Recasting a mortgage involves making a lump sum payment toward the principal balance, which reduces monthly payments without changing the interest rate or loan term. Refinancing replaces the existing loan with a new one, often to secure a lower interest rate or adjust the loan term, though it typically requires closing costs and a credit check. Choosing between recasting and refinancing depends on factors such as current interest rates, closing cost tolerance, and long-term financial goals.

Table of Comparison

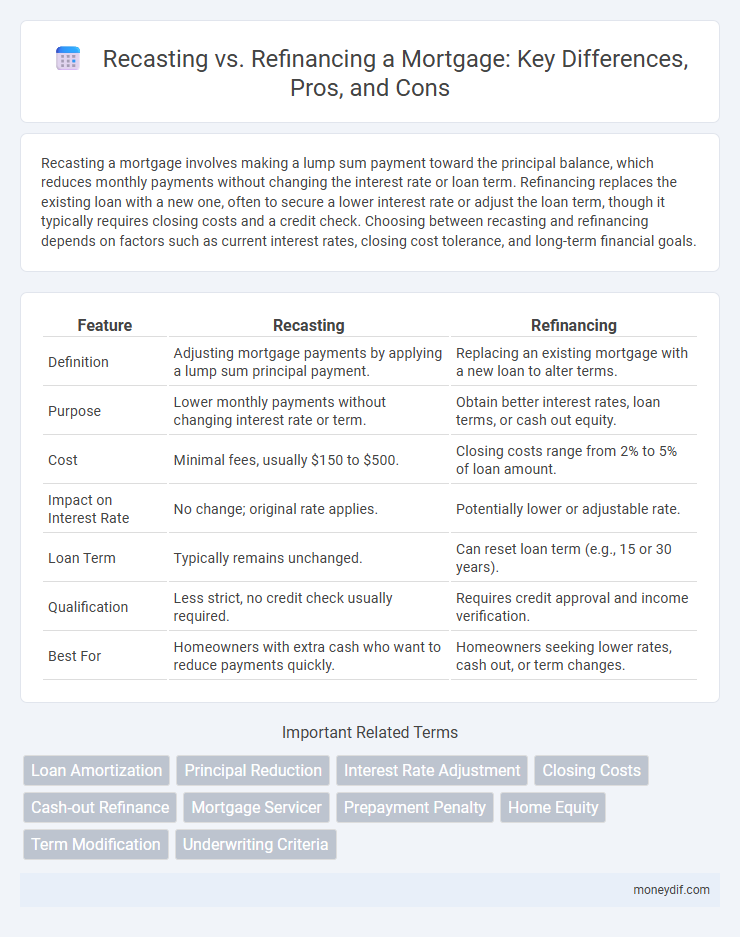

| Feature | Recasting | Refinancing |

|---|---|---|

| Definition | Adjusting mortgage payments by applying a lump sum principal payment. | Replacing an existing mortgage with a new loan to alter terms. |

| Purpose | Lower monthly payments without changing interest rate or term. | Obtain better interest rates, loan terms, or cash out equity. |

| Cost | Minimal fees, usually $150 to $500. | Closing costs range from 2% to 5% of loan amount. |

| Impact on Interest Rate | No change; original rate applies. | Potentially lower or adjustable rate. |

| Loan Term | Typically remains unchanged. | Can reset loan term (e.g., 15 or 30 years). |

| Qualification | Less strict, no credit check usually required. | Requires credit approval and income verification. |

| Best For | Homeowners with extra cash who want to reduce payments quickly. | Homeowners seeking lower rates, cash out, or term changes. |

Understanding Mortgage Recasting and Refinancing

Mortgage recasting allows borrowers to reduce monthly payments by making a large lump-sum principal payment without altering the original loan terms, offering lower fees and fewer credit checks compared to refinancing. Refinancing replaces an existing mortgage with a new loan, potentially securing better interest rates or loan terms but often involves closing costs, appraisal fees, and credit approval. Understanding the differences between recasting and refinancing helps homeowners choose the best strategy to lower payments or adjust loan terms based on their financial goals.

