A debenture is a long-term, unsecured debt instrument issued by corporations, backed only by the issuer's creditworthiness, while a promissory note is a written, legally binding promise to repay a specific amount within a set timeframe. Debentures often carry fixed interest rates and can be traded on secondary markets, providing investors with liquidity options, whereas promissory notes are typically simpler, short-term agreements between two parties without interest or marketability. Understanding these differences helps in selecting the right debt instrument based on risk tolerance, investment horizon, and financial objectives.

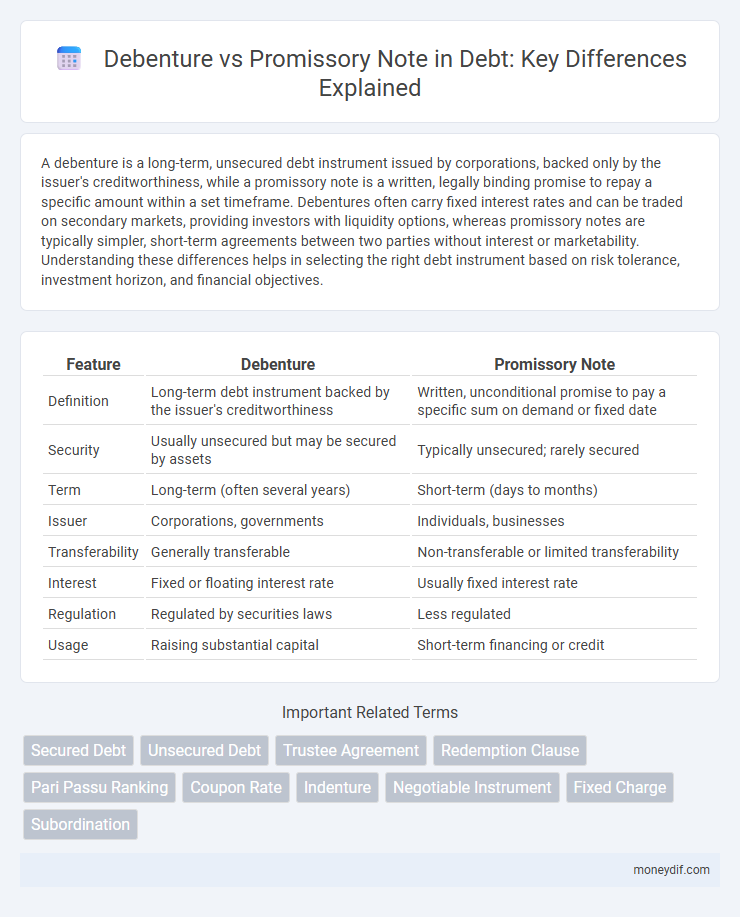

Table of Comparison

| Feature | Debenture | Promissory Note |

|---|---|---|

| Definition | Long-term debt instrument backed by the issuer's creditworthiness | Written, unconditional promise to pay a specific sum on demand or fixed date |

| Security | Usually unsecured but may be secured by assets | Typically unsecured; rarely secured |

| Term | Long-term (often several years) | Short-term (days to months) |

| Issuer | Corporations, governments | Individuals, businesses |

| Transferability | Generally transferable | Non-transferable or limited transferability |

| Interest | Fixed or floating interest rate | Usually fixed interest rate |

| Regulation | Regulated by securities laws | Less regulated |

| Usage | Raising substantial capital | Short-term financing or credit |

Introduction to Debentures and Promissory Notes

Debentures are long-term debt instruments issued by corporations or governments to raise capital, typically unsecured and offering fixed interest payments to investors. Promissory notes are written promises to pay a specific amount of money to a designated party, often used for short-term borrowing with defined repayment terms. Both serve as debt obligations but differ in terms of security, duration, and typical usage in financial markets.

Definition and Key Features

A debenture is a long-term debt instrument issued by corporations or governments, backed primarily by the issuer's creditworthiness rather than specific collateral, and often includes fixed interest payments. A promissory note is a short-term, written promise to pay a specified sum to a designated party under agreed terms, typically unsecured and used for smaller-scale borrowing. Key features of debentures include tradability on secondary markets and fixed tenure, while promissory notes emphasize simplicity, negotiability, and flexibility in repayment schedules.

Legal Framework and Regulation

Debentures are regulated under corporate and securities law, requiring compliance with registration and disclosure requirements by regulatory bodies such as the SEC. Promissory notes fall under negotiable instruments law, governed by the Uniform Commercial Code (UCC) or equivalent statutes, with fewer disclosure obligations. Legal frameworks for debentures impose stricter investor protection and transparency standards compared to the more informal and flexible regulation of promissory notes.

Types of Debentures and Promissory Notes

Debentures include convertible, non-convertible, secured, and unsecured types, each differing in convertibility options and security backing. Promissory notes vary mainly as demand notes, installment notes, and balloon notes, characterized by their payment terms and maturity structures. Understanding these types is essential for selecting the appropriate debt instrument based on risk tolerance and investment strategy.

