A recourse loan allows the lender to pursue the borrower's other assets if the collateral, typically the property, does not cover the outstanding mortgage balance. In contrast, a nonrecourse loan limits the lender's recovery to the collateral alone, protecting the borrower's other assets from seizure. Understanding the differences between these loan types is crucial for managing financial risk when obtaining a mortgage.

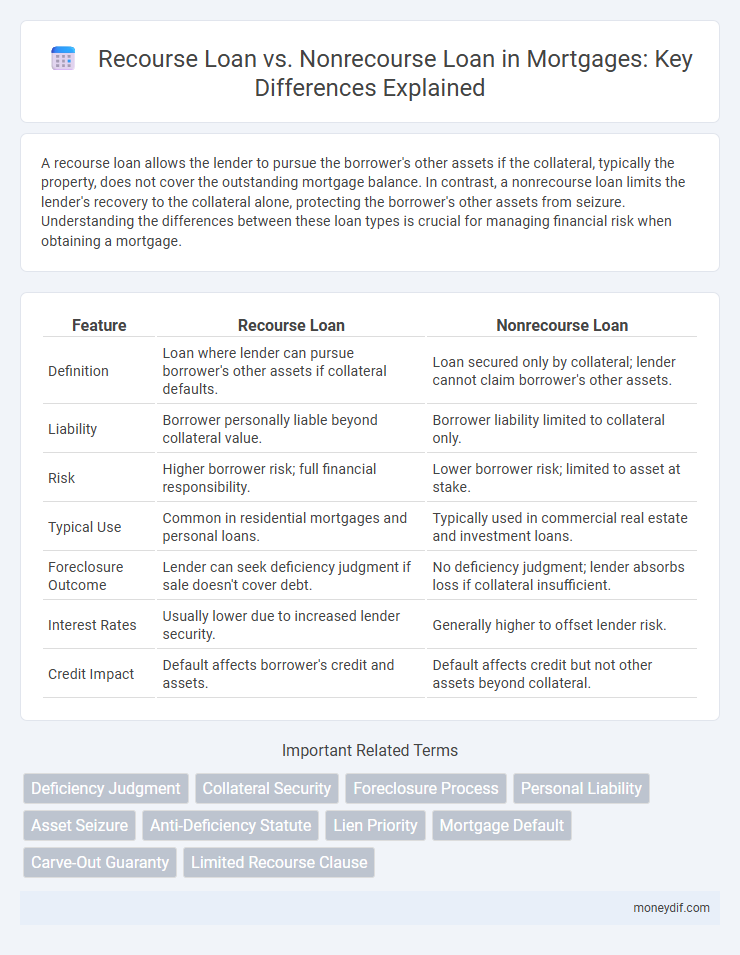

Table of Comparison

| Feature | Recourse Loan | Nonrecourse Loan |

|---|---|---|

| Definition | Loan where lender can pursue borrower's other assets if collateral defaults. | Loan secured only by collateral; lender cannot claim borrower's other assets. |

| Liability | Borrower personally liable beyond collateral value. | Borrower liability limited to collateral only. |

| Risk | Higher borrower risk; full financial responsibility. | Lower borrower risk; limited to asset at stake. |

| Typical Use | Common in residential mortgages and personal loans. | Typically used in commercial real estate and investment loans. |

| Foreclosure Outcome | Lender can seek deficiency judgment if sale doesn't cover debt. | No deficiency judgment; lender absorbs loss if collateral insufficient. |

| Interest Rates | Usually lower due to increased lender security. | Generally higher to offset lender risk. |

| Credit Impact | Default affects borrower's credit and assets. | Default affects credit but not other assets beyond collateral. |

Recourse Loan vs Nonrecourse Loan: Key Differences

Recourse loans allow lenders to pursue borrowers personally for any loan balance remaining after collateral foreclosure, whereas nonrecourse loans limit the lender's recovery strictly to the collateral itself. In recourse loans, borrowers bear higher financial risk due to potential personal liability, while nonrecourse loans provide borrowers protection from deficiency judgments. The choice between recourse and nonrecourse loans significantly impacts borrower liability, loan terms, and risk management strategies in mortgage financing.

