Conforming loans meet the underwriting guidelines set by Fannie Mae and Freddie Mac, including loan limits and borrower credit criteria, resulting in lower interest rates and easier approval processes. Nonconforming loans, also known as jumbo loans, exceed these limits or fail to meet standard criteria, typically requiring higher credit scores, larger down payments, and carrying higher interest rates due to increased risk. Understanding the differences between conforming and nonconforming loans helps borrowers choose the best mortgage option based on their financial profile and loan size.

Table of Comparison

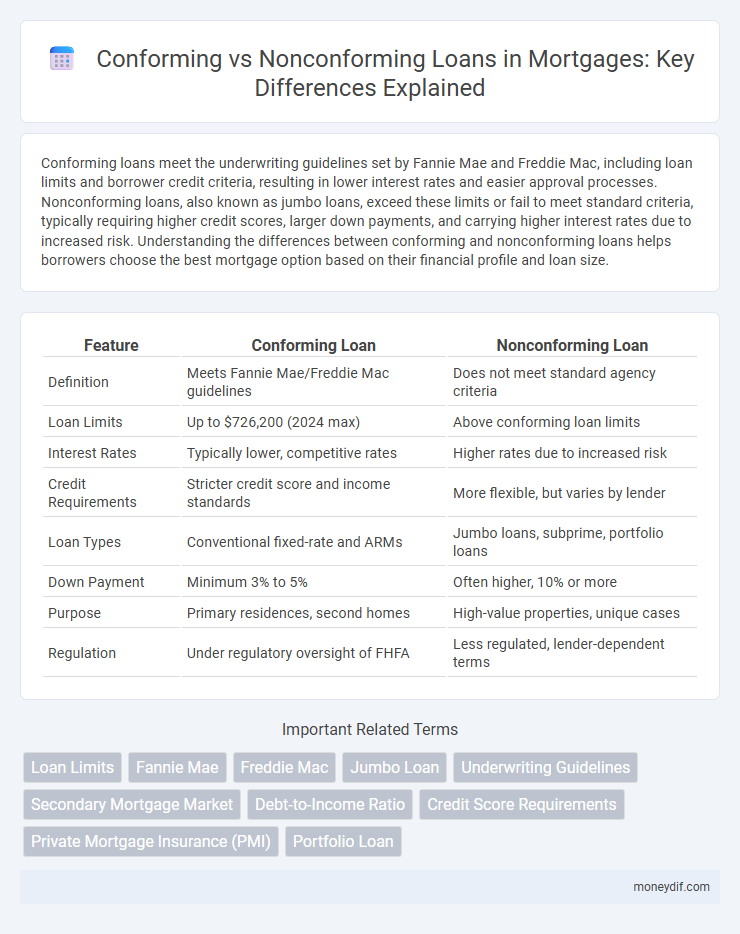

| Feature | Conforming Loan | Nonconforming Loan |

|---|---|---|

| Definition | Meets Fannie Mae/Freddie Mac guidelines | Does not meet standard agency criteria |

| Loan Limits | Up to $726,200 (2024 max) | Above conforming loan limits |

| Interest Rates | Typically lower, competitive rates | Higher rates due to increased risk |

| Credit Requirements | Stricter credit score and income standards | More flexible, but varies by lender |

| Loan Types | Conventional fixed-rate and ARMs | Jumbo loans, subprime, portfolio loans |

| Down Payment | Minimum 3% to 5% | Often higher, 10% or more |

| Purpose | Primary residences, second homes | High-value properties, unique cases |

| Regulation | Under regulatory oversight of FHFA | Less regulated, lender-dependent terms |

Introduction to Conforming and Nonconforming Loans

Conforming loans adhere to the guidelines set by Fannie Mae and Freddie Mac, including maximum loan limits, credit score requirements, and debt-to-income ratios, making them easier to qualify for and often offering lower interest rates. Nonconforming loans, such as jumbo loans, fall outside these standards due to higher loan amounts or unique borrower circumstances, typically resulting in stricter qualification criteria and higher interest rates. Understanding the differences between conforming and nonconforming loans is essential for selecting the right mortgage product based on loan size, credit profile, and financial goals.

