Prequalification offers a preliminary estimate of how much a borrower might be eligible to borrow based on self-reported financial information, requiring minimal documentation. Preapproval, however, involves a more thorough evaluation with verified financial documents and credit checks, providing a conditional commitment subject to final approval. Understanding the difference between prequalification and preapproval can help homebuyers strengthen their negotiating position and streamline the mortgage process.

Table of Comparison

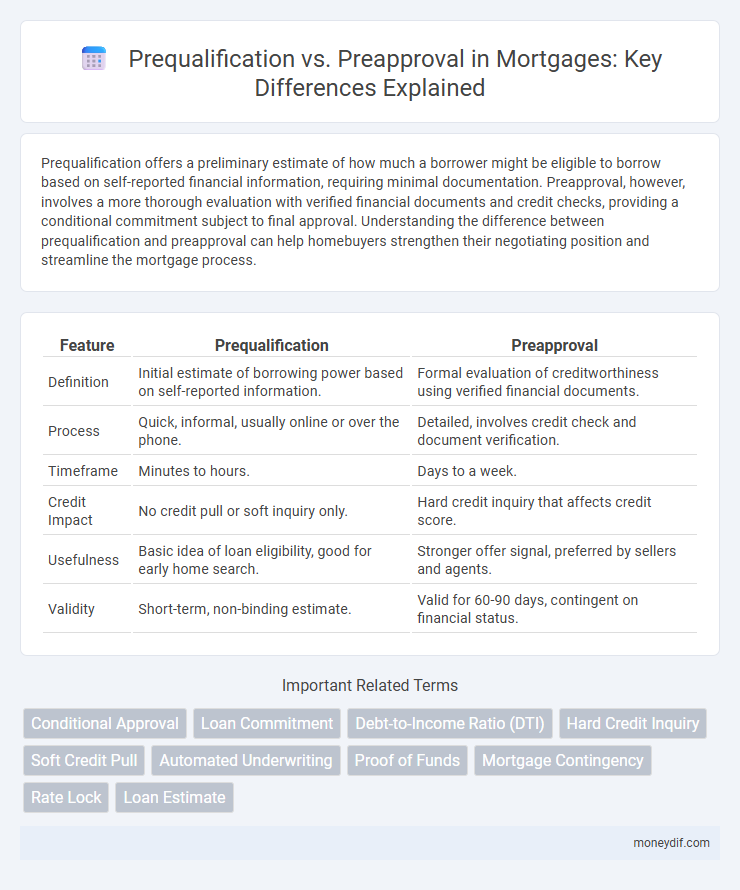

| Feature | Prequalification | Preapproval |

|---|---|---|

| Definition | Initial estimate of borrowing power based on self-reported information. | Formal evaluation of creditworthiness using verified financial documents. |

| Process | Quick, informal, usually online or over the phone. | Detailed, involves credit check and document verification. |

| Timeframe | Minutes to hours. | Days to a week. |

| Credit Impact | No credit pull or soft inquiry only. | Hard credit inquiry that affects credit score. |

| Usefulness | Basic idea of loan eligibility, good for early home search. | Stronger offer signal, preferred by sellers and agents. |

| Validity | Short-term, non-binding estimate. | Valid for 60-90 days, contingent on financial status. |

Understanding Mortgage Prequalification

Mortgage prequalification provides an initial estimate of how much a borrower might be eligible to borrow based on self-reported financial information. This informal process involves submitting basic details like income, assets, and debts without a credit check or documentation. While less comprehensive than preapproval, prequalification helps buyers gauge their budget early in the home buying journey.

What Is Mortgage Preapproval?

Mortgage preapproval is a formal process where a lender evaluates a borrower's financial background, credit score, income, and debts to determine the maximum loan amount they qualify for. It involves submitting detailed documentation such as pay stubs, tax returns, and bank statements, providing a conditional commitment on the mortgage loan. Preapproval gives buyers a competitive edge by demonstrating serious intent to sellers and real estate agents during the home buying process.

Key Differences Between Prequalification and Preapproval

Prequalification provides an initial estimate of how much a borrower may qualify for based on self-reported financial information, while preapproval involves a thorough evaluation of verified documents, such as credit reports and income statements, to offer a more concrete loan commitment. Preapproval typically carries more weight with sellers and real estate agents because it demonstrates a serious intent and higher likelihood of securing financing. Prequalification is faster and less detailed, making it a useful first step, whereas preapproval requires more time but increases buyer confidence and negotiating power.

Which Comes First: Prequalification or Preapproval?

Prequalification typically comes first in the mortgage process, providing a preliminary estimate of how much a borrower might qualify for based on self-reported financial information. Preapproval follows, involving a more thorough evaluation with documentation verification from lenders, offering a conditional commitment for a specific loan amount. Understanding this sequence helps borrowers streamline homebuying by setting realistic expectations and strengthening offers with verified financial backing.

Pros and Cons of Mortgage Prequalification

Mortgage prequalification offers a quick overview of potential loan options by assessing basic financial information, making it a convenient first step for homebuyers. It provides flexibility without a credit check, allowing buyers to explore budgets without commitment, but its informal nature means offers are non-binding and may not reflect true loan eligibility. The main drawback is the lack of reliability compared to preapproval, which involves rigorous documentation and credit evaluation, making prequalification less effective for serious negotiations with sellers.

