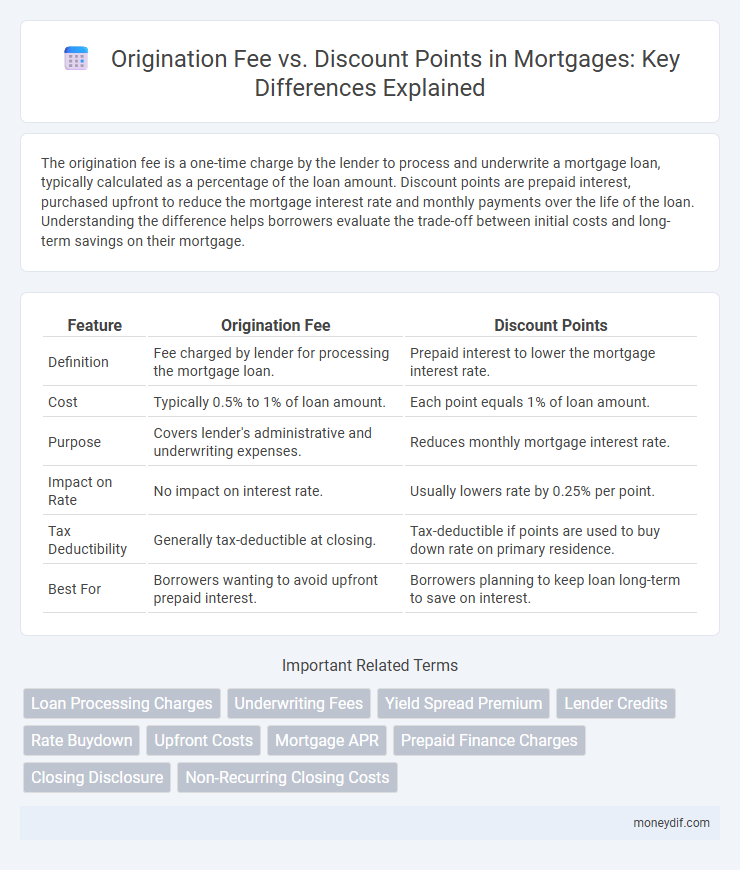

The origination fee is a one-time charge by the lender to process and underwrite a mortgage loan, typically calculated as a percentage of the loan amount. Discount points are prepaid interest, purchased upfront to reduce the mortgage interest rate and monthly payments over the life of the loan. Understanding the difference helps borrowers evaluate the trade-off between initial costs and long-term savings on their mortgage.

Table of Comparison

| Feature | Origination Fee | Discount Points |

|---|---|---|

| Definition | Fee charged by lender for processing the mortgage loan. | Prepaid interest to lower the mortgage interest rate. |

| Cost | Typically 0.5% to 1% of loan amount. | Each point equals 1% of loan amount. |

| Purpose | Covers lender's administrative and underwriting expenses. | Reduces monthly mortgage interest rate. |

| Impact on Rate | No impact on interest rate. | Usually lowers rate by 0.25% per point. |

| Tax Deductibility | Generally tax-deductible at closing. | Tax-deductible if points are used to buy down rate on primary residence. |

| Best For | Borrowers wanting to avoid upfront prepaid interest. | Borrowers planning to keep loan long-term to save on interest. |

Understanding Origination Fees and Discount Points

Origination fees are upfront charges paid to the lender for processing a mortgage, typically ranging from 0.5% to 1% of the loan amount, while discount points represent prepaid interest that lowers the mortgage's interest rate. Borrowers paying discount points can reduce their monthly payments and overall interest costs over the loan term, making it beneficial for long-term savings. Understanding how origination fees affect closing costs and how discount points influence interest rates is essential for optimizing mortgage expenses.

Key Differences Between Origination Fees and Discount Points

Origination fees are upfront charges paid to lenders for processing a mortgage application, typically calculated as a percentage of the loan amount, while discount points are prepaid interest used to lower the mortgage interest rate over the loan term. Origination fees impact closing costs directly without altering the loan's interest rate, whereas discount points reduce monthly payments by effectively buying down the rate. Understanding these key differences helps borrowers optimize upfront costs against long-term savings in mortgage financing.

How Origination Fees Impact Your Mortgage Costs

Origination fees directly increase your upfront mortgage costs by covering the lender's administrative expenses, typically ranging from 0.5% to 1% of the loan amount. These fees add to your closing costs and do not reduce your interest rate, unlike discount points which you pay upfront to lower your rate and overall interest payments. Understanding how origination fees affect your total loan costs helps you evaluate whether paying more initially is worth the potential long-term savings.

Discount Points: Lowering Your Interest Rate

Discount points are prepaid interest fees that borrowers pay upfront to reduce their mortgage interest rate, effectively lowering monthly payments over the loan term. Each discount point typically costs 1% of the loan amount and can decrease the interest rate by approximately 0.25%. Paying discount points can lead to significant interest savings, especially for long-term loans, making it a strategic option for homeowners planning to stay in their property for several years.

