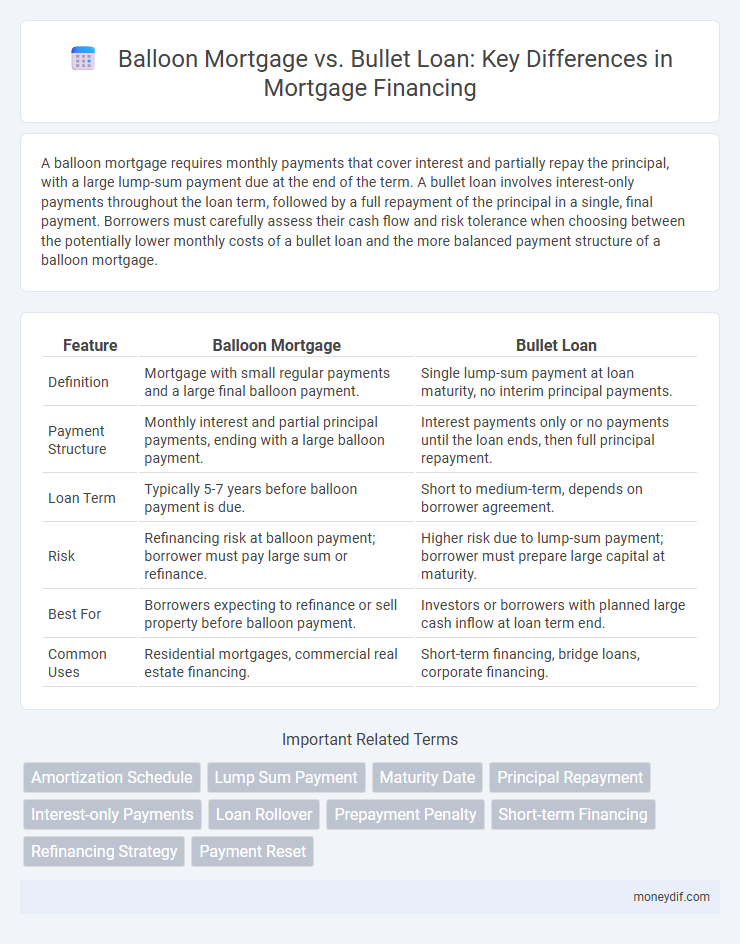

A balloon mortgage requires monthly payments that cover interest and partially repay the principal, with a large lump-sum payment due at the end of the term. A bullet loan involves interest-only payments throughout the loan term, followed by a full repayment of the principal in a single, final payment. Borrowers must carefully assess their cash flow and risk tolerance when choosing between the potentially lower monthly costs of a bullet loan and the more balanced payment structure of a balloon mortgage.

Table of Comparison

| Feature | Balloon Mortgage | Bullet Loan |

|---|---|---|

| Definition | Mortgage with small regular payments and a large final balloon payment. | Single lump-sum payment at loan maturity, no interim principal payments. |

| Payment Structure | Monthly interest and partial principal payments, ending with a large balloon payment. | Interest payments only or no payments until the loan ends, then full principal repayment. |

| Loan Term | Typically 5-7 years before balloon payment is due. | Short to medium-term, depends on borrower agreement. |

| Risk | Refinancing risk at balloon payment; borrower must pay large sum or refinance. | Higher risk due to lump-sum payment; borrower must prepare large capital at maturity. |

| Best For | Borrowers expecting to refinance or sell property before balloon payment. | Investors or borrowers with planned large cash inflow at loan term end. |

| Common Uses | Residential mortgages, commercial real estate financing. | Short-term financing, bridge loans, corporate financing. |

Understanding Balloon Mortgages: Key Features

Balloon mortgages require borrowers to make small monthly payments over the loan term, ending with a large lump-sum payment known as the balloon payment. These loans often have lower initial interest rates but carry the risk of refinancing or paying off the balloon amount at maturity. Understanding the repayment structure and potential refinancing challenges is critical for managing the financial obligations of a balloon mortgage.

What is a Bullet Loan? Core Concepts

A bullet loan is a type of mortgage where the principal amount is paid in a lump sum at the end of the loan term, with interest usually paid periodically throughout the term. Unlike traditional amortizing mortgages, bullet loans primarily focus on interest payments during the loan period, postponing the principal repayment until maturity. This structure benefits borrowers seeking lower initial payments or short-term financing with a clear payoff deadline.

Balloon Mortgage vs Bullet Loan: Main Differences

Balloon mortgages require borrowers to make regular payments with a large lump sum due at the end of the loan term, while bullet loans involve interest-only payments throughout the term with the entire principal due at maturity. Balloon mortgages typically have shorter terms and are often used for properties expected to appreciate, whereas bullet loans are common in corporate financing with longer maturity periods. The main difference lies in payment structure and timing of the principal repayment, influencing risk and refinancing strategies.

Payment Structures Compared: Balloon vs Bullet

Balloon mortgages require borrowers to make regular monthly payments followed by a large lump-sum payment at the end of the term, typically after five to seven years. Bullet loans involve interest-only payments throughout the loan term, with the principal balance paid entirely at maturity, often suitable for borrowers expecting a large cash influx. The key difference lies in payment structure, where balloon mortgages mix amortization with a final balloon payment, while bullet loans concentrate principal repayment at the end.

