Subordination in mortgage agreements involves prioritizing one debt over another, ensuring certain liens take precedence in repayment during foreclosure. Subrogation allows a party, such as a lender who has paid off a debtor's obligation, to assume the legal rights of the original creditor to pursue recovery from the borrower. Understanding the distinction impacts negotiation strategies and rights enforcement within mortgage financing and debt repayment scenarios.

Table of Comparison

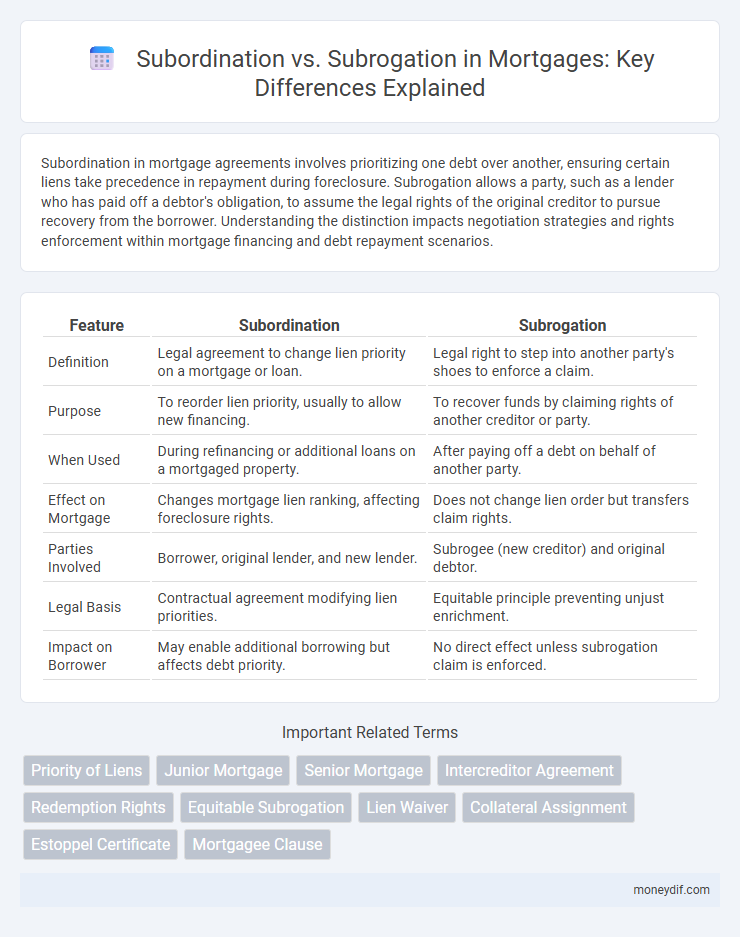

| Feature | Subordination | Subrogation |

|---|---|---|

| Definition | Legal agreement to change lien priority on a mortgage or loan. | Legal right to step into another party's shoes to enforce a claim. |

| Purpose | To reorder lien priority, usually to allow new financing. | To recover funds by claiming rights of another creditor or party. |

| When Used | During refinancing or additional loans on a mortgaged property. | After paying off a debt on behalf of another party. |

| Effect on Mortgage | Changes mortgage lien ranking, affecting foreclosure rights. | Does not change lien order but transfers claim rights. |

| Parties Involved | Borrower, original lender, and new lender. | Subrogee (new creditor) and original debtor. |

| Legal Basis | Contractual agreement modifying lien priorities. | Equitable principle preventing unjust enrichment. |

| Impact on Borrower | May enable additional borrowing but affects debt priority. | No direct effect unless subrogation claim is enforced. |

Understanding Subordination and Subrogation in Mortgages

Subordination in mortgages refers to the process where a lender agrees to lower the priority of their lien, allowing a new mortgage to take precedence. Subrogation occurs when a party, usually an insurer or secondary lender, assumes the rights and claims of the primary mortgage holder after paying off the debt. Understanding the distinct legal implications of subordination and subrogation is crucial for navigating lien priorities and protecting lender interests in real estate transactions.

Key Differences Between Subordination and Subrogation

Subordination in mortgage financing involves prioritizing one lien over another, where a junior lien holder consents to have their claim ranked behind a senior lien. Subrogation allows an insurer or third party to assume the legal rights of a claimant to recover funds after paying a debt or loss. The key difference lies in subordination managing lien priority between creditors, while subrogation transfers legal rights to seek reimbursement.

What Is Mortgage Subordination?

Mortgage subordination is the process where a lien or mortgage takes a lower priority compared to another lien on the same property, meaning that in case of default, the primary lienholder is paid first. This agreement legally alters the order of repayment priorities, often used when a homeowner refinances or takes out a second mortgage. Subordination ensures that the new or refinanced loan gets priority status over existing liens, affecting borrowers' loan terms and repayment structures.

How Subrogation Works in Mortgage Lending

Subrogation in mortgage lending allows a lender who has paid off a borrower's debt to assume the rights and claims of the original creditor, enabling recovery from the borrower or other parties responsible for the loan. This legal principle ensures that the lender can pursue repayment or enforce collateral rights without being disadvantaged by prior claims. Subrogation rights become critical when loans are refinanced or paid off by secondary lenders, preserving the financial interests involved in mortgage transactions.

When Is Subordination Necessary in Home Loans?

Subordination is necessary in home loans when a borrower takes out a second mortgage or home equity loan, requiring the lender to agree that their lien is secondary to the primary mortgage. This ensures that the first lender's claim has priority in case of default or foreclosure, protecting their investment. Subrogation typically occurs when an insurer steps into the shoes of the lender to recover losses but does not affect lien priorities like subordination does.

