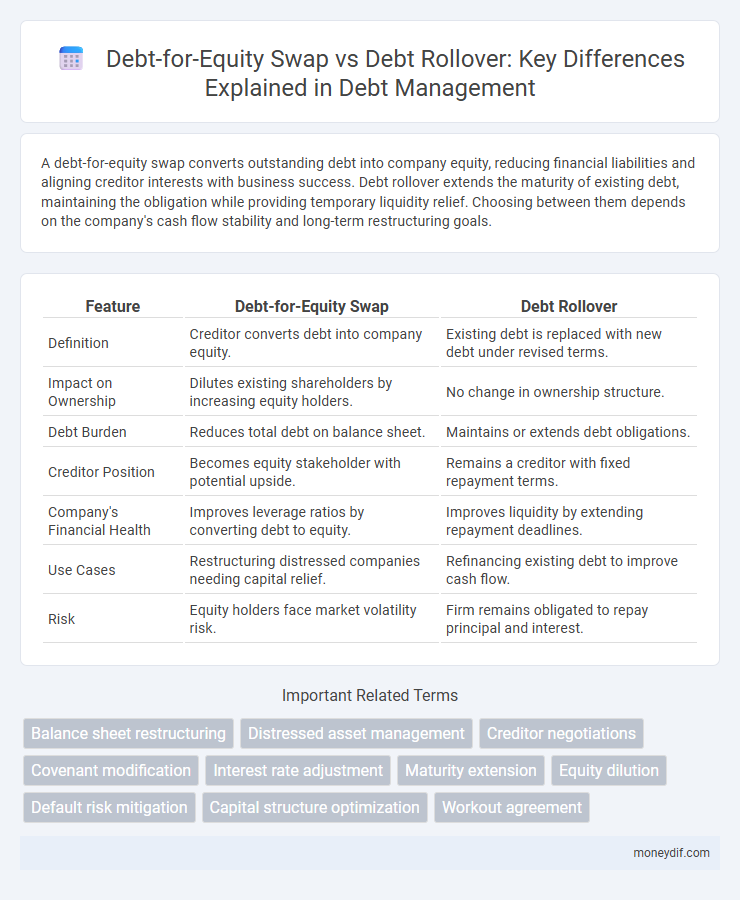

A debt-for-equity swap converts outstanding debt into company equity, reducing financial liabilities and aligning creditor interests with business success. Debt rollover extends the maturity of existing debt, maintaining the obligation while providing temporary liquidity relief. Choosing between them depends on the company's cash flow stability and long-term restructuring goals.

Table of Comparison

| Feature | Debt-for-Equity Swap | Debt Rollover |

|---|---|---|

| Definition | Creditor converts debt into company equity. | Existing debt is replaced with new debt under revised terms. |

| Impact on Ownership | Dilutes existing shareholders by increasing equity holders. | No change in ownership structure. |

| Debt Burden | Reduces total debt on balance sheet. | Maintains or extends debt obligations. |

| Creditor Position | Becomes equity stakeholder with potential upside. | Remains a creditor with fixed repayment terms. |

| Company's Financial Health | Improves leverage ratios by converting debt to equity. | Improves liquidity by extending repayment deadlines. |

| Use Cases | Restructuring distressed companies needing capital relief. | Refinancing existing debt to improve cash flow. |

| Risk | Equity holders face market volatility risk. | Firm remains obligated to repay principal and interest. |

Introduction to Debt-for-Equity Swap and Debt Rollover

A debt-for-equity swap involves exchanging an outstanding debt obligation for equity in the borrowing company, reducing debt load while diluting ownership. Debt rollover occurs when existing debt is refinanced or extended, maintaining the principal amount but altering payment terms or maturity dates. Both strategies aim to manage corporate debt but differ in impact on capital structure and creditor relationships.

Defining Debt-for-Equity Swap

A debt-for-equity swap involves creditors exchanging outstanding debt for ownership equity in a company, reducing the debt burden and improving the company's balance sheet. This strategy often targets distressed companies by converting liabilities into shareholder value, potentially enhancing long-term financial stability. Debt rollover, by contrast, extends the maturity of existing debt without altering the ownership structure or decreasing total liabilities.

Understanding Debt Rollover

Debt rollover involves extending the maturity date of existing debt, allowing borrowers to replace old debt with new debt under similar terms, thus maintaining liquidity without immediate repayment pressure. Unlike a debt-for-equity swap, which converts debt into ownership stakes, debt rollover preserves the creditor's claim as debt, reducing the risk of equity dilution for the borrower. This strategy helps companies manage cash flow challenges and avoid default while renegotiating debt terms with creditors.

Key Differences between Debt-for-Equity Swap and Debt Rollover

A debt-for-equity swap converts outstanding debt into ownership stakes, effectively reducing debt levels and shifting creditor influence to equity holders. Debt rollover extends the repayment period by replacing existing debt with new debt, maintaining the liability but improving liquidity or cash flow timing. The swap alters company capital structure and control, while rollover focuses on managing debt maturity without equity dilution.

Advantages of Debt-for-Equity Swap

Debt-for-equity swaps reduce a company's debt burden by converting liabilities into equity, improving the balance sheet and enhancing financial stability. This strategy aligns creditor and shareholder interests, facilitating long-term growth without increasing cash outflows. Compared to debt rollovers, debt-for-equity swaps decrease interest expenses and lower default risk, contributing to improved credit ratings and investor confidence.