Interest Rates: Which Option Offers More Savings?

Balloon mortgages generally offer lower initial interest rates compared to bullet loans, resulting in short-term savings and reduced monthly payments. Bullet loans often carry higher interest rates due to the lump-sum repayment structure, increasing overall borrowing costs. Borrowers prioritizing minimal upfront interest expenses typically benefit more from balloon mortgages, while those valuing predictable long-term rates may find bullet loans less costly depending on market conditions.

Risks Involved: Balloon Mortgage and Bullet Loan

Balloon mortgages carry significant risk due to large lump-sum payments at the end of the term, which can lead to refinancing challenges or default if borrowers cannot secure new financing. Bullet loans pose similar risks, as borrowers repay the entire principal at maturity, increasing exposure to interest rate fluctuations and refinancing uncertainties. Both loan types require careful planning to manage potential liquidity issues and market volatility risks during the repayment period.

Who Should Consider a Balloon Mortgage?

Homebuyers with short-term financial goals or plans to refinance within a few years should consider a balloon mortgage due to its lower initial monthly payments. Real estate investors aiming for quick property turnover benefit from balloon loans, which require a large payment at maturity, often coinciding with property sale or refinancing. Borrowers confident in rising income or asset liquidation before the balloon payment is due can leverage this loan type to reduce interest costs in the early term.

When is a Bullet Loan the Better Choice?

A bullet loan is the better choice when borrowers prefer lower periodic payments with a single lump-sum principal repayment at maturity, often matching assets with fixed future income. This loan type suits short-term financing needs, such as bridge loans or project completion funding, minimizing monthly cash flow impact. Bullet loans also benefit investors expecting significant capital inflows before loan maturity, optimizing liquidity management.

Refinancing Options After Loan Maturity

Balloon mortgages require borrowers to refinance or pay off the large remaining balance at maturity, often leading to the need for favorable refinancing conditions or a strong credit profile to secure new financing. Bullet loans, which involve interest-only payments with principal due in full at maturity, similarly depend on refinancing strategies to manage the lump-sum repayment. Both loan types expose borrowers to market interest rate risks and lender approval challenges when refinancing options are pursued after the loan term ends.

Final Verdict: Choosing Between Balloon Mortgage and Bullet Loan

Selecting between a balloon mortgage and a bullet loan depends on the borrower's cash flow flexibility and repayment capacity at loan maturity. Balloon mortgages require a large lump-sum payment or refinancing after a fixed term, ideal for borrowers expecting increased income or asset liquidation. Bullet loans demand full principal repayment in one installment at the end of the loan term, suited for borrowers with a concrete plan for a sizable payment, making risk tolerance and future financial projections crucial factors in the final decision.

Important Terms

Amortization Schedule

An amortization schedule for a balloon mortgage shows periodic payments with a large final lump sum, whereas a bullet loan features interest-only payments followed by a single principal repayment at maturity.

Lump Sum Payment

A lump sum payment in a balloon mortgage requires a large final payment at the end of the loan term, whereas a bullet loan involves repaying the entire principal in one lump sum without periodic principal payments.

Maturity Date

The maturity date of a balloon mortgage requires a lump-sum payment or refinancing at the end of the term, whereas a bullet loan's maturity date mandates full principal repayment in a single payment without prior amortization.

Principal Repayment

Principal repayment in a balloon mortgage requires periodic payments with a large final lump sum, whereas a bullet loan defers the entire principal repayment to the loan's maturity date.

Interest-only Payments

Interest-only payments on balloon mortgages involve paying only interest until a large principal balance is due at loan maturity, whereas bullet loans require a full lump-sum principal repayment at the end without interim amortization.

Loan Rollover

A loan rollover involving a balloon mortgage typically requires refinancing or paying off a large lump sum at maturity, whereas a bullet loan mandates full principal repayment at the end of the term without interim amortization.

Prepayment Penalty

Prepayment penalties on balloon mortgages often incur significant fees if the loan is paid off before the balloon payment is due, whereas bullet loans typically do not charge prepayment penalties, allowing borrowers to repay the principal without extra costs.

Short-term Financing

Short-term financing options like balloon mortgages require borrowers to make smaller periodic payments with a large lump sum due at the end of the term, while bullet loans involve paying interest-only during the loan period and repaying the entire principal in one installment at maturity. Balloon mortgages offer more manageable monthly payments but carry refinancing risk, whereas bullet loans are often favored for projects expecting a lump sum cash inflow to cover the principal repayment.

Refinancing Strategy

Refinancing strategies for balloon mortgages typically involve securing a new loan before the large final payment is due, while bullet loan refinancing focuses on managing interest-only periods before repaying the principal in full.

Payment Reset

Payment resets in balloon mortgages often lead to higher monthly obligations compared to bullet loans, which require a lump-sum payment at maturity without interim payment adjustments.

Balloon Mortgage vs Bullet Loan Infographic

moneydif.com

moneydif.com