A debenture is an unsecured long-term debt instrument backed only by the issuer's creditworthiness, typically used by corporations and governments to raise capital. In contrast, a note is usually a short- to medium-term debt instrument that may be secured or unsecured, often used for borrowing smaller amounts. Investors prefer debentures for stable, long-term returns, while notes offer more flexibility in maturity and security options.

Table of Comparison

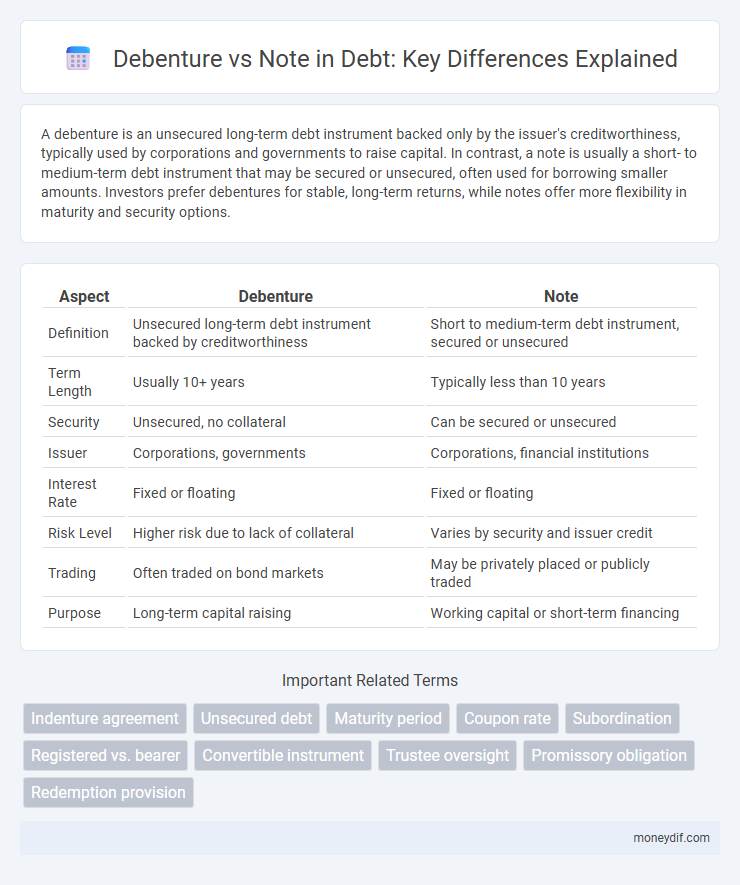

| Aspect | Debenture | Note |

|---|---|---|

| Definition | Unsecured long-term debt instrument backed by creditworthiness | Short to medium-term debt instrument, secured or unsecured |

| Term Length | Usually 10+ years | Typically less than 10 years |

| Security | Unsecured, no collateral | Can be secured or unsecured |

| Issuer | Corporations, governments | Corporations, financial institutions |

| Interest Rate | Fixed or floating | Fixed or floating |

| Risk Level | Higher risk due to lack of collateral | Varies by security and issuer credit |

| Trading | Often traded on bond markets | May be privately placed or publicly traded |

| Purpose | Long-term capital raising | Working capital or short-term financing |

Introduction to Debentures and Notes

Debentures are long-term debt instruments issued by corporations or governments, typically unsecured and backed only by the issuer's creditworthiness. Notes, often called promissory notes, are shorter-term debt securities that may be secured or unsecured and usually involve a written promise to pay a specified amount at a future date. Both debentures and notes serve as crucial tools for raising capital, but they differ mainly in their maturity periods and security features.

Key Definitions: What Are Debentures and Notes?

Debentures are unsecured long-term debt instruments backed only by the issuer's creditworthiness, typically issued by corporations and governments to raise capital without collateral. Notes, or promissory notes, are short- to medium-term debt securities that can be secured or unsecured, representing a formal promise to repay a specific amount on a set date with agreed-upon interest. Both debentures and notes serve as tools for borrowing but differ primarily in tenure, security, and the legal rights they provide to investors.

Structural Differences Between Debenture and Note

Debentures typically represent unsecured long-term debt instruments backed only by the issuer's creditworthiness, whereas notes are often secured or unsecured and have a shorter maturity. Debentures generally involve more complex covenants and higher denominations, making them suitable for institutional investors, while notes are simpler and commonly issued in smaller amounts. The structural differences influence risk profiles, with debentures carrying higher risk due to lack of collateral, contrasted by notes that may offer more security depending on terms.

Legal Framework and Regulatory Requirements

Debentures are debt instruments backed by the issuer's general credit and reputation, governed primarily by securities laws and detailed corporate regulations, ensuring strict disclosure and registration requirements. Notes, often termed promissory notes, are simpler debt contracts subject to the Uniform Commercial Code (UCC) and less burdensome regulatory frameworks, allowing more flexible issuance and transferability. The legal framework for debentures involves comprehensive investor protections and periodic reporting mandates, whereas notes rely on contract law with minimal regulatory oversight.

