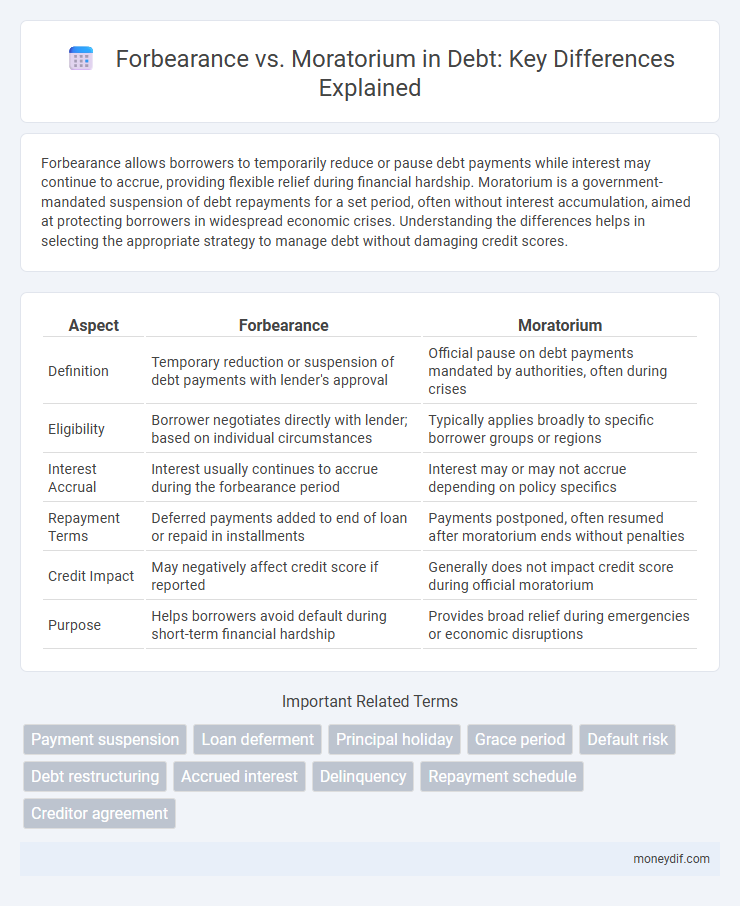

Forbearance allows borrowers to temporarily reduce or pause debt payments while interest may continue to accrue, providing flexible relief during financial hardship. Moratorium is a government-mandated suspension of debt repayments for a set period, often without interest accumulation, aimed at protecting borrowers in widespread economic crises. Understanding the differences helps in selecting the appropriate strategy to manage debt without damaging credit scores.

Table of Comparison

| Aspect | Forbearance | Moratorium |

|---|---|---|

| Definition | Temporary reduction or suspension of debt payments with lender's approval | Official pause on debt payments mandated by authorities, often during crises |

| Eligibility | Borrower negotiates directly with lender; based on individual circumstances | Typically applies broadly to specific borrower groups or regions |

| Interest Accrual | Interest usually continues to accrue during the forbearance period | Interest may or may not accrue depending on policy specifics |

| Repayment Terms | Deferred payments added to end of loan or repaid in installments | Payments postponed, often resumed after moratorium ends without penalties |

| Credit Impact | May negatively affect credit score if reported | Generally does not impact credit score during official moratorium |

| Purpose | Helps borrowers avoid default during short-term financial hardship | Provides broad relief during emergencies or economic disruptions |

Understanding Debt: Forbearance vs Moratorium

Forbearance allows borrowers to temporarily reduce or pause debt payments while interest continues to accrue, offering short-term relief without erasing the debt obligation. Moratorium, on the other hand, typically grants a legally authorized suspension of debt payments and interest accrual for a specified period, aiming to provide more comprehensive debt respite. Understanding these distinctions helps debtors manage financial hardship by selecting the appropriate relief option based on their long-term repayment capacity and lender agreements.

Key Differences Between Forbearance and Moratorium

Forbearance allows borrowers temporary relief by postponing or reducing loan payments while interest may continue to accrue, typically arranged through formal agreements with lenders. Moratorium involves a legally authorized suspension of debt obligations for a specific period, often implemented by governments during crises, halting payments without penalties or interest accrual. Unlike forbearance, moratoriums provide blanket relief, impacting broader debtor groups without requiring individual negotiations.

How Forbearance Works in Debt Management

Forbearance in debt management allows borrowers to temporarily reduce or pause loan payments while interest may continue to accrue, helping avoid default during financial hardship. Lenders agree to forbearance based on borrower requests, often requiring a formal plan outlining repayment terms post-forbearance. This arrangement preserves credit standing better than missed payments, providing structured relief without loan forgiveness.

Moratorium Explained: What Debtors Need to Know

A moratorium is a legally authorized temporary suspension of debt payments, allowing debtors relief from financial obligations without penalties during economic hardship. Unlike forbearance, which often requires negotiated terms between borrower and lender, a moratorium is typically imposed by governments or regulatory bodies to provide nationwide debt relief. Understanding the duration, eligibility criteria, and implications of moratoriums is crucial for debtors to effectively manage their liabilities and avoid long-term credit damage.