Pros and Cons of Paying Origination Fees

Paying origination fees covers lender costs for processing and underwriting a mortgage, potentially securing loan approval faster and reducing interest rate risk. However, these fees increase upfront closing costs, impacting initial cash flow and may not directly lower monthly payments like discount points. Borrowers should weigh the trade-off between immediate expenses and long-term savings based on their financial goals and loan terms.

Pros and Cons of Purchasing Discount Points

Purchasing discount points reduces your mortgage interest rate, lowering monthly payments and potentially saving thousands over the loan term, but requires upfront cash that may delay savings if you plan to sell or refinance early. The primary benefit is long-term interest cost reduction, beneficial for borrowers expecting to stay in the home for many years, while the downside includes increased initial closing costs and decreased liquidity. Evaluating break-even points and personal financial stability is crucial before opting to buy discount points for mortgage loans.

When Should You Pay Origination Fees vs Discount Points?

Pay origination fees when seeking to cover the lender's costs for processing your mortgage application, typically a one-time charge based on a percentage of the loan amount. Opt for discount points if you want to lower your mortgage interest rate and reduce monthly payments by paying upfront, especially beneficial if you plan to stay in the home long-term. Evaluating your financial goals and how long you intend to hold the mortgage helps determine whether paying origination fees or investing in discount points maximizes your loan's value.

Calculating Savings: Discount Points vs Upfront Fees

Calculating savings between discount points and upfront origination fees requires analyzing interest rate reductions against initial loan costs. Discount points lower your mortgage interest rate, resulting in monthly payment savings that accumulate over time, while origination fees are one-time charges that do not affect interest rates. Evaluating the break-even period for discount points helps determine if the upfront investment translates into long-term financial benefits compared to immediate fees.

Origination Fees and Discount Points: Tax Implications

Origination fees and discount points have distinct tax implications for mortgage borrowers, where origination fees are typically considered non-deductible closing costs unless they are assessed for specific services like preparation or document fees. Discount points, classified as prepaid interest, are generally tax-deductible if the mortgage is for a primary residence and meet IRS guidelines, potentially reducing taxable income in the year paid or over the life of the loan. Proper documentation and consultation with a tax professional are essential to accurately claim these deductions and optimize mortgage-related tax benefits.

Tips for Negotiating Mortgage Fees and Points

When negotiating mortgage fees and points, understanding the difference between origination fees and discount points is crucial; origination fees cover lender administrative costs, while discount points reduce your interest rate by prepaying interest. Request a detailed loan estimate to identify these fees clearly and ask lenders to waive or lower origination fees to reduce upfront costs. Compare offers by calculating how many discount points truly benefit long-term savings versus paying more at closing to find the optimal balance.

Important Terms

Loan Processing Charges

Loan processing charges typically include an origination fee, which covers lender administrative costs, and discount points, which are prepaid interest used to reduce the loan's interest rate.

Underwriting Fees

Underwriting fees typically cover the lender's evaluation costs and are separate from origination fees, which compensate loan processing, while discount points are prepaid interest used to reduce the loan's interest rate.

Yield Spread Premium

Yield Spread Premium compensates brokers by increasing the interest rate beyond the par rate, contrasting with origination fees paid upfront and discount points used to reduce the loan's interest rate.

Lender Credits

Lender credits reduce the borrower's upfront costs by offsetting origination fees or discount points, effectively lowering initial expenses in exchange for a slightly higher interest rate.

Rate Buydown

A rate buydown involves paying upfront fees to reduce the mortgage interest rate, typically through discount points where each point equals 1% of the loan amount. Unlike origination fees, which compensate the lender for processing the loan and are a fixed percentage of the loan, discount points directly lower the interest rate, impacting monthly payments and overall loan cost.

Upfront Costs

Origination fees typically range from 0.5% to 1% of the loan amount, while discount points cost 1% of the loan amount per point and are paid upfront to reduce the mortgage interest rate.

Mortgage APR

Mortgage APR reflects the true loan cost by combining interest rates with origination fees and discount points, where origination fees cover lender processing costs and discount points reduce the interest rate upfront.

Prepaid Finance Charges

Prepaid finance charges include origination fees, which cover loan processing costs, and discount points, which are upfront payments to reduce the loan interest rate.

Closing Disclosure

Closing Disclosure clearly separates Origination Fees, which compensate lenders for processing loans, from Discount Points, prepaid interest used to lower the loan's interest rate.

Non-Recurring Closing Costs

Non-recurring closing costs include the origination fee, a lender charge for processing a loan, and discount points, prepaid interest used to lower the mortgage interest rate.

Origination Fee vs Discount Points Infographic

moneydif.com

moneydif.com