The Role of Subrogation in Mortgage Refinancing

Subrogation in mortgage refinancing allows a new lender to step into the shoes of the original lender, ensuring priority in lien position without requiring explicit subordination agreements. This legal mechanism facilitates seamless transfer of rights, protecting the new lender's interests while maintaining the borrower's refinancing benefits. By enabling efficient claim substitution, subrogation minimizes complications in title and lien hierarchy throughout the refinancing process.

Impacts of Subordination on Lien Priority

Subordination impacts lien priority by allowing a junior lien to become superior to a senior lien, effectively altering the order in which debts are repaid during foreclosure. This can affect the risk profile for lenders, as the subordinated lienholder may receive payment only after the higher-priority liens are satisfied. Understanding subordination agreements is crucial for mortgage professionals to assess lien hierarchy and manage potential impacts on loan security and recovery rights.

Common Scenarios for Subrogation in Mortgages

Common scenarios for subrogation in mortgages often arise when a lender pays off a borrower's delinquent property taxes or HOA fees to protect their lien priority. This allows the lender to step into the borrower's shoes, gaining the right to pursue reimbursement from the borrower for the expenses paid on their behalf. Subrogation frequently occurs during loan payoffs, insurance claim settlements, or when junior liens are cleared to maintain the primary mortgage's secured position.

Pros and Cons: Subordination vs. Subrogation

Subordination prioritizes a primary mortgage over secondary liens, enabling borrowers to refinance or obtain additional loans, but it can expose junior lienholders to higher risk and delayed payments. Subrogation allows a lender paying off another's debt to assume their rights, improving recovery chances yet potentially complicating priority and increasing administrative costs. Choosing between subordination and subrogation depends on the lender's risk tolerance, loan structure, and the desired protection of loan positions.

Choosing the Right Approach: Subordination or Subrogation

Choosing between subordination and subrogation in mortgage agreements hinges on priority and risk management preferences. Subordination adjusts lien priority, allowing junior loans to remain behind senior liens, optimizing loan structuring for refinancing or additional borrowing. Subrogation permits an entity, such as a lender or insurer, to assume the rights of the original party, enabling recovery of debts while stepping into the creditor's position to enforce repayment.

Important Terms

Priority of Liens

Priority of liens determines the order in which creditors are paid from a debtor's assets, where subordination agreements explicitly rank one lien below another, altering the typical priority sequence. Subrogation allows a party who pays off a debt to step into the creditor's shoes and assume their lien priority, effectively replacing the original creditor without changing the established lien order.

Junior Mortgage

Junior mortgage subordination establishes a lien priority, allowing a primary or senior mortgage to maintain precedence in repayment and foreclosure, whereas subrogation involves one party stepping into the legal rights of another to claim repayment, often seen when a junior lienholder pays off a senior debt. Understanding the distinction between subordination's priority adjustment and subrogation's creditor rights transfer is critical for lenders managing lien positions and borrower obligations in real estate financing.

Senior Mortgage

Senior mortgage holders hold primary claim priority over junior liens in a subordination agreement, ensuring their debt is repaid first in foreclosure proceedings. In contrast, subrogation allows a party, often a junior lienholder who pays off a senior mortgage, to step into the shoes of the senior creditor and assert the same rights.

Intercreditor Agreement

An Intercreditor Agreement delineates the priorities and rights among multiple creditors, specifying subordination, which ranks one creditor's claims below another's, versus subrogation, allowing a party to assume another's legal rights after payment. These distinctions affect repayment order, enforcement rights, and recovery processes in multi-lender financing structures.

Redemption Rights

Redemption rights allow a borrower to reclaim property by paying off a debt, directly impacting the priority of claims in subordination and subrogation disputes. In subordination, redemption may be limited as one creditor agrees to lower priority, whereas in subrogation, redemption rights enable a party who has paid off an obligation to step into the shoes of the original creditor and assert rights accordingly.

Equitable Subrogation

Equitable subrogation allows a party who pays a debt on behalf of another to step into the creditor's shoes, recovering the payment from the debtor while maintaining priority over subsequent claims. In contrast, subordination involves altering the priority of claims, often ranking one creditor's rights below another, whereas subrogation transfers the right to enforce the original claim without changing its priority.

Lien Waiver

A lien waiver is a legal document that relinquishes a party's right to place a lien on a property, often used to facilitate payment and project completion. Subordination refers to prioritizing lien claims behind others, while subrogation allows one party to assume another's legal rights, both impacting lien waiver enforcement in construction finance.

Collateral Assignment

Collateral assignment involves transferring rights in an asset as security for a debt, which can affect creditor priorities in legal disputes. Subordination adjusts the order of creditor claims on collateral by agreement, whereas subrogation allows one party to assume another's rights after fulfilling their obligations, impacting recovery sequences.

Estoppel Certificate

An Estoppel Certificate is a legal document used to confirm the terms and status of a lease or loan, critical in clarifying rights during Subordination and Subrogation disputes. In Subordination, the Estoppel Certificate establishes priority by confirming that one party's claim or interest is secondary, while in Subrogation, it helps determine the substituted party's rights to step into another's position for recovery purposes.

Mortgagee Clause

The Mortgagee Clause protects the lender's interest in property insurance proceeds in case of damage, establishing priority over other claims through subordination agreements that defer other liens to the mortgagee's claim. Subrogation allows the insurer to pursue recovery from a third party responsible for the loss, ensuring compensation without altering the mortgagee's priority rights under the clause.

Subordination vs Subrogation Infographic

moneydif.com

moneydif.com