In debt financing, seniority determines the priority of repayment, with senior debt holders receiving payments before subordinated creditors in the event of default. Subordinated debt carries higher risk, often resulting in higher interest rates to compensate lenders for the lower claim on assets. Understanding the distinction between subordination and seniority is crucial for assessing credit risk and structuring capital efficiently.

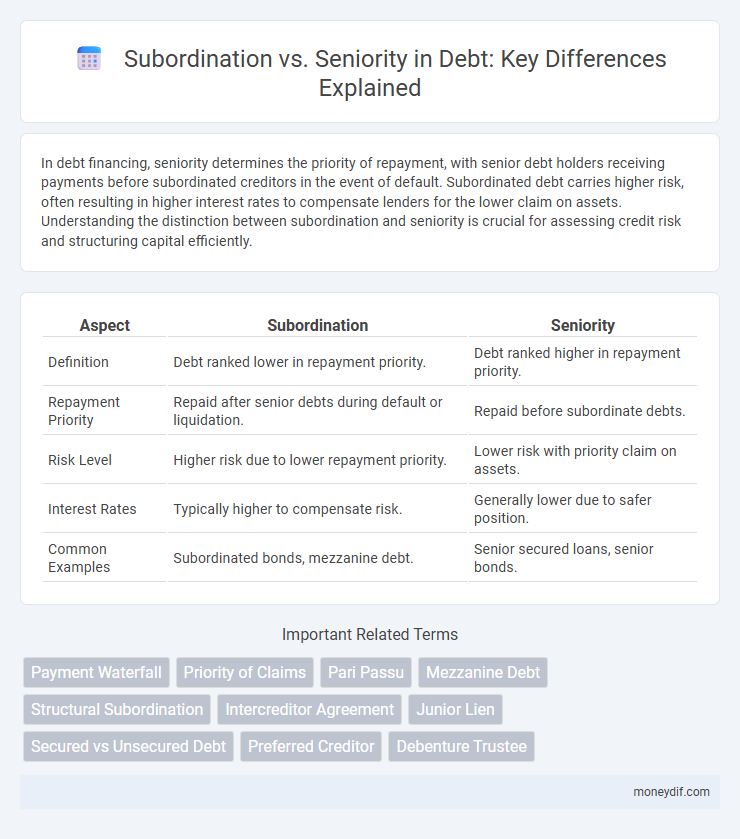

Table of Comparison

| Aspect | Subordination | Seniority |

|---|---|---|

| Definition | Debt ranked lower in repayment priority. | Debt ranked higher in repayment priority. |

| Repayment Priority | Repaid after senior debts during default or liquidation. | Repaid before subordinate debts. |

| Risk Level | Higher risk due to lower repayment priority. | Lower risk with priority claim on assets. |

| Interest Rates | Typically higher to compensate risk. | Generally lower due to safer position. |

| Common Examples | Subordinated bonds, mezzanine debt. | Senior secured loans, senior bonds. |

Understanding Debt Subordination and Seniority

Debt subordination determines the priority of repayment in bankruptcy, with subordinate debt holders paid after senior debt holders. Seniority ranks debt claims based on contractual agreements, where senior debt has higher repayment priority and lower risk. Understanding the hierarchy between subordinate and senior debt is essential for assessing credit risk and expected recovery rates in default scenarios.

Key Differences Between Subordinated and Senior Debt

Subordinated debt ranks below senior debt in claim priority during borrower bankruptcy or liquidation, leading to higher risk and typically higher interest rates for subordinated debt holders. Senior debt holders have first rights to repayment and collateral, resulting in lower risk and lower yields compared to subordinated debt. The key differences lie in payment priority, risk exposure, and interest cost, which influence investor preference and capital structure decisions.

Importance of Debt Hierarchy in Financial Structures

Debt hierarchy determines the priority of claims during bankruptcy or liquidation, where senior debt holders receive payment before subordinated debt holders. This structure influences credit risk assessment, interest rates, and borrowing capacity, making senior debt typically less risky and more expensive to issue. Understanding subordination versus seniority is crucial for investors and issuers to manage capital structure, optimize financing costs, and mitigate default risk.

How Subordination Affects Creditor Rights

Subordination impacts creditor rights by ranking certain debts below others in priority for repayment during bankruptcy or liquidation, ensuring senior creditors receive full payment before subordinated creditors are paid. This hierarchy influences recovery rates, with subordinated creditors facing increased risk of partial or no repayment. Understanding subordination agreements is crucial for creditors to assess the level of risk associated with their claims relative to senior obligations.