Security and Collateral: Secured vs. Unsecured

Debentures are typically unsecured debt instruments that rely on the issuer's creditworthiness rather than specific collateral, making them riskier but flexible for creditors. Notes can be either secured or unsecured, with secured notes backed by specific assets or collateral, offering greater protection to investors in case of default. The presence or absence of collateral significantly influences the risk profile, interest rates, and investor appeal of both debentures and notes in debt financing.

Interest Rates and Payment Terms

Debentures typically offer higher interest rates compared to notes due to their unsecured nature, appealing to investors seeking greater returns. Payment terms on debentures often involve fixed periodic interest payments over a longer maturity period, whereas notes usually feature shorter durations with flexible payment schedules that can include lump-sum or installment repayments. Understanding the differences in interest rates and payment structures is crucial for tailoring debt instruments to specific financing needs and risk tolerance.

Maturity Periods: Short-Term vs. Long-Term Debt

Debentures typically represent long-term debt with maturity periods often exceeding ten years, offering companies extended financing horizons. Notes generally refer to short-term debt instruments, commonly maturing within one to five years, providing more flexible and quicker repayment options. The maturity period directly impacts interest rates, risk assessment, and liquidity management for both debenture holders and note investors.

Risk Factors for Investors and Issuers

Debentures typically carry higher risk for investors due to their unsecured nature, relying solely on the issuer's creditworthiness, while notes often have secured claims or shorter maturities reducing risk. Issuers face increased risk with debentures as they may encounter difficulty raising funds without collateral, potentially impacting credit ratings and borrowing costs. Notes expose issuers to less long-term risk since their shorter duration and possible asset backing lower default probability, benefiting overall financial stability.

Use Cases: When to Choose Debenture or Note

Debentures are typically chosen for long-term financing by corporations seeking unsecured debt with higher creditworthiness, ideal for substantial capital projects or acquisitions. Notes are preferred for shorter-term financing needs, such as working capital or bridge loans, offering flexibility in terms and lower issuance costs. Selecting between a debenture or note depends on the maturity period, credit risk profile, and specific funding requirements of the issuer.

Conclusion: Which Option is Right for You?

Choosing between a debenture and a note depends on your risk tolerance, investment horizon, and desired security level. Debentures, being unsecured, typically offer higher yields but come with increased credit risk, while notes provide secured claims with lower returns but greater safety. Evaluating your financial goals alongside the issuer's creditworthiness will guide you in selecting the most suitable debt instrument.

Important Terms

Indenture agreement

An indenture agreement is a formal contract outlining the terms and conditions between bondholders and issuers, primarily used for debentures, which are unsecured bonds backed solely by the issuer's creditworthiness. Unlike notes, which are typically shorter-term debt instruments with simpler terms, debentures governed by indenture agreements provide detailed covenants and protections to investors in long-term financing arrangements.

Unsecured debt

Unsecured debt refers to loans or financial obligations not backed by collateral, often issued as debentures or notes; debentures are long-term unsecured bonds typically issued by corporations, while notes are shorter-term unsecured debt instruments. Both serve as methods for raising capital without pledging assets, though debentures usually involve higher credit risk and interest rates due to their longer maturity periods.

Maturity period

Debentures typically have a longer maturity period, often ranging from 10 to 30 years, while notes usually have shorter maturities, commonly less than 10 years. This distinction affects the risk, interest rates, and investor appeal between debentures and notes.

Coupon rate

The coupon rate on debentures is typically fixed and higher due to longer maturities and unsecured status, while notes often have lower coupon rates reflecting their shorter terms and varied security.

Subordination

Subordination in finance prioritizes debenture holders below noteholders in claims on a company's assets during liquidation.

Registered vs. bearer

Registered debentures and notes are recorded in the issuer's name, ensuring owner details are maintained, which facilitates tracking interest payments and ownership transfer. Bearer debentures and notes do not require owner registration, allowing the holder to claim interest and principal by possession, increasing transferability but also risk of loss or theft.

Convertible instrument

Convertible instruments like debentures often carry fixed interest and longer maturities, while convertible notes typically have shorter terms and are used in early-stage financing with debt that converts into equity.

Trustee oversight

Trustee oversight in debentures ensures strict compliance with bond covenants and protects bondholders' interests, whereas notes often involve less rigorous trustee involvement due to their shorter terms and simpler structures. The trustee's role includes monitoring issuer payments, enforcing terms, and handling defaults for debentures, providing higher security compared to typical promissory note arrangements.

Promissory obligation

Promissory obligation in a debenture is a formal, unconditional commitment by the issuer to pay the holder a fixed amount, often secured against company assets, whereas a promissory note represents a written promise by an individual or entity to pay a specified sum on demand or at a future date without asset backing. Debentures typically serve as long-term debt instruments in corporate financing, while notes vary in maturity and are commonly used for short-term loans or commercial transactions.

Redemption provision

A redemption provision in a debenture or note allows the issuer to repay the principal before maturity, protecting investors by specifying terms such as redemption price, dates, and conditions.

debenture vs note Infographic

moneydif.com

moneydif.com