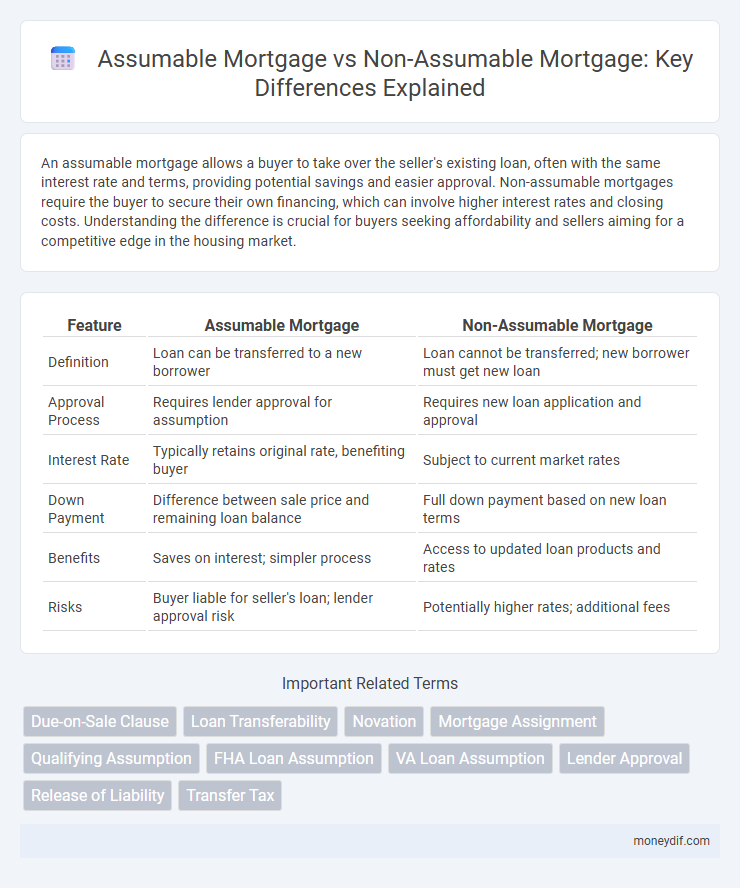

An assumable mortgage allows a buyer to take over the seller's existing loan, often with the same interest rate and terms, providing potential savings and easier approval. Non-assumable mortgages require the buyer to secure their own financing, which can involve higher interest rates and closing costs. Understanding the difference is crucial for buyers seeking affordability and sellers aiming for a competitive edge in the housing market.

Table of Comparison

| Feature | Assumable Mortgage | Non-Assumable Mortgage |

|---|---|---|

| Definition | Loan can be transferred to a new borrower | Loan cannot be transferred; new borrower must get new loan |

| Approval Process | Requires lender approval for assumption | Requires new loan application and approval |

| Interest Rate | Typically retains original rate, benefiting buyer | Subject to current market rates |

| Down Payment | Difference between sale price and remaining loan balance | Full down payment based on new loan terms |

| Benefits | Saves on interest; simpler process | Access to updated loan products and rates |

| Risks | Buyer liable for seller's loan; lender approval risk | Potentially higher rates; additional fees |

Understanding Assumable Mortgages

Assumable mortgages allow buyers to take over the seller's existing loan, often preserving the original interest rate and terms, which can be beneficial in rising interest rate environments. These loans are typically government-backed, such as FHA, VA, and USDA mortgages, and require lender approval to ensure the buyer's creditworthiness. Understanding the conditions and benefits of assumable mortgages helps buyers evaluate potential savings and streamline the home financing process.

What Is a Non-Assumable Mortgage?

A non-assumable mortgage is a home loan that cannot be transferred from the current borrower to a new buyer. This type of mortgage requires the buyer to obtain their own financing, rather than taking over the seller's existing loan terms. Non-assumable mortgages often include most conventional loans and some government-backed loans, limiting the flexibility for homebuyers during property transfers.

Key Differences Between Assumable and Non-Assumable Mortgages

Assumable mortgages allow buyers to take over the existing loan terms, including interest rate and balance, providing a potential cost advantage in a rising interest rate environment. Non-assumable mortgages require buyers to secure new financing, often resulting in different terms and possibly higher rates. Key differences include eligibility restrictions for assumable loans, potential lender approval requirements, and the impact on credit qualification and closing costs.

Pros and Cons of Assumable Mortgages

Assumable mortgages offer the advantage of potentially lower interest rates by allowing buyers to take over the seller's existing loan, which can save on closing costs and expedite the approval process. However, they also carry the risk of assuming the original borrower's debt obligations and often require lender approval, which may limit eligibility. The financial benefit hinges on the difference between the existing mortgage rate and current market rates, making assumable mortgages more attractive in rising interest rate environments.

Pros and Cons of Non-Assumable Mortgages

Non-assumable mortgages prevent buyers from taking over the seller's existing loan, ensuring lenders maintain control over borrower qualifications and safeguarding against interest rate risk. This limitation can reduce marketability and may require buyers to secure new financing, often at higher current rates. However, non-assumable loans provide lenders with security by verifying each borrower's creditworthiness and updating loan terms accordingly.

Eligibility Criteria for Assumable Mortgages

Eligibility criteria for assumable mortgages typically include a thorough credit check, proof of sufficient income, and financial stability to ensure the buyer can meet ongoing payment obligations. Most lenders require the new borrower to qualify under the original loan terms, including debt-to-income ratio and employment verification. Certain government-backed loans like FHA and VA mortgages often permit assumption subject to strict eligibility requirements and lender approval.

