indenture and Surety in Debt Agreements

Indenture is a formal legal contract between bond issuers and bondholders outlining terms such as interest rates, maturity, and covenants, ensuring clear obligations and protections in debt agreements. Surety involves a third party who guarantees the debt repayment, providing an additional layer of security by holding liability if the primary borrower defaults. Understanding the distinct roles of indenture and surety is crucial for assessing risk and legal responsibilities in debt financing arrangements.

Key Differences Between Indenture and Surety

Indenture refers to a formal legal contract between a bond issuer and bondholders detailing the terms of the debt, including covenants and obligations, whereas surety involves a third party guaranteeing the repayment of a debt if the principal borrower defaults. The key difference lies in the nature of responsibility; indenture establishes direct obligations of the issuer to bondholders, while surety represents a contingent obligation reliant on the borrower's default. Indentures outline contractual rights and protections for lenders, whereas surety agreements emphasize risk mitigation by transferring potential liability to the guarantor.

Legal Definitions: Indenture vs. Surety

Indenture is a formal legal contract or agreement, often used in bond issuance, specifying the terms and conditions between the issuer and the bondholders, including obligations and covenants. Surety is a legally binding guarantee wherein a third party commits to fulfilling the debt obligation if the primary debtor defaults, providing added security to the creditor. The key legal distinction lies in indenture establishing direct contractual duties for debt repayment, while surety involves a secondary promise ensuring performance or payment in case of default.

Role of Indenture in Debt Issuance

An indenture serves as a formal legal contract between bond issuers and bondholders, detailing the terms, conditions, and covenants associated with a debt issuance. It establishes the rights and responsibilities of all parties involved, including the trustee's role in protecting bondholders' interests and ensuring compliance with the agreement. This crucial document provides transparency and legal safeguards, enhancing investor confidence and facilitating efficient capital raising in debt markets.

Surety: Functions and Responsibilities

Surety functions as a contractual guarantee in debt agreements, ensuring the principal debtor fulfills financial obligations if they default. The surety's primary responsibility includes assuming liability to creditors, providing a safety net for lenders by reducing risk and enhancing creditworthiness. This role involves closely monitoring the debtor's financial health and intervening when necessary to mitigate potential losses.

Parties Involved in Indenture and Surety Contracts

Indenture contracts involve at least two primary parties: the issuer (borrower) and the bondholders (lenders), with a trustee acting as an intermediary to enforce the terms. Surety contracts include three key parties: the principal (borrower), the obligee (lender or creditor), and the surety (guarantor) who guarantees the principal's debt repayment. Understanding these distinct roles is crucial for assessing obligations and enforcement in debt agreements.

Advantages of Using an Indenture

An indenture offers clear legal documentation that outlines the terms and conditions of a debt agreement, providing both issuers and investors with defined rights and obligations. It enhances transparency and reduces disputes through detailed covenants and protections, which can improve investor confidence and facilitate better credit ratings. The structured framework of an indenture also allows for easier enforcement and monitoring of compliance compared to surety arrangements.

Benefits and Risks of Surety Arrangements

Surety arrangements provide a financial guarantee from a third party, enhancing the borrower's creditworthiness and often leading to easier loan approvals and lower interest rates. However, the surety assumes significant risk, potentially facing full liability if the principal defaults, which can strain relationships and lead to legal actions for recovery. The benefits include increased trust and access to funding, while risks involve financial exposure and dependency on the principal's repayment performance.

When to Choose Indenture Over Surety

Choose an indenture over surety when issuing bonds to multiple investors, as it provides a formal legal agreement outlining the issuer's obligations and the trustee's role in protecting bondholders' interests. Indentures are preferable in complex debt arrangements requiring detailed covenants, transparency, and regulatory compliance, ensuring standardized terms and enhancing investor confidence. Surety bonds, by contrast, are more suitable for guaranteeing specific performance obligations rather than broad debt issuance scenarios.

Case Studies: Indenture and Surety in Real-World Debt Scenarios

Indenture agreements in debt financing establish clear terms for bond issuance, as seen in the General Motors 2020 bond indenture, which detailed creditor rights and payment schedules ensuring transparent debt servicing. Surety arrangements, such as the Chrysler bailout, involved third-party guarantees that enhanced lender confidence and facilitated substantial loans by mitigating default risk. These case studies highlight how indenture contracts structure debt obligations, while surety agreements provide crucial financial backing in high-stakes lending environments.

Important Terms

Obligor

An obligor in an indenture is the party primarily responsible for fulfilling the debt obligations detailed in the contract, whereas in a surety arrangement, the surety acts as a secondary obligor guaranteeing the debtor's performance. Understanding the distinction between the obligor's direct liability under an indenture and the surety's conditional liability is crucial for assessing credit risk and enforcement rights.

Debenture

A debenture is a type of debt instrument governed by an indenture agreement outlining the issuer's obligations and security terms, whereas surety involves a third party guaranteeing the debtor's repayment.

Trustee

A trustee in an indenture holds legal title to collateral on behalf of bondholders, ensuring issuance and compliance with bond terms, while a surety provides a financial guarantee to the obligee that the principal will fulfill contractual obligations, acting as a secondary guarantor rather than holding collateral. Indentures establish bondholder protections via trustees, whereas sureties focus on credit enhancement without direct involvement in bondholder administration.

Covenant

A covenant in an indenture serves as a legally binding promise that outlines the duties and restrictions of the parties involved, ensuring compliance with loan terms, while a surety involves a third party who guarantees repayment if the primary obligor defaults. Indentures focus on contractual obligations between borrower and lender, whereas suretyship emphasizes financial security through a guarantor's commitment.

Guarantor

A guarantor provides secondary financial backing under an indenture agreement by ensuring repayment if the primary obligor defaults, whereas a surety assumes primary liability alongside the principal debtor.

Collateral

Collateral provides security to the obligee by creating a tangible asset under the indenture agreement, whereas surety involves a third party guaranteeing the debtor's performance without transferring specific assets.

Subordination

Subordination agreements prioritize claim precedence, whereas indenture and surety contracts define debt obligations and guarantor liabilities in credit arrangements.

Default

Default occurs when a party fails to fulfill the obligations specified in an indenture agreement, unlike suretyship where a third party guarantees performance or payment on behalf of the principal.

Security Agreement

A Security Agreement creates a lien on collateral to secure debt under an Indenture, whereas a Surety involves a third party guaranteeing payment or performance without transferring collateral rights.

Co-surety

Co-surety shares joint liability with other sureties under an indenture, providing collective financial responsibility distinct from an individual surety's sole obligation.

Indenture vs Surety Infographic

moneydif.com

moneydif.com