Key Differences Between Recasting and Refinancing

Recasting a mortgage involves making a lump sum payment toward the principal and having the lender reamortize the loan, resulting in lower monthly payments without changing the interest rate or loan term. Refinancing replaces the original loan with a new mortgage, often to secure a lower interest rate, change the loan term, or switch loan types, which may involve closing costs and fees. Recasting is generally quicker and less expensive but offers less flexibility compared to refinancing, which can lead to significant long-term savings depending on market rates and borrower goals.

Pros and Cons of Mortgage Recasting

Mortgage recasting offers lower monthly payments by applying a lump sum to reduce the principal balance without changing the interest rate, resulting in minimal fees and no credit check. However, recasting requires a substantial lump sum payment upfront and does not allow for obtaining a lower interest rate or changing loan terms. It is ideal for homeowners with extra cash who want to reduce payments quickly while avoiding refinancing costs and complexity.

Pros and Cons of Mortgage Refinancing

Mortgage refinancing can lower your interest rate, reduce monthly payments, or shorten the loan term, offering financial flexibility and potential long-term savings. However, refinancing often involves closing costs, requires a credit check, and may extend the loan duration, increasing total interest paid over time. Homeowners should weigh the upfront expenses against the potential benefits to determine if refinancing aligns with their financial goals.

Eligibility Requirements for Recasting vs Refinancing

Mortgage recasting requires making a significant lump-sum payment toward the principal balance, typically at least $5,000, and lenders often limit eligibility to conventional loans with good payment history. Refinancing generally involves meeting credit score thresholds, debt-to-income ratio limits, and home appraisal requirements, making it more accessible for borrowers seeking new loan terms or rate reductions. Both processes require lender approval, but recasting is usually simpler and incurs lower fees compared to refinancing.

Cost Comparison: Recasting vs Refinancing Fees

Recasting a mortgage typically incurs minimal fees, often ranging from $200 to $500, as it involves simply re-amortizing the loan balance without changing the interest rate or terms. Refinancing, on the other hand, can cost between 2% and 5% of the loan amount due to closing costs, appraisal fees, and underwriting expenses, making it significantly more expensive upfront. Homeowners seeking cost-effective options often prefer recasting for its lower fees, especially when interest rates remain favorable and loan terms are acceptable.

Impact on Monthly Payments and Interest Savings

Recasting a mortgage reduces monthly payments by applying a lump sum principal payment without changing the loan's interest rate, resulting in lower payments but limited interest savings. Refinancing replaces the existing loan with a new one, often with a lower interest rate, which can significantly decrease monthly payments and maximize long-term interest savings despite potential closing costs. Borrowers seeking immediate payment relief with minimal fees may prefer recasting, while those aiming for substantial interest reduction typically benefit more from refinancing.

Effect on Loan Terms and Amortization

Recasting a mortgage reduces the principal balance by applying a lump sum payment, which lowers monthly payments without changing the original interest rate or loan term, preserving the initial amortization schedule. Refinancing replaces the existing loan with a new one, often altering the interest rate, loan term, and monthly payments, effectively resetting the amortization timeline and potentially increasing total interest savings. While recasting maintains the original loan structure, refinancing offers flexibility to adjust terms and accelerate payoff or reduce debt costs.

When to Choose Recasting Over Refinancing

Recasting a mortgage is ideal when you have a large lump sum to reduce the principal balance but want to keep your existing interest rate and loan terms unchanged. Homeowners should choose recasting over refinancing when current interest rates are higher than their original mortgage rate, making refinancing more costly. This strategy lowers monthly payments without the fees and credit checks involved in refinancing, providing savings without extending the loan term.

