A fixed-rate mortgage offers consistent monthly payments and stable interest rates, providing financial predictability over the loan term. In contrast, an adjustable-rate mortgage (ARM) features lower initial rates that fluctuate periodically based on market conditions, potentially lowering costs but increasing payment uncertainty. Choosing between these mortgage types depends on individual risk tolerance, financial goals, and how long the borrower plans to stay in the home.

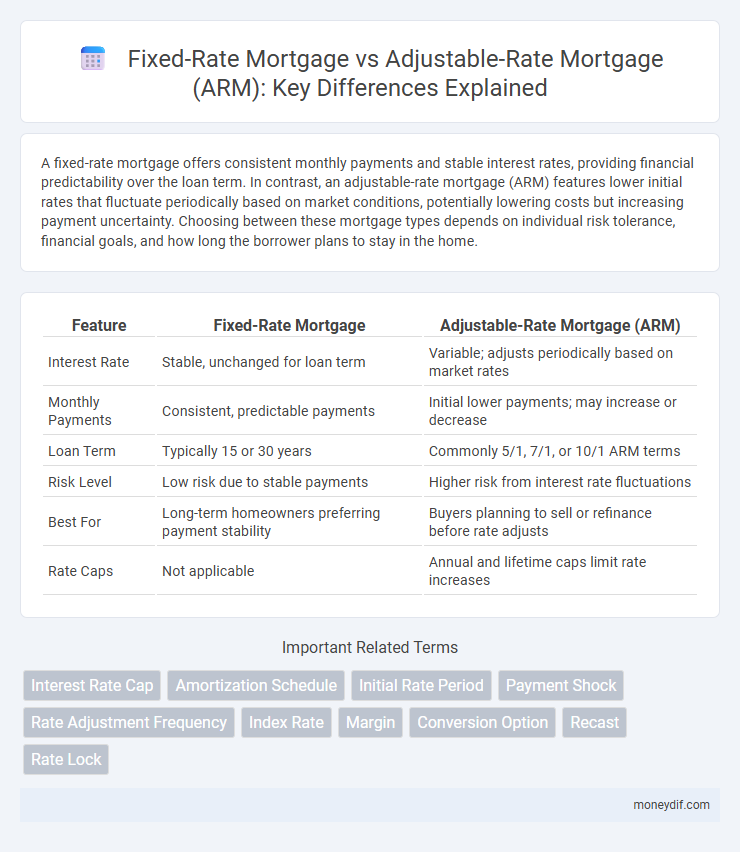

Table of Comparison

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Stable, unchanged for loan term | Variable; adjusts periodically based on market rates |

| Monthly Payments | Consistent, predictable payments | Initial lower payments; may increase or decrease |

| Loan Term | Typically 15 or 30 years | Commonly 5/1, 7/1, or 10/1 ARM terms |

| Risk Level | Low risk due to stable payments | Higher risk from interest rate fluctuations |

| Best For | Long-term homeowners preferring payment stability | Buyers planning to sell or refinance before rate adjusts |

| Rate Caps | Not applicable | Annual and lifetime caps limit rate increases |

Introduction to Fixed-Rate and Adjustable-Rate Mortgages

Fixed-rate mortgages offer a consistent interest rate and monthly payment throughout the loan term, providing stability and predictability for borrowers. Adjustable-rate mortgages (ARMs) feature interest rates that fluctuate periodically based on market indexes, typically starting with a lower initial rate than fixed-rate loans. Choosing between fixed-rate and ARM depends on factors such as financial stability, risk tolerance, and market rate trends.

How Fixed-Rate Mortgages Work

Fixed-rate mortgages lock in a consistent interest rate and monthly payment for the entire loan term, typically 15 to 30 years, providing predictable budgeting for homeowners. These loans are typically based on the borrower's credit score, loan amount, and market interest rates at the time of origination. Because the interest rate does not change, fixed-rate mortgages protect borrowers from rising market rates but may start with higher initial rates compared to adjustable-rate mortgages.

Understanding Adjustable-Rate Mortgages (ARM)

Adjustable-Rate Mortgages (ARMs) feature interest rates that fluctuate based on market indexes such as the LIBOR or the U.S. Treasury rates, impacting monthly payments over time. Initial rates on ARMs are typically lower than fixed-rate mortgages, attracting buyers seeking short-term affordability or planning to refinance before rate adjustments. Borrowers must analyze adjustment periods, caps, and margins to fully understand potential payment changes and manage long-term financial risk effectively.

Key Differences Between Fixed-Rate and ARM

Fixed-rate mortgages offer a stable interest rate and consistent monthly payments throughout the loan term, ideal for borrowers seeking long-term financial predictability. Adjustable-rate mortgages (ARMs) feature an initial fixed-rate period followed by periodic rate adjustments based on market indexes, which can lead to fluctuating monthly payments. The key difference lies in rate stability versus potential cost savings, with fixed-rate mortgages providing certainty and ARMs offering lower initial rates but increased risk of future rate increases.

Pros and Cons of Fixed-Rate Mortgages

Fixed-rate mortgages offer the stability of a constant interest rate and predictable monthly payments over the loan term, protecting borrowers from market fluctuations. They are ideal for long-term financial planning but usually come with higher initial interest rates compared to adjustable-rate mortgages (ARMs). However, fixed-rate loans may result in higher overall costs if market rates decline and borrowers do not refinance.

Advantages and Disadvantages of ARMs

Adjustable-Rate Mortgages (ARMs) offer lower initial interest rates compared to Fixed-Rate Mortgages, making them beneficial for borrowers planning to sell or refinance within a few years. The interest rate on an ARM adjusts periodically based on market indexes, which can lead to unpredictable monthly payments and potential increases over time. Borrowers must consider the risk of rising rates and payment shock, balanced against the opportunity for initial savings and potential rate decreases.