Eligibility Criteria: Forbearance vs Moratorium

Forbearance eligibility requires borrowers to demonstrate temporary financial hardship and may involve credit score assessments and documentation of income loss, while moratorium eligibility is often granted more broadly by governments or lenders during crises without stringent individual assessments. Forbearance agreements typically require a formal application process, proof of hardship, and lender approval, whereas moratoriums are commonly implemented as blanket policies affecting entire borrower categories such as students or mortgage holders. Understanding these criteria is essential for debtors aiming to navigate repayment relief options effectively.

Impact on Credit Score: Comparing Forbearance and Moratorium

Forbearance allows temporary reduction or suspension of debt payments while generally avoiding negative impact on credit scores if agreed upon with the lender. Moratorium provides a legal suspension of debt obligations, often mandated by government relief programs, which typically does not harm credit scores as payments are temporarily paused but expected to resume. Both options help prevent defaults, yet the precise credit score impact depends on lender reporting practices and adherence to payment resumption terms.

Legal Implications: Forbearance and Moratorium in Debt Relief

Forbearance in debt relief involves a lender's legal agreement to temporarily reduce or suspend payments, maintaining the original loan terms and borrower's obligation to repay under adjusted conditions. A moratorium legally suspends all debt payments for a specified period, often enacted by governments during financial crises, potentially altering repayment schedules and affecting creditor rights. Both mechanisms impact borrower-creditor contracts, with forbearance preserving contractual obligations more directly while moratoriums may invoke statutory relief with broader legal protections.

Duration and Terms: Forbearance vs Moratorium

Forbearance typically involves a temporary reduction or suspension of debt payments agreed upon between the borrower and lender, often lasting from a few months up to a year, with specific terms outlining repayment schedules. Moratorium, on the other hand, is a legally authorized pause on debt obligations granted by authorities or lenders, usually spanning a longer duration, such as six months to multiple years, without accruing penalties or interest during the period. Both options provide relief, but forbearance requires negotiated terms for repayment whereas moratorium offers a legally protected suspension.

Pros and Cons: Choosing Forbearance or Moratorium

Forbearance allows borrowers to temporarily reduce or pause loan payments, preserving credit standing but often resulting in accrued interest, increasing overall debt. Moratorium halts repayments for a defined period without penalties, offering critical relief during financial hardship but potentially impacting future credit evaluations and extending loan terms. Selecting between forbearance and moratorium depends on the borrower's ability to resume payments and their long-term financial strategy.

Which Option is Best for Your Debt Situation?

Forbearance temporarily reduces or suspends loan payments, allowing borrowers to catch up without penalty, making it ideal for short-term financial difficulties. A moratorium halts payments entirely for a set period, best suited for severe hardships but may lead to interest accrual and increased future balances. Evaluate your ability to resume payments and the impact on loan interest before choosing the best option for managing your debt.

Important Terms

Payment suspension

Payment suspension under forbearance allows temporary reduction or delay of loan payments with potential interest accrual, whereas a moratorium grants a legally mandated pause on payments without additional charges. Both measures aim to ease borrower financial stress but differ in terms and impact on credit reporting and loan maturity.

Loan deferment

Loan deferment pauses payments due to specific borrower hardship, while forbearance temporarily reduces or suspends payments amid financial difficulties, and moratorium is a legally mandated suspension of loan repayments during emergencies.

Principal holiday

Principal holidays provide temporary relief by allowing borrowers to pause principal repayments without accumulating penalties, differing from moratoriums that typically suspend both principal and interest payments. Forbearance agreements focus on leniency in repayment terms during financial hardship, whereas moratoriums offer a formal, government-backed suspension period, often applied during economic crises.

Grace period

A grace period in loan repayment allows temporary suspension or reduction of payments, differing from forbearance which permits delayed payments with interest accrual, while a moratorium halts repayments entirely without penalties during crises.

Default risk

Default risk increases significantly in forbearance agreements due to relaxed payment terms without waiving obligations, contrasting with moratoriums that temporarily suspend payments and provide clearer timelines for resumption. Lenders typically assess moratoriums as lower-risk interventions since moratoriums offer structured relief, while forbearance may mask underlying financial stress and delay potential defaults.

Debt restructuring

Debt restructuring through forbearance allows temporary relief by delaying payments without altering original loan terms, while a moratorium imposes a formal suspension of debt obligations for a set period, affecting loan repayment schedules.

Accrued interest

Accrued interest during forbearance continues to accumulate and may be capitalized, whereas moratorium typically suspends both payments and interest accrual temporarily.

Delinquency

Delinquency rates often decrease during forbearance periods due to temporary payment relief, whereas moratoriums typically suspend payment obligations without categorizing accounts as delinquent.

Repayment schedule

A repayment schedule during forbearance allows borrowers to temporarily reduce or pause payments while interest may continue to accrue, affecting the overall loan balance. In contrast, a moratorium typically suspends all repayments and interest accrual for a defined period, providing full relief but potentially extending the loan tenure once the moratorium ends.

Creditor agreement

A creditor agreement detailing forbearance allows temporary relief from debt obligations without erasing the debt, whereas a moratorium legally suspends payment obligations for a specified period, protecting the debtor from default consequences.

forbearance vs moratorium Infographic

moneydif.com

moneydif.com