Advantages of Getting Preapproved

Getting preapproved for a mortgage provides a stronger negotiating position by demonstrating to sellers that you have secured financing, which can speed up the home-buying process. Preapproval involves a thorough credit and financial background check by the lender, offering a more accurate estimate of the loan amount you qualify for compared to prequalification. This reduces uncertainty and increases confidence when making offers on homes, potentially leading to better purchase terms and quicker closings.

How Lenders Evaluate Prequalification vs Preapproval

Lenders evaluate prequalification based primarily on self-reported financial information, offering a preliminary estimate of loan eligibility with minimal verification of credit scores or income. In contrast, preapproval involves a thorough review of credit reports, income documentation, employment status, and debt-to-income ratios, providing a more accurate assessment of borrowing capability. This rigorous evaluation in preapproval signals stronger loan approval potential to sellers and real estate agents compared to the informal nature of prequalification.

Impact on Home Buying Process

Prequalification provides an initial estimate of how much a buyer might afford, allowing early budgeting but lacks the credibility needed in competitive markets. Preapproval involves a thorough financial review and credit check, offering a more accurate loan amount and stronger negotiating power with sellers. Buyers with preapproval statements often experience faster closings and increased confidence during home searches, significantly impacting the overall home buying process.

What Documents Are Needed for Each?

Prequalification for a mortgage generally requires basic financial information such as income, employment details, and estimated credit score, often provided verbally or through a simple form without documentation. Preapproval demands comprehensive documentation including recent pay stubs, W-2 forms, tax returns, bank statements, and authorization for a credit check to validate the borrower's financial status. This detailed paperwork allows lenders to make a conditional commitment, providing a more accurate estimate of the loan amount the borrower qualifies for.

Which Option Is Best for Homebuyers?

Prequalification offers a quick estimate of how much a homebuyer might afford based on self-reported financial information, making it a useful first step in the mortgage process. Preapproval involves a thorough review of credit reports, income, and assets, providing a conditional commitment from a lender that strengthens a buyer's position in negotiations. For serious homebuyers, preapproval is often the best option as it signals financial readiness and increases credibility with sellers.

Important Terms

Conditional Approval

Conditional approval occurs after prequalification and preapproval, indicating a lender's initial agreement to finance based on preliminary information but requiring further verification or documentation. Unlike prequalification, which is an informal estimate of borrowing capacity, and preapproval, which is a more thorough evaluation of creditworthiness, conditional approval signifies progress toward a final loan commitment pending specific conditions are met.

Loan Commitment

Loan commitment represents a formal promise from a lender to provide a mortgage loan based on a thorough evaluation of a borrower's financial status, surpassing the preliminary assessment of prequalification which relies on self-reported information. Preapproval involves a more rigorous credit check and document verification, serving as a conditional commitment that strengthens a buyer's position compared to the informal indication of loan eligibility during prequalification.

Debt-to-Income Ratio (DTI)

Debt-to-Income Ratio (DTI) critically influences mortgage prequalification and preapproval outcomes, as lenders assess borrowers' income relative to debt to determine loan eligibility; typically, a DTI below 43% is preferred. Prequalification offers a preliminary estimate based on self-reported financial information, while preapproval requires verified documentation that confirms a borrower's DTI, providing a more definitive loan commitment.

Hard Credit Inquiry

A hard credit inquiry occurs when a lender reviews your credit report during a loan preapproval process, impacting your credit score slightly, whereas prequalification generally involves a soft inquiry that does not affect your credit score and offers a preliminary estimate of loan terms. Understanding the difference between prequalification and preapproval helps borrowers gauge their creditworthiness and strengthens their position when negotiating with lenders.

Soft Credit Pull

Soft credit pull allows lenders to assess a borrower's creditworthiness without impacting their credit score, commonly used in prequalification to provide an initial estimate of loan terms. Preapproval involves a hard credit pull and a more rigorous evaluation, resulting in a conditional commitment from the lender based on verified financial information.

Automated Underwriting

Automated underwriting leverages algorithms and data analytics to assess borrower risk efficiently, distinguishing prequalification as an initial credit estimate based on self-reported information, while preapproval involves a comprehensive evaluation using verified financial documents for a more accurate loan commitment. This technological process enhances accuracy and speeds decision-making in mortgage lending, reducing manual errors and improving the borrower experience.

Proof of Funds

Proof of Funds demonstrates a buyer's financial ability to complete a transaction, often required during Prequalification to verify available assets and cash reserves for initial assessment. In contrast, Preapproval involves a lender's conditional commitment based on verified financial documents, providing a more concrete indication of financing readiness compared to the general financial overview in Prequalification.

Mortgage Contingency

Mortgage contingency clauses protect buyers by allowing contract cancellation if financing falls through, which is more secure when paired with a preapproval rather than just a prequalification. Preapproval involves a thorough credit check and verification of financial documents, giving sellers stronger assurance compared to prequalification's preliminary estimate based on unverified information.

Rate Lock

Rate lock secures an interest rate on a mortgage loan after preapproval, providing certainty before closing, whereas prequalification is an initial estimate without a locked rate, offering less reliability. Preapproval involves thorough financial verification enabling lenders to offer a rate lock, while prequalification is based on self-reported information and does not guarantee interest rate protection.

Loan Estimate

A Loan Estimate provides a detailed breakdown of estimated mortgage costs after a borrower submits a loan application, whereas prequalification offers a preliminary assessment of creditworthiness based on basic financial information without a formal credit check. Preapproval involves a more rigorous evaluation, including credit verification, resulting in a conditional commitment that strengthens the borrower's position in homebuying negotiations.

Prequalification vs Preapproval Infographic

moneydif.com

moneydif.com