Making the Right Choice for Your Financial Goals

Recasting a mortgage reduces monthly payments by applying a lump-sum payment toward the principal without changing the interest rate or loan term, making it ideal for borrowers seeking lower payments without refinancing costs. Refinancing replaces the existing mortgage with a new loan, often at a different interest rate or term, suitable for individuals aiming to reduce interest rates, change loan durations, or access home equity. Carefully evaluating factors such as credit scores, current interest rates, loan terms, and planned homeownership duration helps determine whether recasting or refinancing aligns better with your long-term financial goals.

Important Terms

Loan Amortization

Loan amortization schedules are recalculated during both recasting and refinancing; recasting adjusts the existing loan balance with lower monthly payments by recalculating amortization without changing the interest rate or term, while refinancing replaces the original loan with a new loan that may have a different interest rate and term, effectively resetting the amortization schedule. Understanding the differences in amortization impacts helps borrowers decide whether recasting offers cost-effective payment reduction or refinancing provides long-term savings through improved loan terms.

Principal Reduction

Principal reduction lowers the loan balance by forgiving part of the mortgage, often used in recasting to reduce monthly payments while keeping the original loan terms. Refinancing replaces the existing mortgage with a new loan, potentially with better rates but without directly reducing the principal amount owed.

Interest Rate Adjustment

Interest rate adjustment during recasting typically results in a lower monthly payment by spreading the remaining balance over the original loan term without changing the loan's interest rate, whereas refinancing involves obtaining a new loan with a different (often lower) interest rate that replaces the original mortgage. Choosing between recasting and refinancing depends on factors like current interest rates, closing costs, and the borrower's long-term financial goals.

Closing Costs

Closing costs for recasting typically range from $300 to $500, significantly lower than refinancing, which can incur fees between 2% and 5% of the loan amount. While recasting adjusts the loan balance without new underwriting, refinancing involves new credit checks, appraisals, and higher closing expenses but may offer better interest rates or loan terms.

Cash-out Refinance

Cash-out refinance involves replacing an existing mortgage with a new loan for a larger amount, allowing homeowners to access the difference in cash, unlike recasting which modifies the principal balance without changing the loan terms. Recasting reduces monthly payments by adjusting the loan balance after a lump-sum payment, while refinancing replaces the entire loan to potentially lower interest rates or change loan terms.

Mortgage Servicer

A mortgage servicer manages loan payments and account handling, playing a crucial role in facilitating both recasting and refinancing options for homeowners. Recasting lowers monthly payments by recalculating the loan balance with a lump-sum payment, while refinancing replaces the original loan with a new mortgage, often to secure better interest rates or terms.

Prepayment Penalty

Prepayment penalties impose fees on early mortgage repayments, influencing borrowers' choices between recasting, which adjusts payments without refinancing, and refinancing, which replaces the loan but may trigger penalties. Recasting typically avoids prepayment penalties by maintaining the original loan terms, whereas refinancing might incur fees depending on the loan's specific prepayment clause.

Home Equity

Home equity recasting restructures your existing mortgage by applying a lump-sum payment toward the principal, reducing monthly payments without changing the loan's interest rate or term. Refinancing replaces your current mortgage with a new loan, often offering different interest rates, terms, and fees, which can potentially lower rates or change loan duration but involves a more extensive approval process.

Term Modification

Term modification involves altering the length or conditions of a loan agreement to improve repayment terms, often used in mortgage loans. Recasting recalculates payments based on a lump-sum principal reduction without changing the interest rate or term, while refinancing replaces the existing loan with a new one, potentially adjusting interest rates and loan duration.

Underwriting Criteria

Underwriting criteria for recasting primarily focus on the borrower's existing loan terms, payment history, and equity, allowing for lower risk due to minimized loan modification. Refinancing underwriting evaluates credit score, debt-to-income ratio, property appraisal, and current market rates to assess the borrower's ability to secure new loan terms, often involving stricter scrutiny.

Recasting vs Refinancing Infographic

moneydif.com

moneydif.com