How to Transfer an Assumable Mortgage

Transferring an assumable mortgage requires obtaining lender approval, as the new borrower must meet credit and income qualifications. The process involves submitting an application, paying assumption fees, and completing necessary documentation to formally transfer loan responsibility. This option can simplify home sales by allowing buyers to take over existing loan terms, potentially saving on interest rates and closing costs.

Costs Involved in Assumable vs Non-Assumable Mortgages

Assumable mortgages often reduce upfront costs by allowing the buyer to take over the seller's existing loan terms, potentially avoiding higher interest rates and certain closing fees associated with new loans. Non-assumable mortgages typically involve higher expenses due to the need to secure a completely new loan, which includes appraisal fees, loan origination charges, and increased lender underwriting costs. Understanding the cost differential between assumable and non-assumable mortgages is crucial for borrowers aiming to minimize out-of-pocket expenses during home financing.

Impact on Home Buyers and Sellers

Assumable mortgages allow home buyers to take over the seller's existing loan terms, often resulting in lower interest rates and reduced closing costs, making the purchase more affordable and attractive. Sellers benefit by appealing to a broader pool of buyers and potentially facilitating a faster sale in a competitive market. Non-assumable mortgages require buyers to secure new financing, which can involve higher interest rates and increased qualification hurdles, potentially slowing the transaction process and limiting buyer flexibility.

Which Mortgage Option Is Right for You?

Choosing between an assumable mortgage and a non-assumable mortgage depends on your financial situation and market conditions. An assumable mortgage allows buyers to take over the seller's existing loan with its current interest rate, which can be beneficial in rising rate environments. Non-assumable mortgages require new financing, often with updated terms that may be less favorable, making assumable loans more attractive for cost savings and faster closings when available.

Important Terms

Due-on-Sale Clause

The due-on-sale clause requires full mortgage repayment upon property transfer, typically preventing assumable mortgage benefits by restricting new borrower assumption; non-assumable mortgages strictly enforce this clause, disallowing assumption and necessitating refinancing, while some assumable mortgages waive the clause, permitting buyers to take over existing loan terms and rates. This distinction significantly impacts property sale flexibility and financing options, influencing buyers' ability to assume seller's mortgage under existing conditions.

Loan Transferability

Loan transferability determines whether a mortgage can be passed from the original borrower to a new buyer; assumable mortgages allow the new buyer to take over the existing loan's terms, interest rate, and balance, providing a potential advantage in a rising rate environment. Non-assumable mortgages, in contrast, require the original loan to be paid off at sale, compelling the buyer to secure new financing, which may involve higher interest rates and stricter credit requirements.

Novation

Novation in mortgage contracts involves substituting a new borrower who assumes all rights and obligations, making the mortgage assumable and relieving the original borrower from liability. In contrast, non-assumable mortgages prohibit novation, requiring the full balance to be paid off upon transfer, preventing the new party from taking over loan terms.

Mortgage Assignment

Mortgage assignment involves transferring the ownership and servicing rights of a mortgage from the original lender to a new entity, impacting both assumable and non-assumable loans differently; assumable mortgages allow the buyer to take over the existing loan terms, while non-assumable mortgages require new financing approval. Understanding the distinctions between assumable and non-assumable mortgages is crucial for homeowners and buyers as it affects loan transferability, qualification requirements, and potential financial liabilities.

Qualifying Assumption

Qualifying assumptions in mortgage lending determine whether a borrower can take over an existing loan, typically required for assumable mortgages to ensure the new borrower meets credit and income standards. Non-assumable mortgages do not permit transfer of the loan to another borrower, making qualifying assumptions irrelevant since the new buyer must secure their own financing.

FHA Loan Assumption

FHA loan assumption allows a buyer to take over the seller's existing mortgage under its original terms, often providing lower interest rates compared to current market rates. Unlike non-assumable mortgages, which require new financing, assumable FHA loans streamline the home buying process and can result in significant savings and easier qualification for the buyer.

VA Loan Assumption

VA loan assumption allows qualified buyers to take over an existing VA loan's terms, often benefiting from lower interest rates and reduced closing costs compared to obtaining a new mortgage. Unlike non-assumable mortgages, which require full refinancing, assumable mortgages streamline the home purchase process and can enhance marketability for veterans by preserving favorable loan conditions.

Lender Approval

Lender approval is crucial in assumable mortgages as the new borrower must meet the lender's credit and financial criteria to take over the existing loan, ensuring risk management and loan performance. Non-assumable mortgages do not permit transfer without full loan payoff, requiring new buyers to secure independent financing approved by the lender.

Release of Liability

A release of liability in an assumable mortgage allows the original borrower to be legally freed from future obligations once the mortgage is transferred to a new borrower, whereas in a non-assumable mortgage, the original borrower remains liable since the mortgage cannot be transferred. This release is critical in assumable mortgages to prevent the original borrower from bearing financial risk after the transfer, a protection not available with non-assumable loans.

Transfer Tax

Transfer tax is a government-imposed fee on the transfer of property ownership, influencing the cost-effectiveness of assuming a mortgage. Assumable mortgages can reduce transfer tax expenses by allowing buyers to take over existing loan terms without triggering new tax assessments, whereas non-assumable mortgages often require full loan payoff and new financing, potentially increasing transfer tax liabilities.

Assumable Mortgage vs Non-Assumable Mortgage Infographic

moneydif.com

moneydif.com