Understanding Recourse Mortgages

Recourse mortgages require borrowers to be personally liable for the loan balance if the property's value declines below the outstanding debt after foreclosure, allowing lenders to pursue other assets for repayment. Nonrecourse loans limit the lender's recovery strictly to the property used as collateral, providing borrowers with protection against deficiency judgments. Understanding the distinctions in borrower liability and lender rights is essential when choosing between recourse and nonrecourse mortgage options.

Nonrecourse Loans Explained

Nonrecourse loans limit the lender's recovery to the collateral specified in the loan agreement, usually the property itself, protecting the borrower's other assets from being targeted in case of default. These loans are commonly used in commercial real estate and some residential investment properties, where the lender cannot pursue the borrower's personal assets beyond the property. Nonrecourse loans typically have higher interest rates and stricter qualification criteria to offset the increased risk for lenders.

Pros and Cons of Recourse Loans

Recourse loans provide lenders the right to pursue the borrower's other assets if the sale of the collateral property doesn't cover the outstanding debt, offering greater security for lenders and potentially lower interest rates for borrowers. However, the risk of personal liability can lead to financial strain for borrowers if property values decline or default occurs, making recourse loans less attractive in uncertain markets. Despite these risks, recourse loans often facilitate borrowing larger sums with more favorable terms compared to nonrecourse loans.

Advantages and Disadvantages of Nonrecourse Loans

Nonrecourse loans limit the borrower's liability to the collateral, offering protection against personal asset seizure beyond the secured property, which reduces financial risk in default situations. However, nonrecourse loans often come with higher interest rates and stricter qualification requirements, reflecting increased lender risk. These loans can benefit real estate investors by capping potential losses but may limit borrowing capacity compared to recourse loans.

How Recourse and Nonrecourse Loans Impact Borrowers

Recourse loans allow lenders to pursue borrowers' other assets beyond the collateral if the loan defaults, increasing financial risk for borrowers. Nonrecourse loans limit lender recovery to the collateral only, protecting borrowers from further liability but often result in higher interest rates. Understanding these differences helps borrowers assess risk exposure and choose the best mortgage option for their financial situation.

Risk Factors for Lenders and Borrowers

Recourse loans expose borrowers to greater personal liability, as lenders can pursue other assets beyond the collateral if the loan defaults, increasing borrower risk. Lenders face lower risk with recourse loans because they have broader recovery options, enhancing loan security and reducing potential losses. Nonrecourse loans limit lender recovery to the collateral asset only, which increases lender risk but reduces borrower risk by capping financial exposure to the pledged property.

Legal Implications of Recourse vs Nonrecourse Mortgages

Recourse loans allow lenders to pursue the borrower's personal assets beyond the collateral if the mortgage debt is not fully satisfied, creating greater financial liability for the borrower. Nonrecourse loans limit the lender's recovery strictly to the collateral property, protecting borrowers from deficiency judgments and personal asset seizure. Understanding these legal distinctions is crucial for borrowers assessing risk exposure in mortgage agreements.

Qualifying for Recourse and Nonrecourse Home Loans

Qualifying for recourse home loans typically involves stronger credit scores, lower debt-to-income ratios, and higher income verification since lenders have the right to pursue borrowers' other assets if the loan defaults. Nonrecourse loans often require higher down payments, stringent property appraisals, and may limit borrower eligibility to investors or properties in certain jurisdictions, as the lender's recovery is restricted to the collateral property alone. Understanding these qualification criteria is essential for securing the appropriate mortgage type based on financial stability and risk tolerance.

Choosing the Right Mortgage: Recourse or Nonrecourse?