What Is a Conforming Loan?

A conforming loan is a mortgage that meets the underwriting guidelines set by Fannie Mae and Freddie Mac, including maximum loan limits, credit score requirements, and debt-to-income ratios. These loans typically offer lower interest rates and easier approval processes due to standardized criteria. Borrowers benefit from reliable terms and access to secondary mortgage markets, making conforming loans a popular choice for home financing.

Key Features of Conforming Loans

Conforming loans adhere to the guidelines set by Fannie Mae and Freddie Mac, including limits on loan size which for 2024 typically max out at $726,200 in most U.S. regions. These loans require borrowers to meet strict credit score criteria, debt-to-income ratios, and documented income standards, ensuring lower risk for lenders. Conforming loans benefit from lower interest rates and easier qualification compared to nonconforming loans, which fall outside Fannie Mae and Freddie Mac's standard parameters.

What Is a Nonconforming Loan?

A nonconforming loan is a mortgage that does not meet the underwriting guidelines set by Fannie Mae or Freddie Mac, typically due to loan size, credit requirements, or documentation standards. These loans often exceed conforming loan limits or involve unique borrower circumstances, such as self-employment or poor credit history. Nonconforming loans generally carry higher interest rates and more stringent qualification criteria compared to conforming loans.

Types of Nonconforming Loans

Nonconforming loans include jumbo loans, which exceed conforming loan limits set by the Federal Housing Finance Agency, and are commonly used for high-value properties. Other types are subprime loans, targeted at borrowers with lower credit scores and higher risk profiles, often carrying higher interest rates. Portfolio loans, held by lenders without selling to secondary markets, also fall under nonconforming loans, offering flexible terms but less liquidity.

Conforming vs Nonconforming Loan Limits

Conforming loans adhere to the maximum loan limits set by the Federal Housing Finance Agency (FHFA), typically $726,200 for a single-family home in most U.S. counties in 2024, ensuring eligibility for purchase by Fannie Mae and Freddie Mac. Nonconforming loans exceed these limits or do not meet underwriting standards, including jumbo loans, which may surpass $726,200 and require higher credit scores and down payments. Understanding the difference in loan limits helps borrowers determine eligibility, interest rates, and qualification criteria between conforming and nonconforming mortgage options.

Credit and Income Requirements Comparison

Conforming loans require borrowers to meet strict credit score minimums, typically around 620 or higher, and verify stable income to qualify within government-established loan limits. Nonconforming loans, including jumbo loans, have more flexible credit scores and income documentation standards, accommodating borrowers with higher debt-to-income ratios or inconsistent earnings. Lenders often impose stricter underwriting criteria and higher interest rates on nonconforming loans due to the increased risk.

Interest Rates: Conforming vs Nonconforming

Conforming loans typically offer lower interest rates compared to nonconforming loans due to standardized underwriting guidelines and reduced lender risk. Nonconforming loans, often called jumbo loans, carry higher rates reflecting greater credit risk and less market liquidity. Borrowers seeking competitive rates usually prefer conforming loans within the Federal Housing Finance Agency (FHFA) limits.

Pros and Cons of Each Loan Type

Conforming loans offer lower interest rates and easier qualification due to adherence to Fannie Mae and Freddie Mac guidelines but limit loan amounts to conforming limits, restricting borrowing capacity. Nonconforming loans provide higher borrowing flexibility and accommodate borrowers with unique credit situations but carry higher interest rates and stricter underwriting criteria. Choosing between these loans depends on credit profile, loan size, and financial goals, balancing cost savings with approval likelihood.

How to Choose Between Conforming and Nonconforming Loans

Evaluate your financial profile against loan limits set by Fannie Mae and Freddie Mac to determine eligibility for conforming loans, which typically offer lower interest rates and streamlined approval processes. If your loan amount exceeds these limits or your credit score falls below required thresholds, consider nonconforming loans, including jumbo loans, which accommodate higher balances but often have stricter underwriting and higher costs. Analyze your repayment ability, down payment size, and loan purpose to select the option that best balances affordability and qualification criteria.