Implications of Seniority in Bankruptcy Proceedings

Seniority in debt determines the order in which creditors are paid during bankruptcy proceedings, with senior debt holders receiving repayment before subordinated creditors. This priority affects recovery rates, as senior lenders have a higher likelihood of recouping their investments when liquidated assets are distributed. Consequently, seniority status significantly influences the risk profile and pricing of debt instruments in distressed situations.

Risk and Return Profile: Subordinated vs Senior Debt

Subordinated debt carries higher risk due to its lower claim priority during liquidation, resulting in a higher interest rate to compensate investors for this increased default risk. Senior debt benefits from priority repayment, reducing credit risk and offering lower yield compared to subordinated debt. The risk-return profile fundamentally influences investment decisions, with subordinated debt appealing to investors seeking higher returns despite elevated risk exposure.

Legal Framework Governing Debt Subordination

The legal framework governing debt subordination is primarily established through intercreditor agreements that define the priority of claims among creditors, ensuring that senior debt holders receive repayment before subordinated creditors in insolvency scenarios. Statutory provisions such as the Bankruptcy Code in the United States establish the hierarchy of debts, where senior debt holds precedence legally over subordinated obligations. Courts enforce these frameworks by interpreting contractual subordination clauses, which affects recovery rates and risk assessments for different classes of debt holders.

Real-World Examples of Subordinated and Senior Debt

Subordinated debt often appears in corporate finance as mezzanine financing, where it ranks below senior debt in claim priority but offers higher yields, exemplified by the mezzanine loans used in private equity buyouts. Senior debt includes bank loans and bonds with priority claims on assets, such as senior secured loans issued by large corporations like Apple or General Electric, ensuring lenders receive repayment before subordinated creditors in bankruptcy. Real-world cases like the 2008 financial crisis illustrate how senior debt holders were repaid first, while subordinated debt holders faced significant losses, underscoring the risk and return tradeoff inherent in these debt structures.

Impact on Borrowers: Choosing Debt Priority Levels

Selecting debt priority levels directly affects a borrower's cost of capital and access to credit; senior debt typically carries lower interest rates due to its higher repayment priority in case of default. Subordinated debt increases financial flexibility but comes with higher interest costs, reflecting its lower claim on assets. Borrowers must balance risk tolerance and funding needs to optimize their capital structure and maintain favorable lender relationships.

Investor Considerations: Assessing Subordination and Seniority

Investors analyzing debt instruments prioritize seniority to understand repayment hierarchy, where senior debt has priority claims over subordinated debt in case of default. Subordination impacts recovery rates and risk levels, with subordinated debt typically offering higher yields due to increased risk exposure. Accurate assessment of subordination agreements and seniority clauses enables investors to gauge potential returns and default risk effectively.

Important Terms

Payment Waterfall

Payment waterfall prioritizes cash flow distribution by seniority, ensuring senior debt receives payments before subordinated obligations are fulfilled.

Priority of Claims

Priority of claims determines the order in which creditors are paid during insolvency, with senior debt holding higher repayment priority over subordinated debt. Subordination agreements legally enforce this hierarchy, ensuring senior creditors receive settlements before any subordinated claims are addressed.

Pari Passu

Pari passu refers to the equal ranking of debts or claims where no creditor has seniority or subordination over another in repayment priority.

Mezzanine Debt

Mezzanine debt ranks below senior debt in repayment priority but above equity, combining higher risk with potentially higher returns due to its subordinate position in the capital structure.

Structural Subordination

Structural subordination occurs when debt is subordinated based on the legal capital structure of a company, ranking junior to senior debt secured by specific assets, thereby impacting creditor priority and repayment risk.

Intercreditor Agreement

An Intercreditor Agreement establishes the priority and rights among multiple creditors, clearly defining the hierarchy of debt through subordination and seniority clauses. Senior creditors possess superior claims on collateral and repayment, while subordinated creditors agree to defer their claims until senior obligations are satisfied.

Junior Lien

A junior lien holds a lower priority compared to a senior lien, meaning it is subordinate and repaid only after senior liens are satisfied in case of borrower default.

Secured vs Unsecured Debt

Secured debt holds seniority by being backed with collateral, while unsecured debt is subordinated and carries higher risk due to lack of asset backing.

Preferred Creditor

Preferred creditors hold a higher-ranking claim on assets compared to subordinated creditors, meaning their debts are repaid before those classified as junior or subordinate during insolvency. In contrast, seniority dictates the order of payment priority, where senior debt is fulfilled prior to subordinated debt, reinforcing preferred creditors' advantage in financial recoveries.

Debenture Trustee

Debenture trustees ensure investor protection by overseeing the enforcement of subordination and seniority clauses that determine the priority of debt repayment in corporate bond agreements.

Subordination vs Seniority Infographic

moneydif.com

moneydif.com