Choosing the right mortgage involves understanding the key differences between recourse and nonrecourse loans, where recourse loans allow lenders to pursue personal assets beyond the collateral in case of default, while nonrecourse loans restrict lender claims to the collateral only. Borrowers seeking greater financial protection often prefer nonrecourse loans to limit liability, whereas those with strong credit and lower interest rates might opt for recourse loans due to potentially better terms. Evaluating creditworthiness, loan terms, and risk tolerance is essential for making an informed decision between recourse or nonrecourse mortgage options.

Important Terms

Deficiency Judgment

A deficiency judgment arises when the sale of a collateral property does not cover the outstanding loan balance, allowing lenders to pursue the borrower's other assets in a recourse loan but not in a nonrecourse loan. Recourse loans provide lenders with legal rights to recover the remaining debt beyond foreclosure, whereas nonrecourse loans limit the lender's recovery strictly to the collateral property.

Collateral Security

Collateral security mitigates lender risk by providing assets that can be seized if a borrower defaults, commonly used in recourse loans where the lender can pursue both collateral and the borrower's other assets for repayment. Nonrecourse loans limit the lender's claim strictly to the collateral, making the asset the sole source of repayment and shielding the borrower's other property from seizure.

Foreclosure Process

The foreclosure process in a recourse loan allows lenders to pursue the borrower's other assets beyond the collateral to recover the loan balance, whereas in a nonrecourse loan, lenders can only seize the specified collateral property without seeking additional repayment. Understanding the distinctions between recourse and nonrecourse loans is crucial for borrowers facing foreclosure, as it directly impacts financial liability and potential credit consequences.

Personal Liability

Personal liability in recourse loans requires the borrower to be personally responsible for the full repayment, allowing lenders to pursue personal assets if the collateral value is insufficient. Nonrecourse loans limit repayment to the collateral only, shielding the borrower's other assets from creditor claims in case of default.

Asset Seizure

Asset seizure is a critical risk in recourse loans since lenders can pursue borrower assets beyond collateral to recover outstanding debt, whereas nonrecourse loans limit lender claims strictly to the collateral pledged, protecting other borrower assets from seizure. Understanding the differences in asset seizure exposure between recourse and nonrecourse loans is essential for borrowers managing liability risk and lenders assessing loan security.

Anti-Deficiency Statute

The Anti-Deficiency Statute limits a lender's ability to pursue a borrower for any remaining debt balance after foreclosure on a nonrecourse loan, whereas recourse loans allow lenders to seek a deficiency judgment to recover outstanding amounts. This legal protection in nonrecourse loans shifts the credit risk to the lender, restricting borrower liability beyond the collateral property.

Lien Priority

Lien priority determines the order in which creditors are paid from collateral in case of borrower default, with recourse loans allowing lenders to pursue the borrower's other assets beyond the collateral. Nonrecourse loans limit the lender's recovery to the collateral alone, making lien priority critical in securing repayment and influencing risk assessment.

Mortgage Default

Mortgage default occurs when a borrower fails to meet the loan repayment obligations, leading to potential foreclosure. Recourse loans allow lenders to pursue the borrower's other assets beyond the collateral in case of default, whereas nonrecourse loans limit the lender's recovery exclusively to the collateral property.

Carve-Out Guaranty

A Carve-Out Guaranty specifically holds the borrower personally liable for certain defined obligations within a Nonrecourse Loan, creating exceptions where the lender can seek repayment beyond collateral foreclosure. In contrast, Recourse Loans inherently allow lenders to pursue the borrower's other assets for repayment, often making a Carve-Out Guaranty unnecessary.

Limited Recourse Clause

A Limited Recourse Clause restricts the lender's claim to specific collateral, reducing borrower liability compared to a Recourse Loan where the lender can pursue personal assets for repayment. In contrast, a Nonrecourse Loan fully limits the lender's recovery to the collateral alone, eliminating any borrower liability beyond the secured asset.

Recourse Loan vs Nonrecourse Loan Infographic

moneydif.com

moneydif.com