Important Terms

Loan Limits

Conforming loan limits are set by the Federal Housing Finance Agency (FHFA) and define the maximum loan amount eligible for purchase by Fannie Mae and Freddie Mac, typically capping at $726,200 in most U.S. counties for 2024. Nonconforming loans exceed these limits or fail to meet agency criteria, often categorized as jumbo loans with higher interest rates and stricter credit requirements due to increased risk.

Fannie Mae

Fannie Mae primarily purchases and guarantees conforming loans that meet specific size, credit, and underwriting guidelines set by the Federal Housing Finance Agency, ensuring standardized risk and liquidity in the mortgage market. Nonconforming loans, which exceed these limits or fail to meet criteria, are generally excluded from Fannie Mae's portfolio, often leading to higher interest rates and stricter qualifications for borrowers.

Freddie Mac

Freddie Mac primarily supports conforming loans, which adhere to specific size limits and underwriting guidelines set by the Federal Housing Finance Agency (FHFA), ensuring eligibility for purchase and guaranteeing liquidity in the mortgage market. Nonconforming loans, which exceed these limits or do not meet standard criteria, fall outside Freddie Mac's purchase parameters and typically involve higher risk and interest rates due to lack of secondary market support.

Jumbo Loan

Jumbo loans exceed conforming loan limits set by the Federal Housing Finance Agency, typically above $726,200, and require stricter credit qualifications, higher down payments, and often carry higher interest rates. In contrast, conforming loans meet GSE guidelines with lower limits, offering more competitive rates and easier approval processes due to standardized underwriting criteria.

Underwriting Guidelines

Underwriting guidelines for conforming loans adhere to standards set by government-sponsored enterprises like Fannie Mae and Freddie Mac, including maximum loan amounts, borrower credit scores typically above 620, and a debt-to-income ratio generally below 43%. Nonconforming loans, such as jumbo or subprime loans, allow higher loan amounts and more flexible credit and income criteria but involve stricter risk assessments and potentially higher interest rates.

Secondary Mortgage Market

The secondary mortgage market facilitates the buying and selling of conforming loans, which meet Fannie Mae and Freddie Mac underwriting guidelines, enhancing liquidity and standardization in mortgage financing. Nonconforming loans, including jumbo loans and subprime mortgages, fall outside these criteria, often carrying higher interest rates due to increased risk and limited resale options in the secondary market.

Debt-to-Income Ratio

The Debt-to-Income (DTI) ratio is a critical metric in assessing borrower eligibility for conforming loans, typically requiring a DTI below 43% to qualify under standard Fannie Mae and Freddie Mac guidelines, ensuring manageable monthly debt payments relative to income. In contrast, nonconforming loans, including jumbo loans, often have more flexible DTI limits, accommodating higher ratios due to their exemption from these government-sponsored enterprise (GSE) restrictions, but may require compensating factors like higher credit scores or larger down payments.

Credit Score Requirements

Conforming loans typically require a minimum credit score of 620 to qualify, ensuring borrowers meet standard underwriting criteria set by Fannie Mae and Freddie Mac. Nonconforming loans, including jumbo loans, often demand higher credit scores ranging from 680 to 720 due to increased risk and less standardized lending guidelines.

Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is typically required for conforming loans when the borrower's down payment is less than 20%, protecting lenders from default risk; nonconforming loans, often exceeding conforming loan limits or with unique borrower qualifications, may have higher PMI costs or alternative insurance requirements due to increased risk. Conforming loans adhere to Fannie Mae and Freddie Mac guidelines, enabling more standardized PMI options, while nonconforming loans, such as jumbo loans, usually demand customized PMI coverage or risk-based pricing strategies.

Portfolio Loan

A portfolio loan is a type of mortgage retained by the lender instead of being sold on the secondary market, offering more flexible underwriting criteria compared to conforming loans, which must meet specific Fannie Mae and Freddie Mac guidelines. Nonconforming loans, including jumbo and niche portfolio loans, exceed these limits or deviate from standard requirements, often accommodating borrowers with unique financial situations or higher loan amounts.

Conforming Loan vs Nonconforming Loan Infographic

moneydif.com

moneydif.com