Issuer and Holder Roles

A debenture is issued by a corporation or government entity as a long-term debt instrument, with holders acting as creditors who receive fixed interest payments. Promissory notes are typically issued by individuals or businesses as written promises to repay borrowed funds, with holders holding a direct claim against the issuer. While debenture holders have claims against the issuer's overall creditworthiness, promissory note holders have more specific claims tied to the note's terms and repayment schedule.

Risk and Security Aspects

Debentures typically offer lower risk to investors due to being backed by the issuer's creditworthiness and sometimes secured by specific assets, providing a claim in case of default. Promissory notes are generally unsecured and rely solely on the issuer's promise to pay, increasing the risk exposure for the holder. The security features of debentures make them more favorable in risk mitigation compared to the high-risk nature of promissory notes.

Interest Rates and Payment Terms

Debentures typically offer fixed or floating interest rates determined by market conditions and creditworthiness, with interest payments scheduled periodically over the loan's term. Promissory notes often feature negotiable interest rates that can be fixed or variable, with more flexible payment terms tailored to the borrower's needs, including lump-sum or installment payments. The structured payment schedule of debentures contrasts with the often customizable and shorter-term repayment arrangements of promissory notes.

Transferability and Negotiability

Debentures are generally transferable securities that can be sold or pledged in the secondary market, enabling investors to easily trade them without issuer consent. Promissory notes are negotiable instruments but often require endorsement and delivery for transfer, making their transferability more manual and less streamlined compared to debentures. The negotiability of promissory notes facilitates debt payment enforcement, while debentures offer broader liquidity due to their marketability.

Advantages and Disadvantages

Debentures provide long-term debt financing secured by a company's assets, offering lower interest rates and attracting institutional investors, but they involve complex issuance procedures and regulatory compliance. Promissory notes offer flexibility and simplicity with faster issuance and negotiable terms, yet they typically carry higher interest rates and lack collateral security, increasing risk for lenders. Choosing between them depends on factors like funding amount, risk tolerance, and duration of the debt instrument.

Choosing Between Debenture and Promissory Note

Choosing between a debenture and a promissory note depends on the nature of the debt and the level of security required; debentures provide a secured or unsecured long-term debt instrument often backed by the issuer's creditworthiness, while promissory notes serve as simpler, short-term, unsecured promises to pay a specific amount. Investors typically prefer debentures for their formal structure and potential conversion features, whereas promissory notes are favored for straightforward, quick financing arrangements. Assessing factors such as interest rates, maturity period, and legal enforceability is crucial when deciding which instrument aligns best with the financial strategy and risk tolerance of both lenders and borrowers.

Important Terms

Secured Debt

Secured debt, often evidenced by debentures that are backed by collateral, contrasts with unsecured promissory notes which typically lack specific asset guarantees.

Unsecured Debt

Unsecured debt lacks collateral, increasing risk for lenders compared to secured instruments; debentures are long-term, unsecured bonds issued by corporations or governments, while promissory notes are short-term, unsecured written promises to pay a specific amount, often used in personal or business lending. Both facilitate funding without asset backing, but debentures are market-traded and regulated, whereas promissory notes are private agreements with varied enforceability.

Trustee Agreement

A Trustee Agreement outlines the rights and duties of a trustee overseeing debenture holders, whereas a promissory note is a direct, unsecured promise to pay without requiring trustee involvement.

Redemption Clause

A Redemption Clause in a debenture specifies the terms under which the issuer can repay the principal before maturity, unlike promissory notes which typically lack such detailed redemption provisions.

Pari Passu Ranking

Pari passu ranking ensures that debenture holders and promissory note holders share equal priority in claims during asset liquidation or bankruptcy proceedings. Debentures, typically secured or unsecured long-term debt instruments, and promissory notes, usually short-term and unsecured, may be structured to have pari passu status to protect creditor rights without preference.

Coupon Rate

The coupon rate on a debenture represents fixed interest paid to investors, whereas promissory notes typically carry interest rates defined by the issuer without standardized coupon payments.

Indenture

Indenture is a formal legal agreement outlining the terms and conditions of a debenture, whereas a promissory note is a simpler, unconditional written promise to pay a specified amount without detailed contractual obligations.

Negotiable Instrument

Negotiable instruments, such as debentures and promissory notes, serve as financial documents representing an obligation to pay a specified amount. Debentures are long-term debt instruments issued by companies offering fixed interest to investors, while promissory notes are short-term, written promises to pay a certain sum on demand or at a fixed date.

Fixed Charge

Fixed charges often secure debentures by creating a legal claim on specific assets, whereas promissory notes typically do not involve fixed charges but represent an unsecured promise to pay a specified sum.

Subordination

Subordination in debentures prioritizes repayment hierarchy by ranking debt holders below others, unlike promissory notes which generally lack formal subordination clauses.

Debenture vs Promissory Note Infographic

moneydif.com

moneydif.com