Benefits of Debt Rollover

Debt rollover offers significant benefits by extending the maturity of existing liabilities, enabling companies to maintain liquidity and avoid immediate cash outflows. This process helps preserve credit ratings by demonstrating the ability to meet obligations without asset dilution or ownership changes. Furthermore, debt rollover supports financial flexibility, allowing businesses to adapt to changing market conditions without the complexities and potential shareholder disputes common in debt-for-equity swaps.

Risks and Drawbacks of Debt-for-Equity Swap

Debt-for-equity swaps convert outstanding debt into company shares, which can dilute existing shareholders' ownership and reduce control. This restructuring often imposes valuation challenges, leading to potential disputes and market uncertainty about the company's true financial health. The swap may also weaken creditor confidence, impacting future access to credit and increasing the company's overall financial risk profile.

Risks and Limitations of Debt Rollover

Debt rollover involves refinancing existing debt by issuing new debt, which poses risks such as increased interest rates, potential liquidity shortages, and dependency on market conditions that may tighten unexpectedly. Limitations include the possibility of creditor resistance, deteriorating credit ratings, and the accumulation of unsustainable debt levels that can worsen financial distress. Unlike debt-for-equity swaps, debt rollover does not reduce principal obligations, leaving the company's leverage and insolvency risks largely unchanged.

Practical Scenarios: When to Choose Each Option

Debt-for-equity swaps are ideal when a company seeks to reduce debt burden by converting liabilities into ownership stakes, often used during financial restructuring or bankruptcy to stabilize operations. Debt rollover is preferable when a firm can maintain cash flow but requires more time to repay existing debt, typically chosen in scenarios of temporary liquidity constraints or favorable refinancing conditions. Choosing between these options depends on the company's financial health, creditor negotiation flexibility, and long-term strategic goals.

Impact on Stakeholders and Financial Health

Debt-for-equity swaps directly reduce liabilities by converting debt into ownership, strengthening the company's balance sheet and improving solvency ratios, which benefits creditors through potential equity appreciation but dilutes existing shareholders. Debt rollovers maintain the debt principal while extending maturity, preserving current equity levels and preventing immediate dilution, but may increase interest obligations and financial risk for the company, impacting creditors' recovery prospects. Stakeholders such as shareholders, creditors, and management experience differing impacts: swaps shift risk toward equity holders with enhanced long-term financial health, whereas rollovers defer payment burdens, potentially straining short-term liquidity and creditor confidence.

Important Terms

Balance sheet restructuring

Balance sheet restructuring through a debt-for-equity swap involves converting outstanding debt into equity shares, reducing leverage and improving solvency by lowering debt obligations. In contrast, a debt rollover extends the maturity of existing debt without changing the debt-equity ratio, providing temporary liquidity relief without altering the company's capital structure.

Distressed asset management

Distressed asset management involves restructuring financially troubled assets to maximize recovery, where a debt-for-equity swap converts creditor claims into ownership stakes, aligning interests for turnaround potential. Debt rollover extends existing debt by renegotiating terms, preserving creditor claims while providing the debtor additional time to improve cash flow without immediate equity dilution.

Creditor negotiations

Creditors engaging in debt-for-equity swaps convert outstanding debt into equity shares, reducing company liabilities, while debt rollovers extend existing loan terms to maintain debt without altering ownership structure.

Covenant modification

Covenant modification in debt-for-equity swaps typically involves stricter restrictions to protect new equity holders, whereas debt rollovers often maintain or slightly adjust existing covenants to preserve lender confidence.

Interest rate adjustment

Interest rate adjustment impacts debt-for-equity swaps by potentially reducing borrowing costs, while debt rollovers maintain existing interest terms but may increase total debt duration and risk exposure.

Maturity extension

Maturity extension through debt-for-equity swap converts a portion of debt into equity, reducing interest obligations and improving balance sheet stability by extending repayment timelines. In contrast, debt rollover involves renewing existing debt with new debt, maintaining leverage but potentially increasing future interest costs and refinancing risk.

Equity dilution

Equity dilution occurs when a company issues new shares, reducing existing shareholders' ownership percentage, commonly seen in debt-for-equity swaps where creditors convert debt into equity. In contrast, debt rollovers extend the maturity of existing debt without issuing new shares, avoiding immediate equity dilution but potentially increasing long-term leverage risk.

Default risk mitigation

Debt-for-equity swaps reduce default risk by converting debt into ownership, aligning creditor interests with company performance, whereas debt rollovers extend repayment terms but maintain existing debt obligations.

Capital structure optimization

Debt-for-equity swaps optimize capital structure by reducing leverage and improving balance sheet stability, whereas debt rollovers maintain existing debt levels but extend maturity to enhance liquidity.

Workout agreement

A workout agreement in corporate finance is a negotiated restructuring plan that addresses debt repayment issues by offering alternatives such as a debt-for-equity swap, which converts outstanding debt into equity to reduce leverage and improve balance sheet stability, versus a debt rollover where existing debt is refinanced or extended under modified terms to maintain current ownership and avoid dilution. Choosing between these options impacts creditor claims, shareholder equity, and long-term capital structure, with debt-for-equity swaps typically favored in insolvency scenarios while debt rollovers suit companies seeking liquidity without equity dilution.

debt-for-equity swap vs debt rollover Infographic

moneydif.com

moneydif.com