Impact of Interest Rate Changes

Fixed-rate mortgages provide stable monthly payments as the interest rate remains constant throughout the loan term, protecting borrowers from rising rates. Adjustable-rate mortgages (ARMs) start with lower initial rates that can fluctuate periodically based on market interest rate changes, potentially increasing or decreasing monthly payments. Borrowers with ARMs face uncertainty in budgeting due to interest rate volatility, while fixed-rate mortgage holders benefit from predictable long-term financial planning.

Which Mortgage is Better for Your Financial Goals?

Fixed-rate mortgages offer predictable monthly payments with interest rates locked in for the loan term, ideal for homeowners seeking financial stability and long-term planning. Adjustable-rate mortgages (ARMs) start with lower initial rates that adjust periodically based on market conditions, potentially benefiting borrowers expecting income growth or planning to sell before rate changes occur. Evaluating your financial goals, risk tolerance, and housing timeline is essential when choosing between the consistency of fixed rates and the flexibility of ARMs.

Factors to Consider When Choosing Between Fixed and ARM

Interest rate stability and payment predictability are crucial factors when choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM). Homebuyers should evaluate current market interest rates, their risk tolerance for potential rate increases, and the length of time they plan to stay in the property. Loan terms, initial interest rates, caps on adjustments, and potential savings versus long-term financial security also heavily influence the decision.

Fixed-Rate vs ARM: Frequently Asked Questions

Fixed-rate mortgages offer consistent monthly payments with interest rates locked for the loan's duration, providing stability and predictability for homeowners. Adjustable-rate mortgages (ARMs) usually start with lower initial rates that adjust periodically based on market indices, which can lead to fluctuating payments over time. Common questions address how rate adjustments impact affordability, differences in initial costs, and which loan type suits varying financial situations and risk tolerance.

Important Terms

Interest Rate Cap

An interest rate cap limits the maximum interest rate on an Adjustable-Rate Mortgage (ARM), protecting borrowers from significant payment increases over time, unlike Fixed-Rate Mortgages, which maintain a consistent interest rate throughout the loan term. This cap provides a safety net that helps ARM borrowers manage financial risk while potentially benefiting from lower initial rates compared to fixed-rate loans.

Amortization Schedule

An amortization schedule for a fixed-rate mortgage provides a consistent monthly payment breakdown of principal and interest over the loan term, ensuring predictable budgeting. In contrast, an adjustable-rate mortgage (ARM) amortization schedule varies as interest rates adjust periodically, causing fluctuating monthly payments and altering the principal repayment timeline.

Initial Rate Period

The Initial Rate Period in an Adjustable-Rate Mortgage (ARM) refers to the fixed interest rate phase at the start of the loan, typically lasting 3, 5, 7, or 10 years, offering lower rates than fixed-rate mortgages during this time. Homebuyers often choose ARMs for these initial savings, but after the Initial Rate Period, rates adjust based on market indexes, unlike fixed-rate mortgages that maintain consistent interest rates and monthly payments throughout the loan term.

Payment Shock

Payment shock occurs when borrowers with Adjustable-Rate Mortgages (ARMs) face sudden increases in monthly payments due to interest rate adjustments, unlike Fixed-Rate Mortgages which have stable, predictable payments over the loan term. Understanding the risk of payment shock is crucial for homeowners when comparing initial lower ARM rates against the consistent affordability of fixed-rate loans.

Rate Adjustment Frequency

Fixed-rate mortgages maintain a consistent interest rate and monthly payment throughout the loan term, providing payment stability and predictability. Adjustable-rate mortgages (ARMs) feature variable interest rates that adjust periodically based on market indexes, causing monthly payments to fluctuate after the initial fixed-rate period.

Index Rate

The index rate for an Adjustable-Rate Mortgage (ARM) determines periodic interest adjustments based on benchmarks like the LIBOR, SOFR, or U.S. Treasury rates, directly impacting monthly payments. Fixed-Rate Mortgages maintain a constant interest rate unaffected by index fluctuations, providing predictable payment schedules throughout the loan term.

Margin

Margin in Adjustable-Rate Mortgages (ARMs) is the fixed percentage added to the index rate to determine the interest rate after the initial fixed period, typically ranging between 2% and 3.5%. Fixed-Rate Mortgages maintain a constant margin embedded within the initial interest rate, ensuring stable monthly payments throughout the loan term.

Conversion Option

The conversion option allows borrowers with an Adjustable-Rate Mortgage (ARM) to switch to a Fixed-Rate Mortgage, providing financial stability by locking in a consistent interest rate and monthly payments. This feature is especially beneficial during rising interest rate environments, helping homeowners mitigate payment shocks and secure predictable long-term housing costs.

Recast

Recasting a fixed-rate mortgage involves making a large lump-sum payment to reduce the principal and lower monthly payments while keeping the original interest rate and loan term unchanged, offering payment stability and predictable budgeting. In contrast, recasting an adjustable-rate mortgage (ARM) can also reduce monthly payments after a significant principal payment, but the borrower remains exposed to interest rate fluctuations inherent to ARMs, affecting long-term payment predictability.

Rate Lock

Rate lock secures a fixed interest rate for a borrower during the mortgage approval process, providing certainty in fixed-rate mortgages where the rate remains constant over the loan term. In contrast, adjustable-rate mortgages (ARMs) typically lock an initial fixed rate period before rates adjust periodically based on market indexes, resulting in variable payments after the lock expires.

Fixed-Rate Mortgage vs Adjustable-Rate Mortgage (ARM) Infographic

moneydif.com

moneydif.com